AgFed – the Agriculture Federal Credit Union based in the DC area – is NCUA insured and has $240 million in assets, about 22,000 members, and 6 branches.

They sell Visa gift cards online for $3.95 that come embossed with your name on them. (These are fulfilled by FIS Global.)

Joining the Credit Union

The credit union is open to:

- People who live, work, volunteer, or go to school in DC

- Employees or members of a bunch of government agencies or organizations with affiliations like the Embassy of Jamaica and the Kennedy Center

- Anyone who pays $20 to join The Friends of CityDance Association

Opening an account generates a soft pull on your Equifax credit report. They require you to open a free savings account with $5 minimum deposit. They also offer a free checking account (there’s a $5 fee after 12 months of billpay inactivity).

I expected that I would be automatically enrolled with CityDance (since I selected that option) during the signup process, but I was not prompted to pay $20, and my card wasn’t charged. I opened the account with the expectation of having to cover this $20 fee, and still expect to.

Funding Your Account

They allow credit card funding of a new account, Historically this posted as a purchase rather than a cash advance at least with some issuers. I reached out and they shared the following:

The initial deposit limit, using a credit card, to fund a checking account online is $1500. This is processed as a purchase, and not as a cash advance.

So far I have funded only a savings account. Just because they process the transaction as a purchase doesn’t mean that any given issuer will code it that way, though most will. They accept only Visa and MasterCard, no American Express, and out of abundance of caution I’d probably avoid Citibank cards. I used my Hyatt Visa, and will know for sure its disposition once the transaction moves out of the pending stage.

You can also fund via another account outside the credit union. Although the simplest and quickest approach, even if a cash advance, might still be a minimum $5 deposit to savings.

AgFed used to sell CDs with funding via credit card years ago and Chase cards posted those as purchases rather than cash advances. Oh those were the days!

Do They Want You to Open Accounts and Buy Gift Cards?

An insider to the credit union writes to me,

The CEO is fine with people joining and buying gift cards, in the hope we’ll get other business…We always want new members, and we often offer special deals–last Labor Day we offered .49% on a 4 year car loan.

Buying Visa Gift Cards Online

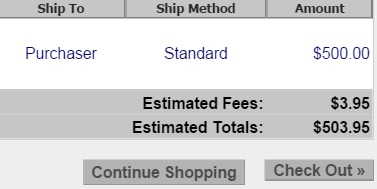

They sell Visa gift cards in denominations you select, up to $500, and accept credit cards for payment.

- Each Visa gift card costs $3.95

- They emboss the recipient’s name on the card

- 5-7 day shipping is free

You’ll have to call with each card to set up a PIN number, these aren’t as easy as the Vanilla gift cards where the PIN became whatever the first set of numbers you used.

AgFed also sells Visa debit cards (as opposed to gift cards) online with a limit of $2500 for initial funding but it appears they only accept their own credit cards for purchase of those.

Update: the credit union wants more members who will take advantage of a variety of their services. I’m hearing that though they’re excited to share their offerings – including gift cards – they may not be able to continue to approve folks through the ‘CityDance’ affiliation, that’s the kind of membership link that is suspect to the National Credit Union Administration. So unless you actually qualify to be a member through one of the other mechanisms they may not be able to work with you.

Update 2: the concern about CityDance memberships as a means of joining turns out to be unfounded and the credit union appears to be approving new members. Good news.

Update 3 May 12 7:30pm Eastern: Ok, let’s pause the signups. We’ve already moved the needly on the credit union’s membership base and we want to keep this sustainable.

can you load these visa gift cards to redcard?

Very interesting 😉

From the FAQ’s:

What should I do when the merchant’s sales terminal asks me to press “Debit” or “Credit”?

You should always press the “Credit” button. Although the Visa Gift Card is not a credit card, the transaction is

processed like one. You should always sign a sales receipt.

When I swipe my card, the terminal asks me input my PIN. What is my PIN?

A Personal Identification Number (PIN) is not issued with the AgFed Visa Gift Card. If a PIN is requested, simply

press “Cancel” on the terminal, then select “Credit” to complete your transaction.

So these are only good as credit?

you should take this down so everyone doesnt jump on it

Gary,

Do these cards have a word “gift card” printed on them even though you can have your name embossed?

@John there’s a bunch of different designs, some may be less pronounced, but I believe they do

@Andrea despite that note you can ring up to get a PIN assigned. Presumably just be outdated (unupdated) information.

@Dave – I haven’t seen this credit union discussed online in years, why not share this? The credit union’s CEO is comfortable with the word getting out it seems.

My prediction is the CEO will change his mind and be uncomfortable with the idea by the end of the week. LOL..

@Gary, is the purchase of the gift cards also only Visa/MC? Or that’s just the funding, and the gift cards can be purchased with Amex as well?

Funding a new account is visa/MasterCard only. What about purchasing these gift cards? Is that Visa/MasterCard only or can you use an ACG?

i don’t think this CEO understands what he’s in for…

@chuck these are visa gift cards.

Gary, since you have an account, can you look under the prepaid card section? I was reading that and it is described just like the visa buxx cards. Can you see if that reloadable prepaid card (not the gc) can be loaded with cc or just the attached bank account?

@Gary Chuck is asking if you can purchase these Visa gift cards with an AMEX

It sounds like the gift card won’t load Redbird since it’s credit only. Too bad since the purchase fee is so low.

Gary,

Great information! Will you let us know if you can use the cards for Red Bird once they arrive?

Also, it would seem these could easily be used for Wal Mart money orders, correct?

Thanks.

Josh

Gary, Chuck was asking if we can use Amex cards to actually buy these VGCs. You wrote that we can’t use Amex to fund the checking account, but can we use Amex (and especially AGCs) to buy these VGCs? Thanks.

And another one bites the dust?

The prepaid reloadable card, as I mention in the post, can only be purchased using a credit card issued by this credit union.

They allow purchase of gift cards with visa/mastercard. You’ll be able to add a PIN to these over the phone once they arrive. Positive reports on Walmart.

@AlohaDaveKennedy were you using this one? I don’t see recent references to it in forums when I search, so i figure it at least wasn’t widely known. In any case, I never share info that has been shared with me in confidence. That’ll teach you not to share your tricks with me..!

Hi Gary,

When PIN is set, Can someone else still use it like credit card? or PIN is required when making purchase. I lost money on gift card before so I am very cautious. Thanks

Any limit on how much you can buy per day/week/month?

@everyone:

These are fulfilled by FIS. At least that’s where the confirm email comes from.

YMMV but when I called them, a PIN is assignable. I ordered these from Agfed last year and they came with my name embossed and I added a PIN by calling and going through prompts.

My recollection was Dodd Frank required a PIN to be available Somebody can correct me on this if I’m wrong. But, it IS a debit card. I was able to cash out. It’s still costing you more than .9 cents net per mile.

It’s not reloadable per the FIS terms when I ordered one yesterday.

So, I’d start slow. YMMV.

I’m involved with the CU and there is always a money-laundering question when someone buys tens of thousands in gift cards, particularly if we don’t personally know you. My recollection from discussing this with the CEO is that FIS could stop you as well as the CU. I’d be more concerned with FIS right now.

PLEASE REMEMBER THE GOAL HERE IS TO EVENTUALLY GET OTHER BUSINESS, AND TO EXPAND THE GEOGRAPHIC REACH OF MEMBERSHIP. The CU’s auto loan rate is very good, and as far as mortgages go, the CU retains all adjustable rate mortgages . A good friend of mine just found the jumbo mortgage rate to be the best available.

Please don’t abuse this.

@traderprofit What dollar amount would you consider starting slow? What dollar amount would you consider abuse? 5K? 10K? 20K? Do you think same day orders using multiple credit card numbers will be okay?

Yea !! Deal Killer is back. My guess is its dead in 10 days.

I laughed out loud when I read that he posted this article because it wasn’t posted on any other forum. It’s clearly going to survive now that it’s on boarding area.

I didn’t say I posted this “because it wasn’t posted on any other forum” I’m saying that knowledge of this was pretty darned limited, sharing can only be a net benefit to frequent flyers in general EVEN IF it were killed in 10 days. But sharing this is something that the credit union itself encouraged. You think all 6 of you working this in the shadows were going to keep it quiet under those circumstances?

@jeveryone

I think $10k is likely going to attract attention. I honestly don’t know the answer. I was told the risk manager is concerned by these memberships, but we certainly don’t want to create ill will.

Beyond that, the CEO has asked that people only apply if they are in one of the traditional groups

that is in the FOM.

Apparently NCUA, in response to complaints from The American Bankers Association, has been

examining these associational memberships closely. This is very recent and is covered at depositaccounts.com

I’ve asked Gary to remove the post.

If you have applied already I’d assume you get approved, ,but if rejected due to the Citydance association and you’ve paid the $20, I assume we will return the $20. We’re not out to steal $20 from people.

I apologize to anyone rejected on this basis.

Certainly, there’s no risk in applying, and I don’t think today’s apps will be rejected due to Citydance….but it’s not up to me.

Meh. If you can easily buy $500 Visa GCs at a supermarket and earn 5% cashback + gas points, it means earning a total of $45 per $500 GC – $6 activation fee = $78 net per $1000. And it’s a debit card with PIN, no need to call anyone to set and activate a PIN, and no need to wait for snail mail delivery. Far outstrips this offer, but it could be another way to meet spend requirements, I guess.

whats the point of paying $504 for $500?

UPDATE:

The CEO contacted me and advised that using CityDance to join is FINE FOR NOW.

The CU really appreciates the new memberships, mainly because it’s a bunch of people with good credit who will likely go for cross-selling when there’s a car loan deal or a home loan deal.

We (I’m associated with the CU) have offered teaser car loan rates in the past as low as .49% for a 4 year loan.

I’ll work on getting deposits by credit card if you guys join up. No promises.

So, go ahead, see what you can order. Don’t go crazy.

Worst that happens is they reject the order.

There are several other CU’s with this same offer but I’m not sure if they accept credit cards for payment. I’ll check and report back.

When I say I’m associated with the CU, I am just on a committee–it’s an unpaid position, so there is no benefit to me for pushing this except to drive new membership.

@Redder–The point is you can cash out the cards and earn miles on the purchase of the cards.

It’s not a free way to earn miles, but it’s EASY, because they mail the cards to you.

@anon-I get 6% back at grocery stores, but there’s a limit to that, correct?

How can we pay the $20 to cover the CityDance contribution? Will we be billed at a later date?

@traderprofit — New Blue = up to $6000@6%. Old Blue = up to $50000@5%.

@Jason They should be charging you in the signup process. I would call.

@Anon : We aren’t all so lucky. Do you really get away with buying 50k in VISA cards at grocery stores with no blowback?

Chase closed all my accounts a few years ago over the Ink purchases at Staples, I presume They would not say why.

:popcorn:

That cit dance website seemed a little suspect. Looks like the org hasn’t been active for years

MESSAGE FROM AGRICULTURE FEDERAL:

Hi everyone. As I mentioned before I’m on a committee of the CU.

The CU has asked, once again , to cease signups using Citydance, mainly because there are large orders of gift cards and the CEO told me in a call that FIS WOULD SHUT THIS DOWN if it goes on.

The CU greatly appreciates your business, and wants to go a little more slowly.

I can’t say if you would be turned down for membership–likely not. But if the sole reason you join is to buy massive quantities of gift cards, FIS will stop this (and I’ll look bad).

There have been over 80 new members as of today, and that’s an extra 1.3% membership growth, which, while great, is going to make you guys mad if FIS shuts this down.

We’re certainly interested in seeing if this leads to other business, which was the goal.

I apologize, but as @Lantean said, the CU was not expecting this volume of card ordering.

Refi your car at 1.49% . It will make the CU happy and show management there will be cross-selling.

Remember CU’s are owned by members like those who have joined. You get a vote every year.

Good luck to those who have signed up.

Our membership has grown by almost 4.7% in just two days. Keep it up.

You think your gentle readers aren’t going to continue signing up via CityDance? Nah. They’ll all sign up, and first thing buy $20K of GC, the CU and the continuation of the deal be damned.

Don’t know what you were thinking Gary. Your readers aren’t the type to milk a deal like this. Pillage is more like it.

I’m in the midst of a refi of my condo and don’t want any pulls right now, but after that is done, I hope this opportunity is still around. Meaning, the gift cards. I am a resident of DC so I would not need to sign up via the CityDance membership.

Please don’t kill the deal by buying 10K! Please start with 1K or 2K. 🙂

I don’t ant to discourage anyone from joining, but it really isn’t THAT great of a deal at .9 cents (or less if you get more than 1 mile) when you can pay the same price at a Simon Mall, and there are other credit unions where you can do they same thing. It’s certainly nice to get the cards in the mail.

During the financial crisis I had accounts at 23 credit unions through an association membership.

I never checked Visa gift cards though.

Check Justice Federal (their automated phone system is comically called “the informant.”), Digital Federal, Alliant ,Pentagon Federal just to name a few.

Personally, I”m bound to lose 2 out of every 20 cards I order the first day I get them. I stopped doing MS except very occasionally just to meet a spending requirement.

I’d call around in your city or look at their sites.

Please note over 900 credit unions are NOT insured by the federal government. They have private insurance through American Share Insurance of Ohio.

Justice Federal has the $3.95 deal but I have not checked if you can use a credit card. Ag Fed isn’t the only CU with this deal.

lol, some angry mobs. Go find another CUs making the same mistake over and over.

@Lauren – it’s a soft pull not a hard pull on your credit

this one has been quite interesting.

actually may be looking for a car loan soon, will keep it mind.

@traderprofit, I don’t understand. If the CEO wants people to stop signing up using the CitiDance link, why not TAKE THE LINK OFF THE WEBSITE? Similarly, if the CU is concerned about an influx of people buying thousands of dollars worth of VGCs – can’t they just restrict the number of cards any customer is allowed to buy? Or temporarily suspend the offer until the fuss dies down?

And it will die down, because (as you pointed out) this isn’t all that lucrative a deal. It’s handy if you need to buy gift cards now and then to make minimum spend and would like to do it from the convenience of your home. But surely most rabid MS-ers prefer their gift cards frosted with portal payouts and category bonuses?

Thanks for the article.

I did not see any sign up link on the website.

Also.. what type of purchase would I see on my cc if I buy these cards?

Can you make initial deposit using US Bank club carlson visa card? Is it cash advance or purchase?

I would love that cheap auto REFI for my truck loan. I hope my membership survives long enough to take advantage of that low promo rate. I have not bought a GC yet but I plan to take it slow and easy. Redbird only takes $5K a month anyways so no point in going too crazy.