George W. Bush used to talk about the soft bigotry of low expectations. All I could think when American Airlines CEO went into his carrier’s fourth quarter earnings call oddly triumphant is that former Texas Governor Bush must have had the Texas-based airline in mind.

- They boast about ‘record revenue’ which would be almost impossible not to see after 20% inflation since the pandemic.

- They earned $590 million for the quarter, which isn’t losing money, but it’s only half of what their major competitors United and Delta earned.

Former CEO Doug Parker declared in September 2017 that the airline would ‘never lose money again’. At the time he laid out an expectation that the carrier would always earn $3 billion to $7 billion annually. Adjusted for inflation that’s now $3.5 billion to $8.5 billion. Yet for the full year they did not earn even $1 billion. Against $54.2 billion in revenue, $846 million is a paltry 1.6%.

Falling short several billion dollars in profits, they touted success in cutting costs $100 million more than they’d planned. That’s called re-arranging deck chairs.

This is better than losing money. It’s better than Spirit Airlines – which Isom used to say was his north star. But their 2025 forecasts don’t show business improving aggressively. They project losing money in the current quarter.

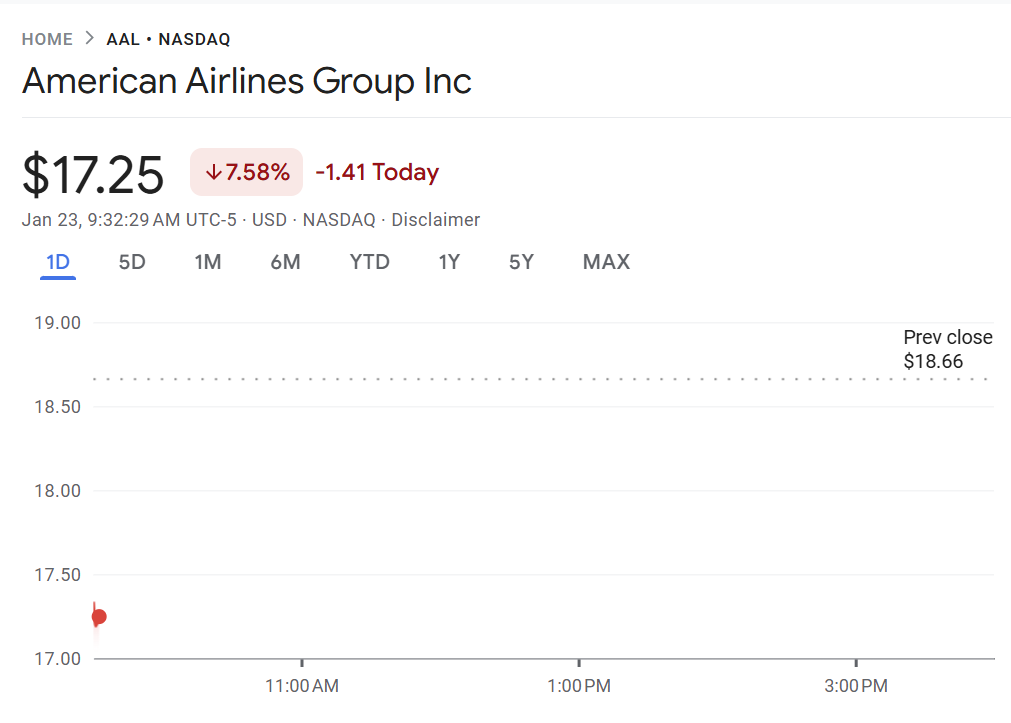

American Airlines stock opened down ~ 7.5%, while United and Delta opened roughly flat.

American Loses Money Flying People In Their Planes

Most of the money American is earning comes from Citibank and Barclays. Operating cost per seat mile was greater than passenger revenue per seat mile in both the fourth quarter and for the full year. This means they lose money moving passengers. The profit they earn comes from selling miles to banks.

Yet the numbers aren’t quite as big as they tout. They claim $6.1 billion cash from AAdvantage, up 17% year-over-year, but a significant portion of that growth comes from a signing bonus on their new 10-year credit card partnership. That’s non-recurring and will be amortized over the life of the deal.

And even American’s credit card has lost ground – what ultimately matters isn’t just deal terms but how much consumer spending happens on the card. Six years ago, American airlines cards saw more spend than any other airline’s co-brands. At their last investor day they conceded they had dropped to third (so behind Delta and United).

American Airlines Can Compete With The Best In The Industry, But Leadership Needs To Shift Focus

There’s a lot to look forward to from American in 2025 from new business class widebody suites; the arrival of the Airbus A321XLR; Philadelphia Flagship Lounge that should be nicer than the rest of American’s business lounges; more first class seats on Airbus A319 and A320 narrowbodies; and high speed wifi on 2-cabin regional jets.

Credit: American Airlines

Flagship Suite Preferred Seat, Credit: American Airlines

American needs a Chief Commercial Officer and a unified head of AAdvantage, rather than a split team with one group focused on passenger customers and a different team focused on selling points. AAdvantage is the shining star of American Airlines, and a real competitive advantage and yet it’s actually under-marketed (beyond executives repeating the mantra that it’s better).

There isn’t someone doing much of a job of owning the vision and communication to customers about the value they can get out of the program through greater engagement, and driving continued improvement at a senior enough level to make big things happen quickly.

Their new Citi cobrand agreement may be great, but it will be underexploited. Revamp of the premium Executive card made that product worse for consumers, and while the small business card comes with access to their small business program and extra credit for tickets towards earning status, the way card spend interacts with the program has been confusing and the program itself is hugely devalued by about two-thirds.

And they need to stop playing small ball, more interested in ‘not spending a dollar more than they need to’ and investing in the kind of product that customers want to pay a premium for – in other words, doing more than just talking up ‘premium seats’ but delivering on a premium experience. And doing more than giving away the store to managed corporate business to bribe them back after chasing them away.

Presumably all US based airlines make little profit on their actual core business. Without credit card revenue they’d all be in financial trouble. However, DL and UA seem to have a more robust and lucrative International operation versus AA. The only air passengers that make any money for the airlines today are the ones buying International premium.

AA doesn’t have the planes to expand Internationally and they seem reluctant to do anything to improve the domestic coach experience beyond being a step above Frontier and Spirit. Ditto operational reliability.

And yet they keep degrading their inflight product. The new service standard of not having a second beverage service in Y on most longer domestic flights just stinks of cheapness.

Great opportunity for them to layoff crew, and use the excess funds to do stock buybacks. Rinse and repeat.

And, please, keep picking fights with corporate travel platforms and other OTAs. Brilliant.

Their new motto should be: ‘Bring your own devices. Deal with it.’

Right now AA does not have the right planes, the right leadership, and (mostly) the right workforce. Before they had AA brand and very strong AAdvantage program. Not anymore. Tell me one aspect AA is better than competition?

American has spent years making their customers want to go to another airline. It worked for me, once did at least 6 flights per year with American, now zero.

The board are incompetent, they all need to go. Then the new board needs to fire the leadership as they are also incompetent. Only then can things start to turn around.

Amazing that Isom’s reported salary ($34m) is 4% of AA profits. His pay should be closer $340k and even that is being generous given his performance

They’ve been terrible for years, treating customers badly, reducing seat sizes, charging for everything. I literally live at their hub and do everything I can to avoid flying American. It adds an hour to my commute but I’ll drive to Love Field and take Southwest if I can, because Southwest’s service is so much better than American. If Southwest had international code share I’d likely never fly American again.

Time to raise prices and get rid of free upgrades!

“It is not the critic who counts: not the man who points out how the strong man stumbles or where the doer of deeds could have done better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood, who strives valiantly, who errs and comes up short again and again, because there is no effort without error or shortcoming, but who knows the great enthusiasms, the great devotions, who spends himself in a worthy cause; who, at the best, knows, in the end, the triumph of high achievement, and who, at the worst, if he fails, at least he fails while daring greatly, so that his place shall never be with those cold and timid souls who knew neither victory nor defeat.” — Theodore Roosevelt

Wow. Really well stated article, thanks Gary. As for the part about Cash Flow (“They claim $6.1 million cash from AAdvantage, up 17% year-over-year, but a significant portion of that growth comes from a signing bonus on their new 10-year credit card partnership. That’s non-recurring and will be amortized over the life of the deal”), that’s borderline fraud. The SEC may wish to have a word. In sum, what several others have pointed out is spot on: This is a failure of leadership, the CEO and the Board has to go.

Jetblue should enter OneWorld, team with Alaska Airlines, and kick American out.

It’s so sad to hear how much people hate American and its product. I’m a flight attendant for AA and I would do nonstop inflight service for those who wanted it, and I want to provide the best I can for our passengers. Our management is to blame for most of our problems. They barely give us any supplies, the quality is low, the seats and lack of seatback IFE suck. I want to be proud of what we provide people. Every customer needs to speak up and demand we get rid of Isom, the BOD and all of the current upper management team. Otherwise, nothing will ever change.

I avoid AA like the plague. They used to suck and I thought I’d give them another try last year and it confirmed they suck more than ever!

@TexasTJ – the language they use about it is accurate, i’m just pointing out that the number shouldn’t be used when comparing like-to-like with (say) Delta’s #s

No jet way?…really?

Anonymous AA FA,

AMEN!

I have been with American for decades but I find myself in International Programs now where I can book a seat in business class on miles/points between 29k to 90k on average on a nicer plane

@ American that 57k business class award typically means you are booking BA with a 700 plus dollar extortion fee

American flights in business/first seem to be 250 to 400 k each way so I’ve switched to other programs

Even booking BA makes more sense than booking most anything on America and just paying the high fees

Also to many games with married segments and the like.Sadly I’ve moved on

So that means not buying revenue seats or using their partner credit cards as its a rip off

@dwondermeant

‘American that 57k business class award typically means you are booking BA with a 700 plus dollar extortion fee’

tbh, I think it’s BA that extracts the fee. If you get AA for a leg, the fee is much lower. And even Alaska has a fee when you book award via BA.

I do agree that AA redemption rates on its own metal have jumped up dramatically. And with Qatar and Etihad flights being rarely available, AA isn’t what it was even 1 year ago.

You are very deceiving on you part about CASM vs PRASM making it seem like AA was the only one in this boat when DL was worse off and UA just barely above water. While AA was 17.34 vs 17.52. DL was way worse at 17.79 vs 19.22 and United eeked out a penny at 16.95 vs 16.85. TRASM vs CASM was in the black for all three airlines. And lets not forget the company owned up to the cost of the failed sales strategy back when Vasu was let go (in the neighborhood of $1.5B lost revenue for the year). Adjusting for this lost revenue would have AA only $1.3B behind in total operating revenue. I will be the first to admit AA needs to move on from hyper-focusing on being the most cost-efficient airline in the industry to dual focusing on that plus improving revenue, especially since the $15B debt pay down was completed a year ahead of schedule. Even Isom said on the earnings call he wasn’t happy with our lack of margin growth. Lets get to work then.

When airlines sell miles or points, they are selling travel, no matter how they account for it.

I’m a recently retired AA legacy employee who worked for the real AA.you can blame ROBERT ISOM and DOUG PARKER for the Airlines problems. They are both morally bankrupt and completely changed AA for the worse.until they dump ISOM in the garbage where he belongs AA will never change for the better.its a shame too see what AA has become. The only thing ROBERT ISOM does well is Bankrupt Airlines! Whoever thought bringing the losers of the Airline business to AA would help make AA better than the previous management team is delusional. Oh yeah,,,it was the pilots.and now the pilots are unhappy with management! REALLY???

Guess you’re not as smart as you think you are.

“Six years ago, American airlines cards saw more spend than any other airline’s co-brands. At their last investor day they conceded they had dropped to third (so behind Delta and United).”

Gee, maybe Corporate Security shutting down all those churners 5 years ago wasn’t the best idea after all…

We need a fresh, exciting airline that cares about people and its employees, and that will bring back international flights and consistency!

We fly to Argentina and Santiago often, and they don’t even fly year-round anymore.

Part of the AA problem was how they recently treated their business customers with their propriety web requirements. What an insane way to alienate your premium PAX and corresponding travel departments.

It will take a lot of kissing up to climb out of that Rabbit Hole.

I mean I’m not beholden to AA but fly them probably 80% of the time. No one can tell me ANY US-based airline has great service (and yes I’ll argue with any Delta apologists out there). Their network in the US for me at least usually provides the best flights and the best price (for non-basic economy). I’m not looking for luxury when flying CONUS I just want to get where I’m going economically and on the schedule I want. And their network… .just works in most cases.

And this is from someone who has a wife with United status thanks to her company loyalty to them. I just don’t see a difference.

@Gary – Didn’t Delta lose money flying passengers as well?

Thank you, Gary, for your article,” ‘Never Lose Money Again’? American Airlines Lost On Every Passenger In 2024 As Stock Crashes 7.5%” I am confident that many passengers would be happy to help stop American Airlines from hemorrhaging money if AA paid their valued clients to NOT fly on AA for a year. For example, if a passenger flies 100 segments a month on American Airlines and AA loses $25.00 per segment, totaling $2,500 or $30,000 annually, incentivize these loss leader customers not to fly on AA. According to an article published in Mashed, “there is the legend of the $100,000 olive. As ABC recounted in 2001, Robert Crandall, the head of American Airlines in the 1980s, calculated that he could save the company $100,000 a year…The point, however, is that Crandall figured a good wheeze for squeezing some extra savings.”

I bet now AA is regretting that 40% pilot increase & giving up F seats to crew members I remember back in the day when Robert Crandall said if he can make more money mowing lawns for American, he’d do it. This company has definitely lost its focus going forward for profit.

I am an accountant. The frequent flyer program “making money” is complete fiction, based on outdated assumptions that say that somehow a seat redeemed for mileage costs the airline less than the same seat sold as cash.

Today flights are fully sold and price in miles fluctuate, so this assumption is no longer valid. But because it was blessed by the accounting profession decades ago, and fits management narratives, it has no Mt been fixed yet

@Robert – that’s not how the accounting for redemption seats generally works on major airlines (when redeeming miles against seats on their own flights)

I hope they get it together because they have the closest major hub to where I live so if I can’t find direct flights, often it’s going to be AA. I think not investing in the basics of their interiors has not helped, and lack of vision on things like wifi and service have led to this.

I’m a long time EXP and my reason for going for that status was I was almost always upgraded on long haul flights using SWU’s. I was upgraded 1 out of 4 legs LAX to LHR (and on very few domestic legs) in 2024 due to AA offering J class cash upgrades dirt cheap to non-FF’s (which they no longer offer to EXP’s once an SWU is waitlisted). Biz class was wide open but starting about 2 weeks out seats started disappearing. I was always #1 on waitlist at the gate, but didn’t clear. Once I hit EXP for 2025 I decided to vote with my wallet and put the AA Exec MC in my drawer and am using other cards now. I’m done until they improve things as EXP is no longer valuable to me, so I’ll stick with my lifetime PLT status and not get anything less except for bus class lounge access on long hauls versus first class lounge, access which is no big deal. I’m certain I’m not the only one – they are killing the cash cow…

I just flew AA rt MCI to OGG. EXP upgrade MCI-DFW full flight. SWU DFW-OGG another full plane. Everything was on time or early. Service onboard was great, good food and drink. I purchased J for the night flight back so I could sleep. Again, every flight was on time and service was great. The meal out of OGG was better than in the past. Visits to the admirals club in terminal A on both visits were very pleasant. Little snack and beverages. Kuddos to the crew and agents on the DFW-MCI flight that got out on time after a late inbound aircraft. I do fly AA most of the time with no issues whatsoever. SWA being my other carrier of choice. Management has an opportunity to make American Great Again. I remember the days of caviar in first, carved roast in first and cookies baked on board. Isom and team need to go, get some fresh blood in there. The employees want to do the best, but don’t always have to tools or extra inserts of drinks to go above and beyond. The agents are understaffed. What’s that old saying, spend money to make money? Yeah that.

My co-workers kept telling me and I finally listened. I’ve got 8-10 cross-country flights a year. They were all American and they’re now all Delta. American just feels dingy. Just downgraded my Citi AA card to a no-fee version. Company will pay the annual fee on my Amex Delta.

My two issues are broken seats and the Admiral’s Club. I can’t remember the last time I flew on AA where there was not at least one out of commission broken seat on the flight, usually in or near the front of the plane where the $$ seats are. And the food selection at the Admiral’s clubs is abysmal not to mention the size of their facilities. I live in PHX an AA hub and all three clubs are tiny and always packed. Fortunately I have lifetime status on another OW carrier so the clubs are free but I just can’t see anyone actually paying for a membership.

@Pilot93434

You had me until the part, make “American Great Again”

I’ve been executive platinum now for 12 years and this year I’m considering switching to United. I can deal with almost everything American does except for the fact they have absolutely atrocious in flight service. I was on a United flight last week into Denver and a flight attendant came over and congratulated the woman beside me on her birthday! On every flight, I’m on with United I hear them thank their 1K members for flying with them.

Pre-pandemic you would hear that on AA flights but now you don’t receive any appreciation or even greeting by name in first class… it’s sit your ass down on the seat and we’re taking off mentality…

It’s the small details and the way you feel that matter. Every airline can get you there reasonably on time. It’s how you feel when you’re flying that makes the difference..