In a glowing New York Times magazine profile of Brian Kelly, the founder of The Points Guy website, there are a number of unreasonable and poorly-argued claims. One in particular bothered me enough to address: that people earning credit card rewards do so at the expense of the poor.

The poor underwrite the fantasies of the middle class, who in turn underwrite the realities of the rich. When credit cards charge high interchange fees, they pass the cost of loyalty programs on to merchants, who in turn pass it back to customers by building the fees into their sticker prices. Those who pay with credit can earn it back in points. Those who pay with debit or cash wind up subsidizing someone else’s free vacation.

According to a 2010 policy paper by economists at the Federal Reserve Bank of Boston, the average cash-using household paid $149 over the course of a year to card-using households, while each card-using household received $1,133 from cash users, partially in the form of rewards. It remains a regressive transfer to this day.

Merchants pay fees to swipe credit cards, but the cost to accept credit cards is lower than other forms of payment. In the fight between businesses and credit card companies over fees, poor people are used as a fig leaf for corporate interests. Cutting interchange rates doesn’t lower prices, and doesn’t improve access to credit for the poor.

Credit Card Sales Are More Profitable To Businesses Than Cash

Credit card purchases have higher average sales, accepting credit cards means getting bigger more lucrative transactions that they make money on. Smaller cash transactions are less profitable overall, people are limited to their cash on hand and are more careful spending cash. Plus wealthier consumers spend more.

Cash is a lot more expensive to accept than credit cards. Focusing on credit card fees misses that other forms of payment aren’t free. It’s actually higher cost transaction methods that drive up average costs to merchants.

- Cash has to be physically transported to the bank. This takes employee time which businesses pay for.

- Cash gets lost. Change gets miscounted, with customers getting too much money back.

- Employees pocket cash.

- Businesses may face higher insurance costs when dealing extensively in cash.

- Checks are harder to pocket and don’t involve miscounting change (where businesses don’t allow customers to write checks for more than purchase amounts and get cash back) but also have costs. People write bad checks. Businesses can insure against bad checks, but that comes at a cost too.

A more nuanced argument might be that premium rewards cards have higher interchange rates than less premium cards, but those too have average higher transaction amounts than basic Visa or Mastercard products (and American Express interchange doesn’t vary in the same way).

Reducing Interchange Hurts Equality

However if you’re concerned about inequalities in the financial system, the problem isn’t that businesses pay interchange it’s that efforts to reduce interchange have shut out access to the banking system by the poor. Complaints about interchange are usually driven by large merchants, who would love the same service at lower prices, using the poor as a fig leaf.

But when the federal government adopted the Durbin Amendment to Dodd Frank financial reform legislation, capping interchange rates on debit cards, banks responded by adding fees to checking accounts. Banks offered checking accounts free (at a loss) to attract debit business, earning a return for their services on fees for these transactions. Without the ability to earn a profit on these fees, banks could no longer offer free checking. The poor – those without high bank balances or direct deposit – were shut out and forced into more expensive venues (like check cashing stores).

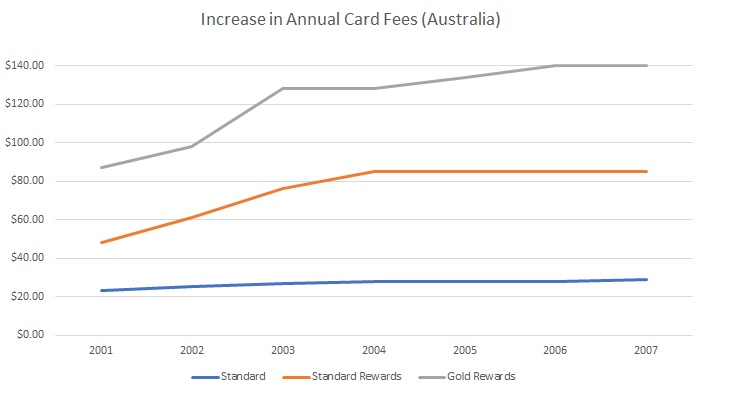

And when interchange caps were put into place in Australia, that drove up rewards credit card annual fees – putting these tools out of reach of less well off consumers.

In 2002 Reserve Bank of Australia introduced new credit card processing rules that went into effect a year later: capping interchange fees on four party card networks (i.e. Visa and MasterCard), and allowing merchants to pass these fees on to consumers. Here’s what happened to annual fees on rewards cards:

Retail prices didn’t fall, in fact when retailers were allowed to charge consumers for use of credit cards those fees generally exceeded the cost of credit card acceptance and Australia had to go through a new round of rulemaking to address higher prices.

Congrats, Gary! You managed to do a complain post without including a tantrum about how evil Trump is and the problem is all his fault. lol. Now let’s go for two in a row! 😉

“ and Australia had to go through a new round of rulemaking to address higher prices.”

Yup.

The lie that cash subsidizes credit card spend is particularly intentional in New York City, where so many businesses were REQUIRING credit cards TO SAVE MONEY that the city council enacted a law PROHIBITING retail establishments from going cashless.

The NYT writer knows this because he or she used to see plenty of restaurants that had signs saying they were cashless but they perpetuate the lie because the mission of the New York Times is to bring about social change, not to report the truth.

Thank you Gary for writing this. The problem is that the cash costs don’t go away unless you can actually get rid of cash which as other commenters have pointed out continues to be outlawed in various cities. The one that has always surprised me to see if that more merchants don’t have debit card only policies. Costco obviously was famous for this for years (obviously with an AMEX asterisk) and I know there are various gas chains that have experimented with it (Arco), but surprised more mom and pops don’t do it given the low fee caps.

@Gary: Higher interchange fees categorically increase prices. They are a cost of doing business. Increase them, and costs go up. Lower them, and costs go down (and competition lowers prices).

@Gary: “… but the cost to accept credit cards is lower than other forms of payment.”

Categorically false. You live in Austin. Drive up I-35 to Dallas. What does it say on a marquee above every single gas station? One price for credit — and a lower one for cash.

Ergo. Your statement is false, or they would be posting the reverse price relationship.

Another major downside of cash is the physical risk to employees from robbery. The employees working at gas stations and convenience stores certainly deserve safety.

Gary you are arguing details and missing the bigger point: this is another salvo the rich vs. poor, divide and conquer.

“Rich people” with reward cards will get thrown to the masses to score points. Political points.

You’ve got a rewards card? Not fair.

You’ve managed your money and grown your credit score over time? Not fair.

You got a better deal than me? Not fair.

You have the desire to travel to nice places and are trying to get good value for your money? Not fair.

Gary rewards cards are a big business. A tax will get levied. And that tax will ultimately be payed by you.

Sure, the tax might be assessed against AmEx or the merchant but we all know who ultimately pays those taxes.

L3 Says: “ One price for credit — and a lower one for cash. Ergo. Your statement is false, or they would be posting the reverse price relationship.”

This is an elementary error that can be easily disproven. The cost for processing ticket sales entirely online in a cloud-native platform is close to zero. The cost for processing ticket sales by staffing a box office 9-5 every day is manifestly higher. You can pay with a credit card either way, so the interchange fees are a wash. Yet Ticketmaster charges as much as 20% of the price of the ticket as a “Convenience Fee” and an (email) “Delivery Fee”.

Does this mean it would’ve cheaper for Ticketmaster to process all ticket sales at box offices? They would need to hire tens of thousands of new sales agents and buy millions in new equipment.

No, it merely reflects the value to the consumer. It’s at least 20% cheaper (money plus time) to snap up a ticket online than to drive to the box office and wait in line to buy a paper ticket that you might misplace. And so they charge extra for that. Just like when banks used to charge you to withdraw from their own ATMs but not for waiting in line at the branch, even though the latter costs more to process..

Why anyone would ever think that anything published in the NY Times has any validity/honesty/accuracy/impartiality is completely beyond me.

Even their RESTAURANT REVIEWS sometimes slam certain politicians.

Good points Gary. Looks like another woke article through the lens of critical race theory from the NYT disguised as a travel feature.

Would bet the author of this article has multiple rewards cards.

Rewards are the great equalizer. How else would average or poor people be able to experience luxury previously reserved for the 1%?

What makes it equal? Everyone can make simple but good choices. Pay your bills, establish credit, don’t carry a balance, enjoy vacation.

Nothing about that penalizes the poor. Just people who make poor decisions.

Grew up with a single mom on welfare, holes in the floor, graffiti on every usable outdoor space. Now I sit in $15,000 first class cabins regularly thanks to my ability to follow those simple rules.

@SeanNY2: Irrelevant. Read the question.

@john: Did you read the clear and unambiguous disclaimer at the top of the article?

Ryan, you are correct that rewards give the 99% of us chance to travel in luxury. And the 1% don’t like our participation—we should know our place is in economy and stay there. As the article states, rewards will also come under attack from the SJW in the name of the poor. I just hope this remains a smaller item on their action list for a few more years, but they will get around to “fixing” it at some point.

This post is below you, Gary.

The NYT is quoting a serious empircal study. And you do nothing but postulate that the transaction costs associated with cash are higher? Sure, that Boston Fed study is not exactly brand-new but what you’ve got is no evidence whatsoever.

The New York Times isn’t about truth it’s about socialist activism. Wealth redistribution, “rich” people with credit cards and airline miles are bad, white guilt, you name it. I feel sorry for people who believe what they read in newspapers like this.

Credit cards are evil and the ones with rewards are used by ignorant or selfish people. I say this even though I use reward cards.

The rewards are paid for entirely by the small business. The merchant fees are higher for reward cards versus non-reward cards. So this article that partly wrongly states that cash is bad and credit cards is good for the merchant overlooks that debit cards and credit cards with no rewards are less expensive to the merchant. Some really small businesses that might only have 1 charge per day really pay because they have swipe fees, settlement at the end of the day fees, etc.

Banks are like terrorists holding people hostages as far as reward cards. Banks tell merchants that they must accept all MasterCard and Visa and cannot refuse reward cards nor charge fees to the consumer for rewards. Small merchants are lucky that no credit card has a 25% cash back because then they’d probably have to pay 30% in fees.

I’ll go with the findings of the Federal Reserve of Boston on this over going with the belief of the blogging thought leader on travel.

Stores going cashless has been done to cut cash handling/cash management costs and reduce the risk of embezzlement and of other theft of cash (including armed robbery).

Thank for this Gary! I actually thought the people who pay interest from their credit card debts are the ones who subsidized our rewards points/miles.

SeanNY2 is peddling misinformation when stating this: “The lie that cash subsidizes credit card spend is particularly intentional in New York City, where so many businesses were REQUIRING credit cards TO SAVE MONEY that the city council enacted a law PROHIBITING retail establishments from going cashless.”

The fact of the matter is that when some businesses went cashless, they required bank cards for payment; but they didn’t require credit cards, as debit cards were acceptable too; and many of those retailers that went cashless for a while were aimed at getting business from debt card-users in the main.

Cash purchases at merchants used to subsidize bank card purchases, but that was when cash handling costs and related risks were such that merchants considered card purchase-related handling costs to be worse for them than cash purchase-related handling costs.

New York Times says “fill in the blank with any article”

That’s not true.

@GUWonder it’s two people who work there, not the view of the Federal Reserve Bank of Boston

GUWonder says: “SeanNY2 is peddling misinformation … The fact of the matter is that when some businesses went cashless, they required bank cards for payment; but they didn’t require credit cards, as debit cards were acceptable too; and many of those retailers that went cashless for a while were aimed at getting business from debt card-users in the main.”

“many of those retailers that went cashless for a while were aimed at getting business from debt card-users in the main”

GUWonder, if you have some factual support for your factual assertion, please feel free to provide it.

In the meantime, I rate your factual assertion: False, and also beside the point.

Evidence that it is False: The two dominant POS systems in use in New York (Shopify and Square) make no distinction between debit and credit cards in the amount charged to the merchant .

Square official website: “Square’s standard processing fee is 2.6% + 10¢ for contactless payments, swiped or inserted chip cards, and swiped magstripe cards. ”

Shopify official website: “The same rate is accepted for debit and credit cards using Shopify Payments.”

Evidence that it is beside the point: Many high-end restaurants went cashless before the city council banned the practice. These establishments rarely encounter anyone paying with a debit card. I discussed this witht he manager of one such restaurant who explained that the reason for going cashless is exactly as Gary described it: the all-in cost of accepting cash is higher than paying the 2.2 – 2.6% fee for card payments. Even if it were true that some retailers pay less for debit card swipes (evidence please?) and even if it were true that some retailers “aimed at getting business from debt card-users in the main” (evidence please?) it would be beside the point because these establishments were solely balancing the cost of credit card fees vs. the cost of handling cash and judging that the cost of handling cash was not just higher, but so much higher that it was worth losing some amount of business and inconveniencing some customers to avoid it.

Nowadays the Nytimes basically has to stick something about racism, sexism, classism or global warming into basically every article. Shouldn’t surprise you they stuck it in.

Other future Nytimes topics:

>Credit scores are racist because black people have more delinquencies

>Churning is bad for the environment

>What’s the carbon cost to mother earth of all those “free” flights?

>Churning is sexist because…

Senor Leff, I’ll still go with the findings from those then-researchers at the Fed being accurate at the time of the research.

SeanNY2,

Go back to the era of “you must accept cash, and not just cards” thing went into play, and provide evidence of even one merchant — not including rental vehicle companies — that said the presented bank cards must not be debit cards?

Debit card swipes used to cost US retailers less than most credit card swipes. Has that changed? 😉 All you need to do is go back and look at a collection of merchant services agreements that were around at the relevant time.

GUWonder says: “Go back to the era of “you must accept cash, and not just cards” thing went into play”

Ah well I remember that era. That long lost era that ended … when was it? Why it seems ages ago. Oh right, it was 51 days ago in New York City … on Nov. 20, 2020, to be exact.

So fortunately our little trip down memory lane won’t take us very long.

“Debit card swipes used to cost US retailers less than most credit card swipes.”

Incorrect and beside the point.

The two dominant POS systems in use in New York (Shopify and Square) make no distinction between debit and credit cards in the amount charged to the merchant.

Here are two quotes from Square and Shopify, using the wayback machine to reach deep back into murky past of early November in the year Two Thousand and Twenty:

“Square’s standard processing fee is 2.6% + 10¢ for contactless payments, swiped or inserted chip cards, and swiped magstripe cards. ”

“The same rate is accepted for debit and credit cards using Shopify Payments.”

GUWOnder says: “provide evidence of even one merchant … that said the presented bank cards must not be debit cards?

Thank you for helping to prove Gary’s point, which is that cash (that would be bills and coins) cost retailers more to process than credit cards. Which is why many establishments prohibited the more expensive option. For retailers, debit cards have the same convenience as credit cards and for retailers using the dominant POS systems in New York debit cards and credit cards cost exactly the same. But cash costs them more, so many retailers banned it even though it cost them some business.

Not at all sure how accurate the article is. Have never understood a statement like “credit cards charge high interchange fees”. My businesses accept ALL credit cards. Don’t care what card a customer uses. The fee is exactly the same for all cards. Current price increases are directly related to higher cost in doing business due to government imposed tariffs and COVID-19 related cost, not to mention higher wages that are increasing in many areas. Perhaps the way to go would be to teach lower income consumers how to better manage their money, their credit, and choosing the right bank to avoid fees. Even today, there are no fee checking accounts out there.

wow great article, to add to that our company is adding safes to every store with armored car pickup daily since the current cash losses and cost of going to the bank every day is so great. None of these huge costs are necessary with accepting credit cards other than the exchange fee.

Brazil and South Korea seem to have it all figured out. Certainly there’s no way in 2030 we’ll all be discussing the viability of cash.

SeanNY2,

Debit card interchange fees in the US are lower than credit card interchange fees.

Don’t fight the Fed(eral Reserve Bank): https://www.kansascityfed.org/~/media/files/publicat/psr/dataset/us_if_august2020.pdf , for no amount of fighting/lying like Trump will change the facts.

The travel bloggers seem from the outside to get most of their revenue from rewards credit cards. While the article did eventually address the issue of rewards driving high interchange fees, it was late in the article. Journalism has long had the issue of advertising affecting content. I can’t say this drove writing this article, but it does make it hard to say it was unlikely.

The problem that banks have is trying to distinguish their card from competitors cards. Rewards is one way to distinguish cards from other offerings. Having rewards cards without allowing merchants to reject rewards cards or to charge more for rewards cards takes power away from merchants the same way that restaurant delivery services take power away from restaurants. It’s hard to say that consumers would benefit from eliminating rewards, but it’s undeniable that poor people are less likely to be able to take advantage of rewards cards.

@jcil Amen. But we are low hanging fruit. Nobody can actually touch the 1%. Those are the people who own and edit the NYT. So it’s always easier to take a seemingly large action against a small group. Us, the points & miles whores. Hope I’m wrong.

Went to Sweden in 2019 and almost no business will accept cash. Hotels,

restaurants, stores. A cashless society . . .

L3 says: “… but the cost to accept credit cards is lower than other forms of payment.”

Categorically false. You live in Austin. Drive up I-35 to Dallas. What does it say on a marquee above every single gas station? One price for credit — and a lower one for cash. Ergo. Your statement is false, or they would be posting the reverse price relationship.”

L3 fails to take into account that card transactions can be made at the pump, while cash transactions require going in to see the cashier inside the store. The stations are trying to draw customers into their store to buy impulse items to drive up revenue. The only times cash is better than credit cards for customer payments are when buying drugs or politicians.

GUWonder says: “Debit card interchange fees in the US are lower than credit card interchange fees.”

Yes, on average. but not if you use Square or Shopify, and even if you don’t, that’s irrelevant if you’re a high end restaurant in new York whose customers rarely use credit cards.

Gary’s point is that cash is more expensive for the retailer to handle than credit cards. He proves his point if he can show that merchants whose only two choices are to (i) pay credit card fees on all or most transactions or (ii) suffer the costs of cash on some or all of their transactions, indeed choose to go cashless.

(1) We observe in New York that numerous high-end restaurants who rarely receive payment in debit cards went cashless. We also observe that numerous smaller retailers who use Square and Shopify (for whom debit and credit card fees are equal) also went cashless. This proves that those retailers believe that handling cash is more costly than handling cards with full credit card fees.

(2) If there are other retailers who have a choice between accepting cash and accepting a mix of debit and credit cards with an average fee lower than credit card fees, and they go cashless, that proves that to them, handling cash is more expensive than debit card fees.

But since we already showed that handling cash is more expensive even compared to credit card fees, we have already proved Gary’s point. Going on to show that cash is also more expensive to handle than something that’s cheaper than credit cards is entirely beside the point.

@AlohaDaveKennedy: Obviously not. They would advertise items in the store if they wanted to draw people in. Why exclude card payers from those deals?

“if you’re a high end restaurant in new York whose customers rarely use **debit** cards.”

isn’t it time Brady (above) stops having to let us know that he supports the racist thug in the White House? And that he admires a man who grabs women by their genitals and mocks the disabled?

Thank you all for paying for my wife & I to fly first class roundtrip MIA-NAN (Fiji) next summer!

@ Gary. Interesting article. I hadn’t considered the cost of cash. When I owned a retail business in South Austin I liked cash transactions (many airline pilots back then had side jobs.). It does have some downsides and I fully understand why governments want to switch to a cashless society. I also completely agree with AlohaDaveKennedy. With a retail business you want customers to come inside your store. Realistically the 3 cents per gallon saved by using cash will be spent several times over on a super jumbo slurpee.