I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

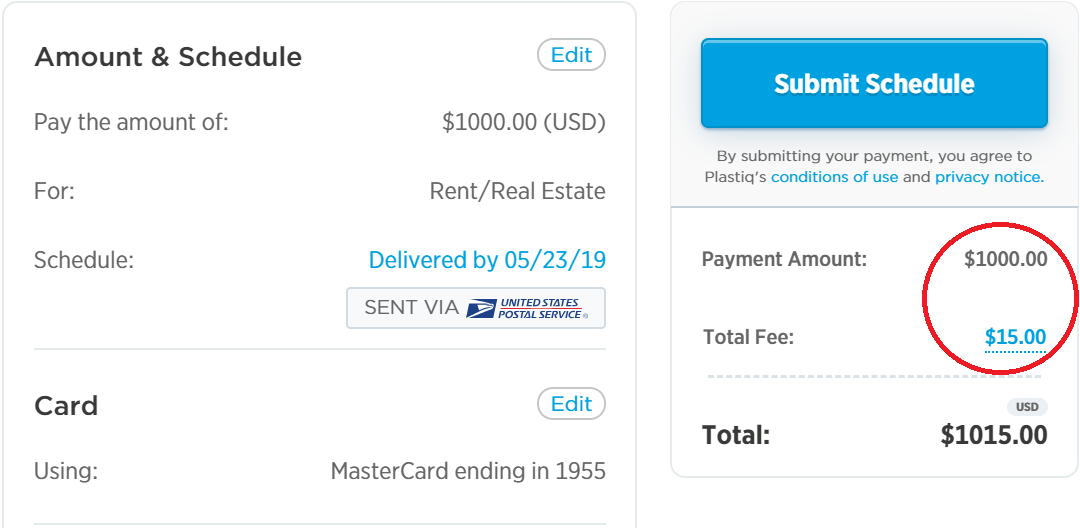

Plastiq.com is a service that will charge your credit card and mail checks on your behalf. (With some vendors they also make electronic ACH payments.)

Their usual fee for this is 2.5%. It’s worth it to incur that fee if you’re earning a signup bonus with the credit card charges, or you’re meeting a spending threshold for a bonus.

However I generally advise that it’s not worth it for the ongoing miles without a spending bonus. You don’t want to incur a 2.5% fee to earn 1 mile, you’re buying that mile at 2.5 cents. No mile is worth that.

There is an exception: for business spending companies can generally write off the fee. If you’re paying business bills via Plastiq.com your net cost is 2.5% minus (2.5% * your marginal tax rate).

Here’s something I love though: right now it appears that Plastiq is charging just 1.5% for Mastercard payments. You can pay a residential mortgage with Mastercard credit cards. That creates a pretty cool opportunity if you value the miles you’d earn at more than 1.5 cents apiece, or if you’re working on a bonus with a Mastercard. The two premium American AAdvantage credit cards that earn elite qualifying miles based on spend are Mastercards.

Plastiq has made this adjustment to their systems to charge just 1.5% on Mastercard payments, but has not yet advertised this special offer.

(HT: Doctor of Credit)

Update: fee has reverted to the usual 2.5%. Personally I scheduled my mortgage payments out a year, and they remain intact at the 1.5% fee quoted. I’ll be watching to make sure that remains the case!

Is this for new payments only? I don’t see it being effective on my previous or next MC mortgage payment.

best mastercard sign up bonuses with Chase, excluding IHG?

best point earning Mastercards issued by Chase?

I just deleted the payment and send out a new payment. It adjusted the fee.

@Tim O’Brien – Chase is almost exclusively Visa, the IHG card is the exception. Citi AA cards are Mastercards though.

@Andrew yes new payments only, I had some payments scheduled and I deleted them and re-entered to get the 1.5% fee

The Citi Double Cash Card is a Mastercard which gives 2% back (1% at time of purchase and another 1% when the balance is paid off), so one could theoretically ear half-a-percent on each [Plastiq] transaction. It would be cool to pay your monthly mortgage with this, but I’ve heard one too many stories about payment snafus with Plastiq to trust it at this time.

Missing or being late on a mortgage payment would undoubtedly lop a lot of points off your credit score, so it then boils down to a Dirty Harry (Clint Eastwood) moment of decision… “Do you feel lucky? Well, do ya?!?”

@Gary – got it. Thank you!

I am still getting 2.5% on new payments.

I take it back, it’s working for me.

@Gary Does this work for rent?

Plastiq ALWAYS snags my payment and tells me they’re rejecting it if I pay anything big like a mortgage, even if I use MasterCard. Then, when I respond to their rejection, I never get a response— only get my charge reversed, so I am not using them at this time. Just WAY too unreliable, with unreliable customer service.

Gary, what is your buy price for AA miles.m (not counting spend bonus considerations).

@Beachfan – I view them as worth 1.4 cents apiece (https://viewfromthewing.com/2019/01/31/how-much-are-miles-really-worth-assigning-a-value-to-points-from-each-program/) but the value varies based on how many points you already have, how you’ll use them, etc as I outline in the link. With a 7 figure balance already I value incremental AAdvantage miles less than that personally. But miles that put you over the top for an award you’re going to claim in the near-term are worth more.

Tried but it wouldn’t work for me.Was told it’s only for those on a list for this promotion. You had to have received an email.

Yes… It appears fee has reverted to the usual 2.5%. I tried all methods of sending (mail, ACH). All showed 2.5%

@ Jocool – yes, it seems to have expired. I signed up for it yesterday and BoA sent me a new credit card today, invalidating my previous credit card.

Suck.

@Gary: When these deals occur, is there any way to get notified? Plastiq seems to revert the deals really quickly.

@L3 this one may have been a mistake, so…