JetBlue is looking for revenue anywhere it can find it. Not only are they struggling, and their business plan scuttled by back-to-back anti-trust rulings, but corporate raider Carl Icahn is breathing down their neck. He’s taken a 10% stake in the carrier, whose stock has cratered, and he controls two board seats. He could acquire more of the company.

That has had some readers worried about their miles. I don’t have inside knowledge about what the airline plans to do with their points, but there are two basic schools of thought here.

- Devaluations would hurt them more. They’re looking for additional revenue from their credit card. Only Delta has consistently been able to devalue their points without hurting their co-brand charge volume and revenue, and even Delta learned this past fall that there are limits to what the market will bear for program changes.

It would be silly to devalue their miles. JetBlue hasn’t realized the benefit of its frequent flyer program as much as competitor airlines. Their best opportunity is in leaning into that opportunity, rather than cutting it.

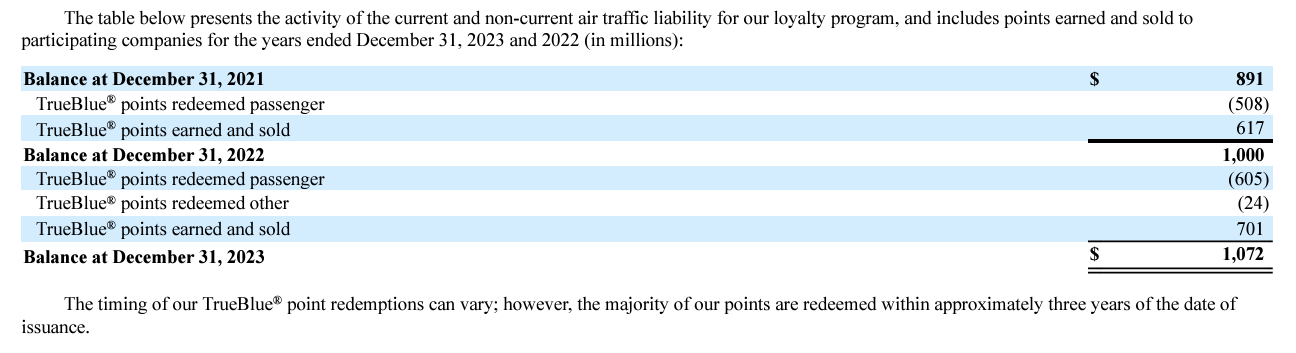

- Yet it’s a quick and easy cost-savings. If they are looking for cost cuts, one place on the balance sheet to look is the future travel liability of TrueBlue. Carl Icahn’s involvement is a bit of a wildcard – it’s a short term balance sheet maneuver rather than something that actually benefits the business.

Here’s JetBlue’s 2023 form 10-K filed with the SEC in February. There’s about a billion dollars in liability, and if they reduced that it would also mean a one-time recognition of revenue.

There’s no specific information about an impending devaluation, just a worry that Icahn’s involvement could lead to short-term cost cuts that harm the business in the long-term.

I’m not sure it matters either way, though. Your strategy should be the same. Your miles will (almost) never be worth more in the future than they are today. Saving points for some distant future – a travel IRA of sorts – is never a good idea.

There are occasional arbitrages. Points with America West Flight Fund arguably took on a new life when that airline acquired US Airways, opening up Star Alliance redemption opportunities. If Alaska Airlines succeeds in its acquisition of Hawaiian Airlines, and HawaiianMiles convert 1:1 into Mileage Plan, then the value of HawaiianMiles will go up.

Once those arbitrage opportunities come to fruition you are… best off redeeming, rather than saving for a future which will involve devaluation.

In general always best to redeem sooner than later – JetBlue points don’t seem likely to get more valuable, unless they wind up joining a global alliance.

Icahn is a disastrous, ruinous beast.

He will strip all negotiable assets and run away.

Good bye JetBlue.

Nice knowing ya

I had some JetBlue points so I used them to offset part of a ticket. I’ll be earning more soon when I fly on that ticket. I was looking at my United mileage. It has built up from flights on other airlines but using it may be painful in comparison to JetBlue.

Gary – you have an inaccuracy in your title. They aren’t “your” miles (regardless of the airline). All miles (and hotel points) are owned by the issuing company and it is fully within their rights to change the value or even totally discontinue the program at their sole discretion. Granted it would be dumb to do that from a marketing standpoint which is why you never see miles wiped out in an airline bankruptcy filing. However, it is full within the airline’s rights to do so and if they did there is no legal option you can take.

Icahn will sell off JetBlue’s assets. The airline as it exists today won’t be around in a few years. It will shrink gradually and eventually, what’s left will be swallowed into another.

I have 100k true-blue points sitting for years after receiving mosaic card bonus haven’t found use for yet. Guess time to force a redemption with it soon

That’s why 2% cash back cards are the true gems of the rewards scamconomy.

Jetblue, I’m sorry I wanted to build more of a relationship but Carl came along and TWA’ed you. Sorry.

I wish they would join OneWorld.

@DaninMCI

Could not agree with you more!!

Plan to cash in my TrueBlue points before year end and close the books on B6.

No one should take Gery Leff reporting on JetBlue accurately. Many know about his personal grievances burned by them in the past. “Financial turmoil”? They actually have an industry standard balance sheet and they are less encumbered on assets than most airlines. One again a lot of this and no sources. Except for 10k which shows liability that’s a long term and standard. Spirit on the other hand has a billion that’s DUE, in 15 months and they haven’t been cash flow positive yet. But let’s ignore all that and talk about this demise of JetBlue that many been talking about since jetblues inception.