I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

We used to think of miles as worth 2 cents apiece. That was a simplistic calculation, 25,000 miles paid for a $500 domestic ticket more or less. The truth is miles with several airlines used to be worth far more than 2 cents apiece. They’d sell you miles for 3.5 cents, and credit card signup bonuses were commonly 5000 miles (if anything at all).

Airlines have so devalued their miles that most aren’t worth anywhere close to 2 cents anymore, although the specific value of each currency varies. As a result, in order to get the same juice in consumer behavior as because, it’s necessary to:

- Offer big signup bonuses

- Offer earning greater than 1 mile per dollar (category or threshold bonuses)

- Sell miles cheaper

In other words, devaluations have made a fool out of members who trusted airlines with their existing mileage balances but haven’t as much fundamentally altered the earn and burn proposition offered to consumers on a forward-looking basis in recent times.

For Black Friday American Airlines offered miles for sale at 1.77 cents apiece, which I dubbed ‘regular price’ it isn’t even the cheapest they’ve sold miles for in 2017 (which was 1.72 cents a couple of times). Last month United was selling miles at 1.88 cents apiece (an offer they made over the summer, too).

Now both United and American are back selling their miles at a lower price than they used to, but for still more than either currency is worth.

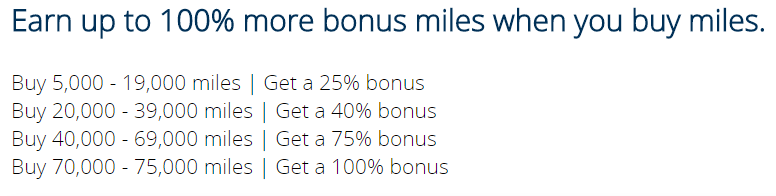

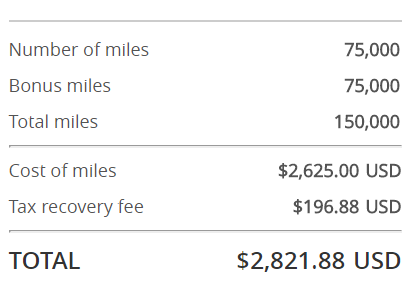

United is again offering a miles sale you have to log in to see the offer but most at least seem to be offered up to a 100% bonus.

That lets you buy miles at 1.88 cents apiece all-in.

United sells miles via Points.com. That means you won’t get reimbursed for the purchase as a travel credit. And it actually means that Points is taking a cut of the purchase price. (They may also be guaranteeing some minimum sales to United, buying in bulk and reselling at a profit.) United itself is earning meaningfully less than 1.88 cents apiece through this arrangement.

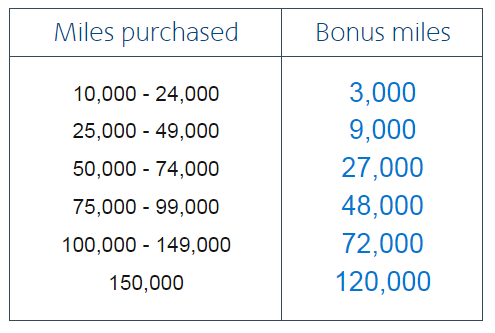

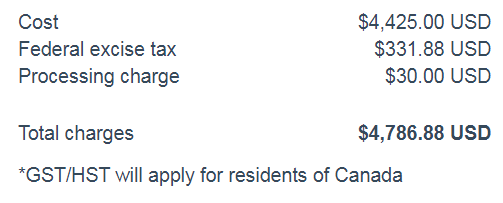

Meanwhile American is selling miles at their Black Friday 1.77 cent price through the end of the year.

That yields a price of 1.77 cents per mile when maximizing the bonus. American sells their miles directly rather than through a third party.

On average across all customers American sells miles for about 1.3 cents apiece. They make good money doing so — they’ve historically accrued liability for transportation of 1/7th to half a cent per mile although this figure should go up January 1 with new accounting standards in place.

Of course these deals gets better if you claim the federal excise tax back demonstrating that the miles were used for something other than domestic air travel. (And you really shouldn’t use the miles for domestic air travel anyway.)

All that said it’s better to buy miles at a lower price than a higher price so if you’re likely to need to buy miles from American or United anyway, great to know that there’s a bonus for it.

Took advantage of this bonus to top up my account after transferring over my SPG points. Made a nice booking to he southern hemisphere. Didn’t max out the bonus, but still way better than paying “full price”.

Why do you think United uses a third party whereas American sells its miles directly?

I’m done with much of their Ponzi scheme ff programs and doing cash back ccs more frequently now as they all burned their bridges with poor valuation

Their Currency is worth a penny or a bit more a mile on average if your lucky

I’m sure once they make first class revenue based for redemption that will kill off likely the rest of those passionate hanger ons

Id rather buy Bitcoin over Parkers unstable mileage currency

I agree with the Bitcoin analogy. Airlines have definitely found their Bitcoin equivalent in that the miles are useless to both parties if the planes are half full.

Southwest is the exception.

Not much point if you have already purchased their annual maximum during the calendar year.

What is the point of imposing an annual maximum again?

It’s worth more than a penny in some cases. I used Chase UR points converted to UA miles to get a Polaris business class seat Chicago to Singapore for 30K UA miles plus $300 cash. I didn’t have all the 30K UA miles. It all depends on the circumstances. Sitting for 14 hours plus in coach versus paying about $600 (give or take) more for business in a flat lay down seat was worth it to me. I felt better when I got there too. Though I rarely buy airline miles directly.