I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Air France KLM Flying Blue is a transfer partner of all the major bank transferrable points currencies.

Air France KLM gives members of their program access to far more business class award seats on Air France than partners like Delta and Alaska have access to.

Points generally transfer instantly to Air France, at least I can vouch for that with both American Express and Chase (and indeed Air France told me their partnership with Chase was delayed because Chase insisted they get the IT done to make transfers instant).

Air France’s website is reasonably good for booking awards including partner awards. For instance you can often book Delta flights for fewer miles than Delta would charge their own members, and Delta’s transatlantic availability is surprisingly good in the off season.

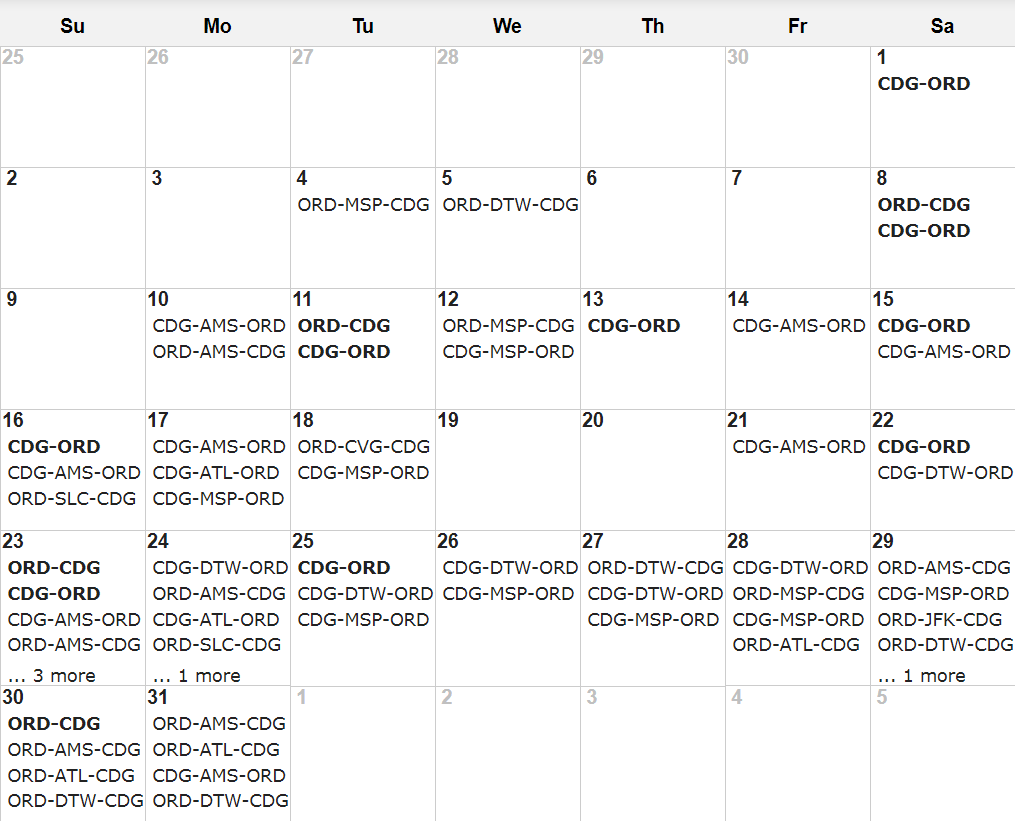

Here’s a search for four business class award seats, Chicago – Paris, in December.

There are 10 days where non-stop flights in one direction or the other are available for four passengers or more. There are of course more available dates if you’re searching for fewer than four passengers.

Available Chicago – Amsterdam flights are on KLM. Minneapolis, Cincinnati, and Salt Lake are on Delta. Detroit may be on Air France or Delta. Atlanta is on Air France.

Points can be transferred from cards such as:

- Ink Business Preferred℠ Credit Card has an 80,000 point signup bonus after $5000 spend within 3 months. It earns 3 points per dollar on travel — that’s airlines, hotels, rental cars, tolls, even Uber — and 3 points per dollar on shipping and advertising on social media and search engines, so great for anyone who advertises on Facebook or Twitter, or who spends money advertising with Google.

- Chase Sapphire Preferred Card lets you earn 50,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. With a $0 annual fee the first year, then $95, I suggest that as the number on card to get started with in miles and points. The card earns two points on travel and dining at restaurants and 1 point per dollar spent on all other purchases worldwide.

- Business Gold Rewards Card from American Express OPEN offers 50,000 Membership Rewards points after $5,000 spend on purchases with the card within your first 3 months of cardmembership. (Offer expired)

- Citi ThankYou® Premier Card is offering a 50,000 point signup bonus after $4000 in purchases on the card within your first 3 months of account opening. It has a $0 annual fee the first year, $95 thereafter. And it’s a stronger points-earning card than the $450 annual fee Citi Prestige Card since it doesn’t just earn triple points on air and hotel (Prestige) but on all travel (such as gas). (Offer expired)

This is what makes Air France a useful transfer partner. Currently transatlantic business class is 62,500 miles each way. prices are going to change slightly both up and down June 1.

Air France has some unique partnerships as well with Air Mauritius, Aircalin, Air Corsica, Bangkok Airways, and Ukraine International Airlines.

There are a couple of cautions though. Air France does add fuel surcharges to award tickets. And they’ve been known to have super-aggressive anti-fraud procedures. They may put an account on hold or require a customer to go to the airport to issue tickets that opens an account, transfers in points, and immediately books travel.

So my recommendation is always to:

- Open an Air France KLM Flying Blue account now, so that it isn’t brand new when you need it.

- Book over the phone the first time you transfer points and immediately redeem for an international award. I’ve had success over the phone in the past with award holds as well.

I find these strategies reduce the likelihood of a problem.

AF agents will often times say they can’t see Bangkok Airways award availability. You can now check this yourself on JAL’s website before calling.

I recently booked our return tickets from Europe for December 2018, FCO – LAX, for 62,500 + $300 each for my wife and I. It was easy. I had created a FlyingBlue account for each of us about a year ago in anticipation of eventually doing something with it and just transferred in points from Chase UR immediately prior to booking.

The CDG – LAX flight is supposed to be on a 777-300, but it is so far away we’ll see what actually happens there. We’re flying several other AirFrance planes on paid itineraries this year so it’ll be fun to compare the aircraft.

Good article and good tips. Didn’t know about the zealous antifraud measures, glad I read this.

Hey Gary,

How is their award chart for routes besides TATL?

What sort of YQ should we expect for the TATL routes?

If you value AF miles at say 2c, then their $360 in YQ is equivalent to 18,000 miles, add that to your 62,500 price to get 80,500 that’s the real TATL comparison rate with a US program.