The President of the American AAdvantage program says they’re intending to get rid of award charts. He offered comments to The Points Guy website that they’re working on a replacement like “a real estate website that shows you how many people have bought a property in a given area and for what price range, as well as a ticker for how many people are looking at a specific property right now.”

The more I think about this model, and this analogy that he offers, the worse it sounds for customers.

- The price is whatever American says in the moment. Prices will fluctuate instead of offering any anchor to consumers in the form of a published, stable price list.

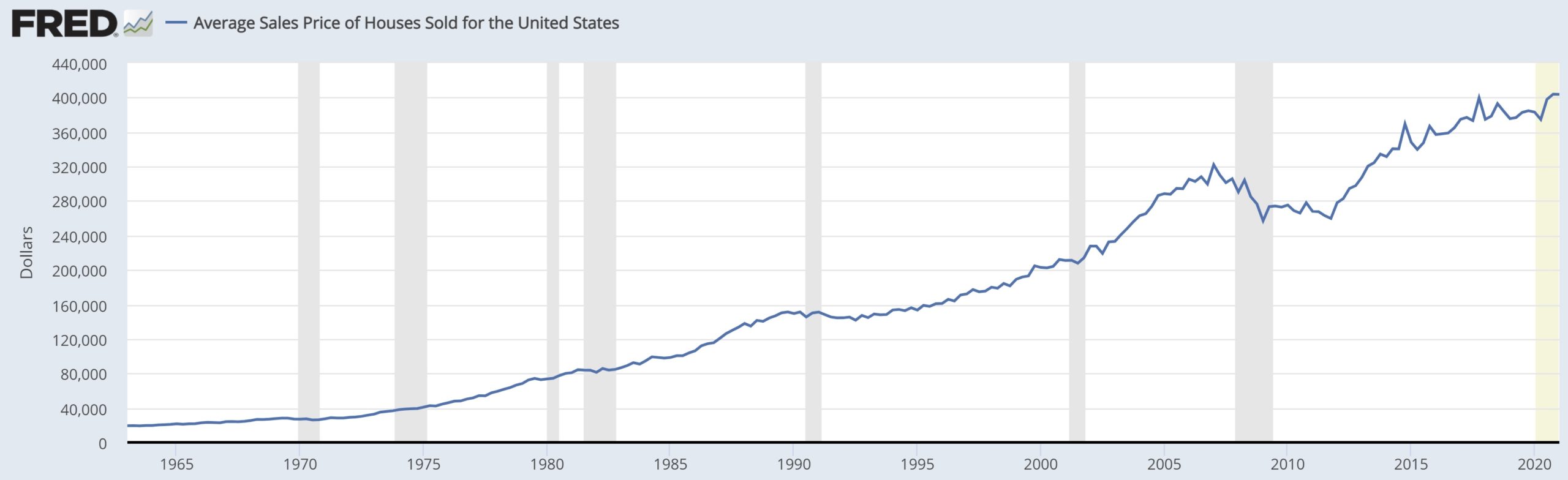

- The expectation is that prices will rise Outside of the Great Recession, what happens to real estate prices over time?

- Creating a buying frenzy. What difference should it even make “how many people are looking at” a specific route over particular days right now? We know that a lot of people are interested in warm weather leisure destinations over the Christmas holidays, that Europe peaks in the summer. What is a heat map going to tell us other than that we’d better ‘act fast’ or ‘lose out’?

- Be prepared to offer American more than asking price? Real estate prices where I live in Austin are regularly going for more than $100,000 over asking price.

Median sales price $465,000 Median sales price, year-over-year 42.3% increase Homes sold, year-over-year 33.1% increase All homes for sales, year-over-year 19.1% decrease New listings, year-over-year 35% increase Median days on the market 24 Median days on the market, year-over-year +8 Share of homes sold above asking price 73.7% Share of homes sold above asking price, year-over-year 42.9% increase

Replacing award charts with ‘a real estate website’ turns a valuable currency into more or less a synthetic CDO.

Somewhere along the way there was this idea that the price of an award ticket in miles should track the price in dollars, when nothing could be farther from the truth.

Mileage programs were build to reward customers for travel, giving them outsized value on their leisure trips, because:

- The mileage program could access all of the spoiling inventory the airline had. They could make unsold seats available to mileage members, without undercutting ticket sales.

- And the mileage program is the largest buyer of seats at the airline.

They’re getting bulk discounts and seats the airline wouldn’t be getting ticket revenue for, and making those available to mileage members. The whole point of the program is to offer deeply discounted tickets as a reward for loyalty. That gives the program incredible leverage.

There’s not always enough spoiling inventory for this, once planes fill up and the program prints too many miles. So there’s also ‘rulebuster’ style awards where additional inventory gets made available for more miles.

Not everyone goes business class to Europe or Asia, and certainly not every year. It’s not the only way people spend their miles. But having great value awards that are accessible to members gives them something to stretch towards. It’s what motivates – people put Bali or Thailand or even just Hawaii on their screens back in the day when we used to use screen savers.

And it’s that opportunity to make travel far more accessible than just saving money with a cash back card and using it for travel is what motivates people to engage in the program, to choose the mileage card over the cash back card, and to utilize a program’s partners that reward transactions with miles (and for which the airline gets paid).

The price isn’t supposed to just change at will. There should be a goal to reach towards. And that anchors our sense of value, too, whether or not we’re getting a good deal from the program.

When you take away the award chart you get a postmodern big mess. There’s nothing to anchor to. The program can raise award prices at will and not tell the member they’re doing it (let alone give them any advance notice, so they can accelerate their earning to reach their goal or redeem their miles for the trip they’ve been saving for). What we have seen from every single program that’s eliminated award charts is that’s exactly what happens.

The thought “complete disaster” comes to mind…

I truly never thought Dug Parker could ruin American Airlines but essentially he did

Damage it yes.Kill the most important part of driving loyalty it’s program with his henchmen

Wow what a mess scary

AA is inferior to DL and UA. The only thing that keeps them competitive is the award program. Without it l I’ll just fly Delta. At least they can run an airline.

Welcome to the race to the bottom, AA! Watch Alaska follow all of this!

Without fixed value mile redemption, aka award chart, the American will quickly lose to competition like Southwest and JetBlue, as they offer lower cost, free bags on all routes with CC, and better change/ cancel policies. And also to Delta with the better planes and service.

It will ruin the program, so like Doug said you will only buy peanuts with your miles… Skypesos are looking more attractive if that happens.

All of a sudden I don’t feel so bad being banned and having all my miles stolen… RIP AA

Well stated, especially “ And it’s that opportunity to make travel far more accessible than just saving money with a cash back card and using it for travel is what motivates people to engage in the program, to choose the mileage card over the cash back card, and to utilize a program’s partners that reward transactions with miles (and for which the airline gets paid).”

It’s fascinating that American imagines they have a product that can compete with Delta. Because at this point the one thing they had was a better program that kept people coming in spite of the inferior product. At the very least Delta worked to create a better offering (at least pre-covid and hopefully going forward) when they implemented these program changes. We are truly nearing the end of the great mileage game. And the loyalty that follows.

Booked San Diego to New Orleans southwest non stop for 7,700 points

Of course I could connect on American and spend 50,000 miles in cattle

Thanks but no thanks I’ll pass with their Ponzi scheme

I keep trying to burn through my remaining AA miles. I still remember flying US air off peak to Europe in business round trip for 60k. The old saying “are they on acid?” comes to mind.

How can airline CEOs not see that linking the value of airline miles to ticket price destroys the value of the programs, which are intended to promote customer loyalty? It basically turns miles into a more restrictive (and therefore less valuable) form of cash back. Might as well just skip the miles and get REAL cash back, which can be used to buy a ticket on ANY airline.

Sounds terrible for consumers and beneficial for AA.

If they do this they need to be regulated.

Gary

There is no mile that is worth more than 2c as you well know.

The programs regularly sell you miles below that often enough.

The value the miles give you is now 1c average or lower than that.

The main time you can buy miles below the value you get is with signup bonuses that are large enough.

The only other time is when you get bonused spend e.g., gas or groceries etc

Even then you have to factor in the opportunity cost of the spend and the annual fees.

instead of telling people to focus on aspiration, tell them the truth for once.

e.g., a 100k amex card for 10k spend with 550 annual fee is really 750$ cost = 75000c/ 100000 miles = 0.75 cpm

e.g., 3 miles per $ spend is really 2.625c (best cash back card)/3 = 0.875c

When you do this at large enough numbers over a long enough time, you build up value and benefit

It is not very flashy and it is not much money saved but some people will benefit

Most people are best served by a good 2% cash back no annual fee card (and those cards do not give the blogs easy money)

I just checked-Yup, my cash has not been devalued.

But stay tuned as it will take about 5 years by my estimate for a consensus that this is pretty much all smoke and mirrors at this point.

AA, UA, Delta all seem to be doing a great job of devaluing the value of their mileage programs and delivering no accountability with every year. All the innovation relates to optimizing their programs to their benefit. They are at the opposite spectrum of the way a company like Amazon thinks which is centered on the customers experience. Why would anyone collect miles if they don’t have some kind of chart to see what they are “saving” for. I realize AA would prefer to do anything that makes them more money (greed is endless it seems) but they are banking that we all don’t have choices. I’m enjoying having lots of choices and stopped caring about miles or upgrades as I just buy the right ticket at the right price. Go free agent and never look back!

Just booked 2 tickets MCI-DFW-DOH-CPT biz and just came back from MLE also on QR, the best redemption with AA miles. The best thing about AAdvantage truly is their partners and award chart, it’s why I’ve continued to fly AA. Got enough for 2 more @ 70-75k/each, but need the schedule to open up more before they implement this terrible idea and then I’m most likely done with prioritizing AA. They do these things and it just makes the decision so much easier to leave.