What is the value of miles and points by airline, hotel and credit card program? Miles used to be thought to be worth 2 cents. I think that conventional wisdom developed out of the idea that a cross country flight cost about $500… or 25,000 miles. 20 years ago that was generally true, and award availability wasn’t really a problem either.

That was long before:

- Airline alliances opened up huge possibilities for miles.

- Mileage programs increased the cost of many awards.

- Awards became tougher to get with flights full.

Plus the 2 cent number probably wasn’t ever true to begin with.

Many different folks have taken a stab at how much miles are worth. For this post I’m not going to give you a single number. I’m going to share my own rough and ready number for several different programs. And I’m going to explain how I think about the value of miles — why they are different for different people, and for different circumstances of how you plan to use them.

I haven’t published updated valuations in over a year so it seemed like a good time to look at this question.

The Value of Points are Not Actually Fixed

Here’s how to think about the value of miles and points by airline, hotel and credit card program.

It depends on how you redeem them. What value are you going to get for your points? The important thing here is not to use the retail price of a ticket you’re getting, since

- with premium cabin rewards you might not have been willing to spend that much cash.

- Frequent flyer tickets aren’t necessarily worth as much as a paid ticket. They don’t earn miles. They may not be upgradeable. And you can’t necessarily just pick whatever flight you want, you have to be flexible and worry about award availability.

It depends on when you’re going to redeem them. You don’t earn a rate of return on miles and points like you might with cash in a bank or investment account. And you need to discount to present value if you’re going to use the points later. Plus there’s substantial risk of devaluation with many points currencies.

It depends on how many you already have. The value of points at the margin is different than an overall average value. As you approach having enough points for an award, the marginal value of a few more points goes up substantially — since those extra points are what make the award possible. On the other hand, once you have more points than you’ll redeem in the near-term the value of additional points falls since you may not ever use them, or may not use them under current award charts.

We Can Make Some Overall Comparisons

The value of a mile is the amount at which you are indifferent to holding miles versus cash.

If a mile is ‘worth’ 2 cents you should be equally happy with a mile or two pennies, if you’re offered a mile at a price of 1.9 cents you would be a buyer — you’d consider yourself to be earning a 5% margin.

Put another way, when we put a charge on a credit card, that doesn’t earn any bonuses (it earns 1 mile per dollar spent), we’re effectively buying that mile for 2 cents since the opportunity cost is putting the charge on a 2% cash back card. You’re revealing a preference through your behavior that you believe the mile is worth two cents.

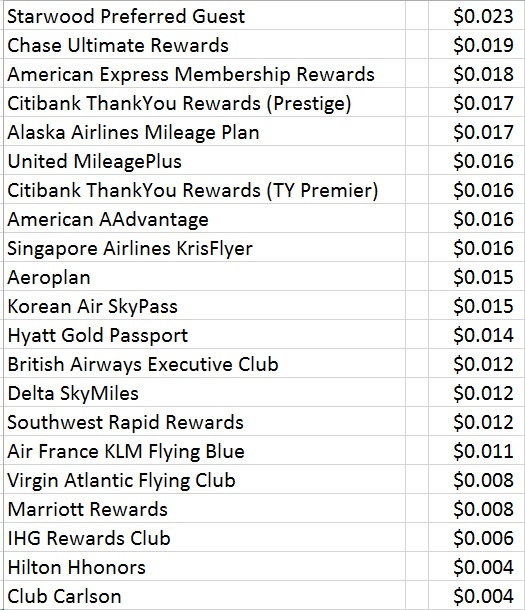

My Overall List of Values

Here’s my overall ranking and valuation of several common airline, hotel, and credit card points currencies.

Transferrable Points Currencies Top the List

The most valuable points, at the top of my currency list, are transferrable points. That means Starwood, American Express, and Chase points. You can transfer those into a variety of programs. Earning those gives you tremendous flexibility and optionality.

Starwood lets you transfer 20,000 points into 25,000 miles with the most number of airlines. That means their points are worth at least 25% more than the most valuable currency they transfer into. And they’re worth even more than that because of their option value, the ability to put points into the account you need them in when you need them — to top off an account at the margin (remember, miles at the margin that you need for an award are worth even more). In the past 6 months they’ve added excellent transfer partners in Korean Air (cheap transatlantic Skyteam awards, cheap Hawaii awards, and awesome first class award availability) and Aegean (cheap Star Alliance business class awards).

Meanwhile, Chase transfers to several valuable partners — and unlike Starwood in most cases the transfers happen instantly. I like that Chase transfers to United (no fuel surcharges) and duplicates Amex with British Airways and Singapore. They also have a more valuable transfer partner and ratio in Hyatt than Amex does. That’s why I value their points a bit more highly than American Express Membership Rewards.

Nonetheless, American Express has more transfer partners and many do transfer instantly. Meanwhile, Citibank’s transferrable points are more valuable if you have the Prestige card because you can also use those points to straight-up buy paid American Airlines tickets at 1.6 cents apiece.

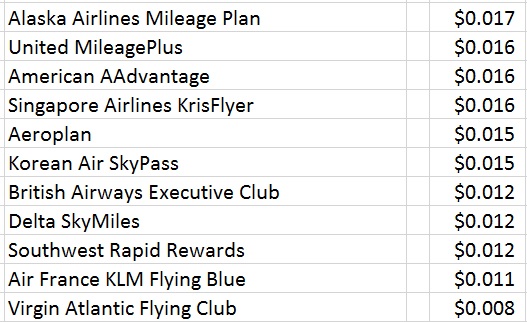

The Value of Miles and Points by Airline

Here are airline programs compared.

Alaska Airlines miles are often undervalued — they partner with many airlines in both the oneworld and Skyteam alliances, offer one-way awards (with a stopover), and show availability for most partners on their website. The biggest drawback is that you cannot combine different partners on a single one-way award. I love that they partner with Emirates, whose A380 first class awards have become quite easy to get on several U.S. routes.

United miles get you access to the Star Alliance, which means the best availability between the US and both Europe and Asia in business class. There are no fuel surcharges. But awards are quite expensive when traveling in premium cabins on partner airlines, impossibly so if you want international first class.

I’ve knocked down the value of American miles with the pending March 22 devaluation and with how tough it’s gotten to find award space on American’s own flights most of the time. It remains best for first class awards though — Cathay Pacific, Etihad, Qatar (limited routes), British Airways (fuel surcharges) as well as somewhat more difficult ‘get’ Qantas.

I value Aeroplan points a little bit below United miles. They’re both members of the Star Alliance, and for many awards their prices in miles are cheaper but they add fuel surcharges onto many of those partners. Here’s how to book Star Alliance awards without fuel surcharges.

Korean Air has a pretty good award chart, does add fuel surcharges to awards, but offers amazing first class award availability. They have great Hawaii awards (Alaska Airlines, Hawaiian) and great Europe awards (80,000 roundtrip in business class). The two challenges are that they’re a member of Skyteam, so their partners aren’t as good and don’t often offer as good award availability as some of their competitors, and also that you have to deal with the idiosyncrasies of Korean – rules like only redeeming your points for family members.

British Airways points are worth still less to me, and I’ve knocked them down in the past year due to a devaluation and the pending end of the 4500 point domestic US award.

Delta takes a bit of a drop with their persistent devaluations, their practice of journey control making it tough to piece together awards, and their lack of transparency with the removal of award charts.

The least value points currency among the major ones often discussed by US frequent flyers has to be Virgin Atlantic’s — fuel surcharges, cannot mix and match partners, partner awards that cannot be booked one-way, and challenging call center agents all rolled up into one. Here are the best uses for Virgin Atlantic’s miles.

Hotel Points Use a Totally Different Scale

Here are my values for hotel program points compared:

Hotel loyalty programs simply use a different ‘scale’ than airlines for the most part. A room with Hilton HHonors might well cost 90,000 points for a single night, and points in many programs can be transferred to airline miles at ratios like 2:1 or even 5:1.

On the other hand they give out points in pretty large denominations. I’ve often assumed that was to make you feel like you were getting a lot especially if you were used to airline miles. Earning 5000 airline miles for a roundtrip flight might make 20,000 points for your hotel stay feel quite rewarding.

The point here is that I am offering the value of a single point — that has nothing to do with how easy it is to earn the points, or an overall earn-burn relationship. It’s a different question entirely to ask which hotel program is the most rewarding for your spending in terms of free nights. They each award and redeem points at different rates, so I created a way to compare them.

Here’s we’re just looking at what 1 point is worth in each program. At the high end Hyatt points can be worth quite a bit, especially for category 5 and 6 properties during high season and even more so when cash and points awards are available. Still, the airline transfers aren’t as lucrative as Starwood’s and if you’re looking at an ability to trade in Hyatt points for a hotel stay where you’d otherwise use cash I find that most of the time you can do a bit better than 1.5 cents. I value the cash more than the points at the margin, though, so I’m not actually a buyer at 1.5 cents.. I downgrade them slightly plus I would choose Aeroplan or Korean points over Hyatt points 1:1.

Hilton points are worth a little less than a half cent apiece, the average redemption I find hovers somewhere just above that half cent mark. And IHG Rewards points are worth only a little bit less than what you can buy them for through the back door.

How to Use These Valuations

Since valuation here is the amount at which you are indifferent to holding miles versus cash this figure is useful for:

- Comparing when to spend miles or cash. Should I spend 50,000 miles for an award ticket or $700?

- Comparing when to spend on airline’s miles versus another for the same award. Should I spend 25,000 United miles or 35,000 Delta miles?

- Comparing the value of different credit card signup bonuses. Is an 80,000 point offer from Marriott better than a 75,000 point offer from Hilton? In fact, I view a 50,000 point offer from Chase Sapphire Preferred better than both (and that’s without the 5000 extra points for adding an authorized user to the account).

- Determining which hotel chain offers the better value reward when you’re considering staying at two different hotels. Should you spend 12,000 Starwood points or 35,000 Hilton points?

- Deciding whether to buy points when there’s a big bonus promotion.

- Figuring out how much extra you might be willing to spend to earn points through a bonus promotion, or figure out whether a hotel promotion should influence your decision about where to stay

But since these valuations aren’t precise I won’t actually pay 1.6 cents for an American mile. I want to accumulate American miles when they’re substantially less costly than 1.6 cents apiece. And I know I am clearly not a buyer at 2.5 cents.

In practice these are fairly blunt tools that tell me “1 cent a point for American miles is a really good deal” but that I’m not going to spend 2 cents unless there’s a very specific scenario — like a few points at the margin to top off an account for an award I’ve put on hold — where it makes sense (and in that scenario, my valuation of each point is higher since they’re helping me to save with a real redemption).

How Do You Value Your Miles?

What is your value of miles and points by airline, hotel and credit card program?

Let me know if you think I’m off base on any of my valuations!

I should start tracking my hotel redemptions. However, my value for Delta is at .018 as that is the minimum value I get when I redeem.

A great chart, Gary, and I agree with most of your relative valuations. The biggest problem with valuing airline miles these days is availability, though. With hotel points, you can pretty much compare the cost of a room to the number of points required to book it and come up with a plausible valuation. But how do you value airline miles when award seats are only available on, say, 5% of flights? Obviously, you discount that valuation, but by how much? That’s an impossible calculation. For example, somebody who’s willing to travel to France on any day in May if he can do it on miles will value those miles a lot more than somebody who needs seats to be available on several days in May in order to travel.

Hey Gary, just a quick question for you.

How are you arriving at 1.2 cents per rapid reward point for Southwest? I bring this up with just about every blogger–and it’s a hill I’m willing to die on. RR points are typically worth 1.5-1.7 cents in my experience, with redemption values of 2 cents being fairly common and easy to come by. Would you mind chiming in?

Gary,

In regards to redeeming 80K Korean Air SkyPass miles for business class US/Europe redemptions…….which airlines are these available on? Korean? Using Delta’s website and Expert Flyer…….I see availability on both for Delta Saver awards……but when calling Korean……they can’t see or haven’t received this availability.

Thanks

Gary, .08 for Marriott!!??!? did Marriott pay you to write that?!? try .04. you’ve dramatically overvalued Marriott. their chart is basically like a mix of IHG and Hilton. find me a Cat 2 SPG 3/4k and the *maybe* comparable Marriott with no 4pm checkout, breakfast etc (upgrades with Marriott- yeah, good luck), is 25,000 or more! or a Cat 3 SPG @ 7k- per your valuation, a comp Marriott is 21k points. ah, no. a less-than-comparable Marriott is 35k+. add in the lack of perks for status and i’d argue Hilton are worth more Marriott (find me a 10k point/night Marriott comparable to the Doubletree KUL). as Diamond i always get nice upgrades, breakfast, late (usually 4pm) checkout, etc. Seriously, please rethink this and amend your post.

What about Jet Blue?

To move to Alaska after AA devalues: Can you get a free stopover on one-way 12.5K award anywhere except SEA since I’m only seeing AK flights available to where I travel at the lowest level.

Finally a blogger that recognizes the thankyou points value difference between prestige/premier!

$0.012 for Delta SkyMiles is an overvaluation. Flying Blue miles are worth more than Delta SkyMiles and if they are valued at $0.011, which I believe is reasonable, Delta should be somewhere between $.008 and $.009, say $.0085.

In general I agree with your assessment, though I think your rating of SPG is too high. The fact that you can transfer 20k into 25k AA does not mean that they’re automatically worth at least 25% more, for the simple reason that my 10,000 Starwood points don’t become 12,500 American miles, and nor do my 30,000 Starwood become 37,5000 American miles. Further, I find 2.0 to be a more realistic valuation for hotel use as well.

Still, good analysis here through and through

This post should come with a HUGE caveat: The valuations are useless for comparing different programs without doing a “points currency conversion”, since a point is not a point or a mile is not a mile if different programs award different amounts of them for comparable transactions. That caveat is especially true for hotel loyalty points. You cannot, e.g., look at SPG and HHonors valuations and say that the startpoint is worth more. That’s because one earns ~6 times more HH points a pop than one earns starpoints. If you need to do a comparison across programs you must first compute something called “spend per free night/ticket” because that provides a more quantitative estimate of the cost of awards for each program, since it takes into account the earn and spend sides of the mile/point equation. It is, if you will, the “points currency conversion” I mentioned above…

G’day!

What is the difference between prestige typ and premier typ?

Nicely done. But you really ought to add WN and VX just for comparison sake (both would fall just below .015 I think).

Also the inescapable conclusion is that most people are better using a cash back card for everyday spend (Citi 2%, Fidelity 2%, JCB 3%) than any of the other credit cards you commonly tout. Plus unlike points there is no restriction on how you spend that cash back.

Southwest points are better than cash. First, you avoid the taxes except for $5.60. Second, you get full refundability on nonrefundable fare bucket pricing: Canceled points tickets go right back into your points bank and are not locked to one passenger as a cash purchase would be. That refundability feature is easily worth 10% to 20% when redeeming for an infrequent traveler.

SPG to Star/One/Sky alliances can make your SPG points worth 8c/point-ish.

@Larry Prestige can use points at 1.6 cents apiece to buy American Airlines tickets

@DCS the entire exercise is about the value of a single point, not about ease of earning those points, I make that very clear in the discussion. We know you love Hilton, and Hilton points for stays are easy to earn. Great. That’s fascinating. But irrelevant to THIS discussion.

@Gary — It seems that even you missed the point, which had nothing to do with the “ease” of earning points. The purpose was to blunt the usual tendency in which folks see these purported loyalty points currency valuations and they automatically begin comparing them mindlessly across loyalty programs, not realizing that without an appropriate points currency conversion such comparisons are as meaningful as comparing apples and oranges…

I used to accumulate all my points through American Express, mostly to transfer to Delta. With all the devaluations, I have switched completely to the travel rewards card from Bank of America. Because I also have investments with Merrill Lynch, I get a 75% bonus on a reward of 1.5 points on each purchase. This gives me a value of 2.25¢ per dollar to credit against any travel expenses charged to the card. Now that airline miles are devalued and the great international bargains are almost impossible to get, a consistent dollar value credit is my preferred way to go.

Miz using Delta miles I have scored great tickets at great values. the Delta stuff is pretty tired.

ATL-JNB 160K business class (How can American get me to South Africa? )

MIA-LHR Many times On Virgin 62.5 Upper class. No fuel surcharges

LAX-SYD Business Class 160 RT. Try booking on Quantas let me know how that goes

MIA-FCO 62.5 Business Class Booked this week

All low level.

I think most of these valuations are inflated, but that’s a matter of opinion. What’s not a matter of opinion is that, even by your own numbers, most of your readers, most of the time, are far better off just using a 2% card–not exactly something you mention when you constantly push cards. And that’s a fact.

I agree with DCS and robertw.

This exercise to assign a “value” to a mile or point is seriously flaw because the first and the “value” lies in how can you use it to exchange something back – ONLY when you can exchange something back, these phony currency would have any value.

The examples cited by robertw are something most bloggers completely ignore to mention, or rather, deliberately choose to ignore.

Furthermore, without looking at the EARNING SIDE of the equation is downright stupid. If it takes you to spend 5 times more in order to earn that highly valued SPG pts versus the most maligned HH pts for the comparable hotel room, then the SPG pt is worth less than the HH pt.

I also agree with James K. that most of the time my SPG redemption value is around 0.02. very very rarely it goes above that.

Finally for my usage Marriott pts worth the least, about 0.005 – until they have bought Protea chain and now the chain is fully integrated into the program. You will find exceptional value redeeming Protea properties in South Africa because they are largely Cat 1 to Cat 2 while retail rates are all over $100 and some close to $200 even with the Rand down to 16.5 to 1 USD. That is probably the only high value spot of the Marriott pts unfortunately.

Miles are worth however much you were willing to pay in cash/credit card for your ticket.

If you only are willing to pay economy saver promo prices, that fare is how much you should value your miles, no matter if you redeem a eco or business or first class ticket.

Also throwing out that Southwest is undervalued and SPG is overvalued. The ability to make speculative SW bookings at no penalty makes it better than cash. And for SPG, I find 2 CPP to be closer to average, since the transfer bonus isn’t practical for most considering how slow one acquires the points.

Very useful, thanks! Could you also throw out a ballpark figure for car rental programs’ points? Trying to decide if I want to earn in Hertz’ program or in airlines instead. Much appreciated!

@Tim actually you’ll find me mentioning quite often that unbonused spend belongs on:

1. Amex Everyday Preferred (used 30+ times a month for 1.5x Membership Rewards)

2. SPG Amex

3. 2% rebate card

That’s a regular theme of mine, not “not exactly something you mention when you constantly push cards.” And that’s a fact.

I agree with previous comments:

-The flexibility of Southwest points (fully refundable) and their value redeeming for Wanna Get Away fares (usually 1.6-1.7 cents/point or higher) makes them “better than cash” for both Southwest frequent and in-frequent travelers.

-I’ve reduced my valuation of SPG points from 2.2 cents to 2.0 cents because it’s much harder than it used to be to get “outsized redemption value” for hotel stays, and because of the uncertainties of the merger with Marriott.

Wow , I just can’t believe some of these commenters don’t agree with you Gary ( being facetious , of course ) . Good general guidelines though , THANKS

Gary. There’s no gettingbbc.co through to DCS no matter how many caveats or disclaimers you put on these types of analyses. It’s always about the earning ratio for him.

G’day. And by the way I love Hiltons.

I would reconsider Southwest valuation. Their award availability is great. Mid weak flights inexpensive. Cancellation fee zero. This is tremendous value.

Gary, consider segmenting your valuations for non-elite and elite members. Non-elites face high change and cancellation penalties on almost all airlines. Elites also get better award availability.

Both these factors are notably absent for Southwest Airlines. As a multi-program elite member, you may not have accounted for this important fact.

thank you for covering korean air.

how about ANA?

Gary – Can you give us the valuation on Qantas miles. Why are they not included in this post and all your others on this topic.

@bobbie thing is i am torn on qantas miles, long haul awards are crazy expensive especially in premium cabins and they add fuel surcharges to awards even when there’s no fuel surcharge on the ticket itself (like qantas international flights departing australia). but they can be useful for things like emirates new york – italy (90k + $500 one way) for instance in F. Probably somewhere in the 1 to 1.1 cent range. The Emirates partnership could push it a little higher and they’re good for US domestic awards. Could be as high as 1.3. Just haven’t firmed up my thinking on Qantas Frequent Flyer with the new award chart.

Southwest ROCKS! There’s no way it should be near the bottom of the valuation list… Major mistake Gary. I owe my Southwest membership to you, and it was a top-notch tip. In the last 3 years I financed multiple family vacations and business trips, and I still have a nice-sized bucket of Southwest miles remaining. We’ve enjoyed the free baggage, for sure! And almost always we’ve taken advantage of the no-change-fee to make last-minute schedule changes. And since we only fly Economy, we’re getting flights for ~6000 miles a flight. NO OTHER AIRLINE OFFERS THAT!

Although I still love SPG and it’s multi-airline transfers & bonus, there’s no denying that Southwest offers much higher value to the common folk.

It’s not even close. For people willing/wanting to fly coach & only wanting domestic, Southwest tops the chart. NO OTHER PROGRAM COMPARES.

Valuations – this topic always brings out the cynic in everyone who plays Game of Miles and Points!

Many already understand that anything ever written by any blogger are just guidelines and are supposed to figure out on their own to see what actually fits the bill!

A 3 night stay at Hilton costing about $200 a night would earn approximately, 200x3x10=6000 HH points, while if you registered for double points promo, (which is pretty much around the year) , one would earn 12000 HH points. This is considering one isnt using HH’s cobranded credit cards which if used with Citi or Amex’s cards (ones with AF), you would earn even more… 12x200x3= 7200 HH points.. all in all thats 19200 HH points.. ( If one actually uses the Amex Surpass e.g., you would earn a bonus 25% points as a Gold Elite member)

A similar 3 night stay with SPG property with similar $200 cost per night would approximately earn, 200x3x2= 1200 Star Points..! when used with SPG Amex card, you earn additional 1200 points! Now just for holding card, you wouldnt earn any elite status, so alas no bonus however even if you are gold, thats additional 600 points.

Just by simple calculations, a regular person would earn 19200 HH points vs. 2400 Star points for a 3 nights stay spending $800.. considering another stay like this, someone like me would earn 38400 (not even considering elite status bonus) HH points while 4800 star points…..

I say I got my free night right there for Hilton probably at a good property compared to SPG!

SPG only has better valuation due its transfer capabilities to other airlines and nothing more… Every Blogger should probably have atleast one post on the Earning and Burning rather than just redemption points and valuations based on that..

I’m not concerned about free nights in hotels because I usually travel to Europe and don’t stay in chain hotels. I also changed a few years ago from relying on Amex to using a Chase/BA Visa card. I won’t use lots of points for a free coach flight, but will use a smaller number to upgrade to Business Class (usually from Premium Coach). It doesn’t always work and sometimes seems to be based on whether or not there is a full moon, or if other plants are aligned, but when it does work, it is heaven.

I routinely book united awards for family members to Frankfurt in the summer for 60,000 miles when tickets cost $1,400 and up so my valuation for United miles is $0.022

I have to cancel an Alaska Airlines flight for which I paid 10,000 Alaska mileage points (5000 points each for me and my travel companion). To cancel, Alaska will charge me $250 to put the 10,000 points back in my account ($125 change fee per person). How do I figure out if it’s worth it to pay the $250 or if I should not pay the $250 and just walk away from the points?