American Airlines is refinancing the mortgage it took on its frequent flyer program with the U.S. Treasury by raising $7.5 billion against AAdvantage in private financial markets.

As part of these efforts they had to make a ton of information public about AAdvantage in an SEC 8-K filing – much more than they’ve shared with the SEC since current management clamped down on the rather robust information American always used to provide in its annual 10-K filing.

Here are 14 interesting things that they had to share with investors and the SEC:

- American makes money selling miles, not flying planes. The airline acknowledged that ‘net cash from operations’ of the frequent flyer program exceeded the airline’s pre-tax income for all of American in 2019. I’ve written for years that American Airlines is a credit card marketing company that flies planes.

This is the biggest benefit to new partnerships that increase the airline’s relevance in New York, Boston, and Bay Area financial centers and becoming more attractive to cardmember spend in those markets. They need to fly in order to have relevance to cardmembers, but the flying wasn’t making them money on its own.

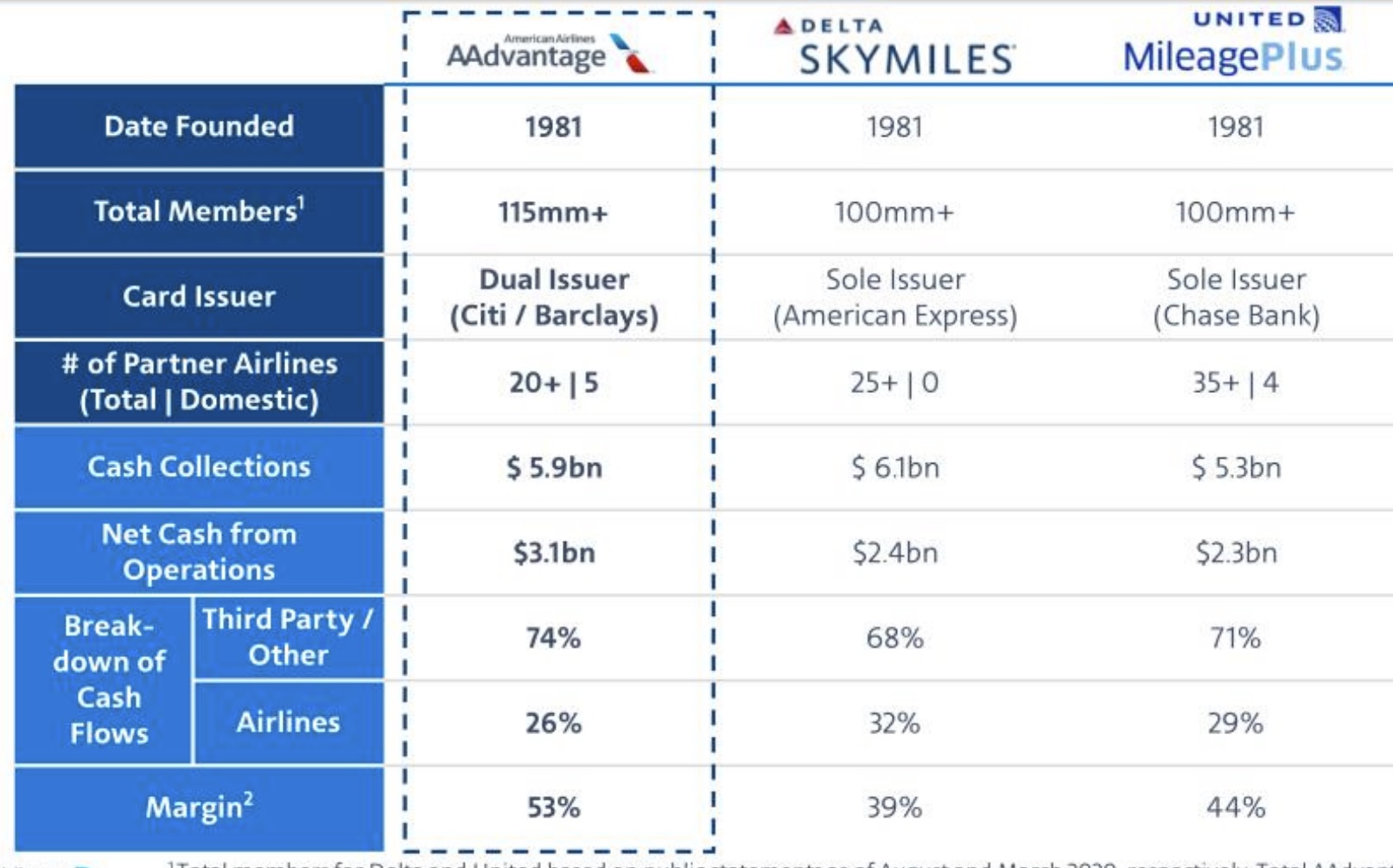

- Frequent flyer profit margins are huge. They claim $3.1 billion in net cash off $5.9 billion in cash sales, for a 52% margin. There’s a strong argument to be made that the airline is booking too much AAdvantage revenue off of its tickets, that the program’s costs are even lower, and so its margin is actually higher than this.

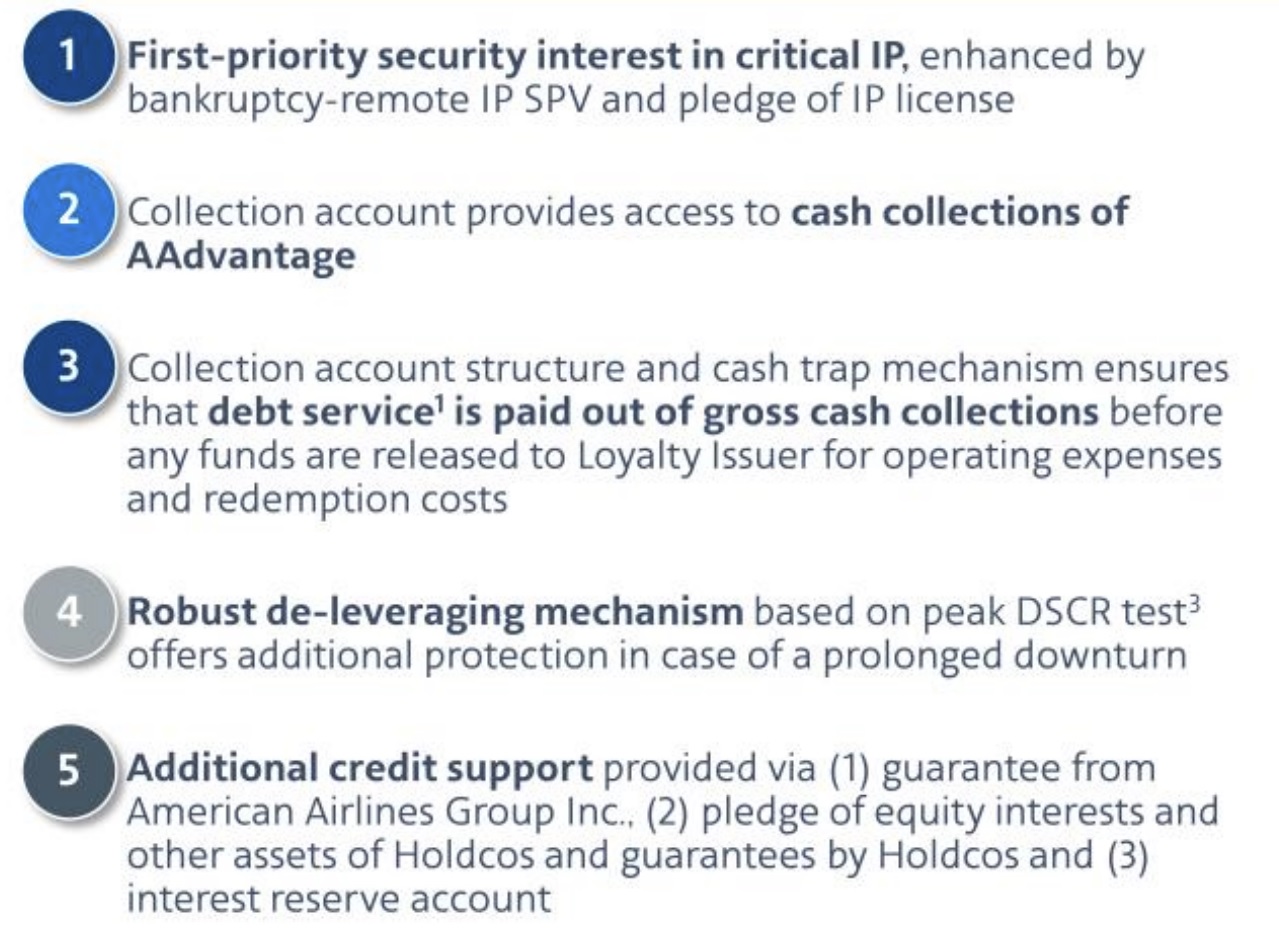

- They think they can devalue to keep margins high. Their business model gives them the “flexibility to control costs and preserve margins” (i.e. they can devalue at will, although they’d put dynamic award pricing into this bucket – though that’s really the same thing).

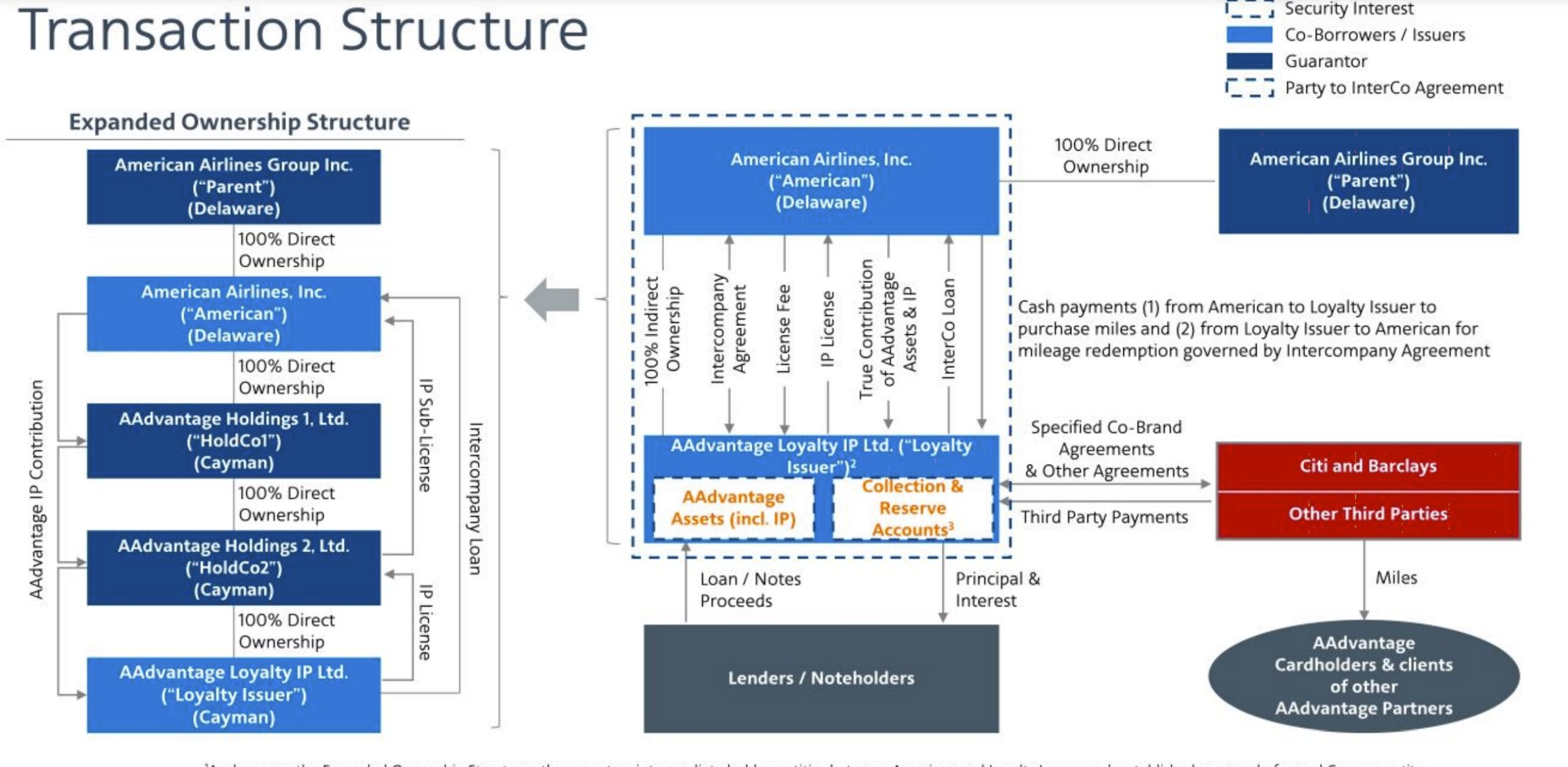

- The AAdvantage Program Is Now An Offshore Holding Company. American created 3 Cayman Islands holding companies for AAdvantage. The airline should make special frequent flyer charter flights to Grand Cayman available so that AAdvantage members can visit their miles.

- If American can’t repay the debt, you can’t redeem your miles. AAdvantage debt holders are in a first security position ahead of program members. They get paid before the program can pay for mileage redemptions.

- British Airways is no longer their most important air partner..? The airline is pitching its network strength to investors ignoring joint venture partners British Airways, Iberia, Finnair and Japan Airlines – and instead focusing on Alaska, JetBlue, Gol and Qatar. In fact neither BA nor Heathrow appears in the document.

- The program is huge, but most accounts are dormant. Their claim to being the largest frequent flyer program is caveated as being prior to removing inactive accounts from their database. When US Airways Dividend Miles was merged into AAdvantage, there were over 100 million unique members between the two programs (the overlap in members who were part of both programs was about 10 million). Now American says the number of ‘active’ members is 23 million.

- The program continues to grow (slower than it should). They’re adding 5 million members per year, though this number should be higher – they don’t actually make it easy for a non-member to join the program in the booking path at AA.com.

- People who spend a lot on American join the program. AAdvantage members contribute 61% of the airline’s revenue. 40% of members have household incomes over $100,000. And while 36% of members are ‘millennials or younger’ program members stay with the program a long time: the average active member has been in the program for 10 years.

In fact, the annual flight revenue per AAdvantage member was $1220 versus $408 per non-member. AAdvantage members spend 44% more per mile than non-members.

- The rewards focus is on travel, and that’s how people spend their miles. Only 3% of AAdvantage redemptions are for things other than air travel. Of course American offers fewer non-travel rewards than many programs.

- Delta SkyMiles generates more revenue than AAdvantage, MileagePlus is closing in. American acknowledges that Delta SkyMiles generates more revenue than AAdvantage, but argues they have lower costs than Delta. And everyone knows that United’s MileagePlus lagged financially before their new credit card deal with Chase which was inked just before the pandemic. The gap with United will have closed since then.

- American is a huge player in its partners’ businesses. American co-brands represent 24% of Citi’s 2019 credit volume, 28% of Barclays’, and 12% of Mastercard’s (both Citi and Barclays cards are Mastercards).

- You’re buying a lot of miles when American runs sales and bonus offers. AAdvantage generated $538 million selling miles directly to members in 2019. This dropped to $213 million in 2020, unsurprisingly as people weren’t traveling much.

- Program revenue is down significantly during the pandemic. Miles sold to third parties (mostly Citi and Barclays) dropped by $950 million in 2020, down from $3.9 billion to $2.9 billion.

American actually offers tours of the closely-guarded, climate-controlled facility where the miles are stored. It takes some planning, though: you have to request the tour months ahead of time and complete a fairly lengthy application.

yawn

Fantastic article Gary! Always great insight from you

Excellent article. More like this please, less misbehaving passengers — they aren’t news.

SkyMiles only has a 39% margin, skypesos can still go lower.

It is interesting how many people are duped into playing the mileage game. I admit that I too at one time swam in the pool, but after a) change to revenue-based plans from mileage-based, b) numerous devaluations, c) limitations on availability of nonstop flights for flight awards and d) limited upgrade opportunities, I switched to “cash back” cards which makes more sense for me.

I have the freedom to go with the carrier that offers the best value for my itinerary. That often is American, but at other times, it is Southwest.

What’s that about the “robust de-leveraging mechanism”? Is that the devaluations?

Good analysis with no Karen news!

These are the type of posts that show you deserve the top row of milesfeed.com.

Thank you.

Do they give Pulitzer Prizes for CC/Mileage Journalism? This does, once again, raise the important question if, when all is taken into consideration, including fewer advantages to the “Advantage” Program is “cash-back” cards are a far sexier and rational alternative to “Less elite by the minute” mileage status. Don’t know how you find the time for this Gary – but thank you once again.

Did they mention how much they made by closing so many AA accounts and confiscating the miles they had sold to Citi, Citi had given to customers, and then AA took from customers?

Did Citi get refund or all those miles that AA confiscated or did AA just pocket that cash?

Simple story, AA sells miles to Citi, Citi gives miles to us after agreeing that we met their criteria, AA takes miles from us. How is Citi not due a refund if AA never had to honor those miles they sold?

The major US bank card issuers jumped onto paths to try to migrate customers away from the use of airline affiliated bank cards and into the banks’ own proprietary point programs but the card-issuing banks also didn’t want to risk losing the massive amount of business they get from airline affiliated bank cards. Perhaps Señor Leff could cover how that effort is proceeding, especially during this pandemic.

It will never be what it was and people like me who have been doing it for20 years have great stores to tell. That said, it was always more important for me to be in the front of the plane on long hauls than to have a non-stop. Fly across the ocean, go to the lounge, shower and change, have a bite and take the hop to the destination.

We now have non-stops to and from Israel in Business. Over on AA and return on UA. Yes, it is annoying to be paying so many more miles than it used to be (even for Saver awards), but it still works.

That said, if your goal is for Economy seats, I agree that cards that have their own points and buy seats for you (like Capital One) offer a compelling alternative.

Mileage plans are a shell game that I’m surprised is legal. It seems like the ultimate bait-and-switch. I really wish it was regulated.

@ Steven S. I am in complete agreement with you. I have found the AA miles to be a double-edged sword. I have had some great experiences on BA/AA 15-20 years ago when 55-60k miles purchased a F seat on just about your choice of time and date of departure on International flights. Those experiences have kept me in the program. That’s one edge of the sword. The other is . . . Those days are over and a distant memory thanks to AA/USAir/AmericaWest program dilution.

I assume the domestic partners include regional affiliates/subsidiaries? Otherwise, how are the numbers so large? AA has Alaska and Jetblue, but that’s only two. Have to throw in Horizon, Skywest, and Cape Air.

I cant believe how many people buy miles directly from the airline. Usually not a great value… even during the discounts/ promo