Christopher Elliott wrote this morning “Yes, I called credit cards a scam — wanna make something of it?”

Why yes – yes I do.

There are two main thrusts to Elliott’s argument:

- That the benefits consumers dervice from credit cards are a scam

The cards that promise a gazillion points you’ll never be able use, charge you an outrageous annual fee and sky-high interest rates? … Those are obvious scams, waiting for the heavy hand of the Consumer Financial Protection Bureau to end them. And it will happen, trust me.

- That consumer debt means that credit cards are the problem

Consider our debt levels. Americans owe $901 billion in credit card debt. The average household — average household — has $15,677 in credit card debt.

The number has declined slightly over the years, but not because we’ve paid off our debts. One survey suggests it’s because we’re defaulting on the debt.

What does Elliott want instead of credit cards? He admires payment mechanisms that settle transactions without the possibility of debt (presumably like debit cards).

What if we could avoid these slippery, debt-inducing financial instruments and use something more responsible? Other countries are already turning to direct withdrawals and mobile payments as an alternative to plastic, which offer many of the same benefits as a traditional credit card.

What don’t they offer? Well, the opportunity to get neck-deep in debt, for one.

But consumer credit, and worries about debt, aren’t a function of credit cards. Indeed, consumers have needed to smooth out income and meet immediate purchasing needs long before credit cards were first introduced (Diners Club, 1950). And hand-wringing about it is just as old.

Two New York Times headlines from the 1870s?

- “Running in Debt” (1873)

- “Borrowing Trouble” (1877)

What’s more, consumer debt isn’t getting worse. Since the 1960s the percentage of household income used for interest on consumer debt has remained constant.

But how can this be? It’s quite simple. Credit card debt has gone up as it replaced other forms of consumer debt like “buying on time” directly from stores. As a result, total debt repayment obligations for the typical low income household are lower today than in 1980.

We used to buy from large department stores with their own credit operations. Credit cards made it possible for us to buy from anyone, from small retailers without their own credit offerings, from individuals on the internet.

And of course credit cards do offer superior consumer protections as well that other forms of payment don’t match. There are protections against fraud, and chargebacks for non-delivery or subpar delivery of goods and services, not to mention extended warranties and purchase protection for defective or damaged items.

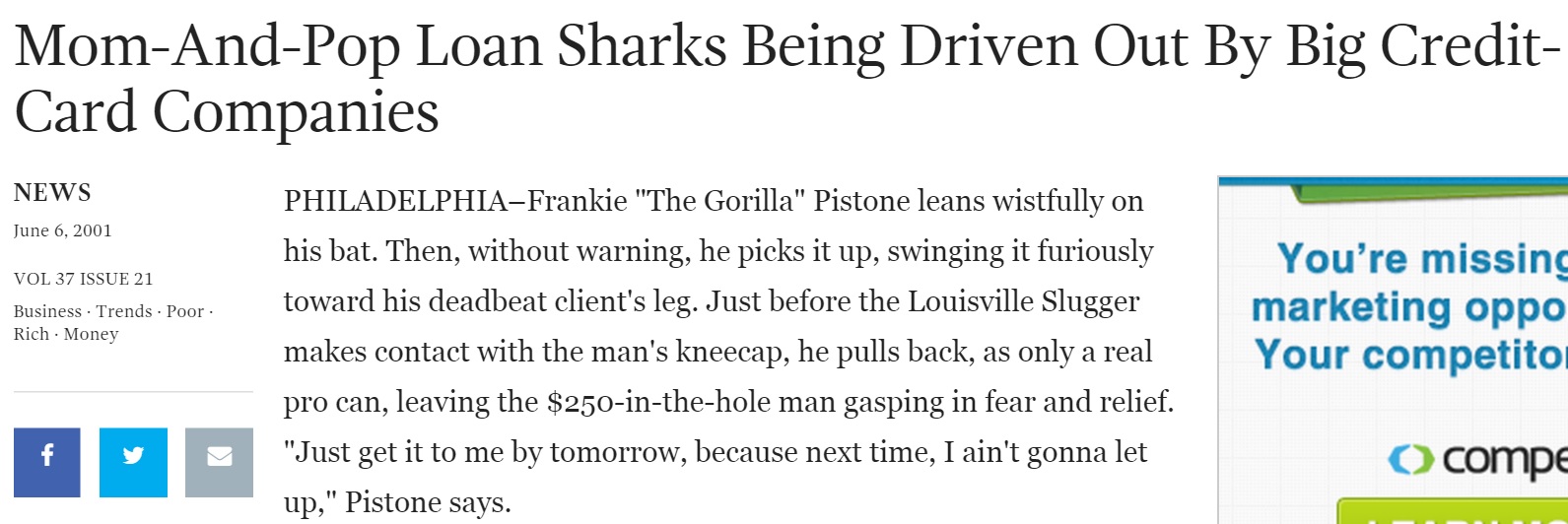

Ultimately credit cards aren’t the cause of the debt, they’re merely the most convenient and advantageous mechanism of payment and a better way to pay over time than alternatives that came before them. In fact, The Onion perfectly summarizes the role of credit cards compared to options faced by consumers otherwise.

In the end, it seems like Elliott just resents his choice of credit card?

Like most Americans, I use a credit card. I hate it. It charges a confiscatory foreign transaction fee, lets me collect bogus “points” that are difficult to redeem, and the interest rate is borderline usurious. I hold my nose when I use it, and I always pay off the balance at the end of the month.

It sounds like Elliott just has the wrong card. If he travels internationally, there are plenty of options that award perfectly valuable points that are easy to redeem which do not add foreign transaction fees.

I agree that it’s best to always pay off the balance each month. But if you need a car repair in order to go to work, and don’t have the cash to pay for it, it’s an investment to pay for that over time. The alternative is far worse. And fortunately there are credit card products that offer low interest rates, or 0% and no fee balance transfers. Not everyone can qualify for those, but for those who can’t the alternative — payday loans and the like — comes at a much higher cost.

Damn, if the dude finds his points so useless, I’d buy them off of him (at a discount reflecting their uselessness) were it permitted.

Yes, if credit cards didn’t exist then consumers would have no choice but to only purchase what they can afford. I’m certain of this. Oh wait…

http://www.nytimes.com/2015/06/16/business/dealbook/goldman-to-move-into-online-consumer-lending.html?_r=0

http://www.wsj.com/articles/springleaf-to-buy-citigroups-onemain-financial-1425338919

A ba blogger that doesn’t have the right set of credit cards! Haha

Can we please Elliott off BA? All he does is complain and cater to complainers. Personal responsibility is not in his vocabulary. Everything is someone else’s fault with him.

I talk to alot of people when they ask me about miles/points. So many people dont know how to use a credit card. Dave Ramsay has a cult following that has made him millions of dollars. He acts like the everyday man although earning millions per year talking about debt. I can see how people can get in trouble with cards and associated interest. His platform is to have zero cards. Forget points earning etc. If you travel debit cards can be problematic to use. Consumer protections overall work easier for credit vs debit. Elliott is just trying to get web traffic or something. I have used many of the 0-3% balance transfer checks for real business purposes as well. They have done great for me and I pay all on time. They are a minefield for those who dont have the ability to repay them on time. They were great for me since the cost is so low for 12-18 months plus money. If you take one of them and cant pay it back on time you get hit with 20% interest approx per month after that.

High interest rate is what feeds sign up bonus, no interest = no income for c/c companies = no sign up bonus.

I would guess for most of your readers the interest rate isn’t even a factor, I know it isn’t for me. I can’t even tell you the interest rate for any of my cards, I’ve never had a reason to care. If you’re choosing your card based on interest rate, then I might agree you might consider ditching credit cards altogether. They’re only good if you can pay off your balance.

In many ways though, isn’t it better to let the nay-sayers have their spotlight. The more people who believe this, the harder banks will need to work for their business. That could mean much bigger sign-up bonuses!

As Nathan said, interest rates are not a factor for most of this blogs readers. The best cards from Chase, Amex and US bank all require very good credit scores. I would guess that it is a relatively small % of people who have very good credit scores but also have big revolving balances that they pay interest on every month.

When you start talking about these “elite” cards, the credit card companies are probably making more of the standard merchant fee than off interest owing largely to the amount of spend that is put on them.

@Dan that’s correct, the merchant fee on premium cards is higher and the spend volume is orders of magnitude higher.

Elliott is an idiot. I really wonder why is column is even including in the blog area as he often highlights ridiculous rants by “consumers” seeking compensation for things that are their won fault.

I am not a fan of credit card churning and the like, but what he always has wanted is a “nanny state” and his rant of today is no different — he expects others to “protect” him from the foolish choices he or his “followers” have made.

I hope his column/blog is kicked out of this blog aggregator.

My apologies, I see that Seth, above, had beaten me to the punch!

“What if we could avoid these slippery, debt-inducing financial instruments and use something more responsible?”

Oh, you mean, cash? That works wonderfully, and you never worry about buying more than you can afford.

One Elliott line is really puzzling: ” It charges a confiscatory foreign transaction fee, lets me collect bogus “points” that are difficult to redeem, and the interest rate is borderline usurious.”

Why doesn’t he get a no-fee Capital One card, which has no FX fees and no annual fee? And then a Citi Double Cash card, which also has no annual fee and pays 2% cash back — better than “points” for domestic coach fliers like Elliott?

No fees, no FX, no hated “points,” 2% back. What’s not to like with that?

The only thing he does right is full payment every month. But then he complains about the interest rate . . . as though that were even relevant. It’s not.

I just don’t get it. How can anyone know so little? About cards & points? On a cards & points site like BA?

Tell me. I want to know. Please.

I also disagree with Elliott’s thinking.

However, I hope we can all agree that somebody is paying for the benefits we’re getting from the banks when using the credit cards. The audience of this blog and others like it is very different from the typical credit card user – we’re very disciplined and we’re very detail oriented.

Somebody is paying for the 100k Membership Rewards bonus I got from an Amex Platinum card. The value of those points is at least $1500. The $450 annual fee will be completely credited back – I already used the $200 annual airline fee credit and plan to do the same next year, I already got some Amex offers etc. Amex knows for sure that they’ll lose money with customers like me but they certainly have *plenty* of other customers who make money for them. Otherwise they simply wouldn’t offer these benefits.

So @Gary, if credit cards do not have a predatory / scam element why do we have an entire executive agency dedicated to protecting consumers from them? The CFPB lists mortgages, credit cards and student loans as the top 3 consumer credit abuses. Why would Citi recently settle for $700 million due to deception? Goodness of their hearts aka “not a scam.”

I didn’t bother reading Elliott because the man is a moron. But you are in no way more correct than he is – the predatory aspects of credit cards are real and as pernicious as payday loan operations (maybe more, because broke people know the payday is a scam). When you are making $9 yet extended more in credit that you make in a year – this is a real issue. I don’t know if the right word is scam, fraud, usury, or predation – or some combination of all.

Anyway, credit cards are not a scam or menace for the people reading this blog (although the companies might not agree). But for the below-average population struggling to get by?

@bode I’m not saying people don’t have challenges with debt, I’m saying that credit cards are better than what came before and better than the alternative. And in fact, debt service levels even including student loans are down (in part because interest rates are down, even for risky borrowers).

Citi didn’t pay fines for its credit cards, but for marketing products like credit monitoring services.

In any case, for folks struggling to get by access to credit is important and if credit cards weren’t an option then they’re faced with higher cost lending or not having access to needed capital to handle life’s emergencies like car repairs to get to work, healthcare for their kids, etc.

Please do us all a favor and don’t link to his site anymore – I’m sure he’s using you to generate traffic…

Credit Cards exist because banks need to loan money. That’s why there’s a minimum spend requirement now. Most are unsecured debt, that’s why there are minimum balance due with “high” interest rates. In the past, there wasn’t a minimum spend requirement. Having said that, it does come down to financial education. The banks, criminals that they are, know that most of the balances derived are from personal credit lines, not business, and could careless what predicament they put people in since there will always be another sucker to enter in the pot.

The problem now is that the major credit cards, and Paypal specifically, allow pirate websites of digitized content to accept them; and in return, they have literally destroyed the economy, wiping out buying and selling physical objects. This current “getting better” economy is not true. From Dodd/Frank, only the CFPB was the good part of that legislation.

In the end, people have no money, exactly how this criminal Obama Administration of Communism wanted it. The airlines now have their 18 months of super profits before Obama guts the economy to the 1929 collapse like Bush (and Silicon Valley) did in 2008.

Gary Wrote: “Citi didn’t pay fines for its credit cards, but for marketing products like credit monitoring services.”

Oh, how much you won’t reveal. LOL. I have a list to the moon of Citi infractions including CC’s way before the CFPB. BTW, CitiGroup was the catalyst in the 1980 collapse and a large chunk of the 2008 collapse. Here comes 2014-2015!

I don’t know the ratio for cc company profits, but we are generating plenty of them, I assure you. Every time we buy that $500 gift card, the store is paying Amex/Visa/MC 2-4% of that $505.95. Speaking as a creditor as well as points collector, I am well aware that the places I use my cards are paying for a large part of the hobby. I don’t pay interest, but the price of goods in stores reflects the cost of credit for all of us. (No judgment here of any of this–just pointing out that the companies we think we are “gaming” are getting the last laugh.)

@Bobby there are lots of things to criticize about Citi, and Goldman, and on and on. A specific recent news item was being used to make a point, and I was noting that the news item did not support that point. That hardly makes me an apologist, given my overall criticisms of the bailouts the banks received.

And the reason for minimum spend requirements is not ‘because banks need to loan money’ it is because they want consumers to put their card top of wallet once they get it, use it, and then the believe it will lead to many continuing to use it. With bigger and bigger signup bonuses they need to recoup the cardmember acquisition cost over time.

Your reference to Obama leads me to think you’re “ED” (known for racist rants) whom I asked not to comment here any longer.

Gary:

Why do you bother to continue to joust with this mental defective?

Gosh, if we get rid of credit cards with 30% interest rates, low income consumers can go back to payday lenders with 300% interest rates….

yeah one need only read any Russian novel ever to know that a society where people all over the scale walk around with giant and ever increasing piles of debt is not a remotely novel phenomenon.

look at who wrote it!

Credit cards do not create debt problems it is the people who create them who are uneducated and try to live beyond their means.

Elliot needs to be taught what cards to get and how to pay off his credit cards without paying 24% interest, while earning .0001% on his savings account.

People who use a credit card to buy something they can’t afford are the problem. If you can’t afford to pay the bill at the first of the month, don’t buy the object. Calling all credit cards a scam is just plain weird; makes me think that Chris doesn’t understand how a credit card should work.

My credit cards give me wonderful perks, I wouldn’t use them if they didn’t. But I never put a charge on a credit card unless I know I can pay the entire credit card bill when it arrives. So it’s not a credit card problem, it’s a social problem; people buy things they can’t afford to pay for.