You don’t actually want to ‘reward your highest spending customers’ through a marketing program.

- You want to ensure you don’t lose spend, and you want to incentivize more spend. In other words you want to influence behavior at the margin. Spending money that isn’t necessary for revenue you’re going to get anyway isn’t good business strategy.

- If someone flies you because you operate the only non-stop flight on their route or have their corporate contract, you’re going to get the business either way, spending more money on those customers reduces your profit rather than increasing it.

- And the highest spending customers aren’t necessarily the most profitable. A customer buying the last seat on a flight that would have been purchased by someone else doesn’t provide you with additional revenue or profit on an opportunity cost basis. Someone filling a seat that would have gone empty is revenue which goes straight to the bottom line.

That doesn’t mean low spenders are more profitable than high spenders, but it means simple slogans like ‘reward your highest spenders’ are sloppy thinking.

Still, the revenue-based programs that have been designed by Delta and more or less copied by United and American don’t actually reward high spenders more than before. They do, however, punish high spenders less.

Let’s look at American Airlines program changes purely on the earn and burn side of the program.

- An Executive Platinum has to spend 18 cents per mile flown to earn as many miles as they did before under the old mileage-based system. That’s hard to do because it’s higher than the average airfare, and indeed fares are falling.

- The price of first class saver awards have gone up 20% – 69% thanks to award chart devaluation. Devaluation of business class awards was more modest, topping out at 28%.

- However if you were going to use your American Airlines miles to redeem for travel on American — let’s say international business class — saver awards virtually no longer exist except for a few days a year when space is briefly made available.

- And getting extra award space no longer costs double miles. Without notice American added award tiers making ‘AAnytime awards’ frequently triple the price of saver (sometimes more, sometimes less).

American Airlines Business Class Boeing 787-9

Customers are earning fewer miles from flying than before, and awards cost more miles than before. Let’s look just as those high revenue customers.

- In fairness to American let’s just take triple miles and not worry about the devaluation.

- Break-even spend is 18 cents per mile flown on the earn side, to have the miles needed for an award you’d have booked before you actually need to spend 54 cents per mile.

- That means you need to spend $54,000 flying 100,000 miles just to break even. Put another way, far from coming out ahead, some Concierge Key members earning that status based on spending aren’t even breaking even.

To come out ahead you need to spend more than $54,000 per year flying 100,000 miles. If you fly 150,000 miles you need to spend materially more than $81,000. It’s those $100,000 a year ticket purchase customers flying 150,000 miles who are actually coming out 25% better off than before.

Some great reward for high spending customers, huh?

Meanwhile over 3/5ths of miles continue to be earned through partners, which means it’s still Citibank and Barclaycard customers who are earning more miles than the highest spending flyers.

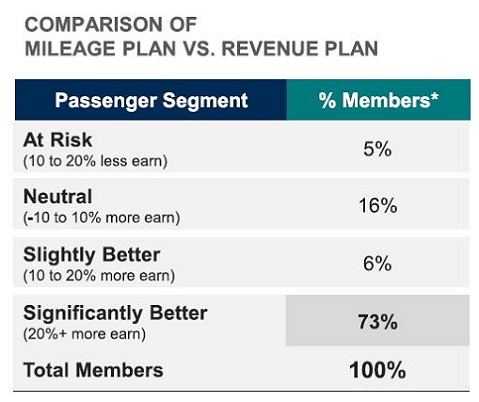

American was candid speaking to me two years ago about their revenue-based changes, that they would mean fewer miles for flying awarded year-over-year. Alaska Airlines, which still awards miles based on distance flown, said that on the earn side alone only about 5% of customers would be better off with revenue-based changes and Delta, United, and American all chose to make the miles being earned worth less, too.

To be clear planes are largely full and Delta, United, and American don’t need to spend as much on customers to fill incremental seats. Alaska on the other hand has faced tremendous new competition out of its Seattle hub and is unlikely to choose to devalue while it’s in the process of merging with Virgin America.

There may or may not be a right level to reward customers given particular business needs. However the notion that most high revenue customers are somehow better off is one of those things that gets repeated enough that people assume it’s true when it doesn’t even come close.

Nailed it, Gary. Very well-said and laid-out.

If you hold constant the devaluation of redemption (which happened regularly before earning models changed) then this is less stark, and many high spending fliers do indeed earn more rewards than they would have under the mileage based earning system.

In fact had they stuck with mileage based, it’s possible redemption devaluation would, shudder to think about it, be even more stark.

The real change is so many more miles being printed / earned from places besides flying, thanks in part to the 2008 era deals with the banks to prop up the airlines. That’s made the old ways of rewarding flight less viable.

I think your analytics fail to capture this distribution.

https://www.cnbc.com/2015/04/13/top-1-pay-nearly-half-of-federal-income-taxes.html

Agree, very well said, but us frequent fliers continue to stay on thr hampster wheel to reach EXP.

Funny last year.. most bloggers and posters talked about how tney would ditch AA this year due to the changes and jump shit.. i think they realized, theres really no other different ship..

It is nice have EXP perks, think i was upgraded 90% of he time this year, all my SWUs cleared (last minute), but still cleared.. but not sure i would spend out of my way anymore, just not worth it. The 6 SWUs i earn this year, are nice but never available at tim3 of booking, hate that unknown factor if i will clear.

This is me rambling, because ita internal struggle what to do. We are fucked due to lack of anyone offering a competitive advantage.

Well done, Gary. I just decided to spend 20K AA miles on Royal Jordanian to hop around from Europe to two destinations in the Mideast … nice use of those miles which are so much easier to get by acquiring a credit card than by flying. Sigh. Good-bye to my platinum status come January 31.

Although I agree emotionally with you, I truly do not see the decision makers in the airline industry ready to accept your points, since they seem to operate in an echo chamber, with Alaska apparently being the only one outside the chamber (for now).

Yet, as you point out often these are both the best of times and the worst of times.

Have a wonderful Holiday.

Gary: I would appreciate an article on AA’s new Basic Economy fare. While booking through my corporate travel site Concur I unknowingly ended up with this fare which does not allow elites to pre-reserve seats. And no changes whatsoever are allowed, even for a price! I contacted the AA elite desk who refused to do anything for me, saying that the restrictions were posted on Concur. They were not. Just the typical pop up saying it is a non-recundable fare. Incredible that no pre-assigned are allowed even for platinum!

Agree 100%. Revenue based FF programs provide significantly lower rewards for spending on airfare and flying. The value of AAdvantage went down to the point that I am no longer acquiring miles through the AAdvantage partners. This means no spending on AA credit card, no rental car and hotels credit to AA.

Most high spenders could care less. These calculations mean nothing to them. They spend nothing for their miles irrespective of whether the program is mileage or revenue based. Also many of them have more miles than they know what to do with.

AA is great for saver award availability and their new 30″ pitch seats will be some of the most generous in the industry.

well, if they are making mistakes, soon they will realize it because they have the data. You don’t have the data, so it is a bit hard to prove your points empirically. I admit, though, that I would love you to be right!

@ken – I am not saying the program is suffering, they don’t need to be as rewarding to fill incremental seats on planes. I’m just saying that when they claim high spenders are rewarded more than before that isn’t true.

@john in my experience with high spenders that isn’t true at all, but it’s beside the point

@Gary, what are you saying is not true?

If I could find two premium saver award seats every other year I could deal with all the other negative changes.

Don’t forget that Delta says it rewards those who spend the most, but it caps the number of miles one can earn per ticket. So that full-fare $9,000 business-class ticket won’t earn anymore miles than say that $5,000 discounted ticket.

Well consider you lost concierge key status for not spending enough, not surprising you feel this way.

The revenue and spend side are completely separate and have nothing to do with each other. In fact my understanding is that airlines are awarding fewer miles for flying than they did under the old programs, so the new earn scheme should not cause mileage inflation. And the increased award prices apply to all members, not just high spenders.

Your unqualified statement that programs do not reward high spenders is completely false. Previously a top level elite buying a typical $6k business class TATL or TPAC ticket might earn 30k miles RT (15k for non-elite. Now the top elite earns 11x6k=66k miles (5x5k=25k for non-elite). So high spenders now earn 2x more on your typical ticket.

Really the primary losers are the non-elite occasional travelers who buy cheapo transcons. They now earn 2k miles on a $400 ticket, instead of 5k.

NICE TRY:

1. Miles are a rebate system.

2. It is fair to give more rebates to those who pay more.

You can destroy loyalty when paying flyers feel lack of basic fairness which was missing on the old program.

@ucipass – not nearly that simple, but also beside the point, I’m not suggesting with this post that American shouldn’t reward customers who pay more — I’m saying that they AREN’T