Bilt Rewards now lets you earn miles paying rent with any credit card – not just the Bilt card.

This is a must join program. I use it to quadruple dip on Lyft rides, it got me free airport helicopter rides this year, and my Bilt status gives me Air France Gold and Accor Platinum status.

I’ve had Alaska Airlines Gold status, and taken advantage of 150% points transfer bonuses to both Virgin Atlantic and Air France KLM. Their transfer bonuses are unrivaled.

But their core value proposition is earning points for paying rent. Before Bilt, most people did not earn rewards for their single largest expense. Soon they’ll offer points for paying mortgages, too.

- The Bilt Rewards Mastercard offers 1 point per dollar spent on rent, up to 100,000 points annually. There is extra no cost for this.

- Since last year, you can earn 3 Alaska Airlines miles per dollar spent on rent using an Alaska Visa, at a cost of 3%. And that Alaska Visa spend counts towards Mileage Plan elite status. You can earn on up to $50,000 in rent spend annually (150,000 Mileage Plan miles).

- Now you can also earn Bilt Rewards points paying rent with any credit card. And that’s on top of the points you earn putting the spending on that card. And the points earned this way count towards earning Bilt status (but not ‘fast track status’ from spend on a Bilt credit card, of course).

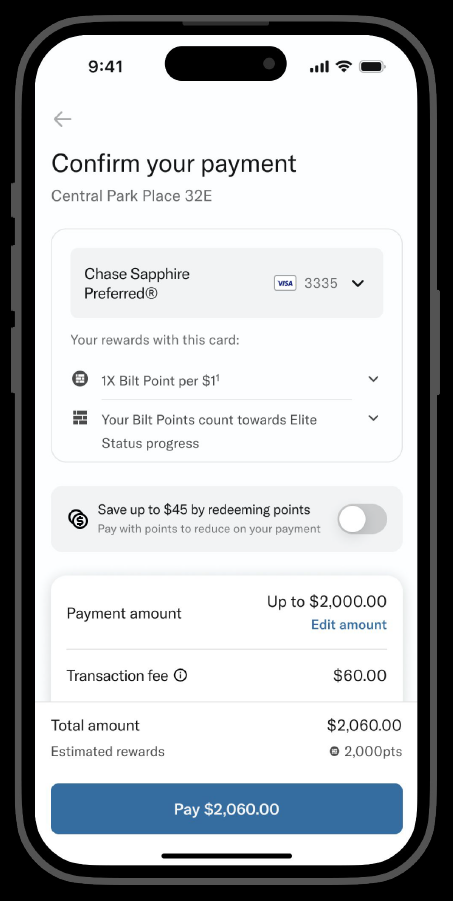

Bilt Rewards will let you charge rent to your Visa, Mastercard, American Express or Discover card. It comes with a 3% fee. And you’ll earn 1 point per dollar spent on Visa, Mastercard or Discover or 1 point per $2 spent on American Express. (You can continue to pay rent via ACH or other means, not charging a credit card, and earn 250 points for each payment as well.)

This new option isn’t as lucrative as paying rent with a Bilt card (no fee) or with an Alaska Visa (3x earning, so the 3% fee clearly makes sense).

Today you can paying rent via a service like Plastiq with a 2.9% fee, where they charge your card and mail a check or send an ACH. You’ll earn the standard points for spending on that card.

This is better because you earn the standard points for spending on any card plus 1 Bilt Rewards point per dollar spent. Call it two points per dollar, which is likely worthwhile for many even beyond scenarios where the spend earns an initial bonus. (It may also earn credit towards your elite status in the program the card is attached to, or other threshold spending bonuses.)

To take advantage of this, pay your rent through your Bilt account and select your preferred card at checkout. That’s it.

Their example here is paying rent with a Chase Sapphire Preferred® Card. That’s a great one, because the card is offering a best-ever 100,000 points after you spend $5,000 on purchases in the first 3 months from account opening. What a great way to earn that bonus.

Hopefully mortgage payment rewards will be this simple, straightforward, and lucrative.

The BILT Mastercard has been good to me, personally. The 2x ‘sort-of sign-up bonus’ up to 10K was decent. However, the primary benefit remains: earning points from paying rent. Sure, they watered down the Rent Day bonus (previously, up to 10,000 bonus points, now just 1,000 bonus points now), and no more Trivia (was an easy 250 points each month). But the fundamentals are still good. The status is whatever. The transfer partners are strong (though I wish they’d kept American; Hyatt’s still my go-to, and it supposedly costs them the most!). The recent (starting this April) Bill Pay (‘pre-authorization’) method for paying rent was a little tedious, but it seems to have worked. I wouldn’t do the 3% fee options. The Alaska card idea is interesting, but you’d really need to value those points/status to do so. Anyway, hopefully Well Fargo will let this last a little longer… for our sake (and for Ankur! That guy neeeeds this. Keep that gravy train running. Bah!)

Still waiting for them to add mortgage payments. Then I’ll get the card.

What category does it code as on credit cards? utilities, business etc…

This seems brilliant on Bilt’s part. Before, they were giving you 1x points on rent for free. Now, they are charging you 3%, probably paying 2% to the processor, and keeping 1%. So rather than giving you 1x points on rent for free, they are giving it to you for 1%, which is likely breakeven or even a bit profitable for them.

Great update! Earning Bilt points on any card for rent is a smart move. Excited to see how this benefits users at IndiaRentalz.

I’ve been hearing this “soon, get points for mortgages” for so long that I doubt this will ever become a reality. Or they’ll limit it to some narrow group of banks who only use a certain third party processor. Or just the third identical recurring 1st mortgage payments in months that don’t end in “R”. Since I pay no rents except my firm’s office (hmmmmm…..), I can’t see why I should get yet another credit card and play yet another game unless Bilt actually delivers. I wish them well, but I don’t see anything in their program for me.

An excellent but weirdly unadvertised Bilt advantage is that you can use the card to pay and collect points on your co-op or condo *maintenance* fees. You simply set it up like a rent payment.