Alaska Airlines CEO sent an email to Virgin America employees about what they can expect as Alaska acquires Virgin America. I reproduce the full email below.

Brad Tilden shares that frontline employees likely won’t see cutbacks, and that there’s more opportunities with growth. He commits to share information as they know it. And that’s the best they can do, while recognizing the anxiety that employees feel.

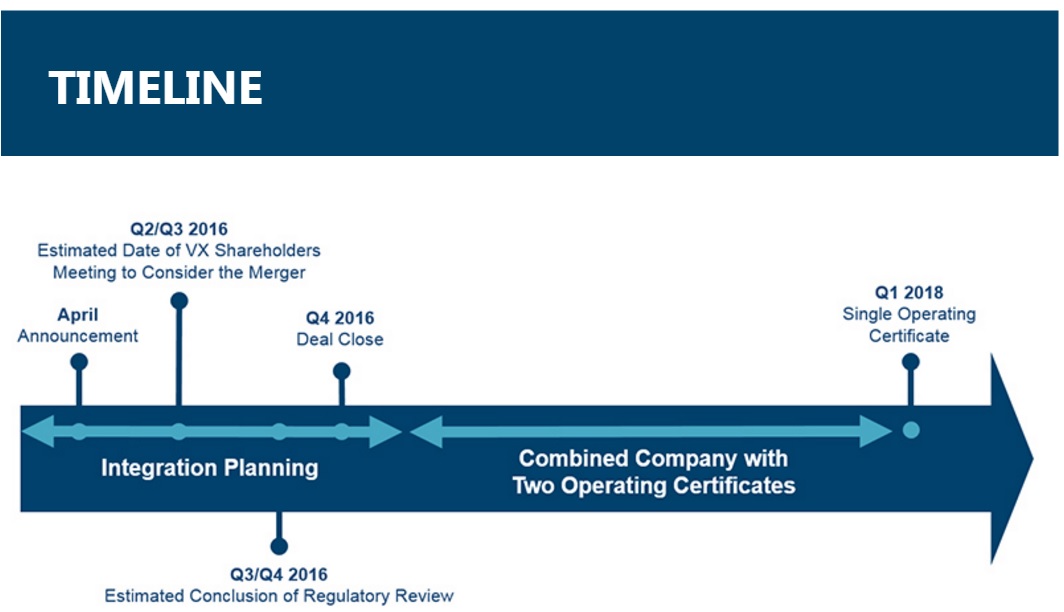

Here’s the merger timeline that was shared with employees, which is consistent with what’s been said to date:

Alaska’s CEO also spoke directly to employees in this video, where he’s speaking from the ramp wearing a reflective vest — presumably meant to look like an employee, ‘one of them’.

Here’s the email:

In early April, Alaska Air Group agreed to acquire Virgin America, bringing together two great airlines known for low fares and outstanding customer service.While the deal is still subject to regulatory approval, the combined carrier will be a bigger, stronger airline with an expanded presence across the West Coast and a bolstered platform to grow and compete nationally.

The deal is expected to close by Jan. 1, 2017, and the two airlines will operate separately until they obtain a single operating license, expected in 2018. Over that time, Alaska will be learning more about Virgin America, and this site is designed to provide information to Virgin America employees.

By now, I’m sure you’ve all heard the news that the boards of directors of Virgin America and Alaska Airlines have approved a combination of our companies. I’m very much looking forward to meeting as many of you as I can, and I know the rest of our leadership team feels the same way. We want to hear first-hand how you’re feeling, and I understand we will have that opportunity with many of you at an All Hands meeting in San Francisco.

I thought it might be helpful to share with you a bit about why we are so interested in the incredible company that you have built. In just nine short years, you’ve created an airline with an extremely strong position at both LAX and SFO, which are the #1 and #3 airports in the country. Not only do you serve the key destinations out of those airports, you do it in a way that we deeply respect. Put simply, you operate on time, you provide a fantastic customer experience, and you bring low fares to the marketplace. We know from experience that this is an unbeatable combination. The fact that you’ve done all this and built a strong following in such a short time is truly impressive.

We’ve had the chance to get to know David Cush and a few other members of your management team over the past several months. They’ve told us a lot about the Virgin America culture and your obsession with bringing a superior experience to the airline’s customers. We’re eager to learn more. We feel greatly privileged to have this once-in-a-lifetime opportunity to look at what Virgin America does well, look at what Alaska does well, and adopt the practices that will best serve the needs of all of the people who depend on us once the combination is complete.

I’m not going to try to tell you a lot about Alaska in this email. I’m sure you’re talking with friends and colleagues and have no doubt learned some things about Alaska Airlines during your time in the industry. I might just say that the reason we are here and remain independent is because we share many of your values — a fighting streak of independence, a focus on operating well, a deep commitment to our customers, and a belief that we are successful only by working together as a team.

I would like to share a couple of thoughts about the opportunities we see for the combined entity. While Alaska Airlines has many flights that serve California, our real strength for originating traffic is in Washington, Alaska, Oregon and, to a lesser degree, Hawaii. Those are the places from which we can take customers to the majority of places they need to go. On the other hand, you are very strong in California – a market which is three times the size of Alaska, Washington and Oregon combined. Today, Alaska Airlines serves only one of the top 10 destinations out of SFO (Seattle), while you fly to all ten. Together, we will have tremendous coverage of the West Coast and, in fact, have the #1 market share of anyone serving the West Coast.

Our vision for the future is not only to preserve the high level of customer service you have built, but to build upon this foundation of strength over time. Our goal is for our combined company to be the premier airline for people living anywhere on the West Coast. To do that, we’ll not only need to fly all over the U.S., but into neighboring countries as well. The moment this transaction closes, our combined network will have 114 destinations, more than 1,200 daily departures, 39 million customers and more than $7 billion in annual revenue. This combination instantly creates a stronger competitor, provides more stability for Teammates, and builds a robust foundation for further growth.

Many of you are wondering how your jobs might be affected. We don’t have all the answers, but let me tell you what we think. We do not expect any reductions for frontline employees (Pilots, InFlight Teammates, Guest Services Teammates and Maintenance Technicians). In fact, I expect we’ll see growth in these ranks. There likely will be overlap in some Headquarters and other management positions that will need to be addressed after the transaction closes, during the integration process. However, the bottom line is that many of the people who want to work at the combined airline should be able to find a role. We don’t know which yet, but it’s likely that some Headquarters jobs will move to Seattle after closing. While we don’t have all the details today, we are committed to communicating with you throughout this process when we have information to share.

I expect the months ahead will be both exciting and challenging. Our goal is to set a new industry standard for how integrations are done. The Alaska Airlines and Virgin America leadership teams are committed to a quick and successful transition once we have been approved to move forward, but we cannot let the integration distract us from our highest day-to-day priorities. Safety is our #1 responsibility, and I’ve asked Alaska Airlines employees to remain focused on running a safe operation as they serve our customers, and I am confident you will do the same.

We are all extremely excited about what the future holds. Both Virgin America and Alaska Airlines have bucked the industry by providing a better product and exceptional service. Together, we will be even stronger and will continue to do the great things we’ve done on a more national scale.

Alaska’s chief operating officer, Ben Minicucci, and I will be spending a lot of time visiting Virgin America employees in the coming weeks. I hope to get acquainted with you, learn how you’ve made Virgin America such a special airline, and get your thoughts on how we can ensure that our combined company will be a great place to work and a great airline to fly.

“By joining forces with Virgin America, we will triple the size of our origin markets and become the go-to airline for more than 175,000 daily flyers in California. We will also gain hard-to-come-by slots at Reagan-National in Washington, D.C., and the primary New York City-area Airports,” said CEO Brad Tilden. “Simply put, this deal puts Alaska Airlines squarely on the national map – something that would have taken years to accomplish on our own.”

We look forward to seeing many of you next Tuesday.

Brad

(HT: Marisa Garcia)

As I thought, this merger is primarily about getting bigger and positioning to become a national and minor international carrier. Alaska needed to increase its size and the fastest way to do that is a merger or acquisition. There are quite a few dissimilarities between Alaska and Virgin America, but Virgin America has planes, gates and people…just what the doctor ordered as far as Alaska is concerned.

The most important part of the email, I believe, is: “the combined carrier will be a bigger, stronger airline with an expanded presence on the West Coast and a bolstered platform to grow and expand nationally.”

That’s why it makes sense for Alaska to pay such a premium for Virgin America.

Alaska lands another blow to Delta.

Here in Seattle, Delta and Alaska have been ” frenemies” for years. Delta tv commercials geared to Seattle make a point that Delta considers Seattle a hub and strong community partner. “We are the airline for Seahawks and Sounders, your community airline.”

As this will allow Alaska to dominate the west coast, transcons would be the next move.

While I sorta like this merger I can’t help have flashbacks of CEO speeches I’ve heard at companies I’ve worked for in the past. Its always the same message “we bought the company for the employees, we love you all and your jobs more than profit”. I hate to sound negative but there will be blood letting at some point. I’m sure AA or ex-US Air folks in Phoenix worry about this, but that is a different situation.

I hope they have success.

Sounds like the typical corporate double speak when a company acquires another which in no way guarantees anything to the employees being “taken over”. AS needs the VX front line crew in the short term simply because AS does not have people trained to fly Airbus planes. Without the front line crew the company would collapse while AS tries to hire and train new people. Anybody in HQ wanting to stay in the Bay Area should be looking for now a new job now. If the acquisition is simply about a land grab at LAX/SFO then the rest of the employees might well look elsewhere too.

Always best in situations like this for an employee to look out for his/her interests first rather than listen to the babble and end up in a precarious position. There are countless examples within the US airline industry where an acquisition takes place and years later there is little to show for it and many people end up losing their jobs. It is not a merger of equals–it is simply one company taking the assets of the other and doing with them what it wants. The “synergies” come from eliminating jobs and CEOs are not going to tell the truth about that and risk a mass exodus before the acquiring company is ready to start cutting.