In some parts of the world businesses charge customers extra who pay by credit card. This became common in Australia when merchants were allowed to recoup the cost of credit card processing from consumers, but then new rules were required because businesses were imposing surcharges that were even greater than their credit card fees.

This always seemed like a strange practice to me. The cost of accepting credit cards is often lower than the cost of accepting other forms of payment. People bounce checks. Cash disappears, change gets miscounted, and employees pocket some for themselves. Warehousing cash that needs to be taken to the bank can drive up insurance costs. In contrast, credit card processing is electronic, it’s easy to reconcile, and the funds are put straight into your account.

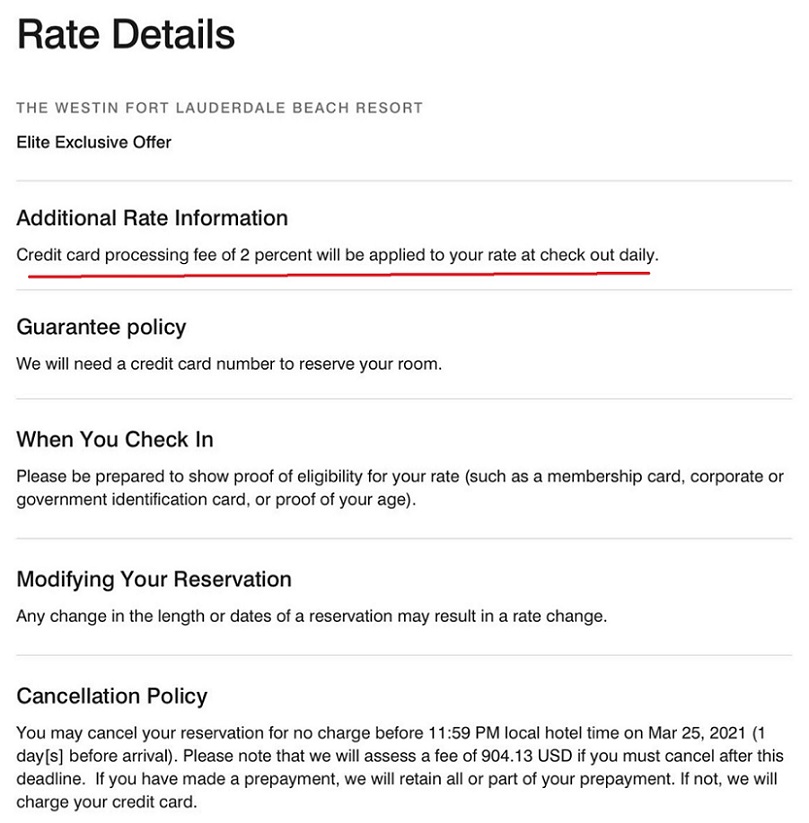

However Marriott’s Westin Fort Lauderdale Beach Resort has been charging guests a 2% fee for paying their bills by credit card.

It’s unclear when this practice began. However if you look carefully enough it’s disclosed by Marriott when you book the hotel.

I suspect that, for a resort, this sort of surcharge is less about the cost of processing credit card transactions and more that everyone pays by credit card. Guests didn’t bring checks with them on their trip, and aren’t going to go through the hassle of finding an out of network ATM while on vacation.

Within 45 minutes of my flagging the issue for Marriott, I was told that the chain was in the process of ensuring that the franchisee that owns and manages the Westin Fort Lauderdale Resort ceases the practice.

Credit: Westin Fort Lauderdale Beach Resort

I have to imagine that even if something Marriott might have been alright with otherwise, their partners American Express, Visa, and Chase wouldn’t have been. At this hotel customers were being charged extra for trying to pay with a Marriott Visa from Chase or with a Marriott American Express card.

As a next step I’ve asked whether guests who were taken advantage of by the property will have these fees refund. Have you experienced a fee to pay by credit card at a major U.S. chain hotel?

Surprised no one mentioned that most hotels, likely including this one, REQUIRE a credit (no debit) card on file for incidentals, etc. To do this and then charge a fee for paying via credit card is ludicrous.

In a place like the US, where most such transactions are settled by credit card, charging 2pc is ridiculous..it should be cost of doing business, especially in an industry such that this where margins are high and customer preference is paramount.

Having said that, I disagree with the author that credit card have lesser cost than other modes..similar to bounced checks ,CC charges can be disputed. Also, there are other electronic modes of payment..one need not go finding an ATM. For e.g., debit cards (usually the tx fee is lesser) or direct bank transfers. Here in India, every business..right from a 25sq.ft. shop to the largest establishments, have a QR code to which you can pay through a variety of mobile apps..

Availability of such cheaper digital alternatives now gives business owners the option to boldly charge the 2pc extra

Charging credit card fees for transactions is illegal in Florida. File a complaint with the consumer protection division of the Florida attorney general’s office.

I once left my wallet in a friend’s car and tried checking in without a credit card. I got enough cash for the room and incidentals deposit out of the bank. This hotel, a Courtyard in San Diego, refused to let me check in because I did not have a credit card. Given this experience, I can honestly say that requiring a fee to pay with a credit card is absurd.

Seems they lower it to 1%.

Anytime someone try to change me for using a credit card.. I just have to laugh, it is 2021.

My opinion is shared set the correct price and quite nickle and diming us.

I have a choice in hotels and that hotel will not be on my list..

Was just in this hotel–thanks for the tip. I complained and they refunded the charge. The people at the desk said my sending them this post caused “a lot of commotion” as they had never heard any discussion to reverse the policy. In fact, the sign is still up. On further inquiry I was told that about 1/2 the guests complain and are automatically refunded. The rest don’t and are charged. Something is very wrong here. If the franchise holder was told to stop they sure haven’t yet.

Oh, one other thing. This is a nice place and the staff is lovely. But the “business center” is using an older version of Windows 7, which itself is obsolete, so it doesn’t work very well. The charge to be online with this embarrassing junk is $7.95 for 15 minutes with $1/copy for each printout (boarding passes free). This sort of nickel and diming is just plain ugly. I’ve been in 2 star hotels with a free computer and printer by the desk. Somebody in the franchise isn’t looking at things the right way.

“The cost of accepting credit cards is often lower than the cost of accepting other forms of payment. People bounce checks. Cash disappears, change gets miscounted, and employees pocket some for themselves. Warehousing cash that needs to be taken to the bank can drive up insurance costs. In contrast, credit card processing is electronic, it’s easy to reconcile, and the funds are put straight into your account.”

Obviously the writer of this article has no clue about the numerous chargebacks businesses have to contend with…it takes us more time and costs us more money to lose on the chargebacks than it is to deal with a few bucks lost here or there…as a merchant, if you don’t do everything just right, you stand to lose a lot because a guest “realizes” they spent too much for their hotel stay and need to recoup their money by chargeback. When times are tough, this practice only increases and CC companies favor the consumer over the merchant each and every time. As the age old adage goes…cash is king…

Also from some of the comments here, people have no clue that when you have your card on file for incidentals, they are only authorizing your card…not actually charging it…if you don’t understand how credit cards work, how businesses use them and don’t understand the costs involved, you probably shouldn’t offer an opinion.

@CH

Your comment is totally laughable! The vast majority of chargebacks are not honored. I know because I had serious issues with MSC Cruises. They have denied everyone’s, not just mine. Put your business on here so we can avoid you!

I live in Mexico. In my city merchants, particularly “mom and pop” restaurants and bars charge 3% additional for a credit card. But, MX is a very cash oriented economy. The city I live in has lots of non MX tourist that use a credit card very frequently. One could look at it as getting a 3% discount if you pay with cash.

Scrutinize all the additional compulsory fees you pay for that wonderful customer experience in major hotel / resorts. It sorta makes that special / discounted daily room rate not such a bargain.

@JohnB

Actually, it’s your comment which is laughable…it is not your cruiseline which is deciding to deny your chargeback…it is the credit card processor that adjudicates the claim…and the burden of proof is always on the merchant. For the consumer, all they have to do is click a few buttons but the merchant must prepare an entire narrative to have a chance of winning….and if the merchant does not respond in a timely manner, you are screwed….case closed.

Your one experience does not make a trend…if you are in business and you accept credit cards, you would know what I am talking about. I don’t need to put my business on this site for the uneducated…those people who own and operate businesses know what I am saying.

We got charged 3% at the TownPlace Suites in Bridgewater, NJ.

Marriott takes out about the same to travel agents on their commission checks. I’m a busy corporate agent and I sell alot of Marriott’s. My checks are constantly being dinged for $2.00-$4.00 for ‘processing’ fee’s. Mind you, it is a direct deposit.