The federal government won its anti-trust lawsuit against the American Airlines – JetBlue partnership at the district court level. JetBlue decided not to appeal, preferring to focus on its (far more anti-competitive, in my view) acquisition of Spirit Airlines.

While the court argued that a partnership like American Airlines has with Alaska Airlines is pro-competitive, American and JetBlue aren’t able to simply revert to that. The government’s position is that all new partnerships have to go through de novo review, and that the carriers should face greater than normal scrutiny over any domestic linkups.

At the same time, the court didn’t want to disadvantage customers who had already purchased tickets in reliance on the arrangement.

- JetBlue passengers who expected to earn miles when traveling on American Airlines, and vice versa

- Those motivated to purchase tickets on one of the airlines because they expected to use their elite status for things like free checked bags and for better seat assignments.

The court wasn’t looking to impose a ‘bait and switch’. The airlines initially argued for a long wind-down of the partnership, to which the government objected. The position of American and JetBlue was, our IT systems aren’t set up to base benefits and mileage-earning on date of ticket purchase rather than date flown. So they couldn’t just grandfather old tickets.

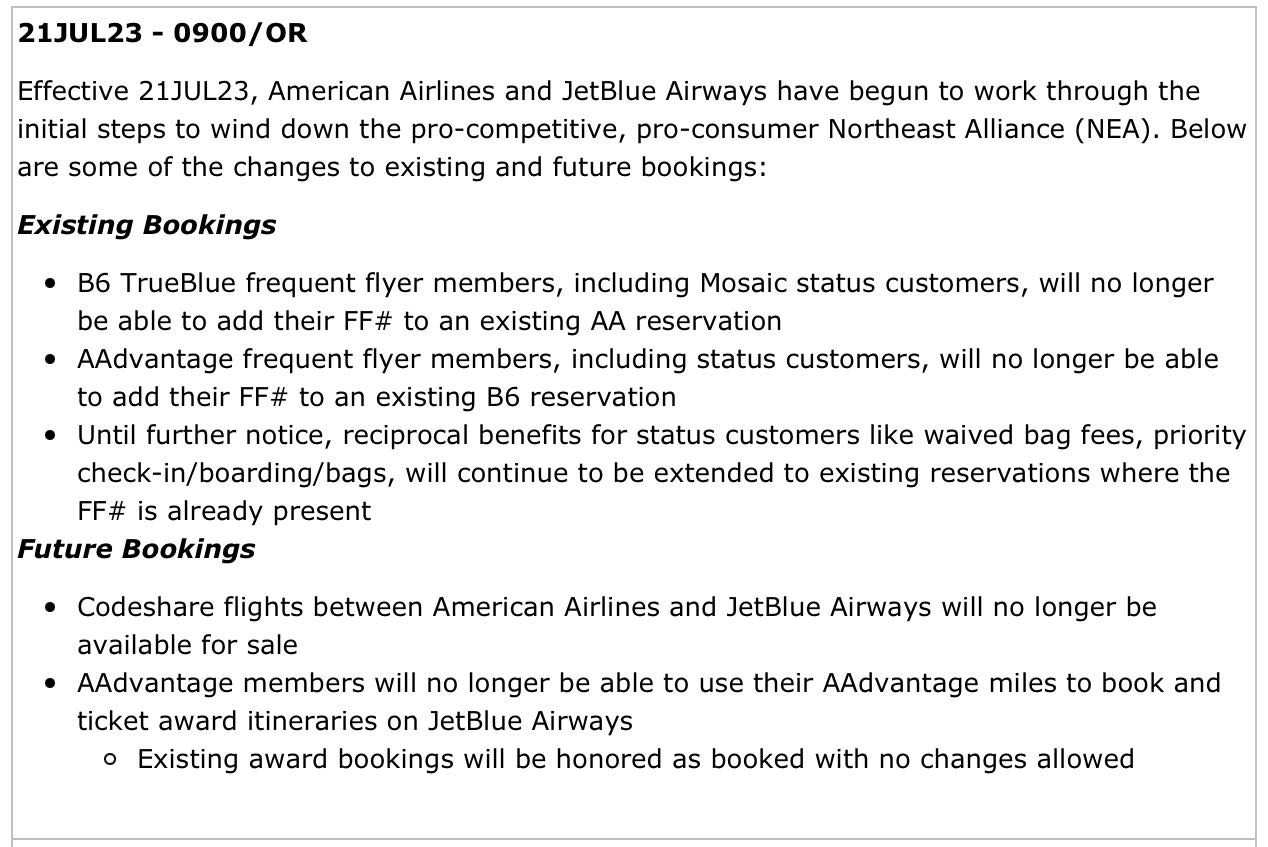

That wasn’t flying as a reason to prolong the partnership. Instead what the two airlines came up with eliminating the ability to add each others’ frequent flyer account numbers to reservations. Anyone who already has their American AAdvantage number in a JetBlue booking, or JetBlue TrueBlue number in an American booking, can continue to earn miles and receive status benefits. But it’s no longer possible to add a number going forward.

Meanwhile it’s no longer possible to book codeshares or award redemptions between the two airlines.

This makes American Airlines and JetBlue each far less competitive against United and Delta in New York. There’s less competition. That’s true both for corporate business (neither American nor JetBlue are as well-positioned to compete for that business, though American hasn’t been as aggressive in that space anyway) and for individual customers who choose a single carrier for their repeat business since neither has the slots to serve all of a customer’s needs on their own.

The lawyers are sorting out what happens to the slots that American Airlines leased to JetBlue. If JetBlue keeps them, then the status quo ante of markets having been sliced up between the airlines remains in place. If they revert then JetBlue is smaller and American is back to where they were, ‘too small to compete, too big to walk away’ and without really having a strategy.

We’re now in a sad place for customers, and Delta and United managements rejoice. As for JetBlue I still want to know whether the government suggested an ultimate resolution to the anti-trust case against their acquisition of Spirit that makes it possible for them to buy the ultra-low cost carrier as an inducement not to appeal.

I don’t think the government had to suggest an ultimate resolution to the anti-trust case against their acquisition of Spirit that makes it possible for them to buy the ultra-low cost carrier as an inducement not to appeal. It was baked in the cake already.

We’ll see but what major airline merger hasn’t eventually been green-lighted by the government in the last 20 yrs? Any ‘government concern’ for airline competition is coming a bit late to the party.

My gosh. A VFTW article that makes sense, has no random tangents, and that I agree fully. This decision is a mess for consumers. Remoives choice in the NE market, makes it harder for both AA and B6 to compete, and will ultimately result in the removal of Spirit and it’s low fares from the market.

Ah good to know! I did get an email from B6 telling me to add my AA FFN early (I checked and it was already applied) but I was scratching my head wondering what’s the point if it won’t get me anything after some unknown date! Was prepared to beg for EMS seats!

A PR company’s dream. You set it up, and it’s a win for customers. It come apart, and it’s a win for customers. Only in America.

AA used to be the best airline. Then came “it’s the schedule.” Are there any grownups left in Dallas to properly run an airline?

@ Gary — Any announcements by AA regarding restoration of service thay used to operate? I am specifically interested in ATL-LGA.

@Gene -the lawyers are working out what happens to the slots and gates leased to jetblue, they need to figure that out before they can announce any service resumptions

The issue I have with the NEA (and many other anti-trust concerns) is that it feels like a moving target based on the whims of the administration of the moment. While I would not support a merger of two 800-pound gorillas like AA and DL, I fail to see how the NEA was anti-competitive and I’m further confused by the litmus test used to make the anti-trust claims.

In the end, we have a judicial process and we need to trust it. That said, I do think the definition of anti-competitive needs to be specific and quantifiable, not arbitrary and subject to interpretation. The poop-show that is AA aside, offering consumers in the NYC market a third viable competitive alternative to DL and UA strikes me as a win.

I’ve never seen a market where removing a supplier increases competition and purchasors are better off. Ever.

Time for you to retake economics 101 (or to disclose conflicts of interest)?

AA’s initial reaction, along with some tertiary announcements (like JetBlue/Spirit offering to sell some gates to Frontier) makes me optimistic that getting rid of the NEA will ultimately result in four major competitors in the market (United, Delta, American and JetBlue) along with robust international carrier and ULLC carrier presence. With the NEA, there would have been three major competitors in the market (United, Delta, and NEA). I see AA and B6 doubling down on the market, which means competition with each other, not just United and Delta.

@Jake – no known conflicts of interest. B6-AA *added* a supplier it did not take one away. American was effectively not a competitor in the market before the Northeast Alliance. And that’s because the market is artificially limited by government restraints (slots granted as property rights to incumbent businesses).