I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

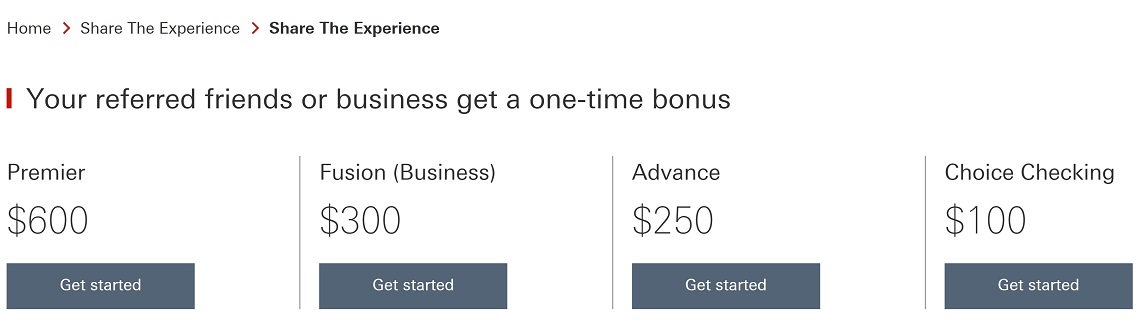

HSBC has a refer-a-friend offer where they’ll give $600 to new Premier Checking customers. Then once you’re a customer you an refer others and earn more money, in addition to the $600 they’ll earn. (HT: Nick at Frequent Miler)

- Open in-person or over the phone a ‘Premier Checking’ account under the ‘Share the Experience’ offer. Call the ‘Premier Relationship Team’ 866-788-5583 (Monday to Friday 9 a.m. – 4 p.m. Eastern).

- Provide an existing customer’s name and referral code. Mine is Gary Leff, S015290052 (that’s an ‘S’ followed by all numbers).

Offer valid through December 31Offer extended through January 31, 2021

After you open your account, you can refer family and friends. It takes two days for your referral code to be active. When they sign up with your code, they’ll get the $600 in their account – and you get $100. (You’re limited to $2000 in $100 referral bonuses per year.)

If you have a spouse, that’s an easy $1300 ($600 + $600 + $100). If you have parents, and your spouse has parents, that may be a total of $4100 between everyone. An so on, and so on.

To avoid a $50 monthly fee on the account, you need one of:

- $75,000 minimum balance in deposits or investments with HSBC, or

- Recurring direct deposit of at least $5000 per month, or

- HSBC residential mortgage with original principal amount of at least $500,000

To earn the bonus your account has to ‘meet qualifying requirements’ within 90 calendar days of account opening.

Many reports are that ACHs into the account will work as direct deposits, even though they aren’t supposed to. This isn’t guaranteed. Nick at Frequent Miler believes that paying the $50 monthly fee qualifies you, though that is not obvious to me in the terms. And when I signed up I was told there would be no monthly fee for the first six months in any case, to give customers time to move funds or set up payroll direct deposit.

It would certainly be worth the $50 per month fee until your bonus posts in order to earn the $600, however it also seems worth moving payroll direct deposit here for a few months to save $50 per month.

Some things to bear in mind:

- Bonuses are supposed to post within 8 weeks of being earned. These bonuses are reportedly successfully posting for people who did this in early September.

- Current HSBC deposit and investment customers aren’t eligible for the $600 new customer bonus

- Bonuses will be 1099 reportable

- There are smaller bonuses for lower-tiered accounts, I’m focused on the Premier account because it’s the biggest and you can only get get. There’s Fusion Business ($300), Advance ($200 bonus), and Choice Checking ($100 bonus) as well.

When I opened my account I was asked the purpose for the account (“besides the Share Your Experience bonus”) and I explained it would be a secondary checking account. I’m not longer using BankDirect for this since that account no longer earns AAdvantage miles, and I earn American miles with their Bask Savings Account instead. Ultimately whether or not you keep the account should depend on the value they deliver to you, but their referral bonus has certainly gotten my attention.

So why didn’t I go in on this (and share it) earlier? I was genuinely torn. London-based HSBC publicly supported China’s new security law for Hong Kong under which dissidents have been jailed, educators have been chilled (they’re now even ‘recommending’ textbooks and lessons), and pro-democracy legislators were removed from office.

I’ve put HSBC into the mental bucket of ‘bad companies’. But once I saw Frequent Miler report the bonuses posting I realized that I wouldn’t be rewarding them with my business so much, I could even turn their money into donations towards human rights promotion.

“I’ve put HSBC into the mental bucket of ‘bad companies”. I can’t agree more.

“I’ve put HSBC into the mental bucket of ‘bad companies’. But once I saw Frequent Miler report the bonuses posting I realized that I wouldn’t be rewarding them with my business so much, I could even turn their money into donations towards human rights promotion.”

So you rationalize your way to earning their promotion bonus?

I opened a Premier account with a $750 bonus in late 2019. Their IT is awful but the account has nice features. No fee wire transfers and bank checks are a nice perk. The new app is decent too (although behind competitors by a lot).

HSBC noted in earnings that they will report on their US strategy during 21Q1 earnings. One of these days I wouldn’t be surprised to see them close shop in the US as it always underperformed.

Thanks for including the China part. For $600 (minus fees), I won’t support HSBC. I’ll just keep adding to my T-Mobile Money account and earn 1.00%. Much simpler as well. -Thanks.

@John

How is he rationalizing? He’s saying he will take their money and use it against them.

HSBC helped Iran avoid sanctions and payed fines for money laundering. Nice bunch.

I used to love HSBC, but not anymore. Nah, incentive requires to many hoops. Good for crazy rich Asians, but not me.

@ Rob — Just like Trump does to his moron followers.

Ah, 1%-ers unite, and take over

The last couple of paragraphs decided it for me, and including them in the post does speak to integrity. But many people will establish a relationship with that sleazy bank due to the promotion (otherwise they wouldn’t offer it), and being a part of that is something I can’t do or support.

Horrible bank to try and do business with. Tried to open a savings account about a year ago and their IT was horrible, then they sent me emails from Hong Kong that my SPAM Filter doesn’t like finally saw them and they wanted more documentation for a savings account than I needed for my home loan so gave up and ignored them

Then they phoned me from Hong Kong and could not understand their English, hung up and good riddance to bad rubbish.

As a person from Asia, I don’t like HSBC either, but will do for 600, then close it later on. hah!

Just applied over the phone using Gary’s referral code. I was on the phone for 90 minutes. The first 30 minutes involved getting transferred to 3 different departments even though I called the Premier line. Then it took about an hour just to open the account. Worth it for $600. But yikes, I’d feel much better about HSBC if I could have done this online!

@Jeff, around same time here, total 65 minutes, it was not because of 600, don’t want to deal with them again!

just wanted to say thank you Gary for the HSBC/China mention and continuing to bring light to the situation. Ga Yau!

Called in (what a disaster/fiasco), but eventually got the correct person/department. Anyway, as others said about an hour total in time to complete everything. Used Gary’s code. $600 for an hour is pretty good, IMO.

From the T&C:

“Customers who currently hold, or have held in the past 3 years, an HSBC consumer deposit or investment account are not eligible.”

The “have held in the past 3 years” is an important distinction not mentioned in your original post that will disqualify a large number of readers…

Not sure depositing $5k/mo (and immediately moving it) for three months in exchange for $600+ is exactly helping HSBC make money, even if you don’t donate the proceeds.

Also worth noting that having the top-tier account makes you eligible to open their top-tier MasterCard, which has a $500-750 signup bonus.

@Gary They are telling me I MUST set up a direct deposit even if I put in $75,000. I wish you would have told us that …. I deposited $75k, but don’t qualify since I don’t have any recurring income. I feel like you hooked us and gave crummy info.

@Rob why do you think I’m the one giving you incorrect information? Straight from the terms of the offer,

“Balances of $75,000 in combined U.S. consumer and qualifying commercial U.S. Dollar deposit and investment* accounts; OR

Monthly recurring direct deposits totaling at least $5,000 from a third party to an HSBC Premier checking account(s)”

Bonus posted 3 months (3/21) after opening 12/20. Is there an issue if I close the account? Do I need to call? If I transfer all the $ out what penalty can HSBC assess? Thanks