I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Bilt Rewards announced yesterday that they’ve raised an add $200 million at a $3.1 billion valuation – remarkable growth for a company that launched less than three years ago.

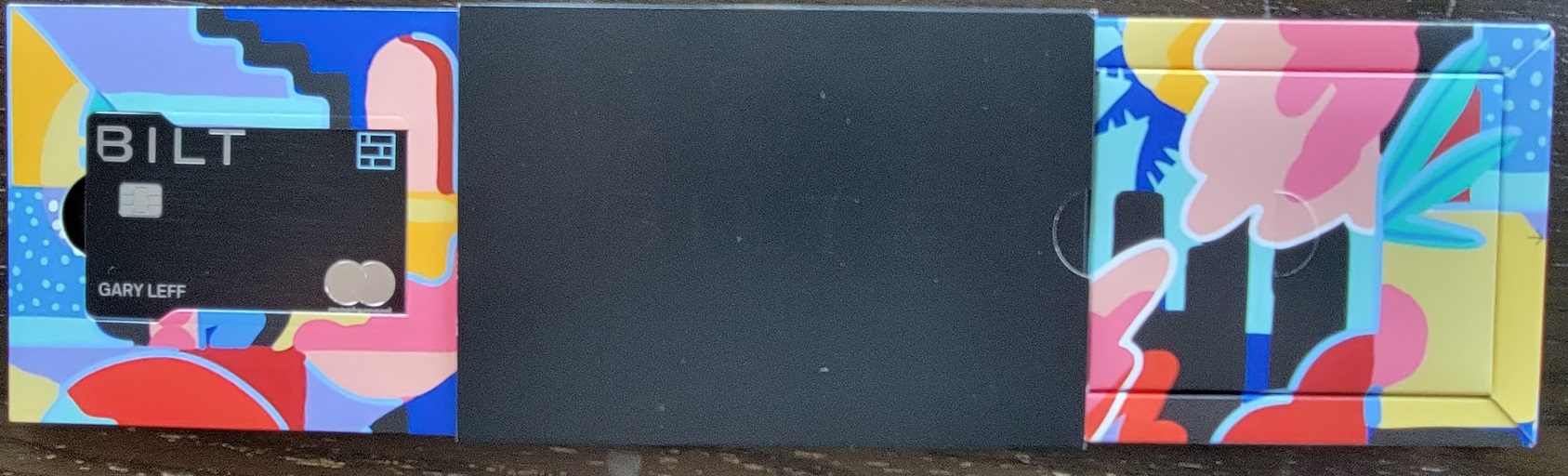

Bilt Launch Party, March 2022

CEO Ankur Jain reports that the company is profitable, which I take to mean that current members more than cover redemption costs. Additional capital must be for membership expansion or new features (or to allow some existing shareholders to cash out).

The company actually tells us that the money is to “fuel further expansion” across “multifamily, single-family, and student housing sectors nationwide” (more markets) and “bolster Bilt’s Neighborhood Rewards program” (more features).

What’s really interesting is these new markets. Student housing means expanding beyond the core urban professional renter, but is still adjacent, reaching a demographic likely to graduate into their current core – earlier.

But “single-family” is interesting, too, since they also say that “Bilt plans to venture into mortgage payment rewards.” So earning rewards paying your mortgage like they currently offer rewards for paying rent.

- It makes sense, and really isn’t fundamentally different. Lease (rent) payments are debt payments, and Mastercard has been comfortable with mortgage payments through platforms like Plastiq.

- If the economics of rewarding rent payments work, through favorable terms with Mastercard and Wells Fargo, then extending those to mortgages seems obvious. (Bilt certainly isn’t paying processing fees on rent like you or I would as a merchant.)

- Certainly funding this is less expensive than acquiring customers with 100,000 point signup offers.

Miles And Points People At Bilt Launch Party

This will be revolutionary. The two concerns I hear most often from readers are that Bilt is too valuable to be sustainable (but if they’re profitable and raising $200 million after their last $150 million raise this seems less a worry) and not relevant to homeowners (this wold change!).

Their Bilt Mastercard® is one of the best new rewards cards introduced in the past several years.

Earning Bilt Points for paying rent with no transaction fee with the Bilt Mastercard® is great. Earning for mortgage payments would broaden out the opportunity. The potential here is exciting.

Plus you earn earn 3x at restaurants and 2x on travel. All of this earn is available as long as you make at least 5 purchases per month on the card. And it’s all with no annual fee. (See rates and fees.)

Points transfer partners are:

- Star Alliance: Air Canada Aeroplan, Turkish Miles & Smiles, United Airlines MileagePlus, Avianca LifeMiles

- oneworld: American AAdvantage, Cathay Pacific Asia Miles

- SkyTeam: Air France KLM Flying Blue

- Non-alliance: Emirates Skywards, Virgin Atlantic Flying Club, Hawaiian Airlines HawaiianMiles

- Hotels: Hyatt, IHG Rewards, Marriott Bonvoy

You can use Bilt points at 1.25 cents apiece towards travel through their (Expedia-powered) portal, redeem for rent (please don’t) or Amazon purchases (please don’t). Given their great transfer partners and huge bonuses – like up to 150% they’ve offered to Air France KLM and Virgin Atlantic – they’re poised to eat the world.

Select to learn more about the product features, terms, and conditions.

After watching my son rack up points on his rent, I would be interested if they open it up to mortgage payments. Thanks, Gary. Please keep us informed.

Where do I sign up? 😉

Another nod to Bilt if they can pull this off. Is this or their program sustainable? I don’t know and don’t care. I’m going to enjoy it as long as they’re around and it makes sense.

Wells Fargo still services A LOT of single-family home mortgages . . . This would be a great cross-sell opportunity over multiple business units

I already use my Bilt card for condo monthly maintenance payments – just like rent. Almost any recurring monthly payment that allows auto ACH payments can, in theory, be set up as rent with Bilt. But it is my understanding that I can have only one such monthly recurring payment on Bilt.

What I would love to see is Bilt allowing multiple monthly payments to be automatically debited (like rent) and earning points. For example, monthly mortgage on my condo and monthly maintenance on that condo both could charged to Bilt each month, and earn points. And for those of us who have summer homes “up north” — even better.

As for “sustainability” – why is that an issue? The issue is one of Bilt’s (and, theoretically, Wells Fargo’s) cash flow to fund the monthly payments for their customers (rent or something else), and then wait for repayment upon billing. In this case, it is no different from assessing credit risk in any other credit transaction, and doing the cash flow forecasting across the market. (My late wife used to do this for many years – managing aboout $4-5 billion in revolviong credit receiveables for a major corporation.) I am sure that Bilt and Wells Fargo watch the transactions carefully, and if a customer misses a payment, the funding for the recurring monthly payment will shut off posthaste.

The risk for the Bilt customer is somewhat greater. If Bilt funds my payment on the 1st or 2nd of the month, and my billing date is some number of days later, I am getting the benefit of the float from when the recurring payment is made by Bilt, up to the last day I can pay my bill without interest — at least 25-30 days after the recurring payment is made. If my recurring payment stream is shut off by Bilt, I lose that float, and will have two payments in the first month after shutoff. Some customers of Bilt (usually the younger, less financially well established customer that Bilt is targeting) will find this a problem for them (but not for Bilt) when it happens.

@GaryLeff How does mastercard or wells fargo have anything to do with the rewards cost to bilt for RENT payments? Not card charges. Doesn’t bilt debit the customers checking account or add the balance to their bill, then ach or mail a check to the landlord? Bilt then pays 1x points for that to the customer

Where is WF or MC for payments that never touch the card network?

I forgot people w en had mortgages. I’ve written a check for my cars and houses (including a 7 figure one for current house) for over 20 years. Guess I’m out of touch with the average person

Being in the Bay Area I wouldn’t mind earning 100k points a year from paying my mortgage. But I’m not sure what the “win” is for Built?

@Retired Gambler. You’re old and rich. Noted.

This BILT business smells like a Ponzi scheme to me… cryptocurrency redux.

Not sure how this would work, at least in New York State (which I know prohibits life insurance payments via credit card, not sure about mortgage). I don’t think any banks here accept debit/credit card payments except MAYBE Chase. But I guess I’ll find out when Bilt officially starts it (won’t surprise me if there’s a little asterisk next to NY).

@Scott – not the rewards cost, the cost to process the rent charges

Something tells me the mortgage credit will only be for Wells Fargo mortgages…but I’d love to be proven wrong.

Then again, despite the mortgage perk, I’m still not sure it’s worth playing Russian roulette by getting a WF credit card. There are soooo many examples of widespread fraud at that company.

I can see how this would be very profitable compared to the current credit card business models.

100k Signup Bonus Vrs Mortgage Payments. Let’s as a ballpark say a mortgage is 3k per month. That’s 36k miles a year. You’re looking at almost 3 years to make 100k miles, and during that period, the customer is likely to be using the card for other purchases.

It’s really brilliant in a way. A 100k signup bonus is easily the better choice for a customer. However, being able to pay your mortage on a credit card? It’s a no-brainer must sign-up for any homeowner.

If they offer mortgage payments via Bilt (without fees), I’m in…and based on this comment section, I’m not alone either. I just checked out the Bilt app but haven’t pulled the trigger on the card, as I don’t rent, I own. But I’ll have a mortgage for life, which means if Bilt can figure this out, they’ll have me as a customer for life!

I don’t see how they’ll succeed where many others failed. All the companies that allowed mortgage payments via credit card were short-lived.

Plastiq still doing it for select cards issuers but charges a 2.9% fee. Not sure how Bilt will do it fee-free AND offer points on top.

On a $2,500 monthly mortgage, we’re talking almost $75 in fees. How will Bilt do this for $0? What am I missing?

@Retired Gambler Trust and believe that you’re out of touch with the average person in more ways than one.

@sean there’s fraud in just about every company you deal with on a regular basis, you’re just not aware of it….yet

@Retired Gambler: Stop being an ass.

@DCS: Ponzi scheme? Crypto? What are you even talking about?? Bilt is a credit card. I’ve had mine since 2021, and it’s a great way for renters to rack up points that can be transferred to travel partners. I also enjoy the float time that enables me to pay my rent a week or more early, but not have to pay the actual bill for it until the following month.

I’d be fascinated to understand how the economics work for rent or mortgage payments. The broad view looks like a typical rewards card: the bank awards an unprofitable number of points for spend in certain categories in the hopes of keeping your spending within their ecosystem, such that the profitable spend outweighs this incentive cost. For something like a travel card, this works really well — most people spend only a fraction of their cash on vacations and dining out, so unbonused spend is a healthy multiplier of those 3-5x categories. However, for the overwhelming majority of people, rent (or mortgage payments) is an enormous share of spending (we are talking on the order of 30-50% of net pay). Even if a typical family put literally all spend on the Bilt card, they would be unlikely to reach a multiple that would make this profitable on interchange alone.

It’s simple. The card makes enough money on the 5+ required non-rent transactions to pay for the rent payment float and points awarded. This is my go to card when I’m not building airline elite status, and it has nothing to do with rent. I don’t understand why non-renters hesitate to get it. For the points game, it’s as good as Amex Platinum, but with no annual fee and better multipliers. Also, it seems like some of the comments don’t realize that there is a cap on rent points (I think it’s 50k per year) and I’m sure there would be a similar one for mortgage. The economics seem simple to me, if they can keep offering a superior product.

I use Bilt to pay my business property lease. I gain alot of points and it saves me money since Bilt mails a physical check to the owner. I don’t have to pay postage or do the work of mailing a check anymore. I know multiple people that pay their mortgage thru Bilt. It is easy since your mortgage company has to accept check payments just like any other payment. So Just lookup the details where to send it to and the name and fill that out for Bilt to mail a check.