I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

What if I told you there’s a way to earn an effective 6% back on rideshare, streaming services, and some of your restaurant spend – on a no annual fee card – and you’ve never heard of it?

That’s because if you came across the new Manchester United Credit Card from fintech startup Cardless you might have skipped right over it, but that would have been a mistake.

And what if I told you that if you had an Apple device (such as iPhone or iPad) and used it to apply right now, it may not count as a 5/24 slot for Chase approvals – so some readers may not even be giving up the opportunity for another card by applying for this one? That’s exactly the case here.

Manchester United Credit Card Offers Strong Rewards

The Manchester United Credit Card offers 10x on Manchester United purchases (Manchester United Megastore, Red Cafe, and United Direct) but what I’m interested in right now is the unique value offered even beyond that for fans of the team.

- 5x on rideshare

- 5x on streaming services: Netflix, Spotify, Apple Music, Hulu “and similar digital streaming services.”

- 5x at bars and restaurants on days that the team plays

I’ve only ever seen a couple of more obscure cards offer 5x on rideshare, such as part of rotating categories. I don’t know any personal card that offers 5x on streaming services. And applying this week ensures those points are worth a penny apiece, as I discuss below.

You might have seen that the initial bonus on this card is a Manchester United Home Shirt after $1,000 of spend within 3 months – a shirt! – and given it a miss. But then you’d have skipped over the real value here.

Even Better Return When You Earn Free Streaming

Since Manchester United games are on Peacock Premium, the card gives you an opportunity to earn free streaming of games that is really a statement credit to cover Peacock Premium. Each month you spend $500 on the card you earn a statement credit for reimbursement of charges for NBC Universal’s Peacock Premium service up to $5.00 for the coming month.

The service comes with content like WWE live events, Saved By The Bell, Modern Family, The Office plus current NBC shows.

In the pre-pandemic ‘Before Times’ I was easily spending $500 a month between Uber and Lyft, Uber Eats and streaming services. On this card those charges would earn 5 points per dollar. And reaching $500 in charges earns an additional $5 statement credit for Peacock Premium – effectively then a 6% return on these categories of spend for someone like me who gets the card this week.

Apply This Week For Permanent Higher Redemption Rates

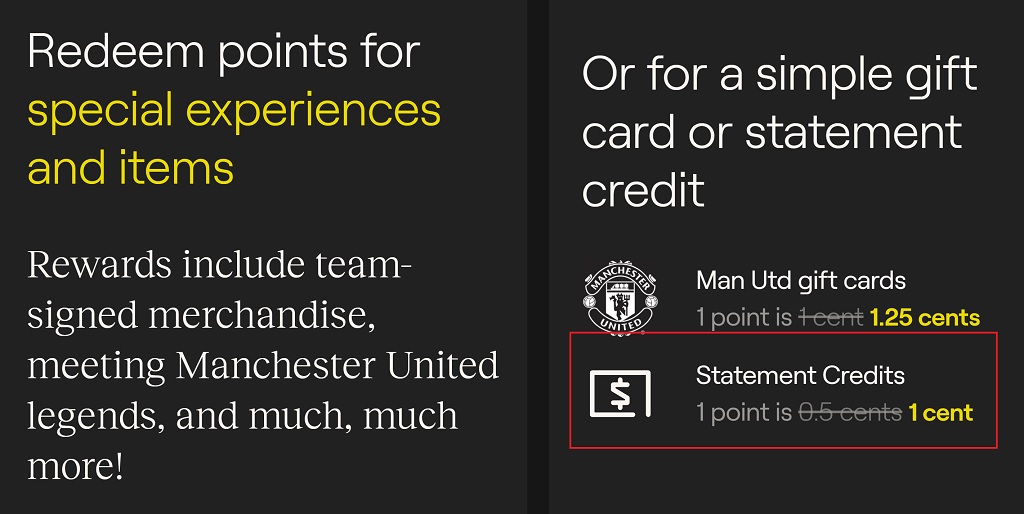

Let’s say that you don’t have an interest in team experiences with Manchester United, or team merchandise. The Manchester United Credit Card‘s base redemption value is half a cent per point. However according to the card’s website, anyone who applies by April 30, 2021 gets permanently higher redemption which shows as points being worth 1 cent apiece as statement credits (i.e. cash back).

Doesn’t Count Against 5/24

When an issuer is brand new, their first accounts don’t get reported to credit bureaus. That will certainly change soon, but it’s accurate as of the date I’m writing this.

The Card Has No Numbers

Cardless issues Mastercards that are available immediately on approval. You don’t wait for a physical card in the mail. If you lose your card, you don’t have to replace it and update all of the accounts (like Uber and Lyft) where your card is the default payment choice – because they don’t print account numbers on the card, when was the last time your card was run through an imprint machine that needed numbers on it? Without numbers the card doesn’t even expire. You can even change your account number without replacing the card.

For All Types Of Customers

Cardless isn’t a bank, it’s a Fintech. They’ve built out their own customer approval metrics from scratch. Instead of funding transactions themselves, like a bank that issues cards generally does, they put together a consortium of lenders that finances different segments of their customers – super prime, prime, and even subprime. I’d give them a shot even if you aren’t getting approved for traditional rewards cards.

There’s Only One Reason Not To Apply For This Card

Since the Manchester United Credit Card has no annual fee, and doesn’t trade off with applying for a Chase card, there’s virtually no reason not to get this card – except, perhaps, that you’re an Android and not an Apple user. Since it’s heavily app-focused, it’s only available for Apple users so far, and I understand Android support is weeks away.

USA ?

@JonG – yes a US card

Watch Out!!! I just applied and got hit with a new credit Inquiry at Experian. I incorrectly assumed that no 5/24 meant no hard inquiry. I wouldn’t have applied if I knew this would happen.

Reason #2 I’m on the fence: I’m a Man City fan. But also, apply by April 30 with no Android app available yet? That’s poor form.

Your claim this won’t affect 5/24 is dubious. Sure, maybe there won’t be a hard pull, and maybe the reporting will be delayed a couple months, but there’s no way payment history won’t get reported by summer. Chase doesn’t look at hard pulls. They look at actual account age

I applied because of your not hit to 5/24 and just got a ding on my experian. Please advise.

As a Liverpool supporter, I wouldn’t be caught dead with this card, even if it was 10% cash back 🙂

TBF a team “shirt” in British English is what we call a “jersey”.

It’s not a fantastic threshold bonus but it’s not a cheap t-shirt, either. For comparison, I looked up the list price of a US Men’s National Team jersey and it’s $90.

FYI Gary, if you want 5% back on Uber, Airbnb, Uber Eats, Doordash, Southwest, Chipotle, Instacart, etc, check out the free Slide app. They give you 5% off on all those services, no strings attached and no credit card sign up required. If you Google, you will find a $20 referral bonus or you can click my name above and it will send you there.

So, are you saying it’s just a soft pull on my credit, then?

@DaveD – hard pull, but approved accounts aren’t showing up

@Paul – With you on that one. As a Leeds fan, I could never have anything to do with this.

Stay away from cardless credit cards, they do not monitor fraud and they do not have a fraud call center off hours. A friend of mine had there number stolen. Couldn’t get a hold of anyone and left him liable for fraudulent charges. All around bad business!!!