When an airplane seat takes off empty, the airline can never sell that seat again. Getting some amount for the seat is better for the airline than not selling the seat. At the same time they don’t want to offer the seat for sale for less than a customer would be willing to pay, if they do that they’re giving up revenue.

Frequent flyer programs have been a great tool for airlines and for customers.

- Airlines can price discriminate. They call unload spoiling inventory at a deep discount, without undermining the market for expensive last minute tickets.

- Frequent flyer programs are also able to negotiate volume discounts, they’re the largest single buyer of seats from many airlines. For instance they’re buying over 6% of the seats of each of United, Delta and American and over 13% at Southwest.

The problem comes in when there just aren’t many unsold seats, at least on popular routes. Airline load factors are as high as they’ve ever been. That makes getting traditional saver award seats tough.

And it means you can get a better deal on the travel most people do with bank travel rebate cards

Overall airline frequent flyer miles still make a lot of sense for international business and first class awards. And you can pool activity from different places (flying, spend, renting cars, real estate transactions, online shopping) in a mileage account to save for an award.

However if you’re like most people you’re probably flying domestically. And you may not be getting great value from airline frequent flyer miles most of the time, yet you might still be battling for availability. And you may not have that kind of flexibility.

If you have to travel during holidays and school breaks, you’re going when everyone else wants to go, demand is high traditional award seats are tough, and you’re likely to have to pay a big premium in miles that outstrips any premium for paid seats.

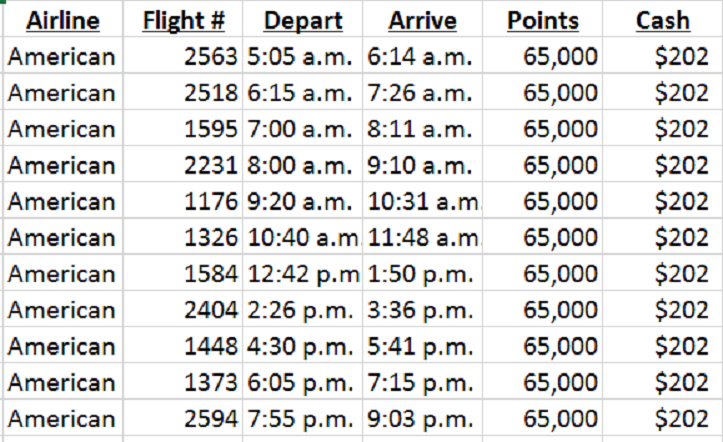

Want to fly Austin – Dallas the Friday before Christmas? When I searched American Airlines was selling seats for 65,000 miles one way, even though tickets were selling for $202 for your choice of flights.

Capital One hit on the consumer frustration with airline miles, and being able to use them, back when availability was much better than it is today. And they’ve been doing something about if for over a decade.

Their earlier commercials featured a reservations agent who took pleasure in telling customers “NO” whenever they called to ask about award availability.

Even in 2005 they hit on something really fundamental: the intertemporal nature of rewards and how that requires trust. You spend money now, jump through hoops, on the belief that in the future you’ll be able to get the rewards you believe have been promised to you. When that doesn’t happen it’s more than a disappointment, it’s not just shrugging shoulders, it’s a violation of that trust.

Already airlines were beginning to act like the reservations agent in these commercials, or so it felt to many members. You may prefer not to have to hunt and peck for award space and prefer just to take the flights you really want.

That’s why it makes little sense to me to spend on a credit card to earn airline miles with an airline credit card when your goal is domestic travel. You’d be better off with a 2% cash back card, take the cash, and buy whatever ticket you want.

But you can do even better than that.

- An initial bonus of 50,000 miles (after $3000 spend within 3 months) is worth $500 in travel. Your first $3000 spend nets $560 worth of travel. (Offer expired)

- The card folds in additional benefits and reimbursement of either TSA PreCheck or Global Entry application fees, providing added value.

- The annual fee is $0 the first year (then $95), in year one it’s a no brainer that you come out ahead — whether you even use the TSA PreCheck or Global Entry statement credit or not.

This card has offered strong rebate value for spend for many years — since back when they started saying “NO” on TV — but what’s impressive is that they’ve continued to invest in and improve the product.

And the flexibility to use points extends to other card features like Card Lock to freeze and unfreeze your account; Second Look which prompts you on possible problems like duplicate charges; the Amazon Alexa skill (you can interact with your card through Alexa!); and Eno which lets you use virtual card numbers from a web browser.

I still want to travel in international business and first class, and I save miles for that. But for domestic travel I find the best return on spend to be with a card that gives you miles that can be used to straight-up buy the ticket. Venture has offered strong return this way for awhile, and has taken steps to improve the value proposition even further this year.

As award charts devalue, and airlines charge more and more points for awards (especially extra mileage awards when saver seats aren’t available) while paid tickets have often gotten cheaper using points to directly pay for travel makes more and more sense. In an era of $300-$400 roundtrips to Europe it can still make sense to pay for travel with credit card points even when it no longer makes sense to do so with airline miles.

Are there any other cards that you recommend? This just sort of reads like a Capital One ad. I’ve used Chase UR points to great effect to accomplish the same thing.

So this post was just an ad for a single credit card? Why no mention of Chase UR Travel or AMEX Travel? If it’s such a good deal to use points to purchase flights then why only mention the Capital One?

I agree with you. We only recently began flying more and when I compared the benefit of my Marriott Rewards vs. getting an airline card, it just didn’t add up to enough savings to justify it. I can see how a frequent business traveler may still benefit, but for us as a family, even though we travel far more than the average family, the hotel rewards still outweigh the airline cards.

I like this card. What’s their likelihood of giving me a second free year when I call up to cancel?

Great ad Gary! What card was that again? Oh, Capital One…mentioned and linked 3 times. Too bad Amex or Chase doesn’t have a similar product

This looks like it redeems at .01 per point. Isn’t CSR a far better deal at .015 per point?

Most of us got into this in order to get free seats in the front of the plane. Yes, that has gotten much, much harder but the goal remains the same. This card is one of many that is useful, for most people, for coach airfare. If that’s your goal, not a bad choice but I can truly say I would NEVER have gotten into this game is this was the reward that was waiting for me.

Did Capital One just increase the referral bonus it pays to bloggers?

I am still waiting for the infomercial credits to run…

@Brian I saw it linked five times and mentioned more than that.

@Mike Kelley The citi double cash which has NO annual fee unlike the venture card, which is a ripoff at $95.

Yea Fidelity Visa and Citi Double Cash offer the same benefit with no annual fee, LMAO

I don’t travel for work, and yet I get outsized value from my airline miles. Although I do admit, I procure most of them through Chase Ink. I fly multiple international Business and First Class flights overseas during the year, and they range in cost from 7k(Dollar cost) each way and UP. (Next week to Budapest!) All would be impossible without the Ink. Airline cards I keep mainly for free bags and boarding perks. Good example of smart Chase Ink usage – My Airbnb in Scotland was 2k. Using Airbnb gift cards and a portal… 7x on spend. 14k miles, on something I would have purchased anyway. What I am really starting to phase out lately, is hotel points. With many chains blacking out the marquee dates (Radisson did this for August in Scotland, hence my alternative) from point usage. I just don’t use them as much. Hyatt I save for certain spots, and SPG I often end up converting into airline miles. For me, I see very little value in any Capital One card. Aside from perhaps a sign-up bonus…..

For Domestic Flights: For me they tend to be so cheap, unless it’s Southwest points – Using any amount tends to be a waste. I’m also flying out of the NJ/NYC area, so that could have something to do with it…

I cant believe the dopes making comments here. Its $.02 redemption value do the math. No chase card/portal booking offers that. And if there are other cards that have similar value, they must be recent, thats great, bring them forth. But Cap1 has been the leader here for a while. Gary is precisely 100% correct and exactly why we heavy up spend on our business Spark card.

Regardless of Gary suggesting a particular card, the overall point is 100% correct for a few reasons:

-You can earn more points (in quantity) from CSR, Amex Platinum, etc. than any of the cobranded airline cards I’m aware of.

-The individual points themselves have a higher value – a Chase UR point being closer to $.02 each while an airline point is usually closer to $.01.

-The card points give you a hell of a lot more flexibility in booking options.

-You can still book great airline awards (in the off chance they are available) using the airline points earned from the actual flying.

Do I have an airline card or two for a specific perk or perks and the bonuses? Sure. Do I ever put my flights on them? Hell no.

@steve It’s only a 2 cent redemption value per dollar spent. It’s actually 1 cent redemption value per mile. When you have category bonuses on Chase, Amex, etc., you frequently get a much better redemption value per dollar spent, even if you don’t get a better redemption value per mile/point. No one provides a consistent 2 cent redemption value per dollar spent so consistently (except for Arrival+). However, depending on where you intend to spend miles/points, you, in your individual life, may find redemption values far beyond 2 cents. It all varies from person to person. People should look to see what purchases make sense for them, and they should have contingency plans.

Hi, do you have a top 3 go to cards that you use or carry with you for everyday use?

A few comments…

There is more than simply $ value at play here. The Capitalone card gives you miles that you can redeem at 1 cent per mile to pay any travel expenses that you have charged. Kind of feels like cash, easy to use up on a long local weekend in a hotel. Using miles and getting a ticket feels like more value than casually using cashback or miles. You basically have to travel somewhere.

The 10% back on the Venture Card (guaranteed only through 1/3/20) is actually a phenomenal deal, as you can get the 10% and still use the hotels.com rewards program – which give you effectively another 10%. That’s close to 20% off hotels, which is then in the ballpark of the 4th night free program from Citi Prestige.

One way Capitalone has devalued the card. The card used to be contactless – could be used at all of those contactless terminals in Europe. But some marketing guy got the idea that a metal card is prestigious – so now you get a “prestigious” metal card without contactless functionality. I contacted Capital One and they could not issue the card as contactless any more.

The Citi Double Cash card earned $ .02 for every dollar charged – all the time – no exceptions and no annual fee.

I’ve been a long time Cap1 customer and fan. I was always intrigued they were often overlooked in all the blogs about the top 10 cc this and top 10 credit card that. It doesn’t get me status with an airline or hotel, but it’s a great way to get me where I want to go and stay where I want to stay. The Barclay Arrival is comparable, as is the fairly new BofA Premium Rewards card. I still keep a UA and AA card for free bags and priority boarding, But not sure they are really worth keeping for that anymore. And of course I have my Ink Plus and the great UR access and will keep that. I’m glad you covered the Cap1. Thanks.

I always tell people as an intro to this game, “for example, you would never buy an airline ticket with an airline credit card.” That always surprises them, but it’s an important rule in the game.

I agree that using CC miles for domestic travel is not the best use for them. The exception I have is for Southwest when you have a companion pass. Whenever I fly, even on points, my wife flies for free. (OK, $12 in fees) I save all my miles for international Business or First Class where you get the most bang for your buck. I need to be flexible, but I try to get $.05 – $.10 per point in value for a premium ticket. the best I did was $.13 per point for a First Class Around the World ticket for the two of us. You’ll never get that value out of a domestic flight.

I agree, I see so many people using airline mile cards when I know they could be earning more points with other cards, and I also know they are redeeming for domestic tickets at a low value. The only reason to collect miles these days is for international premium cabins, or for other perks like getting MQM’s to get status. But for everything else, cashback cards are just as good as Capital One. Either the Alliant 2.5% (3% first year) for $59 AF, or there’s a bunch of them at 2% and no AF, like Citi double cash and Fidelity. I only take 1 (maybe 2) international trips a year, so when my point balances build up I switch back over to cash back.

steve said “I cant believe the dopes making comments here. Its $.02 redemption value do the math. No chase card/portal booking offers that.”

Who’s the dope? You do the match. You earn at 1.5x minimum with Chase (Freedom Unlimited for general spend), then you redeem it at 1.5x if you have the CSR. So your redemption is a minimum of $.0225, plus the opportunity to be much higher.

Perhaps you could talk about the Chase Freedom Unlimited/Chase Sapphire Reserve combination that, if used to redeem CFU points via the travel portal gives you 2.25 cents per dollar on un-bonused spend (as a baseline) or 4.5 cents per dollar on bonused spend, and comes with transferrability to several decent airline programs as well?

Or perhaps the Citi Double Cash card, which gives you a straight rebate that doesn’t bind you to spending on travel?

This isn’t to say that the underlying gist of the article isn’t solid, but you’re pretty blatantly ignoring well-known other options out there. Two thumbs down for this piece.

Also, I think the two cash back-ish cards (Amex Business Platinum and Citi ThankYou) that you listed in an article last week would represent a better offer than this:

https://viewfromthewing.com/2018/07/18/offers-i-dont-think-will-be-around-for-long-if-youre-interested-act-now-2/

With that being said? This might be a worthwhile quick-churn…56,000 points (I refuse to dignify Capital One’s program with the term “miles”) for <$100 via some shuffling with Square, Paypal, or another processor followed by cashing them out and promptly chucking the card does seem like a realistic strategy here.

Excuse me it is far easier to driver Austin to Dallas .200 miles you will spend more time parking the car and going thru security than driving. Bad example

I’m with Amanda Bowers above. For the most part, hotel companies honestly do want to give us rooms for our free points with a “Yes Sir/ Ma’am” attitude. While many airlines want triple miles for award seats 8 months in advance on (so far) empty planes just because they know that it’s high season! I’m reminded of the TV/ movie scene where the sucker comes to collect what the con-man has promised him, so the con-man laughs/ sneers to imply that the sucker is gullible, naive, or stupid: ‘Come on! You didn’t really think we’d let you fly for free, didja?’

So for several years, I’ve been choosing to earn hotel points instead of airline miles whenever I have a choice!