What does the new American Express Centurion Card look like? A reader shared photos unboxing the updated Black Card they received in the mail.

The benefits have been updated on the American Express Centurion Card, and the fees associated with the card are going up from $2500 per year to an amazing $5000 in April 2020.

And along with these changes is an updated card design, which our reader says is “thinner and lighter” – not what you’d expect from a card designed to be a statement.

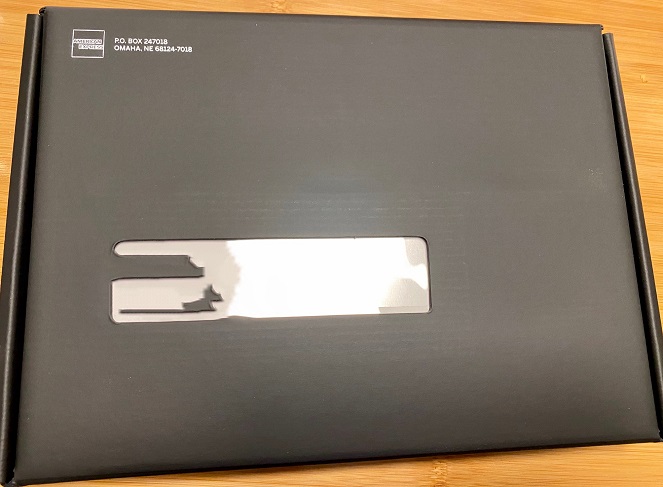

Here’s the front of the Centurion card’s packaging.

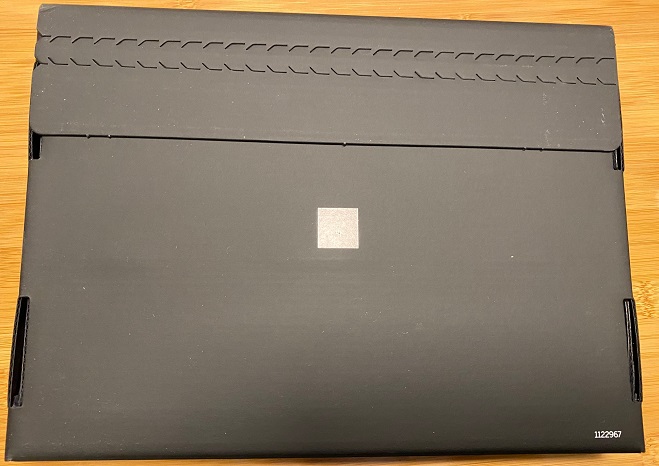

And the back of the package the card comes in.

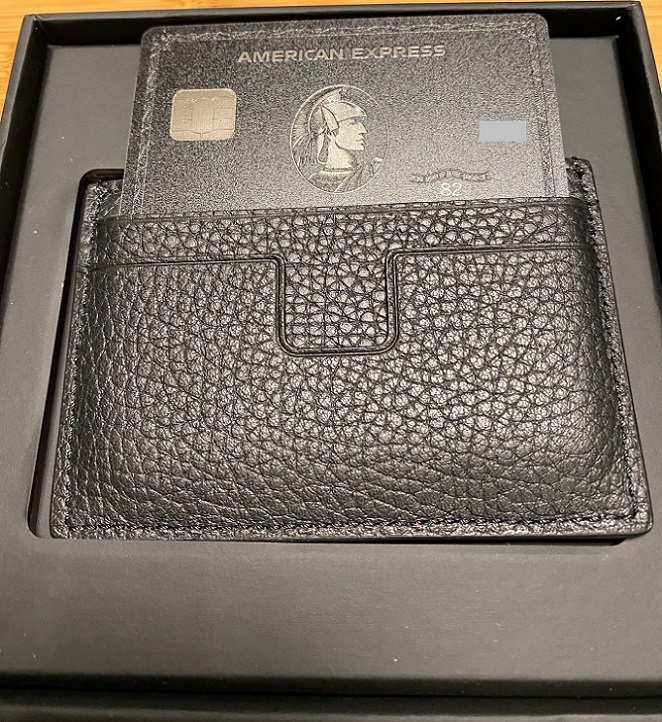

Let’s take a peek inside the box:

Inside is a package that contains the card:

The card itself is presented inside a Tom Ford wallet, which gives the product additional luxury cache.

Here’s a look at the wallet itself.

Our correspondent asked American Express about the card’s less substantive feel and was told that “members were complaining the[ old Black card was] too big for their wallets.” American Express actually sent two new Black Cards by accident. According to the Amex rep “several members [..] had received duplicates.”

True story: I was at a business dinner at a top restaurant in San Fran in 1999. My colleague slapped down a solid black piece of plastic and we were all trying to get a good look at it before the waiter picked it up, trying not to seem like we were gawking.

The restaurant was fairly dimly kir si we couldn’t see any features of the card and knew what it had to be.

Finally the waiter cane by snatched it up, then stopped in his tracks, he’d it up to the light and turned it over, exclaiming at the same time: “Wow! I’ve never seen one of these before!”

Lame.

Forwarding a link to something somebody else wrote where they filmed themselves opening a box isn’t “thought leadership”.

Look at Ross-Smith. He doesn’t post much but what he does post is must read.

Signal > Signal + Noise

I got annoyed that the previous version would often not work with self-swipe machines (gas pumps, parking, etc…). This one is indeed markedly thinner and both looks and feels less substantial. Fine with me.

@Ex-UA Plat. I am glad Gary had the thought leadership to post this article. After reading, I “thought” about the American Express Centurion card and will now take a “leadership” position by not completing the AMEX Centurion card invitation if I am worthy enough to receive one. Thanks to Gary, I have potentially saved paying a $5,000 annual fee.

@ Gary — Only a narcissistic morom would carry one of these.

Tom Ford wallets are available on Ebay for under $250. https://www.ebay.com/p/20028183484

I had a Centurion card for 10 years–and watched as the fees increased while the benefits decreased. I liked it for travel, but the original airline status–Delta, Continental, US Air, and Virgin Atlantic–became just Delta. Airline club access got pared back several times. My dedicated travel agent was sometimes good, but often not. I had to be very careful to get my hotel perks in writing on every reservation, as the hotels often pushed back on honoring them. The hotel upgrades frequently excluded suites, even if my paid request was for a smaller suite.

In general, I became less happy the longer I had it.

I switched to a Platinum last year and don’t miss the Black Card a bit.

@Gene I really do not understand why people have to resort to name calling in these blogs. They should be for sharing travel information. Sometimes lighthearted and many times useful. I looked up the full definition of Narcism, and I honestly believe I do not carry any of those traits. Not worth listing or debating. What I was unsure of was the next word you used, Morom, I do not know how to speak this language unless you meant to call me a Moron, which my wife might agree with.

For those that travel frequently, the Centurian card has had great value but just as Mark stated the value has diminished and the cost has gone up. It will be difficult if not impossible to justify the latest price increase, I have till June. I can only assume they want to thin the number of members.

goto a restaurant, slap out black card…

“sorry we don’t take amex”. lmao

@Chris why would you use a black card and only collect 1 point per dollar.

Life is short. Something is just cool about having the Black Card once in your life. If you are fortunate enough to have the income (and associated spend to get the Black Card offer) then go for it. Unless you are using the concierge on a constant basis it seems the benefits aren’t worth it from a monetary standpoint but pulling out a Black Card is boss. It’s not a logical choice but an emotional one. Sometimes it is fine to ride your emotions.

It’s like, how much more black could this be and the answer is none. None more black.

@Ex-UA Plat

lmao he reported on a tweet yesterday. He doesn’t give a f*** about quality

meh… Platinum seems to do much the same.

I’d be interested in learning more about the new card they want to launch between Platinum and Centurion.

But still, cost< likely less than benefit.

@Leonard

>why would you use a black card and only collect 1 point per dollar.<

If you think holding a Centurion Card is about Membership Rewards points, you do not get it.

@Joseph

A little history first, when I got this card, there was not a signup fee, and the yearly cost was $1,500. I had president’s status with Avis, Platinum with Hertz, Diamond with Hilton, Gold with SPG, Star Alliance Gold with US Airways, Delta Platinum. Gifts every year that were worth a few hundred dollars. Over the years, the cost has increased to what is today $2,500. Benefits have dropped off as mergers in the travel industry have happened.

Today, I keep the card for the Hertz Platinum; I also have access to the first-class lounge for Lufthansa in Munich and Frankfurt, which I have used several times this year and Hilton status. I don’t care about Delta status. The other benefits are available with other cards with less cost but for what I have had, the $2,500 has been worth it. I prefer to earn multiples of points with my Gold or Platinum cards and use the 35% rebate with my chosen airline. I am hoping they have something else to announce to make me want to keep this card, as of now, $5,000 a year is not worth it. I will miss my platinum service the most.

Most of the people I know who have a Centurion card (I only have the Platinum one so can’t speak from personal experience) don’t get it to make a “narcissistic” statement (as @Gene seems to think) or even to really use as a card for points. Most people I know who have a Centurion just buy first class (or private jet) travel and aren’t worried about chasing points. The benefits are the personal services, hotel travel benefits, companion ticket if buying full fare business class or the confirmed upgrade to first when buying qualifying business class tickets and special promotions. Also you can gift someone else a Platinum card.

For people that travel a lot and value the additional benefits the card can provide it is well worth $5000 a year. On the other hand, most people that have the card as either very wealthy or have their own businesses which use the card (like a film maker I know) and wouldn’t miss $5000 if it fell out of their pocket. It is all relative people.

I almost agree AC. I know a few people that have the card and none purchase private jets although from the marketing material I recieve, I am confident it happens. For me, I chase the points and the perks. I would miss the 5K if it fell out of my pocket.

Honestly, I think the Amex Everyday card is a better value than the Amex Black card.

Have a hard time seeing how this card is worth it. Seems like a giant waste of money for people who need an ego boost. I mean if you want the equinox destination membership [some of their gym locations are hardly as luxurious as they want you to think they are and are overpriced for what you get -the membership doesn’t get you into the best clubs], you would be spending 1k at saks anyway and you make a number of premium flight purchases (not just a handful because plat members for a small fee can use this same feature) and you fly delta enough to use the status but don’t fly it enough to earn the status on your own, then maybe it can be worth it. Lots of benefits they offer are overpriced to begin with and some of the perks aren’t even free they just give you the privilege of paying extra to purchase those perks. For the vast majority of people the plat would do the job.

Is it just me – I don’t care what card you “slap on the table.” I know if you have enough money to qualify for a black card, a purple card or a red card. If I saw someone use a black card my thought would be, “why are you wasting $5000 on that?” I’m already questioning why I’m paying what I’m paying for the reserve card . . . But, then again, I just retired and I’m looking forward to getting off the road for a little while at least.

`Law of Credit Card Reward’ schemes..

Card is introduced with fee (variable) & perks…

Later, fee is increased & perks updated (generally means reduction of perks)….

Again later, further reduction of perks with changes to Ts & Cs occuring – generally diminishing & limiting value of any accumulated `loyalty/reward’ points….

Much later, Cardholder considers definitiion of `loyalty’ & `reward’ ….. seeks out alternative Cashback provider……

Can you guys post the new look of the back of the card also it looks just like the black version of the platinum one

Just looks like a platinum one can you guys post a photo also numbers covered i wonder if they did exact same looking for the back like platinum