I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

IHG One Rewards has a completely revamped elite program this year. It is better than it used to be. Status provides more benefits than it used to, like free breakfast as a choice for Diamonds, club lounge access as an annual benefit choice, and the opportunity to confirm suite upgrades (up to 14 days in advance, on non-prepaid revenue stays).

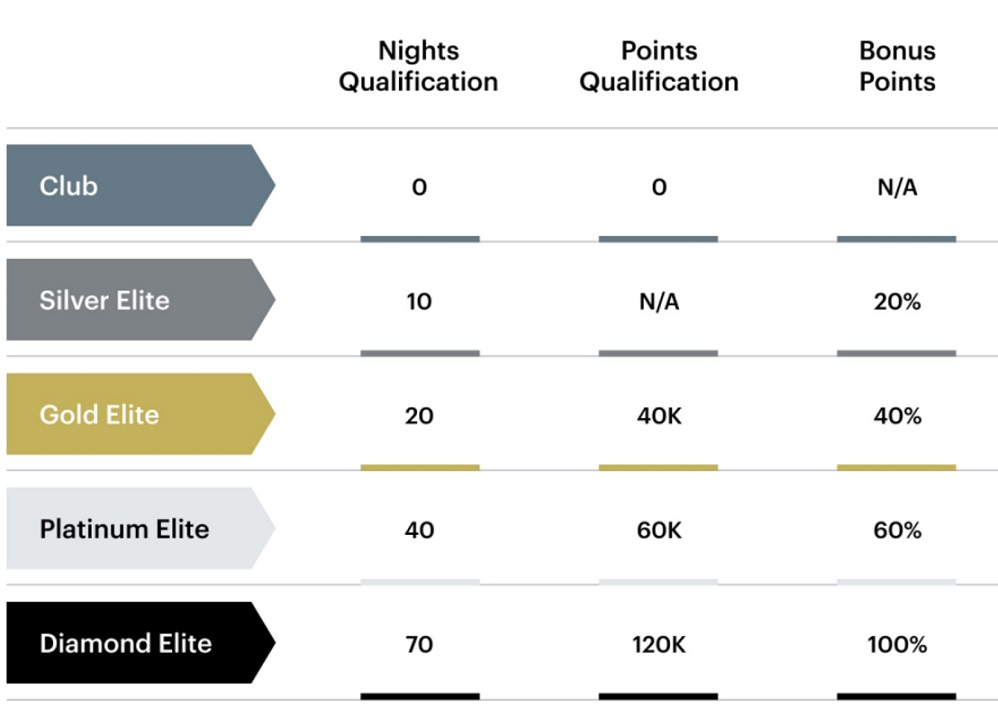

Given improved benefits, the Diamond (formerly Spire Elite) tier is harder to earn. It takes 5 fewer nights than before (70, rather than 75) but for those earning on ‘base points’ – the easiest way to earn the status in the past – it now takes 120,000 instead of 75,000.

Not only does it take more base points to become a Diamond, those base points are going to become harder to accumulate.

Back in January Heather Balsley, Senior Vice President of Global Loyalty and Partnerships at IHG Hotels & Resorts, told me the new elite program wouldn’t see any changes to co-brand credit cards earning elite status, or what counts as base points. That turned out not to be true.

While Chase and IHG revamped and really improved earning with their IHG® Rewards Premier Credit Card – and right now it has an offer for you to earn 140,000 Bonus Points + 1 Free Night after spending $3,000 on purchases in the first 3 months from account opening – they are making Diamond status harder to earn with the credit card.

- The card comes with Platinum status

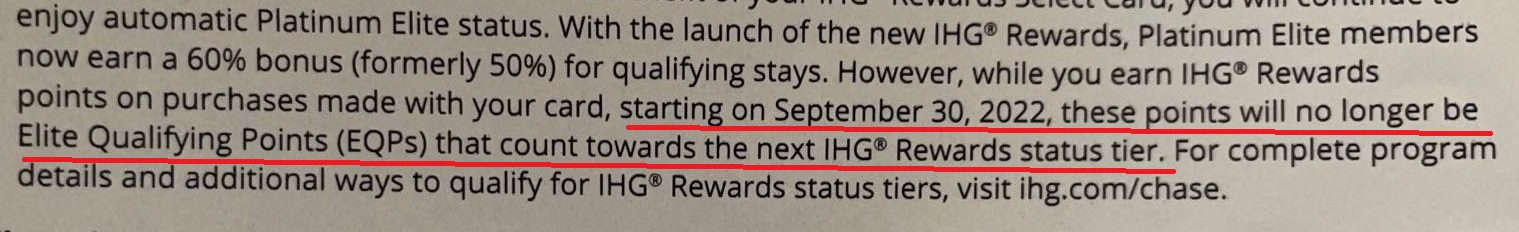

- In the past each point earned spending on the credit card counted as a ‘base point’ towards status. So did points transferred into the program (Chase and Bilt points both transfer)

- However points earned with the card will no longer count towards status. A reader shares this from a notice they received from Chase:

Presumably, then, points transfers will no longer count towards status either – I have asked IHG for confirmation of this and will update if they offer more information.

Since I value an IHG point at half a cent apiece, I never wanted to transfer from a credit card program to IHG One Rewards. Nonetheless, some people did get value spending on the card or transferring points to earn status – though the best benefits in the new program (like club lounge and confirmed suites) come based on nights stayed, rather than points earned anyway.

Update: IHG confirms that this change applies to “all U.S. Credit cards” – noting that there “are no new changes to the UK card.” I also asked whether the change also means that points transferred into the program [e.g. from Chase Ultimate Rewards, Bilt Rewads] will not count towards status anymore as well, and they offered indicated that this is the case.

So, the person responsible for a credit card lied in public statements about conditions on a credit card’s offerings, which could ultimately impact the bank or publicly traded company that is co-issuing it. Isn’t it against the law to make false statements about financial products?

Isn’t this awfully short notice? 120K points from un-bonused spend would be $40K,or bit under $3500/mo. Someone who has been spending at that level all year now would find themselves with 90K by the Sept cutoff, a long 30K from the goal line. Changing the rules at the end of the calendar year would have been much more reasonable. Is this something the CFPB would be interested in?

And yes, people did at least consider spending at that level to get Diamond. See “Miles to Memories”.

I feel like this is old news? I’m a Premier cardholder and this was mentioned in the mailer I received months ago, when they announced the new card earning structure and benefits.

@ Gary — As an 18-consecutive year Royal Ambassador, I am thrilled to see this change, but I would be embarrassed if I were in charge of the new IHG One Rewards program rollout.

In other breaking news some 20 years later the foolish management (modified to not sound as insulting and being more respectful on my favorite blog) at IHG wake up from a deep coma and realize rewarding customers with tangible hard benefits by folks who actually stay in their hotels even reasonably so is better for business then giving status away for spending on a credit card.Well duh!

Fast forward to 2040 IHG decided to actually compete against Marriott, Hyatt.Hilton and others rather than remain in the stone age with crappy benefits and no promise of recognition on award stays(terms and conditions) and offer lifetime status when reaching thresholds.They finally discover its actually profitable to take care of customers in a relationship rather than be penny wise pound foolish.

Fast Forward 2060 when the current management are all deceased they decide to dump the inept international call center and shut it down.The Philippines call center had hemorrhaged their business for decades with untrained cue card reading robots that had no ability or empowerment to help assist customers.Reopening a US based call center and staffing it miraculously boosts profits/revenue 500%

Kidding aside (though real hard honest truth behind it) I actually like a number of InterCon and Kimpton hotels

But that call center has to go and hopefully IHG can finally fix most of what has been broken for decades with a program that has been highly flawed.At least the baby steps are a material improvement of some kind.All these years were wasted with the bottom of the barrel loyalty program that paled by comparison to its competitors.I’ll bet one of the CFOs out there could throw some good speculative numbers out there.Not mentioning any names in particular you know who you are ;).lol

@dwondermeant. Rewarding customers that “actually stay in their hotels” with tangible benefits is most certainly not better for business than giving a status label to someone who is spending on their credit card and not staying in their hotels.

I’m shocked to hear that any hotel loyalty program would ever attempt to devalue or deny stated tier benefits to any member. What will we all do?

@Gary, I agree with @DWT. Isn’t this old news? Back in March or April, CC points stopped being credited as base points. I’m pretty sure I also got a mailer about the changes, too. It’s strange that the reader’s mailer shows that the changes are effective as of September, though…

With all these recent changes somehow I missed a discussion of jumping the Hyatt Globalist ship to the new IHG program. As a public disclosure, my first elite hotel status was with IHG back in ca. 2000. For the last years I mainly stay with IHG to burn free nights earned from $49/year credit card (for me a my wife) and, occasionally, if there is a lucrative targeted promo. I do understand that I missing on the great benefits of the Royal Ambassador, but I typically find a Hyatt or a Marriott/Hilton in places with Intercontinental.

Agreed, old news click bait. Anyone that has a credit card and has looked at how points from spend post would be aware of this even they never read rules of the program.

IHG must have a department that does nothing but think up ways to diss their loyal customers. I have several favorite IHG hotels around the world, but end up booking a Hilton property nearly everywhere else. IHG does not give me that comfortable feeling that they will take good care of me as a reward for my loyalty.

When I travel, for business or pleasure, I browse Hyatt and Hilton brand hotels. If none of them suit my needs, I look at Marriott. If none of those suit my needs, I look at IHG. I try not to book IHG hotels irrespective of any status or rewards program. The whole chain is poorly operated as a business compared to its peers, I mean, fuck’s sake, you log-in with a 4 digit PIN. That’s 1980s level internet security.

If there are no Hilton, Hyatt, Marriott, or IHG hotels at my destination, I rent a car and sleep in it. Bad as IHG is, every other option in the United States is dreadful.

I received the same letter in the mail. One extremely critical detail is omitted here. The limitation outlined in the letter is limited to the old IHG Club Select ($49 AF card) and not the Premier. I have both cards and only have received this letter for the Club card. The Premier still has spend for Diamond listed as a benefit on IHG’s website, so I suspect this reader who sent this information in is mistaken.

https://www.ihg.com/rewardsclub/content/us/en/creditcard/premier

About time, Credit card spend is not elite activity. Time to throw the pond scum back into the standard rooms.

It’s about time real elites get real benefits, spending your way to the top isn’t brand loyalty. I don’t need 100 kids running by the door of my suite cause mommy charged herself into 20k of debt.

So, I got the new Hyatt credit card earlier this year and put $40k of spend on it right away to achieve Diamond status for next year. Did that still count? I’m confused

If anyone is clear on that please let me know. IHG used to post what date your elite status expired, but they seem to not be doing that anymore

@Raylan

I also have both cards and received the letter for the IHG Select Card. There must be some confusion here…has anyone received a letter for the Premier Card stating that spend won’t count towards status?

@Olaf U. Fokker-Sergei

Log into your IHG account, and change it to a proper password. This has been a thing for almost 3 years now.

I have never been able to find value in making charges with my IHG credit card. I happily pay the $49 annual fee, use the free night, but don’t charge a cent to the card.

I think that this is only part of the story. I did get the letter about spend on my older IHG card, but not my newer Premier card.

What I did get was a notice that card spend is not elite qualifying but that $40K spend in one year will provide Diamond status. Not great, but not as bad as indicated above.