The federal government won its case to stop the JetBlue takeover of Spirit Airlines.

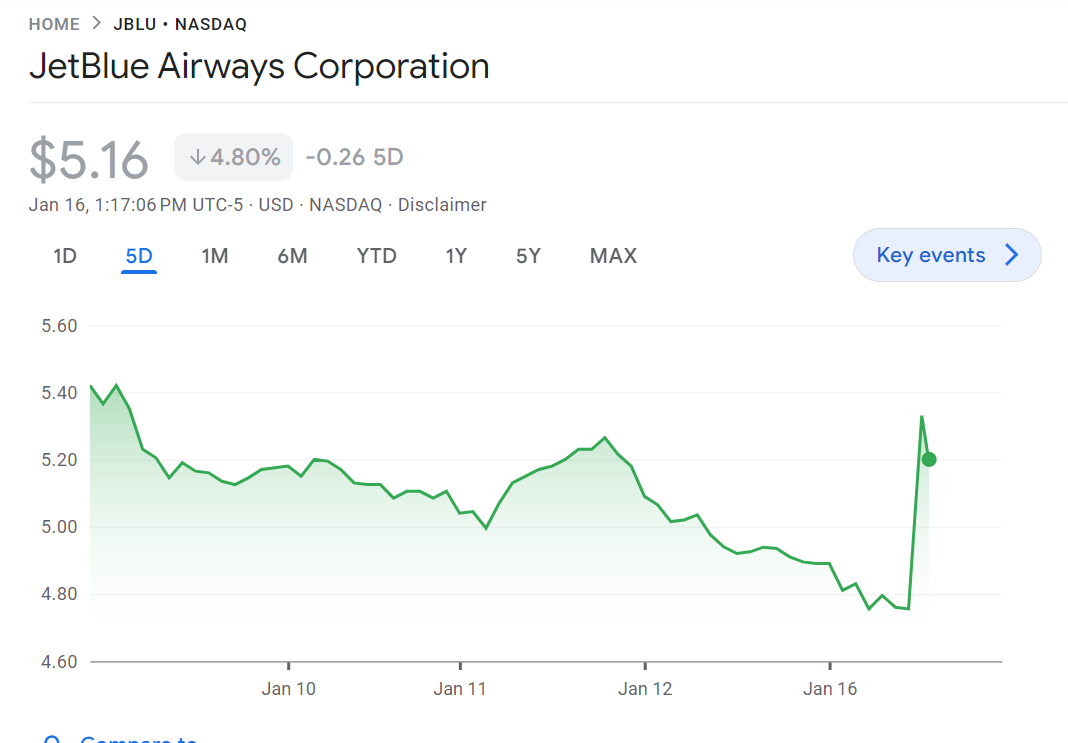

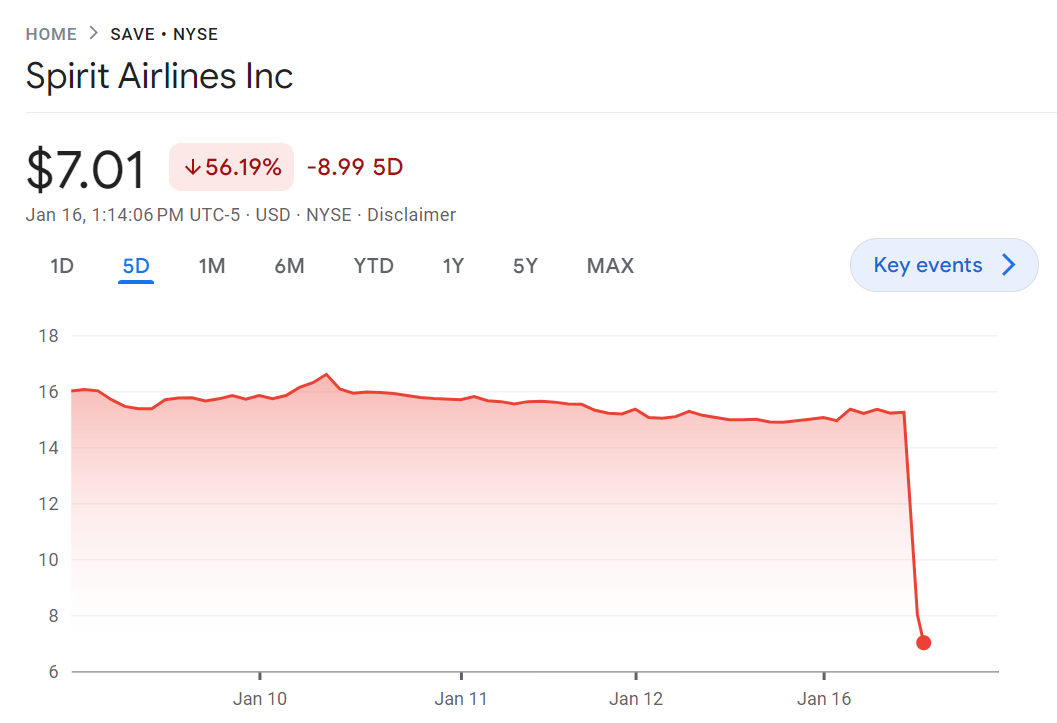

JetBlue’s stock jumped on the news, even as other airlines are down today (as was JetBlue itself). Meanwhile Spirit’s shares

This is very costly for JetBlue if they don’t win this on appeal.

- They owe a $470 million breakup fee – instead of being waived in the event they lose over anti-trust, it specifically applies.

- JetBlue already prepaid $2.50 per share when Spirit’s shareholders approved the deal and they’ve been getting an additional 10 cents per month since January 2023 (though the first year’s payments, or a total of $1.15 per share, counts against the breakup fee).

Nonetheless, this is good for JetBlue shareholders because the airline was overpaying for Spirit’s planes and pilots, and would be applying higher costs to the airline’s employees and imposing a higher cost model on its operations. JetBlue lacks the industry financially and operationally, and a costly merger integration that wouldn’t improve returns on Spirit assets isn’t likely to turn that around.

The Biden administration has pursued a much harder line on anti-trust, and has suffered many setbacks in the courts, but has beaten the JetBlue-American deal at trial and now the JetBlue-Spirit deal. JetBlue walked away from their partnership with American to focus on the Spirit acquisition, opting not to appeal even though that case was likely stronger than buying Spirit which really does take substantial aircraft out of a low cost business model. JetBlue’s response has been that they are dynamic and a disruptor as well, but that hasn’t been true in a decade.

JetBlue has no plan and some even suggest bankruptcy though I don’t see that as solving their fundamental issues. Their CEO has left but replacing him with his deputy, their former HR lawyer, doesn’t appear so far to represent a change in course for the carrier.

Interestingly while the judge’s decision talks about the Department of Justice as “speaking for consumers” but it’s not exactly clear what the consumer interest is in blocking the merger.

- JetBlue was already committed to liquidate slots and gates at congested airports, allowing Frontier Airlines to grow low cost carrier competition.

- While Spirit, the butt of late night comic jokes, would shift its business model and take seats out of planes to deliver a more premium product.

Maybe that’s better for consumers, maybe it’s worse, depends on whom you ask!

With a Spirit-JetBlue deal there would be greater concentration on some routes, and one fewer low cost carrier, but in no sense would an airline still far from breaking into the top four hold any form of monopoly. The primary barriers to competition in the industry come from governments that control airports and air traffic control and impose barriers to supply of pilots, yet the government claims concern over competition while failing to address its own limits on supply. The judge in the case even acknowledges some of this!

The judge notes that “[a]s the JetBlue aircraft configuration involves less seats per plane, total seat reductions across Spirit’s fleet are estimated to total 11%.” Pursuing a more premium business model – giving passengers more legroom – is in part why the merger is deemed illegal.

This is a careful opinion, but one under which it’s difficult to imagine any merger succeeding, or any theoretical concentration which would be permissible. Anti-trust is a strange beast, morphing to fit almost any priors. Businesses that charge too much are earning monopoly profits. Businesses that charge too little are engaged in predatory pricing. And those charging that same as industry peers are engaged in collusion. That’s not a great world in law.

It’ll be interesting to see how this proceeds, since JetBlue really doesn’t have another game plan. They face tremendous uncertainty, but certainly could succeed with a time-consuming appeal. Their costs grow each and every month that the merger isn’t called off, however.

Better, perhaps, would be to revisit a deal with American Airlines akin to the one American has with Alaska Airlines, involving frequent flyer program reciprocity and codeshares – something the judge in that trial expressly suggested would be legal. They’d continue to return money-losing slots in New York to American. That won’t solve all of their problems but is likely a better path – having a partner in strong financial centers that allows them to double down on their co-brand credit card – than pursuing an acquisition of Spirit that wasn’t great for the airline or investors to begin with.

Bad day to have SAVE stock

Will be nice to see a tie up with AA again and encouraging loyalty integration

Maybe I underestimated the potential of B6/NK to add to Mint seats but a tough sell to engage in that loyalty program standalone

@MaxPower – JetBlue was overpaying when they entered into the deal. That’s even more true today. Good time to pull the plug.

@ Buy SAVE now

Too little too late. Two little crappy airlines, whom cares.

Blocking mega-mergers should have started 30+ years ago…

MINT is the best thing about JetBlue. Earning and redeeming AA miles for MINT service was a really good niche and should be brought back!

The Supreme Court needs to weigh in on this. Antitrust law needs to be limited to controlling REAL monopolies, not situations where judges (who almost certainly know less than industry participants) decide “what’s best” for consumers. There are no real antitrust concerns wihen bit players in an industry want to merge. And companies need to have the right to make poor merger decisions (as I think was the case in this merger).

Oh trust me, Gary. I sold my SAVE stock at the peak of the B6 hopes and dreams. Way too much uncertainty to stick around waiting to see how the merger progressed.

But I completely agree. B6 was overpaying at the time and DEFINITELY now.

@ Gene… Only the brave could invest in NK in their current state.

I’d put B6, NK, and Mesa right up there (with Mesa, by far, the riskiest) as the nearest-term risky stocks.

Mesa… just wow. They make B6 and NK look great somehow. Mesa can’t even publish a 10-k

It really is amazing how DOJ has allowed 4 mega-carriers but has left smaller players like B6 to fend for themselves.

I obviously don’t think the courts are biased toward Delta, but it is impressive how three major decisions (DOJ and courts) have cemented Delta’s status in the NE to ensure it can’t be challenged in any meaningful way by a competitor with somewhat comparable resources (obviously UA can challenge in NYC but United can’t challenge Delta whatsoever in LGA or JFK and B6 and AA are too small independently).

:

1. AA/US forced to divest in LGA despite being smaller than Delta there

2. NEA blocked helping Delta in corporate contracts in BOS & NYC and eliminating a true network competitor

3. Now the courts block B6′ ability to scale quickly and have a broader financial base (not to mention pilots)

It is what it is… but the celebrations must never stop in Atlanta with these decisions. Someone on here will, no doubt, have issue that Delta did all the work to build NYC and BOS but DOJ sure has helped them in BOS & NYC…

I am curious if B6 will try to join OneWorld (or if AA will allow it) to easily get the added benefit of AA and BA corporate customers (obviously they don’t have to join OW to do that but potentially easier).

I see AA buying B6 out of bankruptcy to secure the Northeast. Makes the most sense since neither DL with NYC and BOS hubs or UA with NYC hub would be allowed. B6 is anycase is done and Frontier will get Spirit.

Some recreation of the NE Alliance is the best route for everyone. I don’t know what it looks like, but figure out something the DOJ would approve…

Anti-trust and anti-competition are where there is insufficient competition (and consumers pay a higher price than they otherwise would if competition was sufficient), or if there is coordination between companies to set prices (and consumers pay a higher price than if there was no coordination). However, unlike your example, companies copying the published prices of another company is perfectly ok and is not an anti-trust or an anti-competitive issue.

A good example is what happens to other airline’s fares when Southwest releases its fares. Typically, Delta, AA etc. publish their fares 330+ days out, far in advance of Southwest. Then, when Southwest releases its schedules and fares, and as Southwest’s fares are typically lower, the other airlines lower their fares to broadly copy Southwest’s pricing.

Our courts have been compromised, we’ve seen it time and time again with these rulings and most recently the way the law and courts have been used to attack President Trump.

I am not sure preventing bankruptcies should be a valid reason to allow anti competitive merger. Bankruptcies can be healthy for an industry in the long term. They can create room for new entrants and innovators with better business models or ideas to emerge.

Both Spirt and JetBlue have a pile of debt and business models not working. If they both go under maybe something new and better will come out of it that benefits both the industry and us travelers. It could mean a bunch of aircraft, pilots, airport slots, and experienced employees coming into the play that some one could pull together to build a way more interesting or innovative airline with then what the leaders at Spirit and JetBlue have been able to figure out.

Bankruptcies are a great way to purge ineffective leadership and choking debt. The best pilots, mechanics, flight attendants, gate agents, etc from JetBlue or Spirit will get snapped up by other airlines or maybe some of those people will start something new and better!. The other airlines would be fools to let that talent pool go away if it becomes available.

There should be no such thing as too big to fail or bad mergers allowed just to keep badly run organizations in business.

@ AndyS — Average people have received life in prison for treason.

“Antitrust law needs to be limited to controlling REAL monopolies,…”

You’re close, but not quite there. The government should have no authority to address the “problem” of monopolies. Monopolies can not exist in a free market. I know, I know, the United States doesn’t have a free market, which again, is the result of the government. If they would get out of the way, the market would sort it out and the consumer would determine the winners and losers.

Gary is right other than thinking that Delta has had anything to do with the strategic failures that B6 has engaged in. The NEA and the NK merger proposal were both uncompetitive.

This merger blockage by the DOJ has major implications for the airline industry coupled with the Boeing mess. 2024 seemed like it was going to be a good year but 2 weeks into the year it looks like it might be another bad year for most of the industry.

Waiting for the Spirit/Frontier deal to be respected after appeal.

Jet Blue could benefit from the situation if NK declares Chapter 7 or 11.

Pilots would jump ship and leasing agents would seek bidders for the NEO fleet.

B6 could get complimentary airframes and experienced pilots at a fair cost.

“Anti-trust is a strange beast, morphing to fit almost any priors. Businesses that charge too much are earning monopoly profits. Businesses that charge too little are engaged in predatory pricing. And those charging that same as industry peers are engaged in collusion. That’s not a great world in law.” – Obviously

I think its time for Bill Frankie to pick up the phone and call B6. Buy them and turn them into a ULCC. It will make Frontier larger in NYC, BOS, and Florida which will lower fares, create and SAVE jobs, and expand the ULCC model into more Caribbean markets, not just the typical, oversaturated Cancun, Jamaica, and DR. So many tickets to these islands are so overpriced, and its not just the taxes. Spirit will have to liquidate, selling to the bare walls while their assets still have significant value and can pay their creditors. Their greatest asset, pilots and planes, are in high demand, and can command top dollar. I would bet the pilots already have been approached about switching teams. This will on accelerate their departure.

We will see in the future how this helps the real monopolists, the big three, collude on divvying up the USA passenger airline market. I hope JetBlue can survive because I like their product for my USA flights.