United Airlines shopped the MileagePlus loyalty program around to lenders to raise cash, and they had to present a lot of internal data as part of the process. Now that the transaction is moving forward, they’ve had to make this data public.

Here’s how the $5 billion loan is going to work, and some facts about the program they hadn’t previously revealed.

United Will Raise $5 Billion Debt Secured By MileagePlus

United Airlines filed an SEC 8-K saying that they’re taking a $5 billion loan against MileagePlus, and that they won’t need the loyalty program as collateral for a government-subsidized $4.5 billion CARES Act loan. Instead, they’ll use currently-unencumbered slots, gates, and routes as backing for a government loan should they accept it.

The airline is valuing MileagePlus at $21.9 billion based on 12 times 2019 earnings before interest, taxes, debt, and amortization. (American Airlines had AAdvantage appraised at $18 to $30 billion.)

Goldman Sachs, Barclays, and Morgan Stanley committed a $5 billion term loan, though the airline plans to “seek long-term debt financing in lieu of borrowing the full available amount under the committed term loan facility.” So this is a short-term bridge that they plan to replace with less expensive capital if possible

- The loans are backed by MileagePlus “brands and member data.” In addition to your account information, the loan is backed by domain names, copyrights, patents, trademarks, and software including the MileagePlus X app as well as a non-compete clause.

- And repayment takes first priority out of “accounts into which MileagePlus revenues are or will be paid by its marketing partners and by United.” So they’re effectively pledging credit card revenue from Chase.

It’s striking that they’re taking out a loan against MileagePlus, rather than pre-selling miles, though this likely allows them to access more capital than a mileage sale would have. It’s also telling that Chase, which recently renewed their credit card deal with United, isn’t participating.

Disclosure Filings Give Us A Peak Behind The Curtain Of MileagePlus

Investors, and now the SEC, have been provided with data on the program that’s now public:

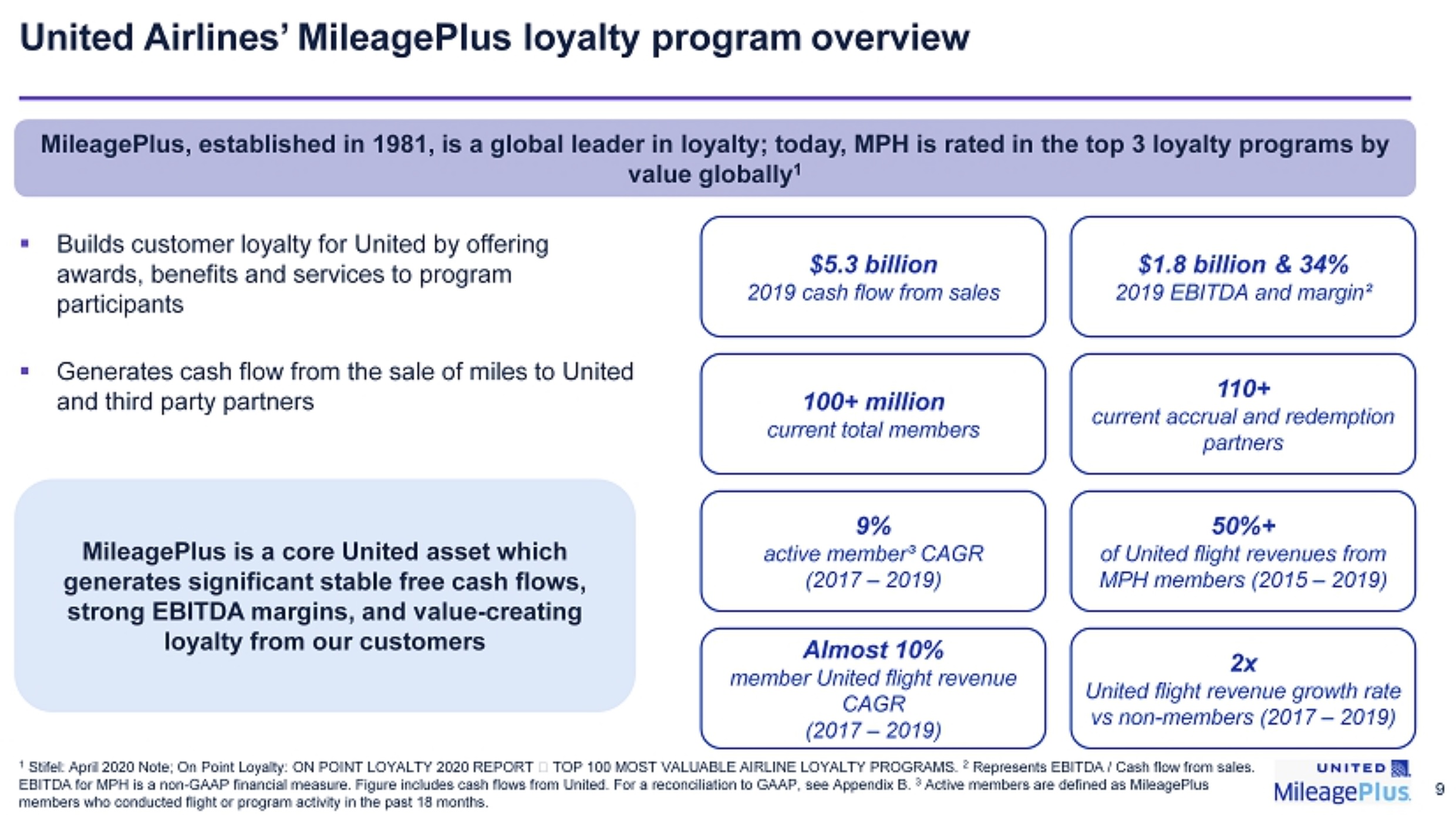

- over 100 million members

- 65% of members make over $100,000 per year [there’s an incongruity, since less than 20 million people in the U.S. earn over $100k per year]

- $5.3 billion cash flow (12% of airline revenue)

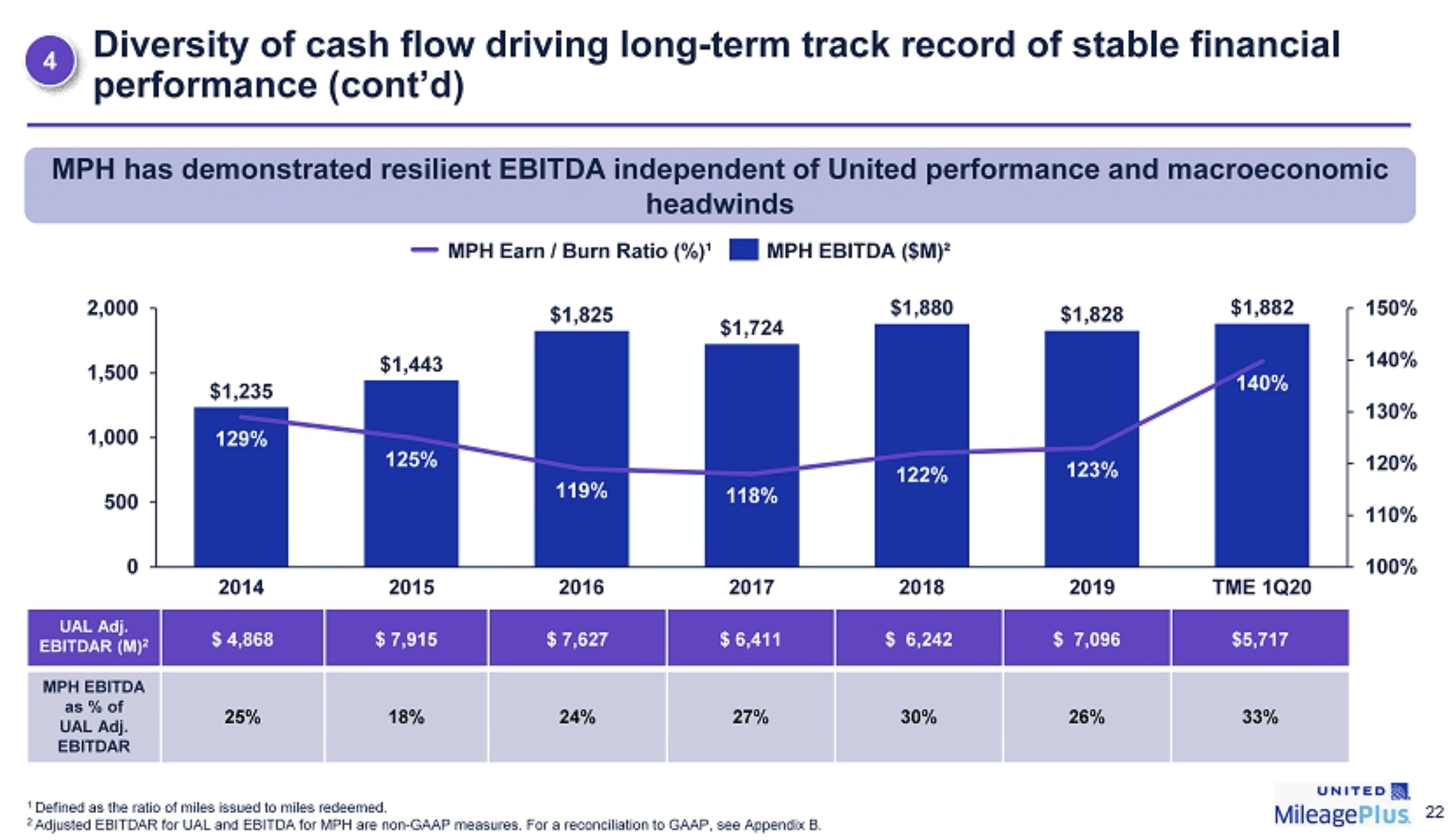

- $1.8 billion EBITDA (26% of United adjusted EBITDAR)

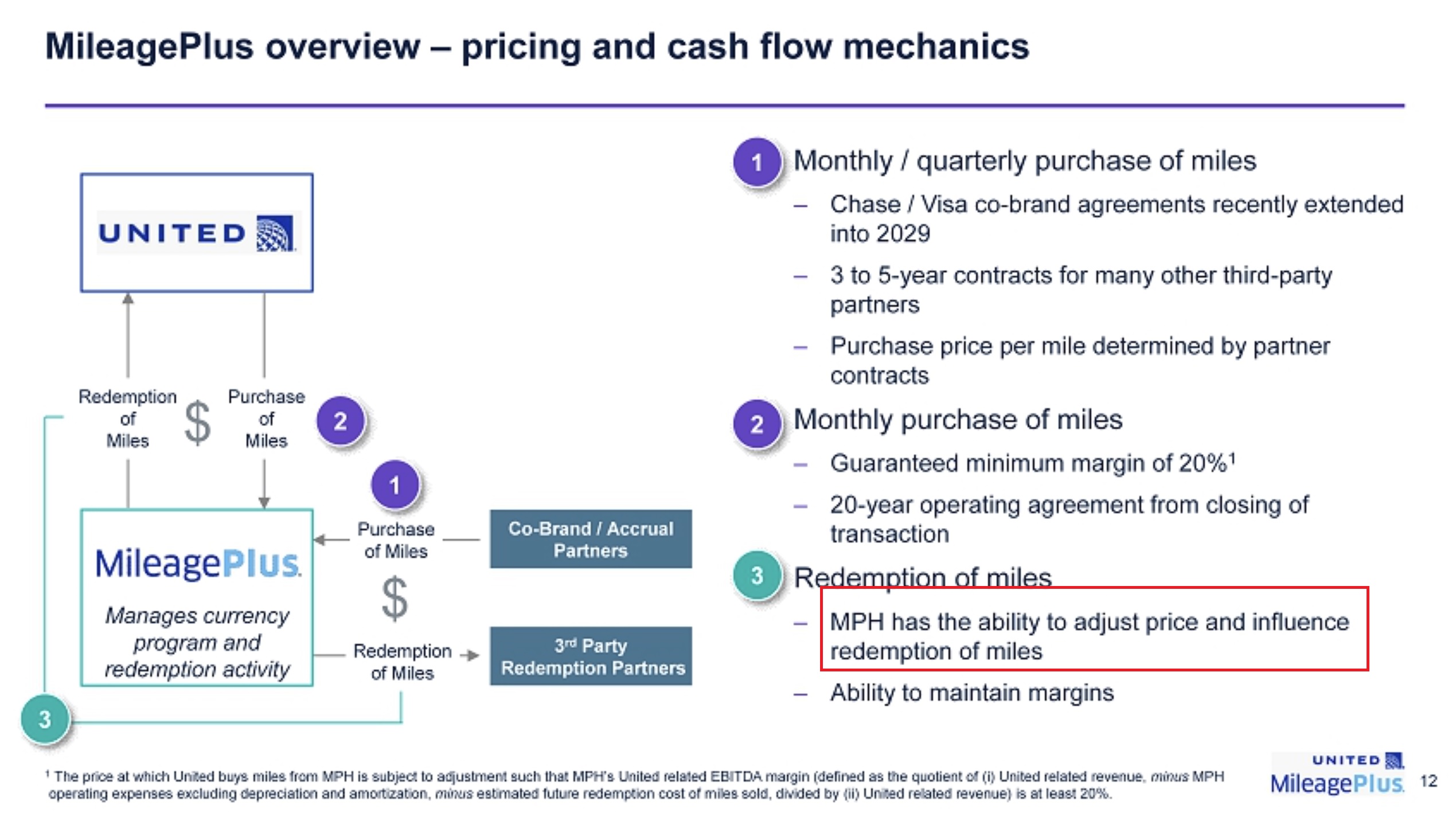

- 71% of cash from miles came from sales to third parties, mostly Chase, while 29% came from miles awarded from flying United

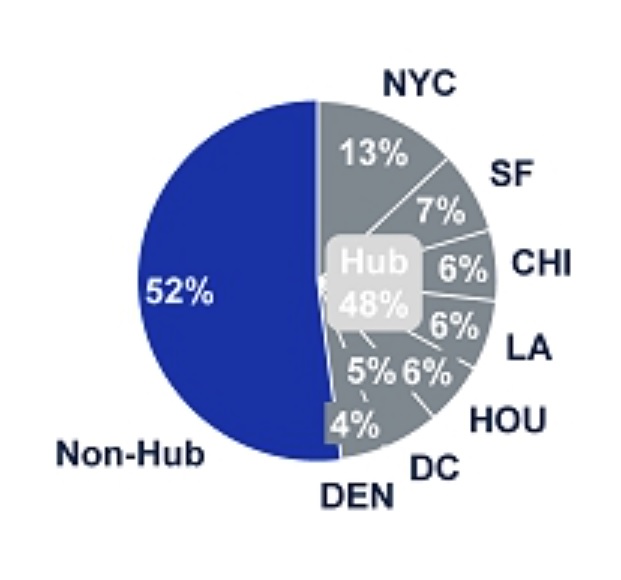

48% of members live in United hubs, the largest concentration in New York followed by San Francisco a distant second.

Members have consistently been earning 20% – 30% more miles than they redeem, though program profitability has been fairly flat.

One selling point, though this really isn’t news, is that the airline can limit redemptions or devalue their proprietary currency as-needed.

The extent to which United is raising even more money in the market than the government is offering – indeed, that funding markets remain open to the airline at all – underscores how inappropriate the CARES Act subsidized loans were in the first place.

I think 9% active member CAGR 2017-2019 indicates the compound annual growth rate of active membership 2017-2019, not that “only 9% are active, with engagement 2017-2019” per your comment.

Interesting no open liability for the outstanding miles already sold. Oops that would make them insolvent. Effectively they are borrowing 5 billion on a liability that is backed by a signature loan and their good name. That’s creative.

1. Chase is the retail bank for JP Morgan Chase and wouldn’t be considered for an investment banking role here.

2. JPM and United very well may have determined that the credit card affiliation/partnership creates a conflict that prevents JPM from being engaged as agent/bookrunner.

3. The comment about the CARES Act funding not being needed because they can tap private capital markets (at a still TBD interest rate) is completely baseless.

Based on 100 million members, the hub percentages seem off. 4% in Denver is 4 million people, but the Denver metro population is only 3 million. Similar for San Fran…

@swag – agree. They must be using something other than 100MM for the denominator in those percentages. Maybe that’s just US-based members, or active members…

This again proves why these programs MUST have regulation. To go out there and say that they have full control over a currency should be scary to almost anyone. This isn’t just United that is saying this, its all the airlines and points schemes.

Well should UA try to file for BK this deal should seal any attempts to shed the FF program!

Likely the 4% represents the active, not full membership. I know the agency that runs the program. It used to have over 12% active members a few years ago, it has been dropping steadily. So 4% of 9 million would be 360,000. I think UA has extremely low active hub percentage compared to AA and DL.

“over 100 million members (only 9% are active, with engagement 2017-2019)”

“65% of members make over $100,000 per year”

Did you mean 65% of the elite members? It doesn’t sound right that 65 Million of their members make more than $100,000 per year

The 71/29% split on miles sold externally vs. used internally is interesting too, and telling…wasn’t that long ago when it was 50/50 and miles from CCs finally surpassed miles earned from actual flying.

Shows you how total miles earned have fallen for all except for the ~5% of flyers who are GS or hub captive short haul.

Anyone know how Mileage Plus pays for the flights that get redeemed with points? I’ve always wondered that about partner awards as well.

And I assume there is a cost given to the points based on average redemption values, and that is subtracted out of profit?

If they have 100 mil members and they say 65% earn $100k+, they are saying they have 65 million members who earn $100k+ annually. I find that hard to believe.

@Gary – What do you read into the fact that Chase is not in on this?

“65% of members make over $100,000 per year [there’s an incongruity, since less than 20 million people in the U.S. earn over $100k per year]”

No: 20% of US households earn > $100k

https://en.wikipedia.org/wiki/Household_income_in_the_United_States#:~:text=One%20half%2C%2049.98%25%2C%20of,%24100%2C000%2C%20the%20top%20twenty%20percent.

Nice catch and analysis — great work.

BTW, there are about 52 million Americans living in households with $100k income (using an average of 2.6 members per households). So the discrepancy between the probably self-reported data in MPH and the reality is not as far off as it appears, especially when you add the international members. But reinforces the fact that people lie — all of us are better drivers than the average driver!

@qofmiwok what they pay themselves (i.e., MP redemptions on UA metal) is an accounting entry designed to promote whatever short-term financial goals they may have. For partner redemptions, there is an established price airlines pay each other, and periodically they settle-up if redemptions are unbalanced (e.g., more UA members on LH than vice-versa). This award ticket price is a small fraction of retail — probably above the marginal cost, but not by much.

I’m late to the party here, but I have an observation. It isn’t here, but I’d love to find out, what price United’s accounting dept. charges United for the miles it sells to itself for that 29% of total miles.

Other than that, spot on observation about the CARES act. The US Big 4 airlines have oodles of assets they could leverage for loans, especially in this atmosphere of Fed-imposed super low rates.