I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Southwest introduced their revenue-based frequent flyer program — Rapid Rewards 2.0 — in 2011. The gist was this:

- You earn points based on the cost of your ticket. However the number of points you earn per dollar is based on the type of fare. The more expensive fare types earn more points. And the higher the fare the more points you earn. So expensive ‘business select’ fares earn rapidly.

- You redeem points based on the cost of the ticket you want to buy with points. The number of points per dollar required depends on the type of fare. The more expensive fare types require more points. So inexpensive ‘wanna get away’ fares cost the fewest points.

This encouraged customers to earn on expensive business fares and redeem for cheap leisure fares.

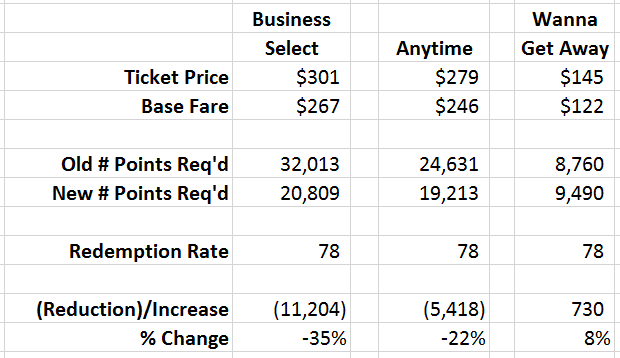

Southwest has changed their redemption values today in a way that upends this model somewhat. They’ve reduced the average number of points per dollar required for business select fares by 35% and anytime fares by 22%. And they’re increasing the average points per dollar required for wanna get away fares by 6%.

You take the base fare, excluding taxes, and then multiply by the number each Southwest point is ‘worth’ towards the fare type (the ‘redemption rate’). With this change Southwest appears to be roughly equalizing the redemption rates across fare types.

- Previously Business Select fares cost ~ 120 points per dollar. That should drop to ~ 78 points per dollar.

- Previously Anytime fares cost ~ 100 points per dollar. That should drop to ~ 78 points per dollar.

- Previously Wanna Get Away fares cost 72 to 74 points dollar. A 6% increase would suggest 76 to 78 points per dollar.

Here’s an illustration of how this changes the number of points required for an award, depending on the Southwest fare type. I looked up one way flights from Austin to Los Angeles, took down the flight prices and the number of points required. Then I compared to prices for paid tickets (the same) and rewards (new points prices) .

I talked with Jonathan Clarkson who runs the Rapid Rewards program and he acknowledged that the majority of redemptions today are in the Wanna Get Away fare types. Customers try to get the most value from their points, and gravitate to the flights where redemptions are the cheapest.

He sees this as “trying to maintain [their] core value proposition” by making the “pricing on business select and anytime more competitive.” And that it “makes more sense to price it this way, if you look at prior to this change the points per dollar required for business select or anytime multiplied times the base fare netted a pretty high price compared to a mileage fare at another carrier. So we felt we wanted to make sure the pricing for our premium fares was commensurate with how we treated them on the revenue side.”

Business Select and Anytime fares will still cost more points because the fares themselves are more expensive, but with this change Southwest no longer really penalizes redemptions for these fares.

On the other hand the price of Wanna Get Away fares go up a little. I can accept this increase when they’re making all of their other seats more affordable. Wanna Get Away fares have moved incrementally several times since the new program was launched in 2011, while expensive fare types move down in one huge swoop.

Already 13.8% of Southwest seats are occupied by customers redeeming their points.

It seems like the average redemption value of a Southwest point may go up, but the maximum redemption value will go down slightly.

I often buy tickets close to departure, where redeeming Southwest points has made no sense at all since I’ve gotten more value banking them for future Wanna Get Away redemptions rather than spending them for Anytime fares. Now it’ll make sense for me to use my points whenever I’m traveling for leisure, close-in or booked far in advance.

That said I don’t love to see the increase in points for the cheapest fares, or the increases we’ve seen over time. If you would only ever use points for Wanna Get Away fares this isn’t an improvement for you, even if the average value of a Rapid Rewards point may go up. This change amounts to a coalescing of value around a single point regardless of fare type which is a fascinating move for Southwest to make.

No way this is a win for consumers. 90%+ redeem at the WGA values, so this just made it worse.

Accuse me of drinking the Kool Aid, but I’m A List Preferred w/ CP, and I will still take this over any other airline’s reward program (except for maybe Alaska’s) because it’s still a great value. The flexibility is next to none, and that is important for my family.

@Elijah: No kool aid at all. CP is still the best FF benefit around, even if it means you have to fly on Southwest to use it.

yes buy paying with points is way better than Chase Sapphire on the cancellation side – points will go back into your account with no expiration where changing a purchased ticket with Chase points will result in an expiration of one year and difficulty tracking those funds as Southwest won’t track it for you in your account.

Until 2014, WGA redemptipns were at 60 points per dollar. Four years later, 78 per dollar means a 30% devaluation from that level. More proof that even revenue-based programs can’t hold their value.

I think this is a net ok change. Yes generally I book the Wanna Get Away fares but that’s because the others are so much higher. With a lower rate on non super discounted fares I might be more willing to book them versus looking for paid tickets and awards on other airlines – or just forgoing the trip.

Compared to repeated huge devaluations on the other big airlines this is minor.

While I see the corporate perspective, to me as a WGA consumer, this is a loss. I agree with Eljah, AS has the best program around, but WN is second. But any devaluation sucks, and this what that is.

It is a devaluation though. We are being nice to them because we like them, but they devalued.

Freddie voting closed March 31. Are April devaluations a coincidence?

I’m not seeing any change in WGA redemption pricing yet. If you have a trip in mind, book it now.

If it’s break even or close on Reserve points, then that’s the way to go and what I’ll be doing from now on. I do quite a bit of SW points flying, so I’ll be looking at this closely on the next booking.

SHITs just cost me the equivalent of 30,000 points with the 6% increase. Just like the last devaluation- no notice. Good busline but a crappy way to handle a devaluation.

Next they will devalue as the USD exchange rate declines- why not, it’s a good excuse.

As someone who always books with “Wanna Get Away” fares, I find this really bothersome. First, there was no notice given. Second, when they admit that ninety percent of their customers booking with points use these fares, it really is a devaluation. Third, it is bothersome that when the points have a fixed value, they are still being devalued. I thought that the benefit of fixed value points was that they in theory should not be valued.

I guess this is the big announcement they hinted at a few days ago???

Your analysis is one data point and not consistent at all with my travel patterns (2 flights per week for the past 11 years) with SW. My most common route is BUR/LAX to SFO/OAK, and I have consistently achieved 57 to 63 points per dollar of base fare for WGA fares ($0.0158 to $0.0175 per point). I see no change today after having booked several more flights. Still seeing 57 to 63 points per dollar. The variance is almost always due to relative demand due to day of the week and time of day, seasonality, and to some extent the specific routing. The variable nature of SW’s RR program means that a much broader analysis would need to be performed to provide valid conclusions. In sum, I seriously doubt that the “devaluation” even exists for WGA fares, which is one of the central conclusions of your article.

Here’s my experience

A non-stop flight from Den to Albany NY on July 14th was $234 or 15539 points last week.

Today the flight is $234 or 15948 points an increase approximating 2.6%.

+1 to Swag. 30% deval of a points program like theirs over 4 years is crazy.