Two U.S. airlines – one small regional airline, and another long haul low cost carrier startup – have joined forces to launch a cryptocurrency that passengers will earn instead of frequent flyer miles.

Ravn Alaska serves small cities in Alaska from its base in Anchorage, flying Dash-8 turboprops. It filed bankruptcy during the pandemic, but is flying again and its passengers can earn miles with Alaska Airlines Mileage Plan.

Ravn, however, is also starting a new transpacific long haul airline called Northern Pacific Airways.

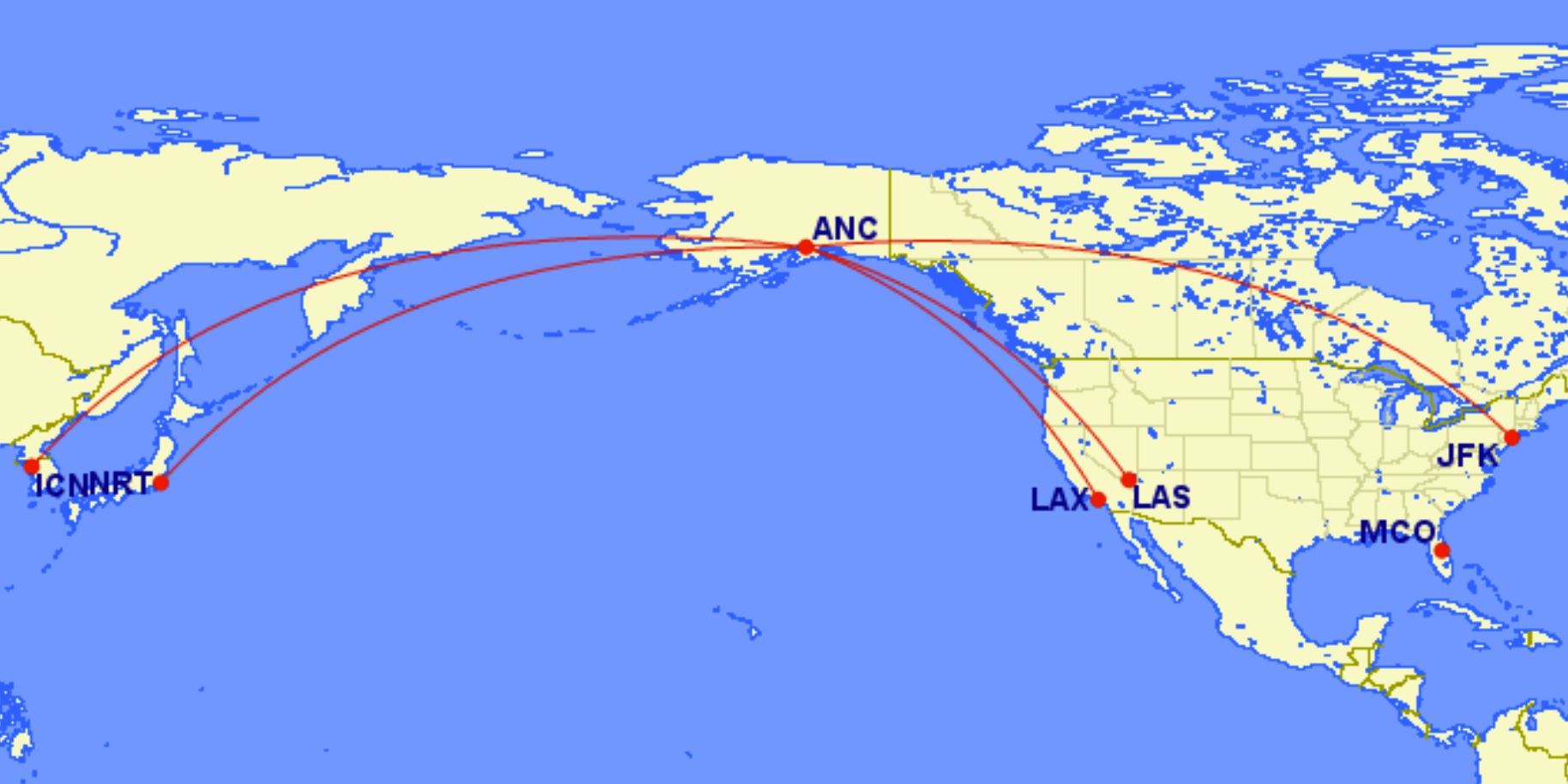

They plan to fly 10 Boeing 737s as a low cost carrier starting in summer 2022 with flights to Asia (e.g. Tokyo, Seoul) via Anchorage to mainland U.S. cities like Los Angeles, New York, Las Vegas and Orlando.

There’s going to be very little demand for connecting from major U.S. cities to Tokyo or Seoul, when passengers can already fly non-stop. Boeing 757s are cheap but narrowbody aircraft with a narrow fuselage is hardly ideal for long flights. And Anchorage itself is highly seasonal, and seeing vastly-increased competition in recent years. Plus long haul low cost carriers don’t have a strong track record of success.

So what do they have going for them? FlyCoin.

Ravn Alaska already participates in its sister company’s currency FlyCoin, a new currency that is exchangeable for free flights, crypto or U.S. dollars, and it will become the currency of Northern Pacific. FlyCoin,

- Doesn’t expire

- Doesn’t devalue (although exchange rates may vary…)

Ravn and Northern Pacific are trying to convince the Anchorage airport as well as local Anchorage businesses to accept FlyCoin.

To be clear, most of this seems speculative at this point. You don’t hold your FlyCoin in a digital wallet and as of now it appears all you can do with FlyCoin is “exchange them for a Ravn Alaska credit voucher.”

I haven’t found a digital wallet for it, one source currently lists a price of $0 while another claims a market cap of $223,000. So for now it appears that this is just a revenue-based frequent flyer program that calls itself crypto.

Imagine if all that SEC paperwork could have been avoided when American Airlines, Delta, and United raised billions in traditional debt backed by their frequent flyer programs.

AAdvantage and MileagePlus could’ve just called themselves crypto. Delta could have renamed itself the Atlanta Blockchain Company. What could possibly go wrong?

So many things wrong with this. The ENTIRE advantage of most crypto is that everything is public and virtually permanent. I don’t even understand why they would do this, except that it is a way of generating marketing “buzz” and potentially avoiding some regulation..? That seems a rather quixotic quest considering the unclear environment in which the SEC is slowly beginning to really assert itself. They may end up with a more regulated frequent flyer program than if they’d just handled it in a traditional manner, which would be ironic if the goal was avoiding regulation.

It wasn’t clear if they planned to use 737s or 757s for long haul, they were both mentioned. For long haul, fuel burn will be a big part of a low cost airlines expenses, but fuel efficient airplanes are new (737 MAX or 32x Neo), so not great bargains compared with used planes. The big advantage of connecting in Anchorage is that it doesn’t need as much fuel as a non-stop, as it’s less efficient to carry the extra weight of fuel for the second half of the trip during the first half. It’s the Iceland connection approach for Pacific flights, and could attract bargain hunters.

Shhh, don’t tell the kids that frequent flyer miles are a cryptocurrency and have been for decades. They won’t think it’s kewl.

Actually, I don’t think that is a bad thing for

Raven to do. The biggest ethnicity in Alaska is Asian, with most being Japanese and Korean. Japan flies people over in the winter to both Anchorage and Fairbanks so they can view the Northern Lights. It is a prime winter destination for them and a huge winter tourism for us. Korea is very close to Asia as the crow flies, and anyone who flies to Asia first has to leave AK and fly to the West Coast. That adds hours to the flight. I think it might very well fly.

My traditional frequent flyer miles are tax free.

The IRS requires me to state whether I sold crypto in the past uear on my return. Any redemption could have huge tax liabilities, if that currency appreciated between accrual and redemption (plus the paperwork alone will be a pain)

Sounds like a terrible idea. Rather than pay flyers in miles (controllable completely within the airline, even de-valuable) vs crypto. What happens to the program when crypto cost climbs, how will they pay for it? What if crypto tanks, how do they keep customers happy? This is all wrong and is clearly a PR ain’t.