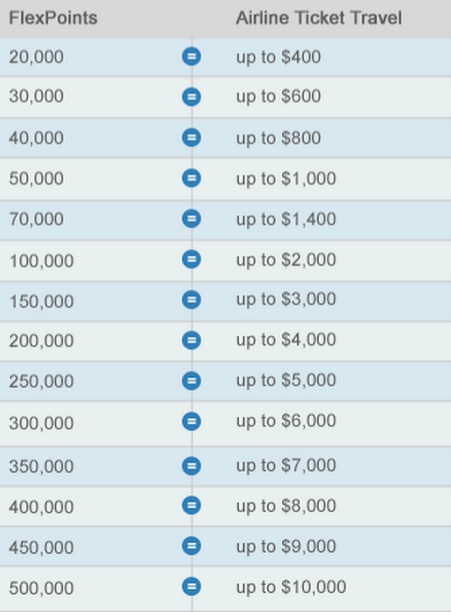

Right now you can get somewhere between 1.3 and 2 cents per point in value for your US Bank Flexperks points. That’s because they have an award chart which lists a certain number of points based on the cost of a ticket.

This is the model that Delta had in mind for revenue-based redemptions when they chickened out and simply kept reward chart-based pricing while hiding their reward charts. (Customers, they found, reacted poorly to true revenue-based redemption. It’s ‘simpler’ but eliminates the possibility of getting outsized value for miles.)

However effective December 31 Flexperks points will be worth a flat 1.5 cents apiece.

Beginning Dec. 31, it will be easier to understand redemption of FlexPoints. Each FlexPoint will be valued at at 1.5 cents when redeeming for car rentals, airline tickets, hotel rooms and travel packages. Redemptions made prior to Dec. 31 will continue to use the current tiered rate schedule.

Most air redemptions — even if you don’t maximize value by redeeming at the upper end of a redemption tier — will get you 1.6 cents apiece or more for your points. So fixed value 1.5 cents a point redemptions are a devaluation.

I’m sure you’re right that this is technically a devaluation, as banks aren’t in the business of creating *more* value for customers.

Although, I must first ask how you justify your position with this one. I’ve found that I’ve been waiting for that “perfect” redemption for my stash of points, and it’s annoying as hell to find something at Kayak, then search the portal, and find out that the portal priced the award about $20 higher than Kayak, and then that bumps me into the next tier. So, I’m presented with a valuation of a little over a penny a mile, but won’t book it because I think I can do better.

So… count me in with the crowd who is fine with, and perhaps may even like, a fixed value of 1.5 cpp… and this card bonuses grocery spend at 2x, so that’s 3 cpp at the grocery store.

Some pros and cons with that change:

Pro – you don’t need a minimum number of points to redeem (assumption for now)

Pro – travel redemption other than maxed-out airfare will get a boost in value (+50%!!)

Con – maxed out airfare will get less value (-33%)

For mid-range card is not bad at all. More people may use it in 2018 and on.

Just booked a $397 fare in December for 1.975 cents per point. Not sure I could have done any better.

Dropping 3x for charity and to 1.5 cents for redemptions puts them pretty firmly in the “why would I keep this card after December 31” camp.

There’s not much left to differentiate this card now from its competitors. Very little advantage over the 1.5x Amex or Chase UR cards once the charity bonus goes away at the end of the year.

But its a pain to get the maximum value. More often than not you end up having an airfare that bumps you into the next tier, and you need another 10,000 FlexPerks. Amex would be smart to follow suit with pay with points. they have two many restrictions, and waiting weeks for a reimbursement is a joke.

This was my #1 CC. Between 3x on Charitys and 2x Supermarkets ( MS with GCs and earn gas pts to boot at times). It was a great CC over the past few years

When I found a lower fare on a carriers site a supervisor would do the booking at the reduced # of pts , HCs were great too There may be some times that it will still pay off at .015 Fare was way below $400 and it didnt pay to use the pts, now it will.

But 1st I will need some time to see what will workout best but no way do I see doing the charging as I have over the past years for .015 flat

The good thing is I wont feel bad using up my large stash of pts as I wont be looking only for eg < $400 NY-LA or < $600 NY-HI, Ill just burn thru them as I chase SQ Gold

thx for the heads up!

I booked a $595 flight on Emirates for 30k points. Hard to beat that. The “”new” 1.5cpp would cost me 45k for the same flight. Huge devaluation. Will cancel card when AF hits.

US Bank points also EXPIRE after 5 years. Doesn’t matter if you

do any activity in the account or not.

And as for call centers they are staffed with people who have no clue about the details of their cards.

How about that website? Ever seen one as dysfunctional?

They would be smarter to get out of the card business and focus exclusively on their core business.

Regarding points expiring. I believe if you transfer them to another account that it restarts the 5 years. That is what a rep told me. I transfer between my and my wife’s account.

I already have plenty of points with other programs for fixed point redemptions. So this is a devalue for me. If a ticket is a bit over the tier range, then I use the fixed points from Wells Fargo or Citi, etc., or an airline award ticket if it is available.

$25 travel credit per reservation still good? If so, this change turns out to be a huge positive.