I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Earlier this month Barclays launched new Emirates credit cards and came up with as compelling a value proposition as was theoretically possible with a loyalty program that partners with Chase, American Express, and Capital One transferrable currencies already. They distinguished the products by offering elite status bundled with the cards, both as a reason to get them and a reason to use them for spend.

Now Barclays has introduced a refreshed suite of Wyndham credit cards and they’ve done as good a job as possible considering the limitation that they’re working with Wyndham, a motley collection of brands and a loyalty program that last year doubled the redemption cost of its best hotels.

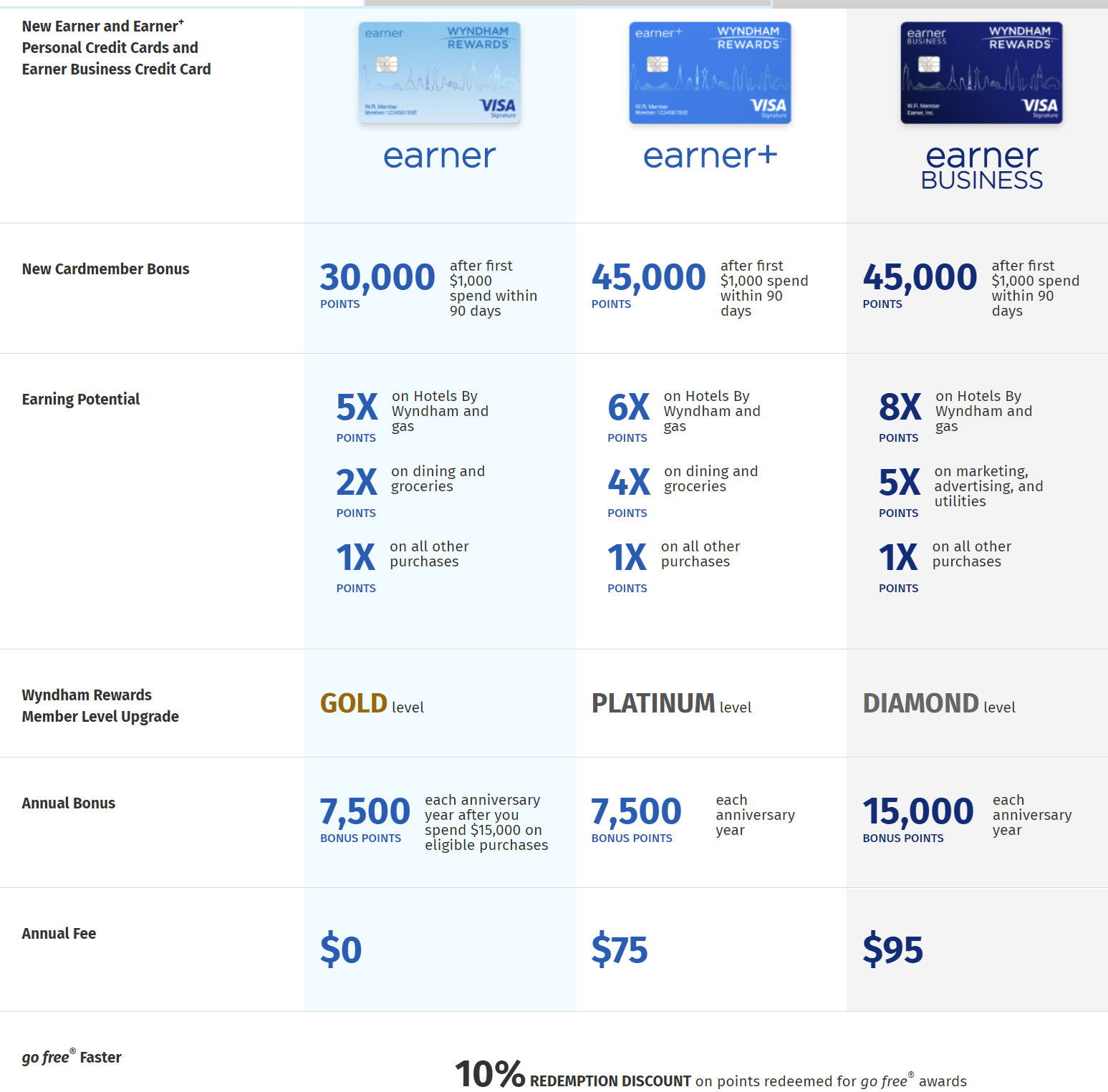

Mass Market Consumer Card

The ‘Earner Rewards’ product is their entry-level no annual fee card. In my view it doesn’t add a lot of value, and certainly doesn’t compared to the more premium products that seem worth their fees. While the card comes with Gold status that’s effectively Wyndham’s giveaway level, the primary benefit is late checkout.

- Initial bonus: 30,000 points after $1,000 in spend within 90 days

- Earning: 5x on Wyndham and gas; 2x on dining and groceries; 1x elsewhere

- Annual fee: $0

- Elite status: Gold

- Redemption discount: 10% off free night awards

- Anniversary bonus: 7500 points after $15,000 annual spend

Premium Consumer Card

Earner+ Rewards has a bigger bonus, no requirement for annual spending to earn 7500 points (worth more than half the card’s annual fee) and comes with better elite status. The primary value of Platinum is early check-in and the ability to match to Caesars Rewards.

- Initial bonus: 40,000 points after $1,000 in spend within 90 days

- Earning: 6x on Wyndham and gas; 4x on dining and groceries; 1x elsewhere

- Annual fee: $75

- Elite status: Platinum

- Redemption discount: 10% off free night awards

- Anniversary bonus: 7500 points

Before last year’s devaluation I consideed a Wyndham point to be worth $0.008. Now I’d say $0.006 makes more sense. Arguably 6.6/10ths of a cent makes more sense considering the 10% rebate on free night awards.

Business Card

The winner of the bunch is the ‘Earner Business’ card which comes with top tier Diamond status and with an annual bonus whose value covers the card’s annual fee. Keep this in your pocket for elite status at a net zero cost. Some will want to use the card for 8x earning on gas, which I value as a 4.8% rebate, or arguably 5.3% (factoring the discount on free night awards).

- Initial bonus: 45,000 points after $1,000 in spend within 90 days

- Earning: 8x on Wyndham and gas; 5x on marketing, advertising, utilities; 1x elsewhere

- Annual fee: $95

- Elite status: Diamond

- Redemption discount: 10% off free night awards

- Anniversary bonus: 15,000 points

Diamond elites are eligible for suite upgrades and can nominate a member to the Gold giveaway level. Matching to Caesars Rewards has value, too. Bear in mind that Wyndham will status match a ham sandwich to Diamond. If you’re considering one of the Wyndham cards, it’s the business product that makes the most sense.

Don’t get me wrong – I love Wyndham hotels and have enjoyed many nights on points at Wyndham Grands. But now that they have doubled the points required for award stays there, I think they need to offer 60k points so you can get 2 nights. Then it would be a good offer – a night and a half is a lot less compelling imo.

is the Earner + bonus 40K or 45K? you list both in the article.