What is the value of miles and points by airline, hotel and credit card program? Miles used to be thought to be worth 2 cents. I think that conventional wisdom developed out of the idea that a cross country flight cost about $500… or 25,000 miles. 20 years ago that was generally true, and award availability wasn’t really a problem either.

That was long before:

- Airline alliances opened up huge possibilities for miles.

- Mileage programs increased the cost of many awards.

- Awards became tougher to get with flights full.

Plus the 2 cent number probably wasn’t ever true to begin with.

Many different folks have taken a stab at how much miles are worth. For this post I’m not going to give you a single number. I’m going to share my own rough and ready number for several different programs. And I’m going to explain how I think about the value of miles — why they are different for different people, and for different circumstances of how you plan to use them.

The Value of Points are Not Actually Fixed.

Here’s how to think about the value of miles and points by airline, hotel and credit card program.

It depends on how you redeem them. What value are you going to get for your points? The important thing here is not to use the retail price of a ticket you’re getting, since

- with premium cabin rewards you might not have been willing to spend that much cash.

- Frequent flyer tickets aren’t necessarily worth as much as a paid ticket. They don’t earn miles. They may not be upgradeable. And you can’t necessarily just pick whatever flight you want, you have to be flexible and worry about award availability.

It depends on when you’re going to redeem them. You don’t earn a rate of return on miles and points like you might with cash in a bank or investment account. And you need to discount to present value if you’re going to use the points later. Plus there’s substantial risk of devaluation with many points currencies.

It depends on how many you already have. The value of points at the margin is different than an overall average value. As you approach having enough points for an award, the marginal value of a few more points goes up substantially — since those extra points are what make the award possible. On the other hand, once you have more points than you’ll redeem in the near-term the value of additional points falls since you may not ever use them, or may not use them under current award charts.

Nonetheless We Can Make Some Overall Comparisons

The value of a mile is the amount at which you are indifferent to holding miles versus cash.

If a mile is ‘worth’ 2 cents you should be equally happy with a mile or two pennies, if you’re offered a mile at a price of 1.9 cents you would be a buyer — you’d consider yourself to be earning a 5% margin.

Put another way, when we put a charge on a credit card, that doesn’t earn any bonuses (it earns 1 mile per dollar spent), we’re effectively buying that mile for 2 cents since the opportunity cost is putting the charge on a 2% cash back card. You’re revealing a preference through your behavior that you believe the mile is worth two cents.

My Overall List of Values

Here’s my overall ranking and valuation of several common airline, hotel, and credit card points currencies.

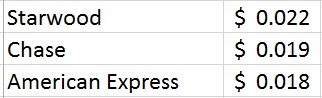

Transferrable Points Currencies Top the List

The most valuable points, at the top of my currency list, are transferrable points. That means Starwood, American Express, and Starwood points. You can transfer those into a variety of programs. Earning those gives you tremendous flexibility and optionality.

Starwood lets you transfer 20,000 points into 25,000 miles with the most number of airlines. That means their points are worth at least 25% more than the most valuable currency they transfer into. And they’re worth even more than that because of their option value, the ability to put points into the account you need them in when you need them — to top off an account at the margin (remember, miles at the margin that you need for an award are worth even more).

As a result, if anything, I may be undervaluing Starwood Starpoints a little bit.

Meanwhile, Chase transfers to several valuable partners — and unlike Starwood in most cases the transfers happen instantly. I like that Chase transfers to United (no fuel surcharges) and duplicates Amex with British Airways and Singapore. They also have a more valuable transfer partner and ratio in Hyatt than Amex does. That’s why I value their points a bit more highly than American Express Membership Rewards.

Nonetheless, American Express has more transfer partners and many do transfer instantly. Here are the best ones.

The Value of Miles and Points by Airline

Here are airline programs compared.

United miles get you access to the Star Alliance, which means the best availability between the US and both Europe and Asia in business class. There are no fuel surcharges. But awards are quite expensive when traveling in premium cabins on partner airlines, impossibly so if you want international first class.

American on the other hand has a more reasonable award chart (and an indication that we won’t see wholesale changes to it in 2015). It is best for first class awards — Cathay Pacific, Etihad, Qatar (limited routes), British Airways (fuel surcharges) as well as somewhat more difficult ‘gets’ Qantas and Malaysia Airlines.

Alaska Airlines miles are often undervalued — they partner with many airlines in both the oneworld and Skyteam alliances, offer one-way awards, and show availability for most partners on their website. The biggest drawback is that you cannot combine different partners on a single one-way award. I love that they partner with Emirates, whose A380 first class awards have become quite easy to get on several U.S. routes.

I value Aeroplan points a little bit below United miles. They’re both members of the Star Alliance, and for many awards their prices in miles are cheaper but they add fuel surcharges onto many of those partners. Here’s how to book Star Alliance awards without fuel surcharges. And see also (for both Aeroplan and United) how to book award tickets on Star Alliance partners.

British Airways points are worth still less to me, although I make great use of them on domestic short non-stop flights. I can get 4-7 cent s point in value sometimes, and for trips I really do need to take. But long distance flying, especially in premium cabins, is super expensive. And they add fuel surcharges onto awards to boot. First class Los Angeles – Sydney on Qantas? That’s 300,000 points and ~ $900 roundtrip — and that wouldn’t include any flights to and from Los Angeles, or beyond Sydney! Here’s a primer on the overall value of the British Airways program and on the British Airways Visa.

Korean Air — expected to return as a Chase trasnfer partner — on the other hand has a pretty good award chart, does add fuel surcharges to awards, but offers amazing first class award availability. The two challenges are that they’re a member of Skyteam, so their partners aren’t as good and don’t often offer as good award availability as some of their competitors, and also that you have to deal with the idiosyncrasies of Korean – rules like only redeeming your points for family members.

Still, their better award chart.. option for one-way awards.. and availability of first class means that I value their miles slightly more than Delta’s.

The least value points currency among the major ones often discussed by US frequent flyers has to be Virgin Atlantic’s — fuel surcharges, cannot mix and match partners, partner awards that cannot be booked one-way, and challenging call center agents all rolled up into one. Here are the best uses for Virgin Atlantic’s miles.

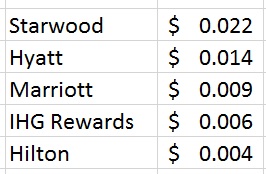

Hotel Points Use a Totally Different Scale

Here are my values for hotel program points compared:

Hotel loyalty programs simply use a different ‘scale’ than airlines for the most part. A room with Hilton HHonors might well cost 90,000 points for a single night, and points in many programs can be transfered to airline miles at ratios like 2:1 or even 5:1.

On the other hand they give out points in pretty large denominations. I’ve often assumed that was to make you feel like you were getting a lot especially if you were used to airline miles. Earning 5000 airline miles for a roundtrip flight might make 20,000 points for your hotel stay feel quite rewarding.

So it’s a different question entirely to ask which hotel program is the most rewarding for your spending in terms of free nights. They each award and redeem points at different rates, so I created a way to compare them.

Here’s we’re just looking at what 1 point is worth in each program. And Starwood points have to be worth at least 25% more than American miles, since they transfer in 20,000 point increments at a rate of 1:1.25. And you get optionality of where to point the points. And you can redeem for hotels, I’ll pretty much always do better than 2 cents a point in value (usually quite a bit better).

At the high end Hyatt points can be worth quite a bit, especially for category 5 and 6 properties during high season and even more so when cash and points awards are available. Still, the airline transfers aren’t as lucrative as Starwood’s and if you’re looking at an ability to trade in Hyatt points for a hotel stay where you’d otherwise use cash I find that most of the time you can do a bit better than 1.5 cents. I value the cash more than the points at the margin, though, so I’m not actually a buyer at 1.5 cents.. I downgrade them slightly plus I would choose Aeroplan points over Hyatt points 1:1.

Hilton points are worth a little less than a half cent apiece, the average redemption I find hovers somewhere just above that half cent mark. And IHG Rewards points are worth only a little bit less than what you can buy them for through the back door.

How Do You Value Your Miles?

What is your value of miles and points by airline, hotel and credit card program?

Let me know if you think I’m off base on any of my valuations!

- You can join the 40,000+ people who see these deals and analysis every day — sign up to receive posts by email (just one e-mail per day) or subscribe to the RSS feed. It’s free. You can also follow me on Twitter for the latest deals. Don’t miss out!

Isn’t the takeaway here that on average a 2% cash back card is basically the best call in light of annual fees and effort required for Starwood (and Chase for that matter)?

Good work on the valuation of the points, but I always said that’s only half of the equation. The other side of that is the aquisition cost of the points. For Example, I can acquire Chase UR points MUCH MUCH cheaper than I can Starwood points, so leaving out that part of the equation is somewhat misleading. I look at my net “profit” on the points, not just the sale price. To me Chase points are the most valuable.

Tom, If we are talking strictly about credit card earning (in this case we are comparing to a 2% cash back card), I don’t think that is the takeaway. I calculated that last year across all my Chase cards I was earning roughly 3 points for each dollar I spent on my Chase cards. If I then redeem those points using Gary’s figure of 1.9 cents in redemption value, I’m earning almost 6% rebate on those spending dollars. With Starwood points, there are no multiples for spending, let alone the inability to churn their cards and earn another sign up bonus. It’s pretty much 1 point earned for each dollar placed on those cards. Placing gary’s value of 2.2 cents at redemption is marginally better than a 2% cash back card.

Hi,

How do you value Club Carlson?

Thanks

Recycled “content”. Where’s the discussion of Citi TYP? They are now transferable. And Carlson is missing – which are quite valuable due to 2 for 1 night promotion.

And yes, beyond the dated recycled content, the post is misleading. You need to look at your earn rate and cost of acquisition to determine which points are the most valuable – spend value is less than half the equation. That’s why I value HH much higher – easy to get a lot of points at low cost. I’d also value URs higher simply because can transfer to Hyatt.

SPG value is horrible for hotels – it is almost always the worst value of all the major hotel chains. Terrible at high end and beaten at low/mid by Carlson and Hilton, followed closely by Hyatt.

Frankly, I think “value” is mightily skewed by how lucrative the affiliate income is…

I think elite status (or lack) causes some of these to bump up (or down) just a little bit for me, but I’m generally in concurrence.

I think the key is diversification – right now I’m too heavy in AA thanks to a year of making EXP and the credit card and the $40k spend for the EQMs. So I’m only valuing any newly acquired miles at about 0.013 if family members want to use them. (No, I don’t sell my miles, they are gifts to deserving family members.)

The Earn rate doesn’t matter, especially I’d you are getting points/miles as sign-on bonus. For many people, they will never spend enough money on any of the cards to come close to the sign-on bonus.

I too agree that the ease of acquisition, and thus the net “profit” are very central to each individual’s valuation. That may be harder to quantify in general, though, so it makes sense for Gary to present his subjective redemption side on his scale. It’s up to us to take everything else into account.

I think the more each person gains experience the less one needs a chart and the more one bases on personal results. For me the most absurd comparison is United at 1.6 and Delta at 1.3. No way Delta is anywhere near that close to United based on the way I use United miles and can never find a use for Delta miles. I get much better than that for United, and my Delta account sits idle.

Thanks Bruce, I forgot to consider that. It’s rare that I’m not earning at least 2x points on anything through Chase or Amex so that would put me at ~3.9 cents/dollar by Gary’s calculation

@Bruce @Tom…thanks both, you are spot on–Chase Sapphire is giving me 1.7% back until 2016, and if I go through the Chase porthole for anything I gain an extra 2x or 3x points. Example: while Skymiles, MileagePlus, and AadvantageShopping are all paying out 1x for purchases at Lowe’s.com, Chase is paying our 4x points. So I jut go through Chase, order online, (paying with GC’s I’ve bought at a 9% discount online), and go pickup at my local Lowe’s. Effectively I have made 5.07X on my purchases. Ditto for Home Depot and Ace Hardware.

If I pay attention to who is offering what deal–cashbackholic.com helps save a lot of time by letting me know who has the best deals at the moment–then I earn a lot faster than most folks.

I enjoyed this article and I think it is very worthwhile. I mostly agree with your valuations, but I totally agree with DaveS that you are overvaluing Delta miles. They are so darn hard to use unless you are extremely flexible. I’d say $.010 for Delta miles at best. I don’t know why you excluded Club Carlson, but I’d value those points at $.007 for people who have the Club Carlson credit card (since you get one free night on each redemption).

No Club Carlson or Lufthansa valuations?

Overall, very good context for considering the value as well as good valuations.

I would rate Alaska a hair higher than American because of the lack of change fees more than 60 days out. Also, I can get TATL from LAX in business via AF. Even though I am EXP, I can’t get TATL on American metal, and using it on BA is worthless with the fees.

Another consideration in valuation is how hard they are to get. Another reason to put Starwood at the top. I’m lifetime platinum but am always short of Starwood points. If I didn’t have to chase EQM on AA, I’d put all my spend on the SPG card.

I hear what people are saying about the difficulty in using Delta miles, but there’s no way they’re worth less than a cent a mile. Even if you’re redeeming for “middle” value, 200,000 miles for business to Europe is worth more than $2000 dollars, 40,000 miles for domestic roundtrips is usually cheaper than $600 dollar cash tickets, etc. And then factoring in that you can still find 125k redemptions to Europe and 140k redemptions to Asia in business, and I think Gary’s valuation is about right

Gary, what European routes are you seeing UA availability in, and when? I’m seeing (reasonably) good stuff to Asia, but dismal pickings to Europe. Originating DCA/IAD, if that matters.

How do you value thank you points and club rewards?

To echo others you left out a lot! (added my own to the list):

– Club Carlson

– Citi Thank You

– Air France/KLM Flying Blue

– Singapore Airlines

– Lufthansa

– Southwest (fixed but good for reference)

– Avianca LifeMiles

Omissions: Club Carlson, LifeMiles, US Airways…

With Singapore Airlines being probably the best transfer partner from Citi thank you points, it would be interesting to see how you would value Singapore Airline miles. Lucky has put some emphasis on Singapore lately, and Citi thank you points are not too difficult to come by.

Gary, how are you using your AA and As miles? I’m finding them much harder to get good value out of than UA. Most of my travel is to Europe during peak or near-peak periods, and there’s very little availability (except BA with usurious fuel surcharges, or, on AS, flights through the Middle East). (I find this true for both Economy and premium cabins. I’ve actually found AA Standard awards on off-peak days – 45K to Europe or 35K to South America – to be a good way to use some of my AA miles.)

I use Club Carlson points heavily for stays in Europe, and value them at least 0.5 cents each. I’d much rather put my non-bonused spend on my Club Carlson Visa card than on a cash back card (especially since I spend ’em as fast as I can accumulate ’em, and with the “last night free” benefit I’m staying in nice centrally located London hotels at way under $200/night). If Club Carlson takes the “last night free” benefit away, I’ll go back to putting non-bonused spend on Starwood.

I frequently enjoy looking at the prices major hotel companies pay the airline programs to buy miles for hotel guests or to transfer hotel points into airline miles.

My husband and I have over a million points between United, American, American Express and Chase, British Airways. We fly to Hawaii on United twice a year, we use Delta and American points sometimes for domestic flights. But mostly we are hoping to use those for international business class in the next few years. I believe that is how you get the most value, assuming you would otherwise pay for business class.

But for new miles we are only using our 2% cash or 2 pts Capital One convert to cash for travel. I think that’s hard to top for most domestic coach flights. We pretty much only have airline cards now for the free bags.

What frustrates me is that even within a single program, the points can be worth a vastly different amount depending on when/where you use them. Earlier this year, I treated my wife to a vacation at a $460/nt marriott for 40k points/night, and am looking to do something similar next weekend, except marriott wants 40k points for a $139/night room — I just don’t think so. So that’s a 3:1 ratio even within a single program. Ew.

So Gary do you redeem SPG points for hotels or based on your valuation do you for the most part only transfer to airlines with them?

I did not see any evaluation for either CITI or Capital One. Any updates there would be appreciated. BTW just signed up for Amex Platinum and looking forward to the TSA and Global rebates.

I think you slightly overstate the value of airline miles by not adequately considering the “hassle factor” in redeeming awards. If award availability was better, the miles would be worth what you state.

That said, your airline valuations are reasonable if, say, you’d actually be willing to pay $2000 cash money for a biz class ticket from the USA to Europe.

As far as top-value SPG goes, the problem isn’t availability, it’s what the hotels are actually worth. Personally, there are very, very few Starwoods in the world that I’d be willing to pay $200 for a room-only rate. I’d make other lodging arrangements. If SPG were willing to sell me points, I don’t think I’d ever be willing to pay more than 1.5 cents. So that’s probably about what they’re worth.

Pat, you’re missing the beauty of “arbitrage”. You pay with points for the $460 room; you pay cash for the $139 room. That’s the way you make your dollars and your points do the most for you.

Until there is a free market for points, anyone can place what they think is a reasonable value on points and deem their method valid.

No one that I know of has ever published their point value findings to a scientific/mathematical journal for peer review, which may get the ball rolling for a serious look at the problem of points valuation.

Another method is to create a prediction market.

Until such time everyone is most likely inefficiently valuing and spending points, or perhaps someone has already done the work and is not telling anyone to maintain an advantage and the status quo.

Cheers

If you want to look at spending power of points, you are really undervaluing IHG, since their redemption rates at the lowest in the industry. You can find plenty $150/night rooms for 10K points (and 5K as special), so that valuation would be 0.015 (and double for the quarterly specials.) I’d have a hard time booking a $150 a night room with anything else in any chain based on that. Marriott & Hhonors, which have the same accumulation rates (10 per $) usually are 20-25K points for $150 night rooms. You also have to figure out the chances that there is a hotel where you want to travel. This really hurts Starwood and Hyatt big time. Unless someone is redeeming only on “inspiration properties”, in real life redemption those 2 fail in the availability part.

You forgot Club Carlson. How much do you think they are worth?

I do not say this lightly (since I am a big and long-time reader of your blog) but your failure to discuss Club Carlson hotel points is inexcusable. It is THE deal in hotel points if you have the Club Carlson Visa to go along with it. And it is, without any doubt, the single best way to manage (reduce) travel expenses (beyond flying mostly for free with miles.) Your failure to include it, I would surmise, is due to a lack of a referral bonus. Understand, Gary, I don’t begrudge you in any way the right to earn referral bonuses for your VERY excellent blog. And I also happen to think that you, as opposed to other bloggers), are not driven by sign-up bonuses in your choice of content. So, tell me, how can you fail to include Club Carlson in your discussion?! Admittedly they are not, in the States, “aspirational” properties but they are pretty darn solid and are also ambivalent in both Europe and Asia, two places that a LOT of your readers are undoubtedly collecting miles for which to visit. So I would suggest you help your readers by including it in any future lists. (For the record, I reckon I have saved, just this year alone, about $4,400 by using Club Carlson points and having its credit card. What would I have to do to get Marriott or IHG points that would let me get anywhere close to that total?)

@TomSAN I haven’t included Club Carlson because I haven’t though deeply enough about the right number. It’s a really variable value, contingent on the US Bank card, not available to all members worldwide. I tried to develop universal numbers, and simply hadn’t come up with the right amount. I know it’s not on the list, and it’s prompted me to give it more though. I do apologize if you feel the list falls short because of it, but I assure you there’s nothing nefarious in the reason — just my own tentative thoughts on the value of the points such that I wasn’t ready to draw a line in the sand on it.

@Gary Leff. Fair enough. I assume you have a number of international readers but I also assume that the majority of your readers have access to the US Bank Club Carlson card. I recommended to my brother-in-law that he get that card for his first trip to Europe and he fell over himself in thanks for my suggestion. If you’re not planning to use your points to stay exclusively in the U.S., then Club Carlson is the way to go (assuming you do not demand “aspirational” properties.) A few years ago, we used our points at Zurich airport at a Radisson Blu (the only in-airport hotel) and, apart from being just really fine, it saved us a ton of money based on Zurich hotel rates. When you combine the cost of stays (in terms of points) with the US Bank card, the value proposition really becomes utterly compelling. So maybe it’s an apples-to-oranges for your your non-American readers but for the American readers, it’s a little celebrated deal that needs to be, well, celebrated (for as long as it lasts!) Thanks, again, for a truly great blog.

Gary,

Curious as how you would rate Diners Club points versus Chase, Citi, and American Express. I was fortunate enough to squeeze in the window to get a card when it was open to applications and curious if it should be my primary card vs. the others. I have the Elite card which gets the 3% category bonuses (groceries, rx, gas).

I got a one way first class ticket from HOng Kong to San Francisco for 68000 points on Singapore Airlines. Cash cost for this one way flight in first class was $10000. USD. Pretty good point value ,I would say.

Unfortunately, if your from Canada, the airline grid doesn’t work.

A long-haul flight from Toronto to Europe is valued by Aeroplan at $0.088 per reward point (sometimes worse). The norm for Aeroplan’s devalued program puts it close to $0.01 per reward point overall for both short-haul and long-haul at current market rates (May 31 2015). I’ve tried 10 different combinations and arrive at the same range $0.088 to 0.01 with flights ranging from under 750 miles to well over 2,000-3,000 miles. At that rate, you start to wonder if collecting reward points is worth the earn cost; cashback starts to look much better.

Gary – How can I get points into Asia Miles for CX? I have plenty of AA miles but the 30 day lag with AA (331 days out) for booking CX when the award seats first post (360 days out) is a problem. I have Citi TYP (but not a lot) and SPG points (would like to save). Is there anyway to use CUR into a different airline that will then allow a transfer of those points/miles into my Asia Miles account? TX

@bobbieeddie you can transfer Amex points directly to AsiaMiles as well.