I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Key link: Plastiq special new member offer

Here’s finally I think a good and super quick and easy way to earn miles paying your rent or mortgage and anything else that you’re currently paying by check or online billpay.

Back in May I wrote about Plastiq, a service that lets you pay bills with a credit card. It’s convenient, you earn miles for the payment, and it costs less than using Paypal.

Not everyone would be ready to jump on a service charging a 2.5% fee, though, it means you’re buying spend at 2.5 cents per dollar (or paying 2.5 cents per mile if there are no bonuses involved). So even thought that’s cheaper than competing services, it’s a niche play .. worth doing if you need a boost to meet minimum spend on a credit card, but not something to use every day.

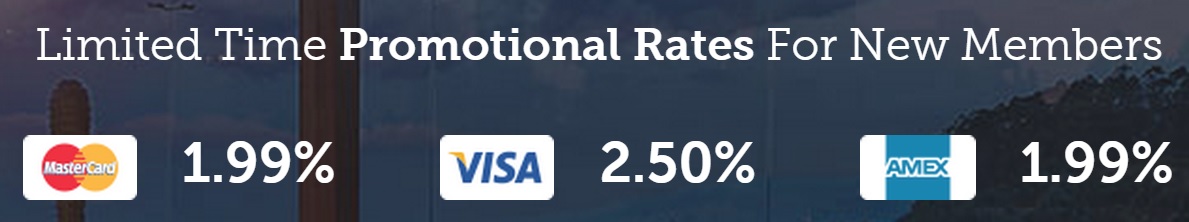

Right now though Plastiq is running a special offer, fees of only 1.99% for new members when paying with American Express or MasterCard.

That’s crazy because American Express merchant processing usually costs more than Visa/MasterCard (plus Visa/MasterCard are so similar). And because there are American Express cards where everyday spending earns a rate of return of more than 2%. So you don’t have to limit use to niche circumstances where you need to generate a lot of spending.

As a result, I think the offer makes sense to me for:

- Meeting minimum spend requirements for a signup bonus.

- Spending enough on a card to earn a spending threshold.

- Everyday spend, if you have the right card or if you need to top off for the right award.

What Bills Can You Pay With Plastiq?

Plastiq will let you pay an US or Canada business or person for any amount. The only restriction is that the payment has to be for a good or service. You can pay an individual person, for instance, if they’re your landlord and you’re paying them rent or if they are your contractor or landscaper.

Just don’t try to pay yourself, a spouse, or another person just to send money (a “peer to peer transfer”), that’s not allowed, and I’ve seen reports of some individuals receiving payment being asked for documentation that there was a bona fide good or service involved for which they’re being paid. It’s not like the ‘good old days’ where you could send $5000 to your spouse for free with Google Wallet, and they could send you the same back.

While you can pay bills with credit cards issued outside the US and Canada, payment recipients need to be in either of those countries.

They don’t allow payments to credit card companies, either (so you can’t pay your credit card bill with a credit card) and no “trust/retirement accounts” either.

How to Pay a Bill With Plastiq

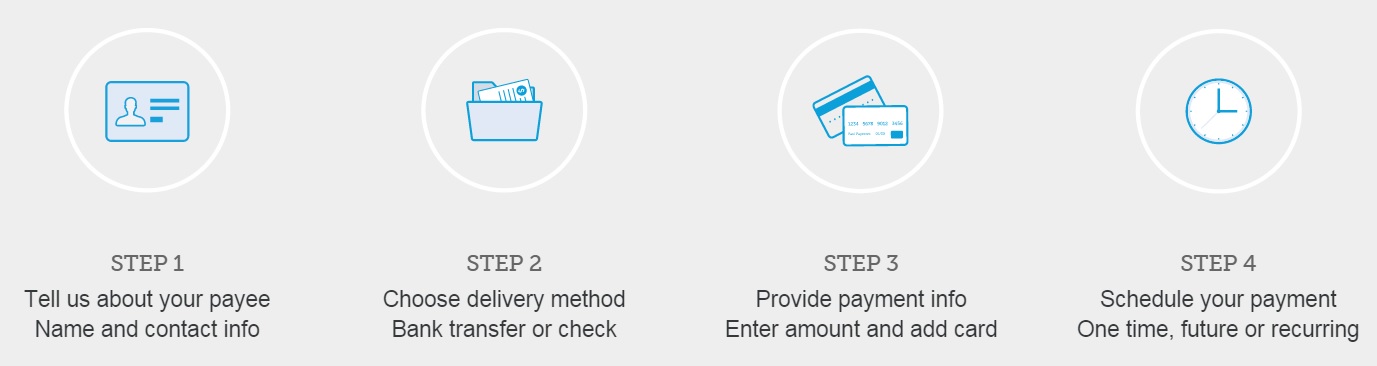

You’ll create an account and then verify your email address. Then:

You can specify any recipient of funds you want to pay using your credit card. And you can specify whether they get a check or an electronic ACH transfer (provided you have their banking information).

That’s it.

Multiple Benefits to the Service, But it’s Fine to Use Because We Want the Rewards

The landing page even highlights Act Now & Rack Up Rewards, so this isn’t something where exposure is going to ‘kill the deal’, I’ve spoken with one of Plastiq’s founders who understands that using their service helps cardholders earn rewards and that’s a strong motivator.

It’s an easy way for folks outside the US to pay US vendors. It can be convenient to pay a bill by credit card close to the due date, but at the beginning of a credit card billing cycle (and thus have nearly 60 days to actually pay).

And I love retaining chargeback ability when paying by credit card versus having to pay a merchant via billpay or by check — I rarely ever need to file a dispute, but it’s great knowing that I’ve paid by credit card and could do so if necessary.

Sign Up Now to Have an Opportunity to Take Advantage of the Promotion

This discounted rate for paying bills via credit card isn’t available through the ‘general’ Plastiq website, in order to get it you need to sign up with the special offer link.

I’ve talked with the folks at Plastiq and they tell me that if you’ve already created an account with them you can still have the offer provided you know about it — they’re fine with you either re-registering for a new account using the special signup link or emailing them with a request to update your existing account.

Regardless, sign up now even if you just want to be able to use this offer later (I don’t have a firm word on how long this new signup offer will be available, but I anticipate that those who sign up will be able to use it for several months).

Key link: Plastiq special new member offer

Agree that it’s A WAY to get minimum spend done, but the fee reduction seems hardly something to rush to. The $7500 minimum spend would only save you $37.50 with reduced vs regular fees. Not saying it’s nothing, but I’d try other avenues first.

Gary,

Are you really not going to disclose that you get a kickback from people that signup with your link? I don’t get why you cant just put it in the body of the post like FM did. Is it because of your ‘disclaimer’ at the top? I wish you and other bloggers would be much more straight forward (like FM) than what you do here.

I think the disclaimer at the top covers it…granted FM is much more…well, repetitive…stating the fact that he gets some dough.

I’m confused about these “special rates”. Unless having a Canadian account has been different than a US one, the standard rates for the year or so I have used them have always been 1.99% – for all credit cards – for transactions they can process online and 2.5% for transactions where they need to send a money order to the merchant. Is there something strange about this “special rate offer”?

While I get $5, which is pretty immaterial as far as these things go, I put the disclaimer up as noted. Definitely not trying to hide that. Happy to donate the $5 to charity from this post as well, it’s not at all a motivator here.

This is great!!! For those of us with jobs, and families, who don’t have time to spend all day running between stores to do MS it’s worth the cost and 2% is worthwhile while 2.5% isn’t, given the value of the miles we earn. Anyone who values their time and does the math should see the difference.

I spoke with one of the other bloggers who is promoting this deal. There are other offers coming. It’s clear Gary is trying to get readers to sign up, I think because he knows but cannot write that there will be opportunities from Plastiq that are even better than this, so if you register you’ll get more options coming.

@ Gary — Thanks for the info and link. I just signed up and sent a trial payment to my mortgage. I had been loading my RedBirds via the DL SunTrust debit card, but now that that deal is dead, I was planning to use my RedBirds to work on earning more DL MQMs via AMEX Reserve cards + V/MC gift cards @ 0.99% fee. Now, I will probably pay the extra 1% to Plastiq for the convenience, as I don’t really cherish the thought of buying, managing, and unloading 30 x $500 gift cards each month to run through my RedBirds.

Do you know when the temporary lower fees expire? I want to pay off my mortgage in the next few months, but would only do so through this method at the lower fee, so it would be nice to know when the offer expires.

@ Generallisimo — Cool! I just hope we will be eligible for said offers even if we sign up now.

@Generalissimo, Gary hasn’t been one to hide his insider knowledge or be secretive about better deals to come–especially if he’s getting a measly $5 referral for this. He’s been upfront with his readers and has, in the past, come right out and told us hold off/go elsewhere if it’s in our best interests.

Any ideas if 1099s will be issued for bills paid through this service? Or are they just transparently serving as the financial transaction provider?

(e.g. Similar to Radpad? Which has explicitly answered that they are only providing point-to-point payment, not accounting services and they don’t/won’t issue 1099s).

Shill clickbait posts are why I’ve stopped giving you my referrals, Gary.

@Bob I believe the deal is EXACTLY what the title suggests. It’s perfectly reasonable to disagree with me, have a different perspective. For what it’s worth I actually like reading folks whose perspectives differ from mine. Other people like to be snarky about their titles instead of engaging with their ideas. To each their own! Best, Gary

Everyone – Please stop pointing the finger at Gary. He’s trying to help us. If he makes $5, why should you be upset? All of the bloggers that provide great tips to us deserve to be paid and I don’t see why that is such a bad thing. He has a disclaimer at the top. He isn’t hiding anything. Why don’t you start a blog and provide valuable information for free? People who live in glass houses….

Can this be used to pay property taxes?

@rj anything that you’d otherwise send a check or do a billpay for sure (with the specific exceptions i note in the post)

Gary, thanks for the post – but I’d wish you’d be better about responding to questions in comments, as opposed to primarily only responding to those who are unhappy with you. For example, in this post, you’ve responded to three comments, two of which are people who didn’t like the post. You’ve prioritized responding to them over legitimate questions from @jim, @Gene, and @RS_WI.

I know you have a finite amount of time, so would love to see that time spent ignoring the haters and responding to the genuine questions, as that enhances the value of these posts even further – because many of the questions posted are things lots of us would like to know as well.

Thanks!

That’s a misleading title Gary. Don’t say “Pay any bill with a CC” if you cannot pay credit card bills. Or at least put the exclusion at the top of the article, or an asterisk next to the “any” in the title.

Thank you Gary for all that you and the other bloggers are doing. I just signed up for the Marriott Premier Card and trying to determine how to meet the minimum spending limit. My card has not arrived yet and this offer sounds promising.

You also state, that it could eliminate the need of buying gift cards and then having to drive and get money orders. I actually thought about using gift cards, but wasn’t sure if it would be received as making cash like charges. The gift card approach would be very beneficial especially if I am too close to my due date so that Plastiq could make the payment.

I know you receive so my questions, but I would be estatic if you have time to answer me.

Thanks in advance

You can also use paypal and send money to yourself / other individuals and pay 1.9% + 0.35€

Th

@Gary,

Now I am starting to understand why US can make such dividends/redemptions upon using Credit Cards.

In Norway, where I am presently based, all service charges are carried by the “seller”, basically service fees from the Credit Card Acquiring Companies (Teller, Nets, Merchant Banks etc.), ranges from 1,07% — 3,65% in fees. However this is never impacted on the “end-user” of the service. (I know it is somewhat calculated into the price=….

As I have been traveling quite broad lately, I have experienced different charges in Denmark, depending on your “Plastic”, any kind of VISA ends out cheapest – and in Denmark AMEX ends at +5,0%. in charging fee.

I would never use my personal card in an attempt to make miles/points if I was being “back/slashed” by any CC company. At present I hold quite a few Credit Cards being funded by either my company or SAS being a Diamond Member, and I earn my SK Euro Bonus points of 200K with-out flying.

I find it a little like traveling Borneo in the 90¨where you could pick up a 4-6% discount by paying cash.

@Michael – I notice your reference to euros, in the US Paypal charges ~ 2.9%, and I wouldn’t mess with Paypal and addresses given their tendency to shut down accounts

@Kenetta gift card purchases with cards from most banks aren’t treated as cash advances when they’re made from a retail store (eg drug store, gas station)

@Andrew I answered a couple of questions offline, although apologize for not being more spot on, I’m visiting with my inlaws this week and only dropping in for moments here

Gary, can this be used for child support and/or alimony payments?

@Greg – that’s a great question, I’ll ask!

Maybe I missed it , but does anyone know how this charge is classified? I assume no bonus category but wanted to double check. Thanks

Thanks Gary, helpful post. I recently used Plastiq and will see if they honor the promo

i have been using Palastiq for quite a while now. I pay small local companies with whom I have charge accounts. I paid my accountant, whose firm does not take credit cards, $2K last month. Was it worth the small fee to put it on my Citi Prestige card. You all can do the math. I thought so. I have 4 different cards I can use with them: Ciit Prestige, AMEX Platinum & SPG, and Chase Sapphire. Depending on what I need in terms of miles/points and how the whole picture of the year looks, I chose which card to use. My wife has a Plastiq account also with the same cards. On your credit ca d bill, the charge shows up as “Plastiq.” At this point, it doesn’t matter to me how it gets categorized by the credit card company. I’m just glad to have another source that moves to more free travel. My advice is try it. If you don’t like it, don’t use it. Gary, thanks for shedding like on Plastiq.

After I read the first person who attacked Gary for the not properly disclosing the referral fee I was annoyed at that person. Glad to see so many people defended this. Disclosure is clear not only hear but on many other sites. Even if he was earning a lot more all the work of gathering and sharing this information is worth it.

Now my question- Can Gift cards be used with this company anyone know. I still like the 5 points I earn at office supply houses. I know it cost a little more. I had been using evolve except they change the rules without notice frequently. With evolve you can make one payment per 24 days to most companies.

Follow up- I see I used the wrong here in my previous post. It would be nice to have a way to edit.

A gift card just worked- Although i plan to try this with non gift cards for my mortgage and auto payment.

A few areas of improvement, it would be better if they could have more preconfigured payees with built in routing information. I assume this will come over time.

The second area which they could and should do soon. Add a short name to credit cards you add. I have two Amex cards listed and only the last 4 digits show. I have 5 Amex cards in all and do not remember the last 4 digits of all them.

First disappointment with this service. I paid a Wells Fargo Same as Cash loan. They took the payment and later sent me an email they voided it. I was hoping I could pay some of the same as cash payments. This would be perfect purchase something with a one year interest free loan then pay for it with a credit card monthly and earn the points you miss in the beginning. I guess you could call it a credit card I call it a loan.

Here is the response I received.

I hope this message finds you well. I am writing to you regarding your recent payment with Plastiq. After reviewing your payment, it appears that you are trying to pay your credit card with Plastiq. Unfortunately, this is not currently something that our service supports, so your payment has been voided. For your information, here are some things that you can pay with Plastiq:

– Tuition

– Rent/Utilities

– Taxes

– Mortgage

– Auto Loan

Here are some things that you cannot pay with Plastiq:

– Credit Card Bill

– Another individual/Yourself/Your own company

– Retirement/Investment Accounts

– Collections Agencies

Thank you again for trying out Plastiq and we do hope to serve you in the future!

I never heard of any utility that won’t let you pay with a credit card. Plastiq not needed. Also, cable and cellular bills. Maybe insurance payments. Do prepays for signup bonuses. Get it back from no monthly payments for months.

My natural gas company, Xcel Energy, charges a $5 fee to pay by CC on their site.

Ken-Can you set up a no-fee monthly auto-pay? If not, can you change gas companies?

Jerry Mandel says:

August 19, 2015 at 2:33 pm

I never heard of any utility that won’t let you pay with a credit card. Plastiq not needed.

========

PG&E aka Pacific Gas and Electric, one of the top 3 utilities in CA and probably in the top 50 nationwide.

Will ripoff PG&E let you set up no fee autopay so they charge to your card each month? I guess, no alternate gas or electricity company. Such is living in CA.

Of course PG&E loves bank debit autopay.

Which areas of the country have a genuine choice of gas/electric utilities?

@Jerry – No and no. ACH withdrawal only. Where can you choose utility providers? I’ve lived in FL, NC, and CO and in all three you were stuck with whichever utility was there. No choices.

I wrote card autopay not bank account autopay. I don’t know if there is a choice of gas providers here in Dallas, Texas but in Texas you can choose among MANY electricity providers/producers with a bewildering choice of plans. They all use the same company which actually transmits the power to your home. See powertochoose.com and powertochoose.org I guess it is one more way that living in CA is so costly.

Sorry, I can’t believe that folks are serious about paying a service to pay your mortgage in order to meet a minimum spend. There are so many ways to accomplish that without buying dozens of small gift cards. Easiest is to buy a gift card from your favorite airline. UAL sells them for up to $10K and they are good for 5 years. You can buy one for up to $1K at Sam’s Club. Good way to use your Visa as they don’t take them in-store. Many other similar gift cards that don’t have to be for just $25.

I pay via EFT at my mortgage web site. It is not worth the hassle to do it any other way on the chance it doesn’t get paid on-time, gets lost, etc. You get dinged $$$ and have to then fight with whomever…. You know, like renting a car through a 3rd party…

@Jerry B many folks don’t want to prepay $1000 for airline travel…

@Gary – True. And at least some people don’t want to pay an extra $20.00 to make their $1,000 mortgage payment. I did sort of think, though, that most of the folks engaged in this game traveled a lot and therefore it wasn’t an extended prepay.

Is this link still valid as of 1/18/2016? When clicked, it leads to a basic sign-in page, and the little “i” symbol lower on the page says 0% fees for debit cards (excluding pre-paid), and 2.5% for credit.