Warren Buffett’s Berkshire Hathaway is the second largest owner of Southwest Airlines with 47.8 million shares (an 8.7% stake) as of the end of 2018.

Now the airline is acknowledging the rumor that Buffett may take over the airline.

There has been speculation circulating that Warren Buffet might be looking to acquire an airline for some time, and that Southwest might be a good fit As a policy, we do not comment on speculations but appreciate Berkshire’s continued support of Southwest Airlines.

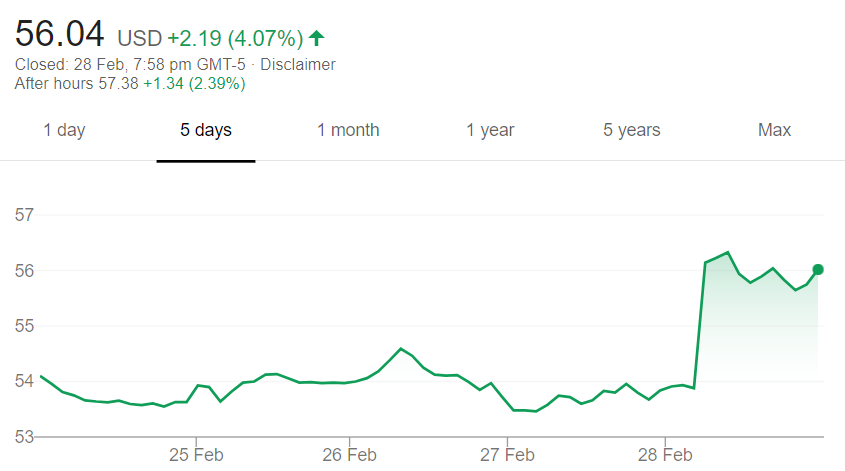

Southwest Airlines shares jumped 4% amidst this speculation.

Buffett started re-investing in airlines a couple of years ago and quickly lost a billion dollars on his trades.

If a capitalist had been present at Kitty Hawk back in the early 1900s, he should have shot Orville Wright. He would have saved his progeny money.

But seriously, the airline business has been extraordinary. It has eaten up capital over the past century like almost no other business because people seem to keep coming back to it and putting fresh money in.

You’ve got huge fixed costs, you’ve got strong labor unions and you’ve got commodity pricing. That is not a great recipe for success.

However if there’s a US airline that is a high quality business, it’s Southwest Airlines which has been profitable for 46 consecutive years. It’s also beginning to show signs of struggle with labor unrest harming the airline’s operation. However the largest carrier of domestic passengers still has significant growth opportunities as their international and overwater route network is highly limited.

Buffett has previously said he prefers to keep his ownership stake in United, Delta, American and Southwest below 10% each.

Below 10% due to the filings required when exceeding. For an investment co like Berkshire having to disclosure any trading of $LUV would be detrimental to their ability to execute on changes given the time it may take to move a significant volume of shares.

Historically, Berkshire took private the premier Class 1 railroad, BNSF, in respect to its operational savvy and unhindered re-investment in Capex every year.

Purchasing a plum like Southwest would stand the airline industry on its end to perhaps appreciate how the market respects a well run airline, minus all the needless trauma created by AA, UA, and even DL.

Go for it, Warren!

There goes no check-in baggage fees!

“If you want to be a Millionaire, start with a billion dollars and launch a new airline.” – Richard Branson

He’s old enough to know better.

I agree with the person who posted “there goes no baggage fees”. When an investment company “invests” in a business it’s not because they like spreading sunshine and roses. They’ll squeeze (or attempt to squeeze) every last drop of “inefficiency” out of the company to grow the profitability of their investment.

This would both strain the labor force, and I suspect dramatically impact the “rewards” we have all come to know and love.

If you’re rooting for this move, I hope you’re not a loyal Southwest flier because it won’t go the way you want.

Improbable that Buffett is buying WN. The company looks expensive compared to its competitors. Honestly, they feel like yesterday’s “big thing” in the airline industry. They’re not a global network carrier and they’re not a low fare airline anymore (they let their costs get too high for that). The vast majority of true frequent flyers (affluent and business travellers) prefer American, Delta and United. If you want to fly cheap, you fly Spirit or Frontier — which are fast growing airlines that can poach WN’s clientele far more effectively than they can poach travellers from the network hubs. In other words, WN’s business model has more risk than that of the Big 3 or the low cost upstarts. Yet it has a relatively high price. While they occasionally screw up (like with Kraft), my bet is that the folks at Berkshire know this.

WN has $3.4B in debt at an average cost of almost 10%. If there is anything Buffett has it’s low-yielding cash. Nice bump to profits from that synergy alone.

Of course, that’s nothing without growth prospects, which I guess Buffett may think WN has.

@chopsticks – their business model has more risks? I am no expert but 46 years of profit verses airlines who have filed bankruptcy several times – looks to me that their business model has worked for a half century and the other airlines are the ones who have failed business models. They have stayed profitable charging no checked bag fee (up to 2) and no seat fee, while the “big” 3 still try to find more ways to squeeze money out of people.

If he’s eyeing Southwest to better screw passengers the same way the other airlines now take joy in doing, then NO THANKS!

For all of Southwest’s current challenges I find it amazing that so many people seem to forget that this is an airline that has been consistently profitable; has consistently paid dividends; has one of the lowest debt ratios; is highly unionized; and unlike American, Delta and United (and many of the predecessor airlines in those airlines’ family trees), NEVER filed for bankruptcy!

Please, those other airlines only wished they could be as successful as Southwest has been!

This is NOT to say Southwest is perfect and doesn’t have present day challenges to deal with.

However, a takeover predicated on “emulating” the Gordon Gekko “Greed is Good” model of the rest of the deceitful, dishonest, predatory and rotten to the core bunch of oligopolistic airlines and their elitist caste system where the 1% takeover more and more square footage of available aircraft cabin space with their space hogging, all aisle access, gated McMansions… er “suites”… that then requires “densification” with cabin compression in the form of chicken coop sized, “no legroom” seats and bathrooms sized for children under the age of 10 for everyone else is the LAST THING the airline industry needs!

So, if that’s “The Oracle’s” ‘Plan’ then most of us would be much better off if he does NOT takeover Southwest.

Besides, seeing as how his company, Berkshire Hathaway, already owns large positions of the “Big 3” oligopolists (American, Delta and United), he’d either have to completely divest his holdings in those (and any other domestic airlines Berkshire Hathaway holds a sizable position in), or likely face the prospect of forced divestiture in the future once a semblance of rationality and common sense returns in the future since owning a large/controlling position in Southwest while also holding sizable positions in its (so-called) “competitors” even in this bat-crap crazy era is hard to imagine as being sustainable once the current orgy of abject sleaze, immorality, hypocrisy, dishonesty and greed runs its course – as it surely will.

@Angela I agree with Chopsticks. WN is starting to show some wear in the armor and I would be skeptical.

1. Basic Economy is cheaper in many cases on the Big Three.

2. Spirit and Frontier are growing and chipping away at Southwest and what is the perception of them being an LCC….they are not any longer.

3. They are starting to have, for the first time, labor issues.

4. The only reason they were profitable and survived unscathed post 9/11 and through the financial crisis was that they had hedged on fuel and locked in at a fixed price.

5. While they have a better frequency and a unique point to point network with less reliance on hub and spoke (the one biggest strength) Delta is starting to make inroads with that and using more efficient planes like the A220 to compete between point to point secondary markets. Continued regional jet growth will also chip away at this model.

6. Norwegian and others (like WOW) are already showing that the discount model has limitations for the long haul Intl. market (the last area of growth potential for WN).

This is not Herb’s original Southwest. WN is at risk in my opinion in the long-term. While they have a strong following and a good brand it is not as unique a model as it once was.

As much as people hate AA, here in PHX I prefer them to WN. WN is always cancelling flight because they aren’t full, their fares are NOT less then AA and the awards program is a joke. If you think AA is unreliable, give WN a try. I prefer to build up my AA miles for global travel too, something you will never be able to do on WN.

@ Stuart — Thanks for fleshing out my analysis. Leading investors like Buffett should be spotting these forward issues as well. Angela is focusing on the past: that’s dangerous in any industry. Look at Sears. They were huge — until retailing changed. The airline industry has changed, too. The Big Three have merged and become profitable global carriers. Unless teleportation is invented, their niche seems secure. They’ve even figured out how to very profitably run their domestic operations. They don’t fear higher cost WN anymore: this is a HUGE change from a decade or so ago. At the same time, WN faces massive new competition from true low cost carriers. There’s no crisis at WN, at least yet, but this is an airline that will ultimately need to tweak it’s business model to stay “relevant.” Maybe they will, maybe they won’t. But it’s risky for its current valuation. Being “established” is no guarantee of continued financial success.

Blue Horseshoe luvs Blue Star Airlines?

Buffet looks for companies with strong management that he can keep in place after purchasing. Berkshire corporate is very hands off the day to day running of any of their holdings. So even if Warren attempted to buy WN (seems unlikely, but he surprised me with the airline stock purchases), he’s not the kind of investor to order them to start tacking on fees and surcharges. He buys businesses that he likes and doesn’t mess with them.

@ Angela. Past performance is no indication of future returns comes to mind. Could it be that WN has merely kicked the high costs “can” down the road? One significant reason for the failures and bankruptcies of major airlines was the defined benefit retirement programs and managements and lenders desire to raid them. WN was late coming to the defined benefit party and wisely instituted a defined contribution program for nearly all retirement benefits. The only “plum” I see Mr. Buffett being able to pick is the bag fees. WN is leaving way too much money on the table by not collecting these. I really doubt the customer acquisition cost is $25 or more where bag fees will continue to increase. Plus waiving bag fees, preboarding and no charge for cancelling or changing ticket for upgraded ticket price (Business Select,) is about the only perk I see.

But then I cannot predict the future, unlike AOC. So “what difference does it make” in 12 years anyway.