I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

American Express is offering a 50% bonus on transfers to Plenti through December 31.http://viewfromthewing.com/wp-admin/media-new.php

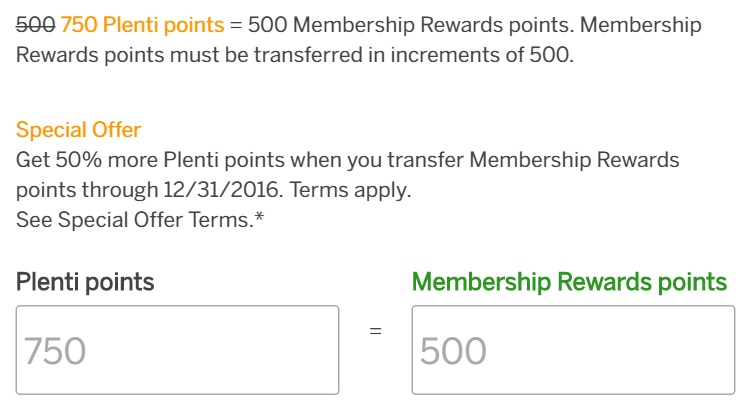

For a promotional period from now until December 31, 2016 at 11:59PM EST, 500 Membership Rewards points can be redeemed for 750 Plenti points. On January 1, 2017, the promotional rate will end and 500 Membership Rewards points will be redeemable for 500 Plenti points. Membership Rewards points must be transferred in 500 point increments. Membership Rewards point transfers to Plenti cannot be reversed.

American Express Plenti is a ‘coalition rewards program’ that lets you earn points for doing business with a variety of merchants. They’re the rewards program businesses like ExxonMobil, Macy’s and Hulu.

You earn points with Plenti partners. You can also spend your points (at 1 cent apiece in value) on those partners. A 50% bonus means getting 1.5 Plenti points per Membership Rewards points — valuing those Membership Rewards points at 1.5 cents each when redeemed to pay those bills.

I value Membership Rewards points at 1.8 cents apiece, so I won’t be doing this. I save my Membership Rewards points for redemptions like:

- Transfers to Singapore Airlines. Singapore makes great premium cabin award space available to those spending its own KrisFlyer miles. I just wrote about how the brand new San Francisco – Singapore non-stop had 2-4 business class awards more days than it doesn’t. You can even travel to Australia via Singapore. And Singapore’s miles give you an option to upgrade almost every time.

Singapore Airlines Boeing 777-300ER Business Class - Aeroplan transfers for Star Alliance awards since those transfers happen instantly, most awards are bookable online, and many partners do not incur fuel surcharges.

- Alitalia transfers for a good SkyTeam award chart and extra miles awards for extra availability on Alitalia’s own flights (although frustrating call centers).

What’s truly newsworthy is that this sets a floor for the value of your points. You shouldn’t be redeeming points for less value than 1.5 cents.

(HT: Doctor of Credit)

DON’T Spend Your American Express Membership Rewards Points at 1.5 Cents Apiece

There, fixed the title for you….. 😉

I think those memberships are really really pricy.

@ Robert Hanson. Gary pointed out he values MR more. Many people, especially primarily domestic fliers, may find 1.5 cents a MR point a great redemption rate. From this post it seems the caveat is using the points at Plenti member retailers (which probably isn’t that hard between Exxon Mobile, AT&T and Macy’s).

Edit: Mobil (not Mobile)

Quick question — for various reasons I’m a bit grounded at the moment but also have 100,000 Membership Rewards points coming from the Platinum Amex deal so Plenti points sound good. Does anyone know whether Amex — or Plenti — will send a 1099 if I cash in more than $600 worth of Membership Rewards points on this deal? Lots of folks online say these points are merely rebates for credit card spending and thus not taxable, but there have also been reports of other banks sending 1099’s. Any wisdom?