When you buy an airline ticket, some taxes are owed right away, and the airline has to send the money to the government whether you travel or not.

- The 7.5 % excise tax on domestic airfare

- $5.20 domestic segment tax

- $22.90 international arrival/departure tax

Similarly, airport Passenger Facility Charges of up to $4.50 per segment apply whether you travel or not.

However you are legally entitled to a refund of TSA security fees and customs and immigration inspection fees on unused nonrefundable tickets on request. When you don’t ask, airlines keep that money. Here’s the Government Accountability Office,

Although applicable TSA guidance requires the refund of the September 11th Security Fee on unused nonrefundable tickets that expire or lose their value, at the passenger’s request, consumers are generally unaware that they may be eligible for a refund.

According to TSA, regulations require airlines to refund the fee to consumers when a change in their itinerary occurs, but this occurs automatically. We asked airline officials to describe the process by which they refund TSA fees to consumers and asked if consumers have requested refunds. Some airlines replied that they have not been requested by consumers to refund the fee and others were not aware that consumers were entitled to a refund but if requested they would issue one.

…Similarly, while CBP allows airlines to refund the customs and immigration inspection fees on unused nonrefundable tickets, because the agency has not communicated this to airlines or the public, consumers are unaware that they fees can be requested.

Most airlines refund TSA fees automatically when you cancel an award ticket. U.S. airlines have mostly moved to making award travel refundable without a fee (Delta and JetBlue will book their cheapest awards as basic economy, placing restrictions on refunds).

When I cancel an American AAdvantage or Alaska Airlines Mileage Plan award ticket, I get the taxes back. If I used Alaska miles to book award travel on one of their partner airlines, though, I don’t get their partner booking (scam) fee back.

JetBlue does not do this. They keep the money, you get a credit. There was even a time when JetBlue would refuse to let customers use these funds to pay TSA taxes on a new award, demanding new cash instead. So TSA tax travel funds could only be used towards booking a new revenue fare.

A lawsuit against JetBlue challenges the airline’s refusal to refund the $5.60 September 11th Security Fee when passengers cancel non-refundable tickets – because the practice violates both federal regulations and the airline’s own contractual promises.

JetBlue’s contract of carriage states taxes and fees “will not be refunded except when required by applicable law.” And applicable law – 49 C.F.R. § 1510.9(b) – requires airlines to refund the security fee if the ticket is canceled and no travel occurs.

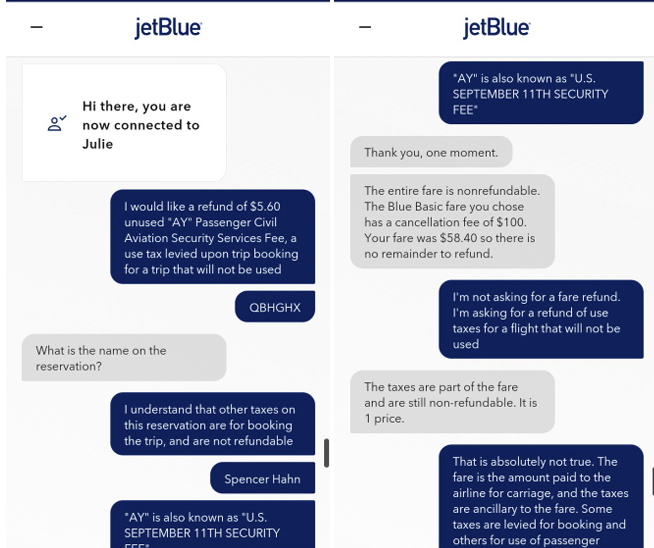

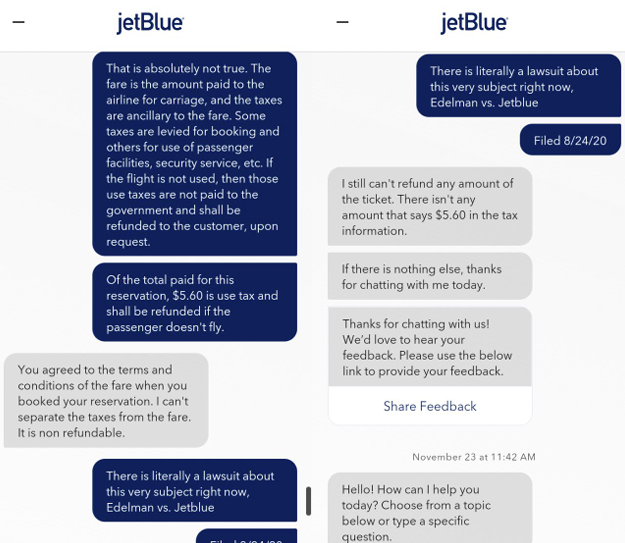

Screenshots in the complaint show JetBlue agents denying refunds, claiming taxes are “part of the fare” and cannot be refunded.

Plaintiffs seek damages for the fees not refunded, an injunction compelling JetBlue to change its practices, and sought class certification. The federal district court struck class action status, but the issue is preserved for appeal.

The legal case against JetBlue seems like a slam dunk. The challenging question is whether you can have a class action against the airline. There’s a lot of class action abuse, but this seems like the most obvious sort of case where you want one: the harm to each individual consumer is too small for them to enforce their rights in court, but the gain to the company aggregating all of the individual thefts from customers is large.

The airline’s contract of carriage seeks to waive class action litigation against it. The judge enforced this, but would be reviewed de novo in the Second Circuit (not deferring to the district court’s reading of the Contract of Carriage).

I’m not an attorney, but I would expect arguments to revive the class:

- The waiver appeared only in a dense web page and consumers never received conspicuous notice or a chance to reject it (although airline contracts of carriage are generally considered enforceable)

- $5.60 in dispute versus a $405 filing fee makes individual litigation irrational. Denying aggregation makes the claim practically impossible to pursue, creating an “effective vindication” problem.

Courts may not enforce an arbitration clause that operates as a “prospective waiver” of a statutory right. When vindicating a right costs 70× the maximum recovery, the waiver is effectively a nullification of refund rights. The challenge here is that American Express v. Italian Colors (2013) says litigation costs alone do not create a prospective waiver. Litigation can still theoretically be pursued. And I haven’t found a Second Circuit decision has struck a similar class-action waiver in a consumer contract.

JetBlue had sought to dismiss the lawsuit entirely, arguing the Airline Deregulation Act preempts the claims, but the Judge disagreed – the suit arises from JetBlue’s own contractual obligations (self-imposed under the “applicable law” provision of its Contract of Carriage, bypassing preemption under American Airlines v. Wolens). The court agreed that the plaintiffs had standing to argue for injunctive relief, given the impracticality of individual lawsuits since filing fees are so much greater than recovery amounts at issue.

Ghetto jetBlue strikes again!

“Soviet Union, I thought you guys broke up?” …that’s what we wanted you to think, muwahahaa! *tanks*

just wait til they have to do a one-time charge to give that money back

Good – scammy behavior deserves to be punished.

It always pi$$d me off that B6 would only issue expiring credits for taxes paid and then would not allow use of credit to pay new taxes

All your tax are belong to us.

This lawsuit gives Southwest a reason not to attempt to hold onto taxes. However there are cases in which an award reservation booked months ago and changed months ago results in non-refundable taxes, It’s a software glitch that works to the company’s benefit, so it stays broken.

@1990 – Which explains the “hot commie summer” in New York at the moment.

The class action lawsuit legislation needs to be fixed so cases like this can go to trial and the prohibition in the CoC is ruled as unenforceable by law. Knowing how the government works, I doubt that will happen. What should happen is that the government files suit to enforce it’s own laws or maybe fines the offending airline treble the aggregate amount not refunded.

I’ve ALWAYS hated scam blues crap policies! ALWAYS!! AND I KNEW they were suspicious as hell. I want ALL my damn money back because this has happened in a few flights!!

A little donation to the Orange Dotard, and they’ll be able to keep the rest of the money.

I went round and round with them last year – they would not refund my $5.20 (x 2 pax), it was an expiring credit! I sent screenshots of the federal rule stating they had to refund, but to no avail. So frustrating, but ultimately not worth my time to escalate for eleven bucks. Maybe I’ll get it back eventually.

Everything in life now is a one big hussle. It’s amazing when the law is clear they intend to fight it. Some useless accountant did the math and the cost of the lawsuit on that much money is worth the fight.

Another useless cattle car airline to mark off the list of Airlines to use. Whats very sad about this is most of the worlds Airlines to avoid are American Carriers.

Does it not cost B6 attorney’s fees to defend each one of these cases? Never met a $5.60 attorney. If enough of us file, perhaps we can put a dent in the arrogant theft.