The Points Guy runs a piece on the 5 discontinued cards they miss most. I think the cards to actually miss the most here are missing. Here’s what they highlight,

- Citi Prestige no longer available to new cardmembers, but it’s been four years since it was a must-have. It used to offer Admirals Club access, a very flexible 4th night free on hotel stays, and elevated 1.6 cent redemption value spending points for tickets on American Airlines. Those benefits are long gone. And it’s hard to categorize it as most-missed in its more-recent incarnation as good card for travel and dining spend.

- Ameriprise Amex Platinum because it was a Platinum with no annual fee the first year. Arguably, at least, this isn’t even the best Platinum Amex that’s no longer available (Mercedes-Benz).

- Barclay Arrival Plus a 2.1% rebate card when spending points for travel, surely it’s been exceeded in the time since it’s disappeared.

- Starwood Amex for many years this was the go-to for unbonused spend, you effectively earned your 1.25 miles per dollar on your choice of airline before there was a Chase Ultimate Rewards or Citi ThankYou Rewards plus being strong on hotel stays. What I miss here isn’t the Starwood Amex (though the personal Marriott Amex has reduced earn-value for spend) but Starwood itself.

- Citi AT&T Access More for 3 points per dollar with online retail spend.

Ok, these are fine as far as they go, although I don’t really miss Arrival Plus or the Citi Prestige value proposition when you could apply for a new one.

What are the cards that really offered outsize value and aren’t available anymore, or played a real role in the development of where we are today?

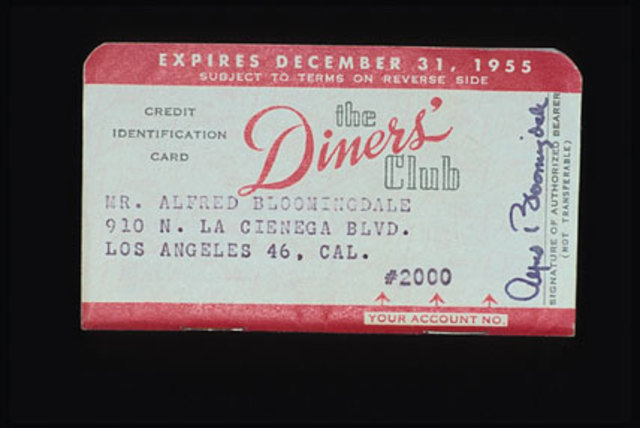

I don’t know how you can offer this list without talking about Diners Club. It hasn’t been available to new cardmembers in the U.S. in years except for a brief period in fall 2014. What Diners Club used to be, before it began processing charges on the Mastercard network,

- 60 days to pay. Two billing cycles meant you didn’t have to worry about how slow your employer was to reimburse business expenses.

- Restaurant savings program. Even when it was just iDine Prime, it meant 20% cash back at participating restaurants. Getting rid of the restaurant savings program from the Diners Club card was bizarre.

- Primary rental car collision coverage. Long before Chase offered the benefit on Sapphire and United cards.

- Mileage transfer bonuses, including an annual 100% bonus on transfers to British Airways when British Airways Executive Club was a great program

You had to drive around to find the gas station that took Diners Club. Acceptance was the binding constraint on the usefulness of this card, but that’s also why it had to be so valuable to get cardmembers to keep it in their wallet and expend the effort required to use it (even just asking, “Do you accept Diners Club?”).

Besides, this was the first credit card, so it has true historical importance.

I’d also put the Citi Driver’s Edge Card on this list, when it was offering 6 points per dollar on gas and groceries matched by the miles you drove. You could earn 12 points per dollar at gas stations and grocery stores – and then redeem the points at a value of 3 cents apiece.

- Points were worth 3 cents towards domestic business class airfare (90,000 points bought a $2700 ticket)

- If you included a non-refundable segment in the booking, you could cancel and retain a credit

- Delta was great for this because the first ticket had to be used in the original passenger name, but subsequent tickets issued out of that credit could be for other passengers.

Of course back in the day Citi’s Thank You program allowed booking tickets without dollar caps if you abided by the rules, and some folks booked $9000 non-refundable coach tickets to Asia with their points.

Now, if we want to limit ourselves to more recent products, the elite-earning potential on the Continental Presidential Plus Mastercard was phenomenal – you could spend for status and even transfer the status miles to other passengers. The 5x earning categories were great on the old Citi Forward Card. And what about second night free on award stays with the Club Carlson Visa?

What are the cards – and card benefits – no longer available that you miss the most?

Ritz? It still a dam good card, its too bad its not available and you have to product change but its still better then any of my bonvoy..

I will soon miss my United Club Mileage Plus card as of November 8th, when it will be replaced by the United Club Infinite Card.

That card will provide infinitely less miles as the miles per $ spent on all purchases drops from 1.5 to 1.0.

CHASE INK BOLD

Working for a company that STILL uses Diners Club in the US – there is still 60 days for payment (2 cycles) and primary rental car insurance. The downside:

1. While Club Rewards is still good, they dropped carrying certain gift cards – and for those that remain, its not $1 for 1 point. CR is $75/year

2. Not sure if this is still the case, but you cannot change your PIN (its chip and pin) if you are US based. I tried this a few years ago and was told that since the US does not support Chip and Pin (although that is starting to change) – I would have to be out of the country to change the PIN – and in a location that had Citibanks. I relented and just memorized an additional PIN. Some places in the US now require the PIN (some restaurants in NYC, LIRR, etc…) and it totally throws them for a loop since its likely the only Chip and Pin US based card.

@jonathan – product changed marriott to ritz today. How can i best take advantage of the new benefits as a WN loyalist?

I still have my legacy continental Presidental plus card and I will have to die before they can pry it from my hands. I do think it’s been devalued in ways over the years, like only being able to use the PQPs for no more than platinum status and increasing the amount needed to spend to earn status, however as of now I’m still greatful for it, and frankly it does it’s job for United… keeps me loyal to them.

I still use my Diners Club, particularly at supermarkets internationally. Until the Amex gold offered 4x points per dollar, Diners was the best with 3x and still transfers to Alaska and Air Canada among others. The transfer rate is sometimes worse than 1:1 depending on the airline but ~2.7 Alaska miles per dollar for gas & groceries isn’t half bad. No foreign exchange fees and chip-and-pin are both nice too.

I still use my Diners Club card for lounge access.

@kerrigjl

Congratz im super jealous, $300 travel credit can be used on southwest for bags or choose a seat or gift cards sometimes, depends on how they bill them. I think $50/time would work but I would only do one at a time. You also might have to call to get a human to refund ya. Or check with Gary, he would know.

Take a look at frequent miler they are always good.

https://frequentmiler.com/ritz-fee-credits-what-works/

I miss the JCB Marukai Premium card. Essentially an unlimited 3% cash back card with a $15 AF and would run anywhere accepted by Discover. JCB left the US market and closed all of their cards.

I wonder how much historical knowledge of credit cards the team at TPG has. Gary, I would go out on a limb and say that your website is probably the best historical depository of the history of the credit card and reward programs.

I would think you would know more than them (which I think you do).

Ah, the good old days of TYP, circa 2007. Booked 2 non-refundable coach tickets for $8,200 a piece. Marathon, FL – Paris – Hanoi – Seoul – Atlanta – Marathon, FL. I flew Delta and Air France for years with that credit. I also got offered 0% for a year so I promptly took out $100,000 and put it right back in their savings account at 5%. Easiest $5K I ever made. No wonder Citi needed to be bailed out.

Chase Ink Plus/Bold. Essentially doubles the bandwidth of the Ink Cash in 5x office supply spend. And unlocks the ability to transfer to partners. All for $95.

I originally got the Diners Club Card because I lived overseas and I wanted the insurance coverage when I rented a car in the US. I do still use that benefit! Now many years later I am so happy I kept the card as I just returned from a trip to Spain/Mallorca and used the Lounge Benefit extensively! I don’t think any other card offers airport lounges for an annual fee of around $100!

In the US, a pin is often necessary but not in Europe! BMO Harris is now supporting Diners Club!

@canuck_in_ca – If the tickets were nonrefundable, how’d you cash them in?

I still have my diners club card. Originally it was Citi Bank offer it. It was then taken over by BMO Harris. People often ask me if I was Canadian because BMO is not in California. I understand is more in the Mid West US, and BMO means Bank of Montreal. You don’t get sixty days anymore. It’s more like regular credit card, and it runs through Mastercard. Overseas like Japan, it’s a status symbol to have a Diners Club Card. Years ago, I was invited to join, but I was a recent college graduate. Knowing it was symbol of success in Japan where I travel often to, I accepted it. Couple years later i was invited to join Carte Blanche. I didn’t accepted it because annual fee was $595. I think there was dedicated over the phone assistant assigned to you. I certainly didn’t have enough spending to justify that. Now I think if I took it, that’s a pretty neat card to have. Not sure if Carte Blanche is still around.

@Christian You couldn’t cash them out. It was an airline credit. $8200 minus the ~$75 change fee back then. I didn’t even have to come up with an excuse to drop the trip: Delta canceled service to Marathon, FL that year and the alternatives proposed were just too darn inconvenient. It took me years to spend the credit. On refundable tickets Citi would have gotten the money back. It became a game of who could find the most expensive non-refundable coach ticket that followed the few Citi rules, like a Saturday night stay over. Another popular destination was Almaty, Kazakhstan. Mostly Lufthansa as a United ticket.