Barclays is re-launching their Uber Credit Card today with a new value proposition. You can apply online or in the app. Current Uber cardholders will be transitioned to the new product in the first half of 2020 after being notified by email and in their monthly statement.

The new card earns Uber cash rather than cash back, but offers a ton of value across all Uber spend.

- 5% on all Uber purchases including Uber rides, Uber Eats orders, and JUMP bike and scooter rides

- 3% on restaurants, bars, hotels (including Airbnb), and airfare

- 1% on other purchases

There’s no minimum to redeem for Uber cash. Whenever you reach $50 in rewards they’ll be automatically transferred to your Uber account.

The card has no annual fee, no foreign transaction fees, and still comes with cell phone protection. There’s an initial bonus offer of $100 in Uber Cash after $500 spend on purchases in the first 90 days.

This is one of the richest cash back cards for Uber customers. It remains one of the richest no annual fee cash back cards. However there are some things we’ll miss in the product.

Uber Credit Card 5% Back Category is Extremely Rich

The old knock on the Uber card was that it wasn’t even the most rewarding card for spend on Uber. It earned 4% back on UberEats and 2% on traditional Uber rides. Now the new product earns 5% on all Uber transactions across the board.

It’s important to note that this is unquestionably the best Uber return from a rebate card. It’s also the best Uber return from a no annual fee card.

Depending on how you value transferable Citi and Chase points, the Citi Premier and (much higher annual fee) Sapphire Reserve may offer the same or slightly better return for Uber spend. If you value a Chase point at 1.7 cents, that would equate to a 5.1% return with that issuer’s most premium product.

Between Uber Rewards rebates, Uber Credit Card earning, and the frequent promotions Uber sends me (often 20% off, covering delivery and service charges) why cook at home?

With Higher Uber Earn Comes Some Reductions

The old product earned 4% at restaurants, that drops to 3%. The old card also earned 2% on online purchases, and that’s no longer an elevated earn category.

Another loss for the new product is the elimination of the $50 statement credit for online services like Spotify, Sirius XM, Netflix, Hulu, and Amazon Prime after $5000 spend each year.

The clear focus of the card is on engagement with Uber now, and a no annual fee product with rich rewards has to also find balance somewhere.

Online streaming and restaurants were interesting categories as a way to target affluent millennials and customers who prefer experiences over things. However I’d bet it’s not necessary to invest in these categories because they’re already reaching the customer base through the relationship and rich rewards for transacting with Uber.

Earn Uber Credit Instead of Cash

The original Uber Credit Card earned cash back (or gift cards including for Uber). Uber Cash didn’t exist when the card first launched. Now Uber has created their own currency, and it makes sense for their co-brand card to align.

Uber credit shouldn’t be considered as valuable as cash (you can spend cash at Uber or anywhere else). Still a regular Uber customer should be close to indifferent. You’ll save cash you’d have otherwise spent when you use Uber credits earned with the card.

Barclays is presumably able to buy the credit at less than face value. That, along with eliminating the $50 statement credit for streaming services after $5000 spend, makes 5% rebates on Uber spending possible.

Missed Opportunity to Partner for Uber Elite Status

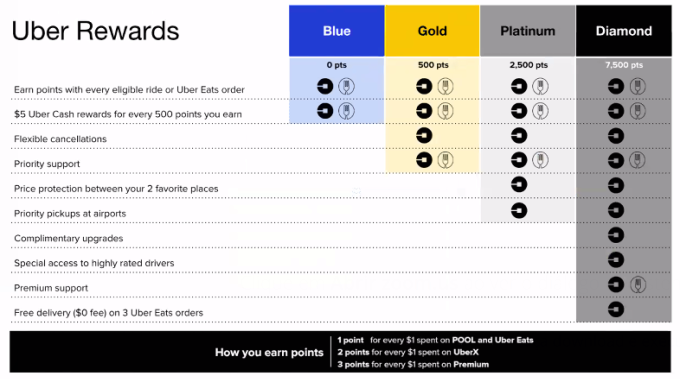

Uber launched its own loyalty program in the past year that gives rebates for spend and rewards frequent customers with benefits.

Uber cardmembers are important customers for Uber. They generate revenue for the company through every day spend. That should be recognized through the Uber loyalty program, but hasn’t been built into the card.

I spoke to Barclays about this and they tell me that “at some point [they] will continue to look at opportunities to evolve this” and that they were worried about complexity. They integrate into Uber Rewards through earning Uber Cash. The separate points system for status presented challenges. They promised to “continue to evaluate” a tie-in with the elite program.

Cardmembers, in my opinion, should receive automatic Gold status in Uber Rewards for priority support and more flexible cancellations. And spend on the card should hep achieve Platinum and Diamond status.

Uber Platinum gives you price protection on a chosen route. I choose travel between my home and the airport, and that keeps me from hitting surge pricing on my airport runs. It also gives priority (connection to the closet driver) on airport pickups.

Diamond status gives car upgrades, access to highly rated drivers, and 3 free UberEats deliveries. Highly rated drivers is also part of UberVIP which comes with American Express Platinum. And since delivery charges and service fees have been broken out in Uber Eats, the free delivery benefit has already been devalued.

Expect to See More Marketing Integration

Barclays tells me their goal in reworking the Uber Credit Card is to focus on “engaging with the customer who uses Uber.” When the product came out two years ago, the Uber card wasn’t the most rewarding for Uber spend (though it was a good no annual fee cash back card). They’ve changed that, and it should appeal to regular Uber customers.

This focus also means they’re “working with on Uber on a robust marketing plan… [you’ll] see more targeted messaging to Uber loyalists and better placement within the Uber ecosystem.” It’s always surprised me that as a heavy Uber customer – my wife and I share a car, and in big cities I rarely rent cars anymore – I don’t get prompted during rides, inside the app, to take their card.

Uber Credit Card Has a Strategic Role to Play in Many Wallets

Uber has a focus on developing their currency, the new Uber Credit Card aligns with that. It aligns with rewarding Uber customers. It makes Uber riders and eaters Uber financial services customers.

In some ways the new Uber Credit Card is a somewhat less rewarding general cash back card, but that’s to be expected – it’s a no annual fee product bumping up their top rewards category to 5% so something has to give.

Frequent Uber customers not already earning 3x from Chase Ultimate Rewards or Citi ThankYou Rewards should get the no annual fee Uber Credit Card card and use it for Uber spend. Without a bonus for spending $5000 (like the card used to have) or a contribution towards Uber status from spend it’s not a silver bullet for all spend.

If you don’t use Uber very often then there is no reason to keep this card. This is a huge devaluation in my opinion with the loss of cash back option.

I had been thinking about getting this card, but no more. They’ve taken a pretty decent cash back card and turned it into the taxi version of an airline miles card. I rode Uber twice this month, but that was more than a typical month.

This is a devaluation for the Uber card. No thanks.

Wait. We lost the 4% dining perk on this card?

And what exactly is Uber Cash? The article assumes we know what this is already.

If it means we lost the cash back option, then this goes into the sock drawer as soon as the changes take effect.

Disappointing is an understatement.

@VX_Flier – Uber credit rather than cash

Now the card is more in line with the quality of the company.