I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

The Bilt Mastercard has no annual fee, lets you earn points paying rent on your card, and has bonus categories similar to a Sapphire Preferred Card as well (2x travel, 3x dining). If you rent an apartment or house you can be 100,000 points richer each year with this card, and points transfer to great airline and hotel partners.

There’s a waiting list to get the card, but they gave me a code to skip the waitlist to share on this site. I do not receive referral credit of any kind if you do.

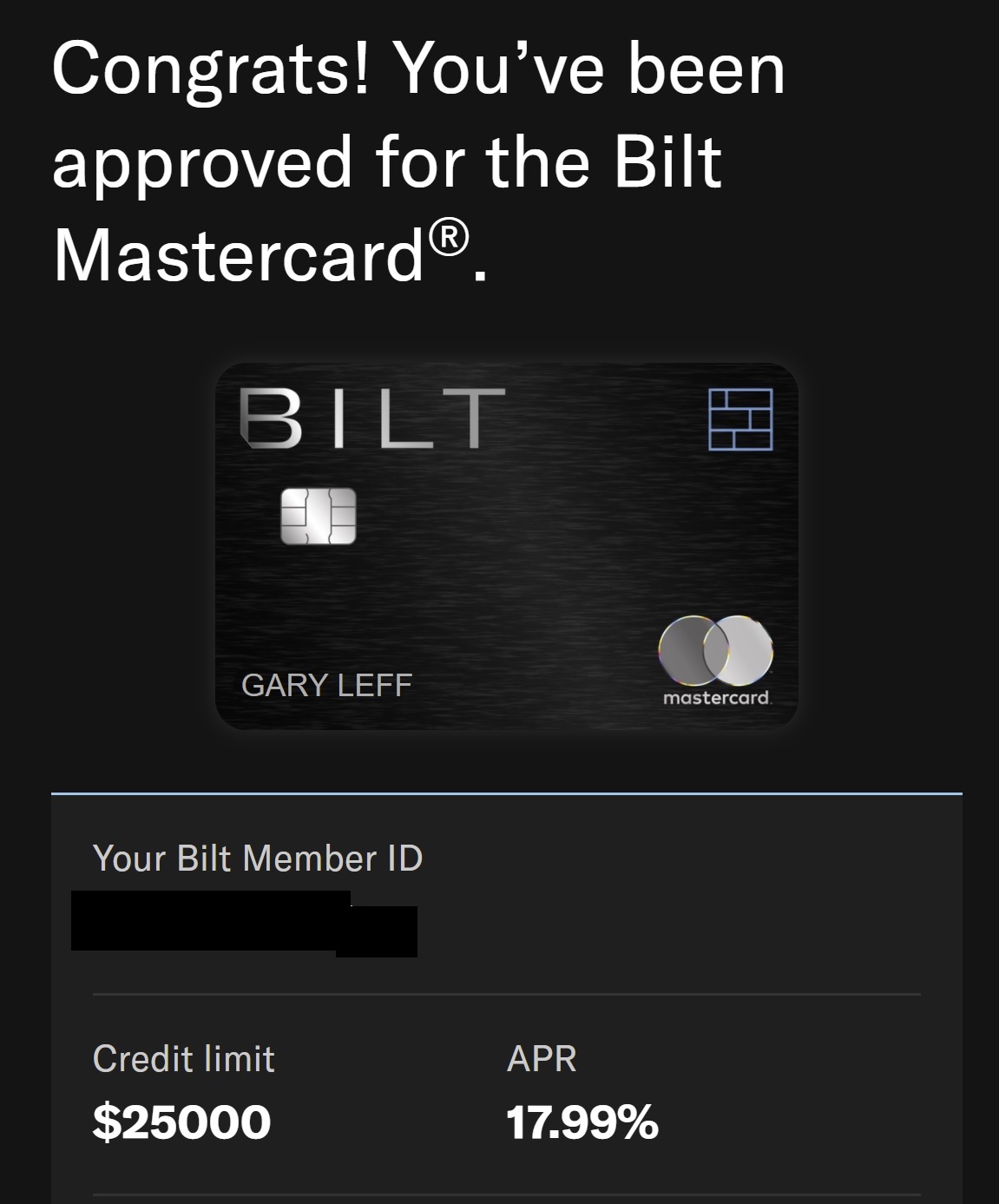

Now that I’m no longer under 5/24 (I’ve recently gotten Sapphire Preferred, a Southwest card and new Venture X) I decided to apply for the Bilt card and was approved instantly.

Earn Points On Your Rent

The card earns up to 100,000 points per year paying rent at no fee. Paying $100,000 in rent would cost you $2850 if you used Plastiq.com to charge your rewards credit card and send your landlord a check. Now you can charge up to $100,000 in rent each year and earn transferable points without paying any fee.

In order to earn points on your spend each month you must make at least 5 transactions on the card that month. That’s easy to meet, splitting up a single grocery or gas station trip into multiple purchases. But the idea is they want cardmembers using the card and not just doing a single ‘one and done’ rent transaction because that’s going to be a big money-loser.

I am a homeowner. I don’t rent. It’s still a good card without being able to take advantage of this unique benefit (and the Bilt Mastercard is unquestionably the best no annual fee rewards card as well). My reason for getting it was mostly to experience the Bilt program, to dive into the Bilt app (they have really good articles on redeeming points actually), so that I could speak about it more intelligently.

Transfer Partners

I value Bilt points at 1.7 cents apiece. Points in the Bilt program transfer to:

- Airlines: American AAdvantage, Air Canada Aeroplan, Emirates Skywards, Air France KLM Flying Blue, Turkish Miles & Smiles, Virgin Atlantic Flying Club, Hawaiian Airlines HawaiianMiles

- Hotels: Hyatt, IHG Rewards

This set of partners is at least as good as Chase’s transfer partners in my view.

Earn Interest On Your Points

Earn 25,000 points a year and you earn interest on your unredeemed balance in the program, which is fairly unique. At today’s low interest rates that doesn’t get you a lot of points, but it’s a built-in way to generate trust – your point balances grow rather than being devalued. Or at least that’s what I hope to see.

Initial Bonus

I’ve referred to Bilt not offering an up front card bonus, and others have made that mistake. It’s not actually true – you earn double points on non-bonused spend for your spend during your first 30 days as a cardmember. They make a digital card available right away so you can use your full 30 days for this.

How You Can Apply

There’s a waitlist to join the program, and it reportedly takes months to be invited in at the moment. However you can go to BiltRewards.com/waitlist, enter your email to joint the waitlist, and you’ll be asked if you have a fast track code. VFTW4BILT will take you right in. (I do not receive any referral credit for this, I simply pass this along as a service to you.)

You sign up for their waitlist, verify your email, and then you can enter the code to go straight to the application. I used the code myself and was approved instantly with a good credit limit.

If you pay rent, you’ll want to be a member of this program (timely rent payments can actually be reported to credit agencies, potentially improving your credit score too). And this gets you immediate access instead of having to wait months to be invited off their waitlist.

As long as you’re not working hard to avoid any card applications right now (about to get a mortgage, trying to stay under 5/24 for Chase cards) and you rent this card is a no-brainer. And it is strong for more than just rent. Plus they’ve invested in Mastercard protections including Premium Cell Phone Protection; Purchase Protection; concierge; Trip Cancellation; and Trip Delay.

Eventhough my APR is well over 20%, 17.99 is a bit high.

Do you know if the “rent” category also works for commercial rent payments? I own my home so I do not have a rent payment, but I do have a sizable monthly rental payment for my office. Thanks!

@michael It should work for any rent payments. I signed up for the card and was approved. I am a renter whose landlord does not work directly with Bilt and I just set it up in the app (which was a very easy process) and they send my landlord a check each month. I’m able to max out the 50K points with my monthly rent payment.

The whole process went very smoothly and I don’t really see that it would matter whether you were paying residential or commercial rent since pretty much any landlord is going to accept a check and I don’t know of any restrictions from Bilt’s side.

I would definitely recommend it for any renters who are not currently getting anything back on their rent or are paying for the privilege via Plastiq. Frankly, Bilt seems like a Plastiq killer to me, but I guess there is still a use case for non-rent payments via Plastiq if you need to hit a sign-up bonus and can’t manage the spend any other way.

@DNN If you’re carrying a credit card balance and paying interest, you’re losing the points game.

Is this just rent or any housing related spend?? Can you put a mortgage on it?

@Eric It’s for rent only. I guess there’s nothing physically stopping you from trying to pay your mortgage, but no guarantee that they would award points for it, and even if they did, they could rescind the, later if they catch it.

The big problem is that you cannot make the rent payment automatic – you have to manually initiate it every month.

@simon As of 10/26 that is no longer the case:

https://www.biltrewards.com/editorial/post/automatic-rent-payments

Gary your renting a 1br these days? The ol lady kick ya out? Or shameless plug…

@tom – uhh, did you read the post? no referral credit and i’m a homeowner

I wonder if an HOA payment would qualify as a rent payment.

@Omar Same answer as above… It’s for rent only. I guess there’s nothing physically stopping you from trying to pay your HOA fees, but no guarantee that they would award points for it, and even if they did, they could rescind them later if they catch it.

That said, if you are paying straight cash right now, nothing ventured, nothing gained I guess. 🙂

I have this card. It fills a niche.

Customer service is more than happy to answer all of your questions.

For tougher questions, such as commercial rent, the representative will pull in a supervisor.

Alternatively, just try it.

I understand that this is probably for hard core points collectors – but it also says you need to use it at least 5x per month? I am intrigued as an option for my rent, but struggling to figure out if it is worth it…….

@michael I haven’t seen anything that says you have to use it for five large transactions a month. So if you can use it on five small things that is probably a non-issue. I’m a bit skeptical about this card though. I feel like it sounds too good to be true and that the other shoe will drop eventually.

Gary, of course you were approved.

Bilt paid to send you to a private island so they could seek your advice, or something.

And you were very careful how you explained how that wasn’t a freebie. Something about paying *your share* of the value you received.

So maybe not referral credit here but that’s awfully specific. Any financial consideration — direct or indirect — as a result of this post?

What would have been newsworthy would if you had not been approved.

Thanks! Approved for $10K !

@Ex-UA Plat – I was approved instantly through the online application, not any special intervention. And no I have not received any financial compensation “direct or indirect” for this post.

Why is it newsworthy? Because it’s my blog and so I share a lot about my travels, the credit cards I sign up for and why etc. Wouldn’t it be weird if I *didn’t* write about the rewards cards I got and why?

I own a Co-Op in NYC could I use it to pay my monthly maintenance fees I wonder ?

Last I checked, my landlord (Prometheus) isn’t part of their alliance, and they’re not willing to take a check in the mail. I wish Bilt would make it easier to search their landlord partners

Simon and Jonathan, just a note . . .

Bilt’s rent auto-pay currently works with those properties in its network. For properties not in its network, it is still a manual thing. However, Bilt is working to add auto-pay for non-network properties . . . and it sounds as if it will be sooner rather than later.

For those who can use Bilt to pay rent — whether auto or manual — no-fee Bilt beats the snot out of using Plastiq.

Hope this clarifies the issue.

For everyone out in reader-land, there are some blogs that exclude coverage of issuers / cards if they do not have a referral relationship with those issuers / cards. We know who those are.

But, there are some who will cover issuers / cards in spite of no referral relationship. In the present case, Gary has covered Bilt. I have even seen one blog advise readers to not use its referral link on a particular card because a different offer that was publicly available was superior.

Gary’s job is his job. Don’t criticize him for it — just move on. And, don’t be conclusory in thinking that everything he recommends is going to earn him referral compensation.

And, if you don’t like his focus on hotel toiletries, don’t criticize him for it, just move on.

If one considers all of the valuable tips Gary provides in this blog, can one not tolerate some stuff?

If my landlord is out of the country how would this work? We are currently paying them with zelle through chase. They live in Australia and we live in NYC.

@Daphne If they can’t receive a check then it’s simply not going to work.

I applied and have excellent credit – score in the high 700s. But my application is in “pending” status. Should I call reconsideration? I’m at a loss since this has never happened to me before. I haven’t applied for any cards recently and don’t have any relationship with Wells Fargo.