American Airlines and JetBlue are moving forward with their alliance which covers New York and Boston flying, and a frequent flyer program agreement. American, JetBlue and the DOT came to an agreement for DOT to close its review of the matter in exchange for a series of concessions.

Here are the concessions American and JetBlue had to make in order to move forward with their partnership.

- JetBlue agrees not to exit JFK non-stop (non-seasonal) routes it served as of February 2020, except for Long Beach, Oakland, and Worcester, Massachusetts.

- The two airlines aren’t allowed to discuss “future fares, fare levels, or revenue management strategies” and they separately can’t discuss route, scheduling or capacity outside the scope of the New York/Boston agreement. Lawyers are going to have to sit in on these discussions.

- Slot swaps between American and JetBlue have to last at least two years, they cannot be traded at whim. (This should largely be American making slots available to JetBlue in New York.)

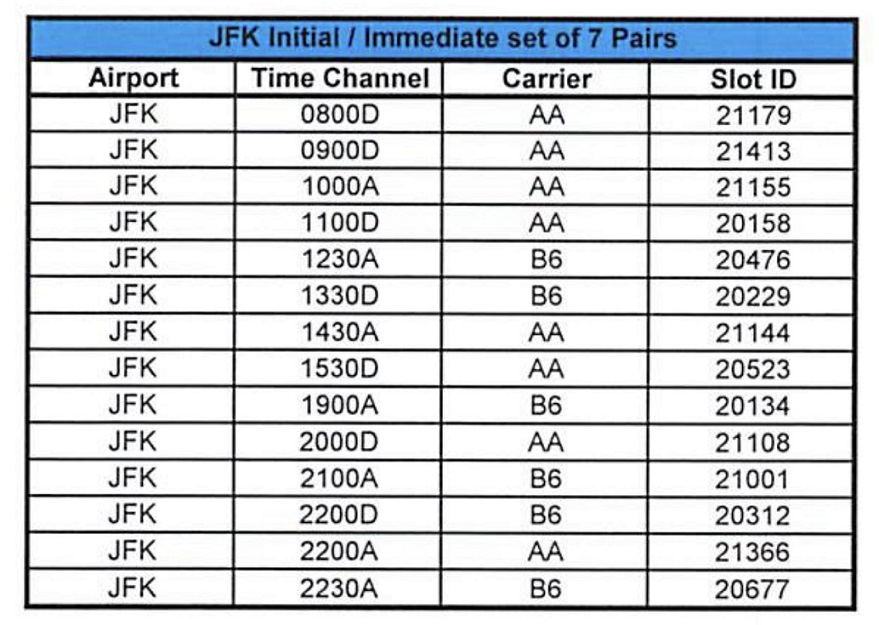

- American has to permanently give up 4 slot pairs at New York JFK and JetBlue permanently gives up 3.

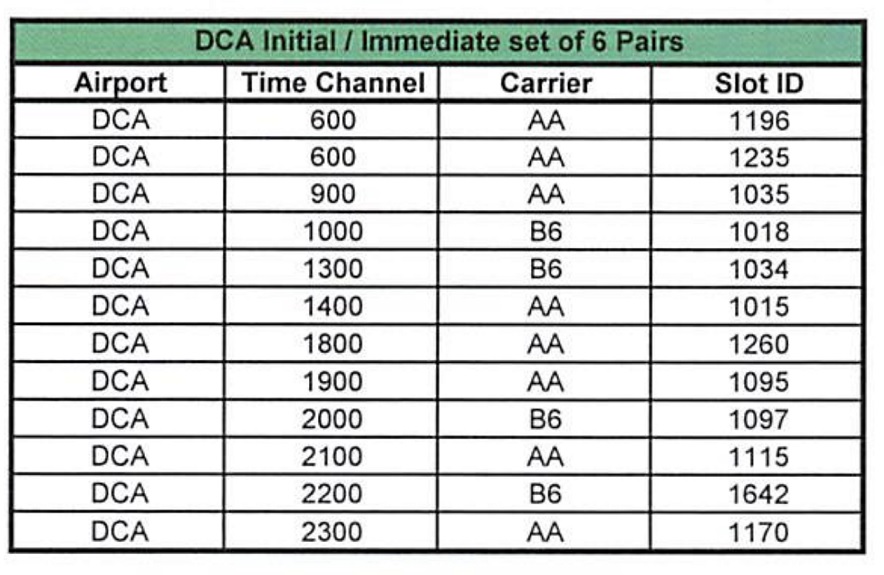

- American has to lease 4 slot pairs at Washington National airport and JetBlue has to lease 2, leases have to be available to other airlines for these slots for the duration of the American-JetBlue partnership.

- The slot divestitures have to be done as a package – 7 slot pairs at New York JFK and 6 at Washington National, and the two airlines have to offer terminal and gate space at commercial rates if the airline acquiring these slots cannot obtain any on their own.

- If American and JetBlue do not grow their seat capacity at New York JFK and New York LaGuardia combined by at least 5% they have to give up 10 more JFK slot pairs (American has already announced they’ll no longer fly small regional jets).

At National airport American had a total of 357 weekday slots. Giving up 8 of these represents just over 2% of their total – and they’re planning to upgauge small regional jets there as a new concourse opens to replace bus gate 35X anywy which will compensate. JetBlue has 60 slots, so giving up 4 is manageable when the airport hasn’t been nearly as central to their strategy, and they’ve even tried routes like this one from the airport:

Meanwhile JetBlue can give up slots at New York JFK because as long as this deal exists they’ll be getting these back in a lease from American. And American can give up slots because without this deal they didn’t really want the slots anyway and were largely just squatting on them, flying routes like JFK-Baltimore when they didn’t have use waivers such as due to airport runway construction.

While the slot divestitures are meaningful, they weren’t so painful as to derail the deal.

And so, enter United @JFK… those divestitures look like a reasonable SFO/LAX schedule.

@GKK – That’s what I was thinking too. Is there anything that prevents the slots from going to a legacy carrier? Normally these slots end up going to an LCC when divested.

Christmas came early for United if they can pick up some of those JFK slots.

AA gave up on JFK years ago. Lost cause and its days there are numbered.

UNITED rising at JFK

@Mark – the DOT will provide a list of “eligible” carriers but there is no indication in the Agreement that it intends only to to offer the slots to so-called independents (LCCs or others). United would be considered a “new entrant” in JFK and I suspect Delta would be ineligible given their slot holdings at JFK to begin with. After the COVID-19 slot waivers expire (or one year from now) the slots will go to auction and one airline will acquire them in a package. The separate package of DCA slots are a lease and there are some more conditions associated with that one.

Southwest, in its support of Spirit’s objection, advocated for slot divestitures only at LGA and DCA, which indicates to me they aren’t particularly interested in JFK operations. Spirit pointed to an essential duopoly at JFK, but only in the context of JFK+LGA taken together (DL/AA+B6), and also called for DCA divestitures. Accordingly, I would expect more robust competition for the DCA package. JFK just isn’t as attractive for LCCs, and, curiously, LGA wasn’t included in the agreement.

No Long Beach, no JetBlue. Bye Mosaic

Any idea when the codeshare routes will be announced?

This is much cheaper for United to get back into JFK than buying JB. Now that JB is tied up with American JB can offer International travel through JFK on American as JB becomes a narrowbody feeder carrier. Its in interesting way for American to bypass their pilot’s union SCOPE provisions. I can’t imagine why JB Pilots would want this since their dreams of getting larger planes and flying International routes just took a hit.