We know that business travel is almost non-existent these days, but airlines in the U.S. have consistently reported that it’s more or less tripled off of a very low basis – it was down 95% and now it’s down ‘only’ 85% (so up from 5% of last year’s levels to 15%).

The business travel that has recovered has been small businesses, often in the Midwest and Sun Belt, as well as critical logistics and health care businesses. Currently the largest traveling companies with American Airlines include Fedex, Siemens, Amazon and Walmart along with the health and pharmaceuticals verticals (though none are traveling at all like before).

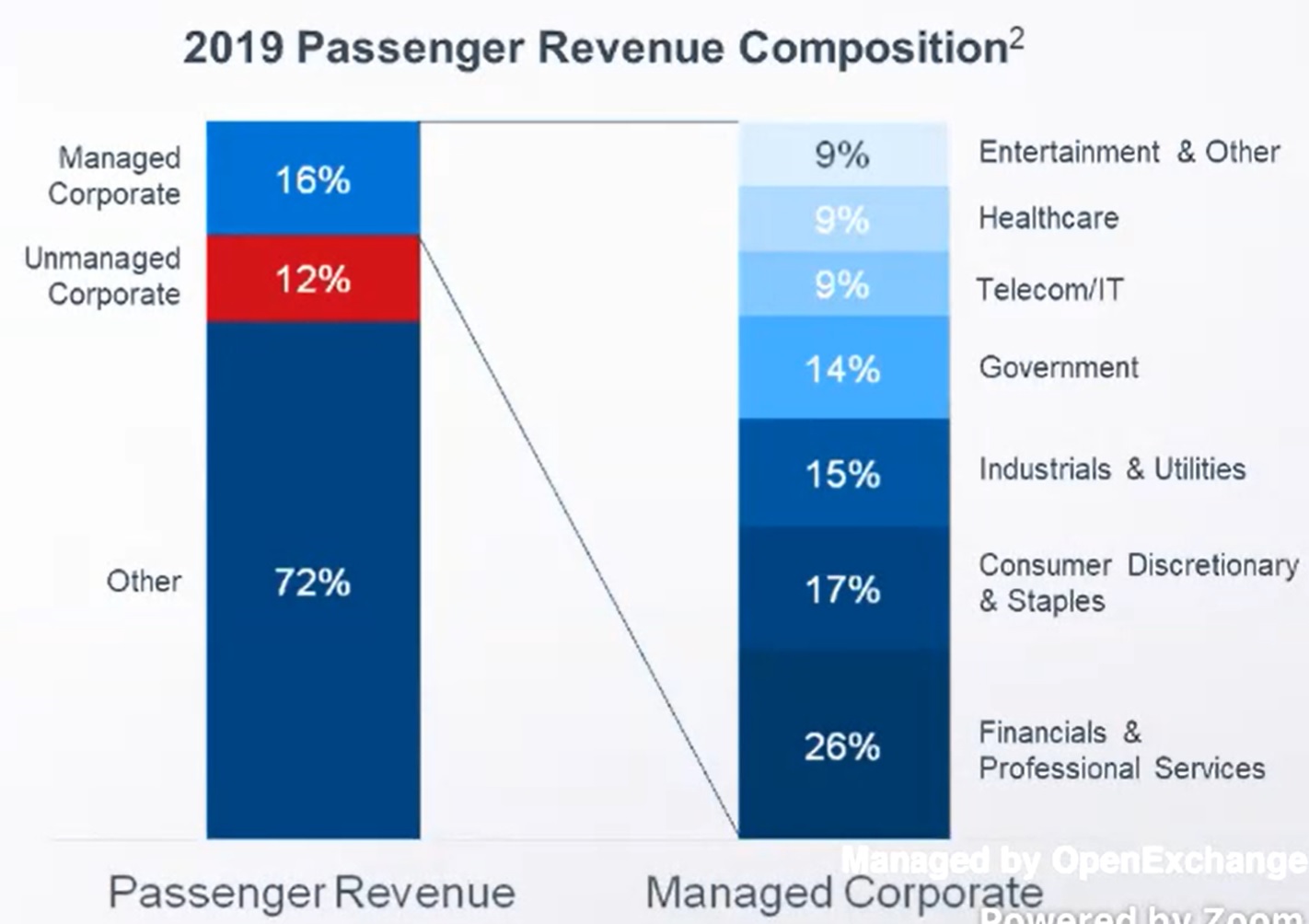

But just how much of a loss does this account for? American Airlines President Robert Isom shared how the carrier’s passenger revenue broke down in the Before Times at the Baird Global Industrials conference on Thursday:

Before the pandemic American’s revenue was already shifting towards once a year leisure travelers and away from frequent flyers. The unmanaged corporate will come back before managed business travel (large business contracts). But neither will come back in full force before it’s possible to hold conferences and events and visit clients in their offices. Still, more than 70% of American’s passenger revenue wasn’t business travel to begin with.

Even given margins of 10% even if all leisure travelers came back and business was still 15% profits will evaporate.

That and the corporate bungling – share buy backs – focus on poor passenger experience to make it a cattle class, etc etc – bad labor issues, – unions with high costs – and on and on – AA will struggle for quite a while as will UA

I am betting on DL – and AS, JetBlue to do better than these 2

SW is almost fully insulated from this long term and may end up buying AA for peanuts

Gary: how do they know all of ‘Other’ is leisure travel?

I have a small business and we all used to travel frequently. But we’d buy tickets on the airline website, Expedia, etc. just the same as any normal consumer.

Wouldn’t that fall into ‘Other’, yet still be business travel?

The revenue amount means nothing, its the profit margins on OPM that matter.

I dont think its a secret that OPM flyers use various methods to pad their own ‘dollar’ amounts to earn status, whether it is by outright buying more expensive tickets, or waiting closer in so that the ticket is more expensive.

Gary, I’m wondering why you even posted this.

Usually you take numbers, rip them apart, and do some interesting reading between the leaves.

This was just . . . a copy/paste of a slide.

That’s not “thought leader”, rather it’s more like just being a Layer 8 Proxy.

C’mon, do better.

AA is burning something like $42 million per day.

And on a *per ticket* basis, AA makes more money from Johnny Business than they do Suzy Leisure.

It would seem the better return on investment is higher/better with business travel. Yet AA seems determined to jump into Spirit and Southwests knife fight.

I’d wager “other” likely includes large numbers of business owners, independent consultants, freelancers, contract workers, etc, who are commuting to a jobsite, interview, and/or client visit.

Customers buying direct or through a traditional or online travel agency are unlikely to fall in “unmanaged corporate” unless some proactive outreach or survey has identified them as such.

For those wondering how airlines estimate business vs leisure travel, they look for patterns in travel attributes by market (city pair) such as:

* Day of week

* Time of day

* Outbound vs return

* Length of stay

* Holiday vs non-holiday periods

* Advance purchase

* Flexible vs restricted fares

* Compartment

* Multiple passengers in the same PNR

* Volume of passengers with FFP status

They may use other attributes as well. The airline can then create a matrix from the attributes to identify patterns that estimate the business / leisure mix with a reasonably high degree of accuracy.