I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Fifteen months ago Bilt raised $150 million at a $1.5 billion valuation. It became one of the fastest companies to ever become a ‘unicorn’.

Now they’ve raised an additional $200 million at a $3.1 billion valuation led by General Catalyst. General Catalyst Chairman, former American Express Chairman and CEO, and Berkshire Hathaway director Ken Chenault will become Chairman of the Bilt board.

NFL Commissioner Roger Goodell joins their board as well. (I wouldn’t be surprised to see more NFL Experiences offered for Rent day.)

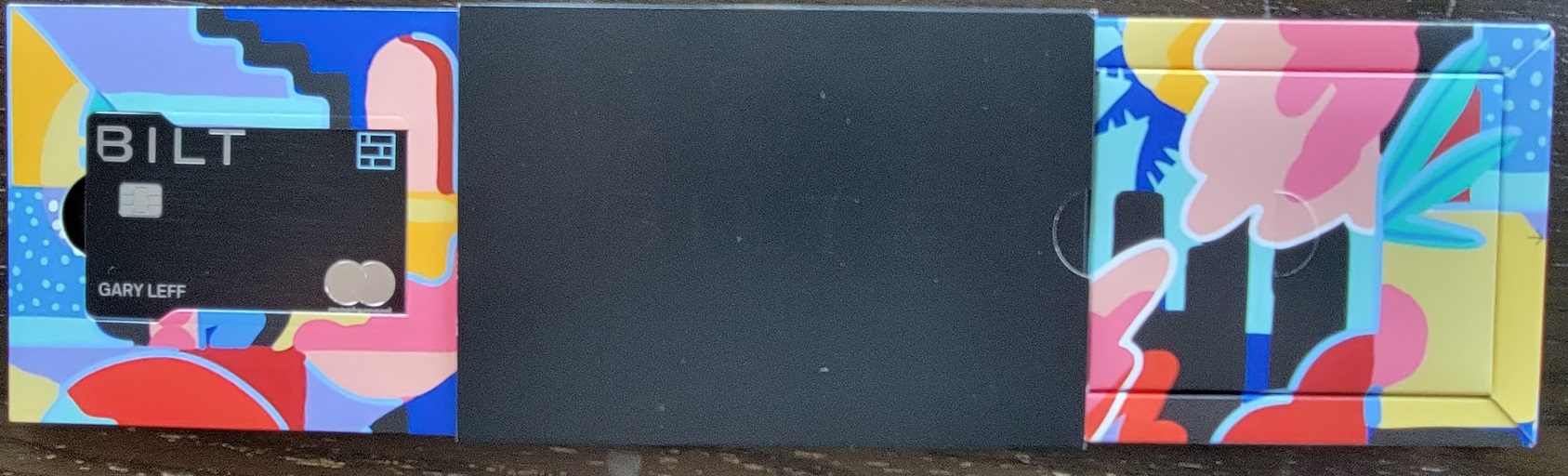

Their Bilt Mastercard® is one of the best new rewards cards introduced in the past several years. Maybe the biggest concern I hear from readers is that the program is too valuable, they’re a startup, so maybe they won’t stick around? However,

- Over the summer I interviewed Bilt founder and CEO Ankur Jain and he reported that they are profitable.

- And investors are willing to put in another nine figures. Ken Chenault isn’t going to become Chairman if he doesn’t see them going places.

So go ahead and earn Bilt Points for paying rent with no transaction fee with the Bilt Mastercard® – it’s the biggest expense most people have, and something no other card offers.

Plus you earn earn 3x at restaurants and 2x on travel. All of this earn is available as long as you make at least 5 purchases per month on the card. And it’s all with no annual fee. (See rates and fees.)

Then transfer your points. Personally I now hold off for transfer bonuses, I’ve taken advantage of 150% bonuses with both Virgin Atlantic and Air France KLM. Their partners are:

- Star Alliance: Air Canada Aeroplan, Turkish Miles & Smiles, United Airlines MileagePlus, Avianca LifeMiles

- oneworld: American AAdvantage, Cathay Pacific Asia Miles

- SkyTeam: Air France KLM Flying Blue

- Non-alliance: Emirates Skywards, Virgin Atlantic Flying Club, Hawaiian Airlines HawaiianMiles

- Hotels: Hyatt, IHG Rewards, Marriott Bonvoy

You can use Bilt points at 1.25 cents apiece towards travel through their (Expedia-powered) portal, redeem for rent (please don’t) or Amazon purchases (please don’t).

Select to learn more about the product features, terms, and conditions.

“Ken Chenault will become Chairman of the Bilt board”

A very bad sign. Chenault’s main contribution at AMEX was to reduce quality and make “Membership has its privileges” meaningless.

So weird @L3 every time I mention Bilt you’re in the comments complaining about it, but you can’t get more mainstream credit than another $300mm investment at a $3.1B valuation less than two years after launch and both the former Amex CEO (who is on the board of Berkshire Hathaway!) and the NFL Commissioner joining the company’s board right.

Bilt is simply the best. In the past year i have earned more than 400k points and received at least 8500 of value if not more. That is 25% of my annual rent.

Get ready for coupon books Bilt members.

“And investors are willing to put in another nine figures. Ken Chenault isn’t going to become Chairman if he doesn’t see them going places.”

These arguments sounded equally persuasive when they were said about plenty of other recent companies (FTX, Frank, Theranos, et al.)

It was interesting to see the CEO of Bilt and Ken Chenault on CNBC this morning. The CEO struggled to explain how the card economics work under the questioning from the CNBC anchors who as lay people are trying to understand the value proposition. It was quite interesting to see.

Additionally, as a Bilt member for over a year and a credit card holder for a bit less than that, I have a reasonably good understanding of the program. Having said that, there was all this discussion about how they were unlocking value to neighborhood merchants that previously did not exist, I thought they were talking about a completely different product and program. Other than dining points in certain select cities and Soul Cycle classes, I am not sure which small merchants the CEO was referring to.

Notwithstanding the $200mm investment from General Catalyst, I would suggest Bilt enthusiasts to find this CNBC interview from this morning and see if they also think that the CEO did a poor job explaining the business

I like Bilt for three main reasons:

1) I use the Bilt rent system to pay my condo monthly maintenance fees, and get points for it – and a month’s float on top of that.

2) It’s the only major card I’ve found that transfers to AAdvantage.

3) 3x on restaurants is often better than CSP.

As far as the staying power of Bilt, I have no illusiions. Some day the points will devalue. Until then, I’ll turn and burn with the best of you all. And I don’t care who I owe money to — I only care about the staying power of those who owe me money.

@Retired Lawyer “Some day the points will devalue” perhaps, but Chase and Amex points really haven’t in the sense that they still generally transfer 1:1 to their partners, though the points of many of their partners have devalued! Oddly enough, the cost to Chase and Amex of some of those points have gone up rather than down!

Does the card offer sign up bonuses?

@ARNY – Bilt neighborhood is mostly dining right now, I think they talk about it as a bigger ecosystem because of their vision for it/ what they are working on. My guess about the card economics is that he was trying to avoid offering specifics that he legally can’t say.

Here’s how I would think about the card economics: processing rent is probably pretty cheap for Bilt, with their Wells Fargo and Mastercard deals. They don’t bonus rent spend with their various offers, and a lot of people redeem those points for rent charges at 55 basis points. Probably a lot cheaper of an investment for them than 100,000 point signup bonuses.

Yeah but who needs award miles when it is Loyalty Points that are the key to get status. I can see using Bilt only for rent (if someone rents) and only put 4 coffee drinks on it on it each month for the 5-purchase requirement. Put everything else on Aviator or Citi to get Loyalty Points to earn status.

In 13 months my Bilt card has already been replaced twice because of unauthorized charges, and its just happened again. Is Wells Fargo credit card security just so much worse than for all of my other cards?

@Carlos You place a lot of value on these “loyalty points” to which I’m assuming you’re speaking about American. When the upgrade list is 30+ people long (and that’s if you’re not at an AA hub) then the status becomes absolutely useless if upgrades is what you’re chasing.

@Arny good call out on the video. I decided to watch. As a consumer I’m excited for the ability to use with a mortgage but temper my expectations. If I was an investor I would be worried. A simple, “I can’t legally speak to contractual specifics” or something along those lines would have sufficed.

If I was a small landlord considering joining it would have made me reconsider with the jumbled answers of who pays for the service.

He came off extremely confused dancing around questions rather clearly articulating what can and cannot be answered due to confidential reasons.