It’s a fools errand for airlines like American or United to offer a lowest common denominator product. When a business produces a commodity product, the lowest cost producer wins. Spirit is at a great advantage because American and United will always have higher costs.

Given their cost structure legacy airlines need to earn a revenue premium. Delta, for its part, is trying to differentiate their product and earns a revenue premium. This is because of a generally more reliable operation, moderately better product (for instance 9-across seating in coach rather than 10-across on Boeing 777s), and friendlier staff who seem to want to be at work. The only outlier seems to be SkyMiles which gives customers less value than competitors.

Historically customers have largely made decisions based on schedule and price. As a result investments in product haven’t mattered as much. Delta’s incremental investments, correlated with their revenue premium, seem to suggest that high yielding passengers do seem to have a preference beyond just schedule and price.

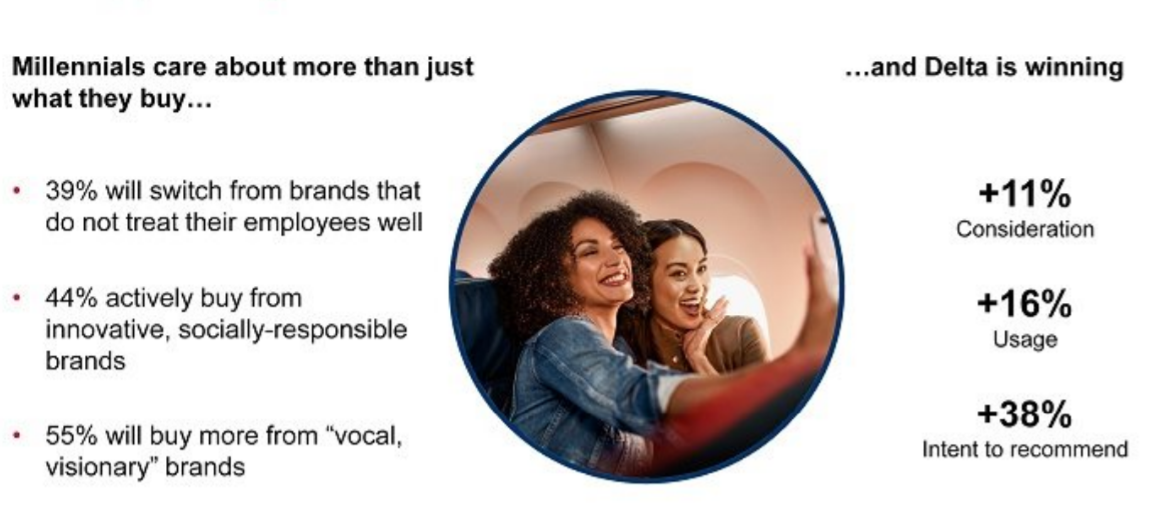

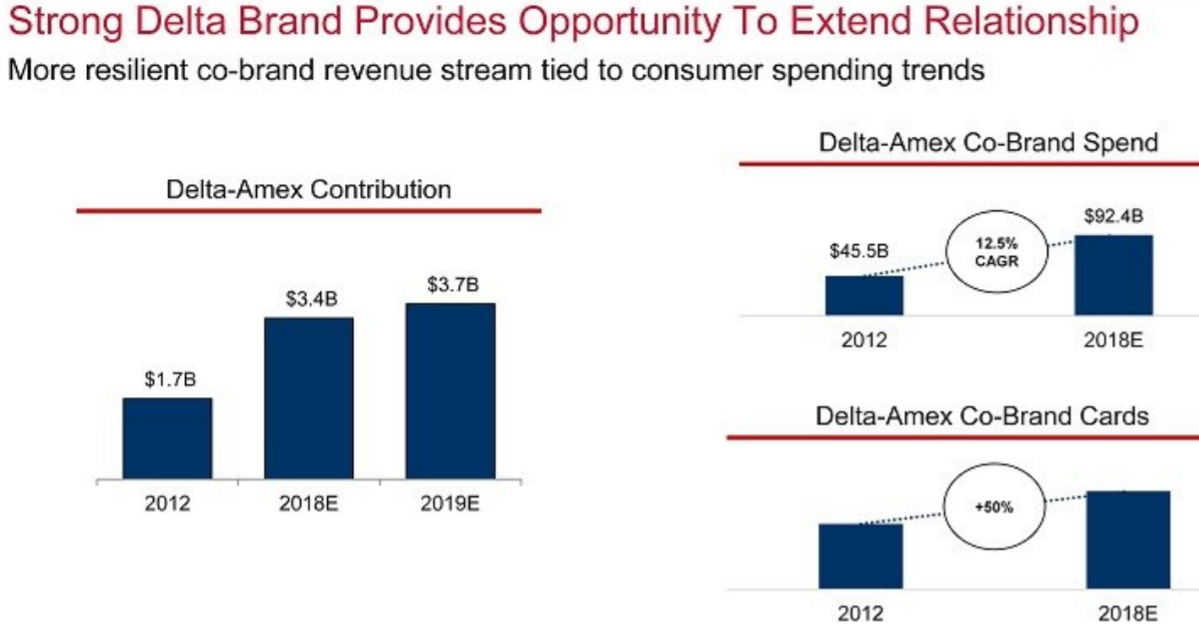

At Delta’s investor day they they believe brand is key to the revenue premium they’re attracting — and also key to growing their co-brand credit card.

Three slides from the airline’s investor day deck make this point clearly.

In the future the importance of inflight experience for passenger buying decisions is going to grow significant. Until now customers have been choosing airlines based on schedule and price because the information presented to them during the buying process has been… schedule and price.

However that’s beginning to change. Google is already presenting richer and more customized data. For instance, what’s the price of an airline ticket if you want to bring a carry on bag on board? That’s forced American Airlines to give up its carry on restriction for basic economy fares.

There’s rich data on a flight-by-flight basis available through RouteHappy. Is there food available on board? Not just internet, but high speed internet? Seat power?

The big question about the future of airline products is, as customers are presented with more than just schedule and price through better online tools what decisions will they make? Google may drag along online travel agencies like Expedia (and its subsidiaries) and Priceline/Booking.com.

Even without this data consumers figure out what they need and who has it. That’s been true for years. Frequent flyer programs were designed to take a commodity product and give customers a reason to have a preference and even shift their schedule a few hours in either direction to stay loyal to an airline.

Internet became a real differentiator — I avoid flying United Airlines largely because of unreliable internet compared to Delta and American, and then-US Airways President Scott Kirby (ironically now in the same role for United) explained the 2012 decision of the airline to add internet: they held off because they didn’t think they’d make money offering it, until they realized they were losing ticket sales by not having it.

Despite the experience with wifi Kirby still believes what matters is schedule and price, and airlines don’t make money with a better product which is why United squeezes more passengers into a Boeing 777 than Delta does.

Kirby believes in investing in a product that’s good enough not better than competitors and that simply flying more should earn his airline its ‘natural share’ of business and that airlines deserve higher prices regardless of product.

Already customers who matter to an airline’s bottom line, frequent customers and higher yielding business customers, make decisions on more than schedule and price. The vast majority of passengers don’t fall into either of those categories, and may not be familiar with the differences in airlines assumign they’re all the same. However when it becomes easier for them to see that every flight offered to them isn’t the same, the differences in flights will increasingly matter to their purchase decisions.

British Airways revealed at its investor day that 25% of the consumer buying decision is now based on brand and not schedule/price. Their brand has been decimated, so they see this insight as giving them upside.

Ultimately it’s not a profitable strategy to bet on making money on consumer ignorance. Lowest-cost carriers can earn a return purely on schedule and price. Higher-cost carriers will need to offer a better product to attract higher revenue.

your characterization of Scott Kirby is quite dated and honestly mostly wrong. Have you even met Kirby face to face and done a single interview at all? Have you even had a single interaction with Kirby in the last 2 years?

Have you seen him speak? Otherwise you are just recycling your “fake news” over and over again and it is not even funny.

@Gary – This is a total non sequitur, but I didn’t see a contact location on your blog. I was hoping for advice and some other people are doubtless in a similar circumstance, so I thought it might be worth asking. I have an Aeroplan award trip this fall returning home from Singapore to the US, but some of the flights are on Asiana. This worries me, given the financial situation they’re in. Award space in premium cabins for my (somewhat flexible) dates and cities are exceedingly limited on other carriers. I have additional miles and flexible points within reason, but don’t see anything viable. Normally, I’d fly back on Cathay, but with the mistake fare, there’s pretty much no seats left for awards. Any advice or suggestions would be welcome. Thanks.

My number one consideration is: will I fly to my destination and back without having to fight to board every single plane? That’s why I’m never setting foot on united ever again. Delta is much more professional on how they deal with cancellations and delays. Like you said, their employees look like they want to be there.

@Xing – Gary is spot on here. Why does it matter if he’s met Kirby face-to-face or seen him speak? That doesn’t have anything to do with the point of the article – that Kirby is wrong and that United is not on the right track for maximizing profits for its shareholders. People want to be treated as human beings on airplanes, and we’ve reached a tipping point in the industry where some airlines are starting to pay attention to that.

Xing, meet HenryLAX!

One doesn’t have to meet Kirby in person to see the negative ramifications of his time at UAL.

Of course, what the good is the price and schedule when UA and AA cancel the RJ flights out of ORD to my small market ever time it rains? At least I know DL will show up.

@christian – gary -at- viewfromthewing.com

@Xing – first yes I have met Scott Kirby and I have appeared on a panel with him. Second the characterization of his views all link to statements he has made within the past two years.

Branding is a key, at least for me. Prior to Parker, I used to fly AA even if it cost more and was EXP for 10+ years. Now I only fly AA if there is no other choice. Delta has been a pleasant surprise and consistently cheaper and just better than AA. So if AA wants to compete on price, so be it, they are almost NEVER the low cost airline so it’s Delta for me.

I flew United to a funeral this past weekend, as the price was so much lower than AA, my usual choice for quite a few years as a mid-tier. While one of the UA mainline flights was better tham the other due to the capricious circumstance of rough air with FA’s having to stay seated (peace and quiet) and a light passenger load, I came away feeling like the hard product has been designed to be actively miserable, with crowding of seats and even armrests that don’t pivot up (that was on a 737) in standard econ. When price is close, I would hesitate to choose to fly United again due simply to the discomfort of the onboard experience — and the knowledge that they wanted it to be that way to convince me to upgrade.

So, I just clicked on the United Airlines Investor Relations site. I pulled up most recent presentation entitled “J.P. Morgan Aviation, Transportation & Industrials Conference Scott Kirby, President March 5, 2019” Scott Kirby makes many public statements. Gary does not need to know him personally [although Gary above indicates above he has met] to comment about Kirby’s views. Its public knowledge.

I would love to fly Delta, especially on the CS100, er, I mean A220, with its 18.6 inch wide seats. But, I don’t want to fly through Hellanta every time. JetBlue, Southwest, and even American Airlines (gasp! I KNOW!!) offer me a non-stop on my most frequent route.

Eddie, put that new plane on my route and you’ll get my money!

I think you discount the influence of hubs and miles (the latter somewhat ironic). Most business travelers (the high rev ones) are not going to take a connection if they live in a major hub and can get a nonstop. Any discount is just not worth the aggravation. And UA – for all its faults – still has the best mileage program in part due to the ability of customers to secure desirable flights on its *A partners. Why would someone go out of their way to fly DL when the skypesos are essentially worth 50% less or worse unusable? Yes maybe the product is better but how much is that worth?

I expect in a decade the millennials will wise up and realize that all this nonsense about socially responsible brands etc. is just hot air. Companies care mostly about profits, a few care about employees and it’s a rare business that really cares about its customers.

Xing? Zing!

/\/\/\/\/\/\/\/\/\/\

After not flying United at all in 2017, I happened to fly UA in 2018 three times out of a total of 24 flights taken last year. I flew r/t SFO-DEN (because AS discontinued the former VX nonstops, and who wants to fly to Denver from SF via Seattle), and one-way SFO-BOS due to the timing of the flight. On both the SFO-BOS and the DEN-SFO flights, wifi failed to work.

In the FWIW mode, AA isn’t that much better. I flew AA five times in 2017 out of a total of 50 flights. Four of those were a roundtrip SFO-MSY with one stop in each direction; the fifth was a re-booking from AS when they cancelled a flight due to weather. None of these flights were anything to get excited about, nor did they rise to anything above “average” at best. Service would have been friendlier on jetBlue or Southwest, even Alaska; so, too, would seat comfort…

Maybe this is the year I try DL?

So if you invested in any airline where Scott Kirby has been President, you’d currently have about a 2000 percent return on your investment, which makes sense because Kirby is a genius at making airlines profitable. But you Gary Left are going to tell us how an airline should be managed and Kirby doesn’t know what he is doing? Incredible.

@chopsticks – have you followed AAL shares?

I was one of the few folks 14 months ago arguing that Wall Street was wrong to trash his plan to grow United…

As far as millenials, brands and Delta go…

Delta was my fave airliner, and the Mad Dog 88 is my favorite (first I flew), then they virtue signaled against the NRA, and so I’ll do my best to never fly them again.

I mostly fly United now, I think they are fine.

In my own case, as I have flown more, I have gotten more discerning about airlines, the aircraft on a route, which seat and so on. So maybe as Americans fly more, they’ve are becoming more educated consumers. While I am sensitive to price, it is not the only consideration. I’ve already pretty much quit all LCCs. UA’s approach to quality pretty much means I will not pay a premium to fly. But it does ensure that unless they are the cheapest J or are upgradeable on a route (which they often are – I am a 1K), I will probably be buying on another airline. Whether that maximizes their revenue, I suppose they know. I prefer the experience on BA (since the food improved), LH and AF.

Is @Christian worried that Asiana might cease operations this year? He sounds like the sort of person who is deathly afraid of jaywalking and/or driving above 55mph.

United has the best route network, frequent flyer program and alliance among the US3.