Bask Bank® is one of the best ways to earn miles without actually spending money.

The Bask Mileage Savings Account awards 2.0 American Airlines AAdvantage®️ miles per dollar saved annually. It’s a savings account that awards miles instead of money. This is one of the highest returns possible, and there are attractive tax reasons to like this as well.

10,000 Mile New Customer Bonus

Right now, they have a new customer offer of 10,000 bonus miles for $75,000 in deposits held for 180 consecutive days. That’s in addition to the current 2.0 miles per dollar saved annually that you earn on those funds.

- After 180 consecutive days with that $75,000 deposit, you’ll have earned 85,000 miles (75,000 miles plus 10,000 bonus miles). That’s more than enough for one-way business class between the U.S. and Africa.

- Or leave the funds in the account for a year, and you’ll have 160,000 miles. That’s enough for a roundtrip business class award to the Mideast, Europe, Southeast Asia or Africa.

Here are key details of the new customer offer:

To qualify for this offer, you must be a first time Bask Mileage Savings Account customer, open a Bask Mileage Savings Account between September 1, 2025 and November 30, 2025, fund your Bask Mileage Savings Account within 15 business days following the initial account opening and maintain a minimum daily account balance of $75,000 for 180 consecutive days out of the first 210 days following the initial account opening.

Note: dates and amounts have been updated to reflect current offer.

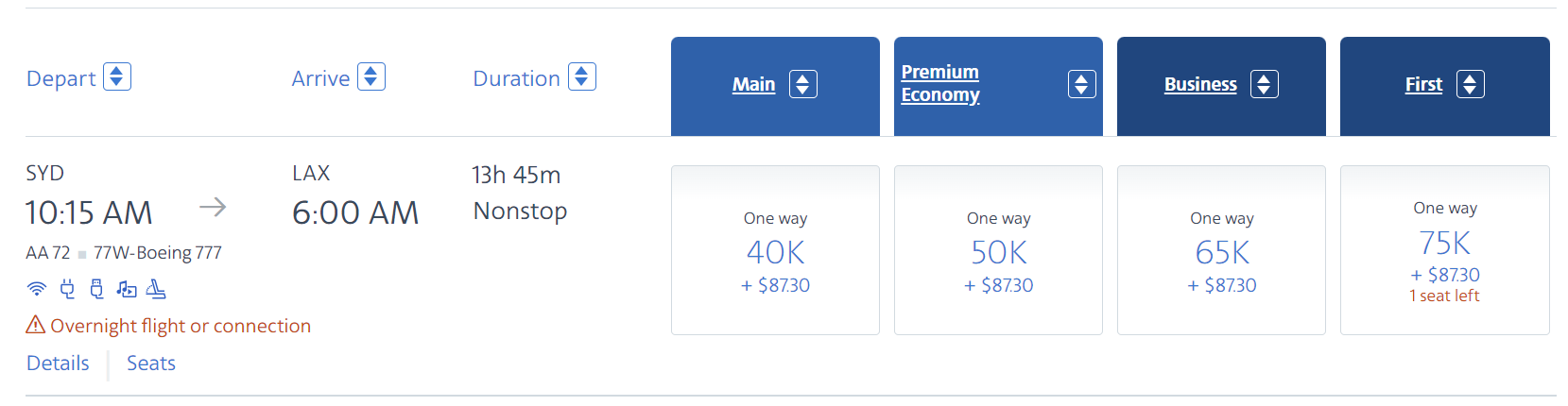

Consider that close to travel, the cost of American’s premium cabin Australia awards do sometimes drop in my searches.

American Airlines Flagship First Class

Qantas First Class Lounge, Sydney Accessible When Departing American Airlines First Class

Why This Can Beat Other Places To Park Cash

If you value American AAdvantage® miles at 1.5 cents apiece then earning 2.0 miles per dollar saved annually is a 3.0% return.

However, you need to adjust this for taxes. Bask Bank has reported the miles I’ve earned for tax purposes at a value of 0.42 cents apiece. Assuming that doesn’t change over the next year,

- Earning 85,000 miles (worth $1,275.00) saving $75,000 for 180 consecutive days would generate a 1099 tax reporting form showing a value of $357.

- If you pay taxes on those miles with a hypothetical combined federal and state income tax rate of 47%, you’re paying $167.79 in taxes. That means netting $1,107.21 in value after taxes.

- Compare that to a hypothetical 4.50% APY. I do not know of any savings account in the country currently paying 4.5%. That same $75,000 saved would yield $1,687.50, $793.12 in taxes, and a net of $894.38.

- You’re coming out significantly ahead with this offer over the six month promotion period!

That’s a lot of numbers to say that this is a really aggressive offer to open an account and hold a large deposit with Bask Bank.

American Airlines flight in Providenciales, Turks & Caicos

A Good Place For Even Small Deposits, Too

Even very small deposits are worthwhile with this account, since there are no minimum balances and earning even a single mile regularly can extend expiration of your miles.

Texas Capital Bank launched Bask Bank in 2020, offering online savings accounts that earn American Airlines AAdvantage® miles. I love that they’ve continued to improve the value proposition since then, increasing earning from the original 1 mile per dollar saved annually and currently award 2 miles per dollar saved annually. They clearly want this to be a very attractive value proposition.

I’ve been a customer of Texas Capital Bank since July 2003 when I first opened a checking account with them. I’ve been with them for over 20 years.

This is a great way to save money and a great way to earn miles. It’s free, quick and easy to sign up, and earning miles for your savings is a better deal than you’ll find from most savings accounts.

My primary way I’ve used my savings account is to put away money for my annual property taxes. That’s one of my biggest expenses each year. It’s something most people don’t earn miles for. Bask Bank helps me set aside the funds and earn miles for it at the same time. It’s an account I’ve kept for the past four years, and the current offer is a good time to open one.

Bask Bank is a division of Texas Capital Bank, Member FDIC.

Mile awards are subject to change at Bask Bank’s® sole discretion. Please see Terms and Disclosures for details.

The views and opinions expressed in this article are those of the author and do not necessarily reflect

the views and opinions of Texas Capital Bank or its affiliates and subsidiaries.

American Airlines reserves the right to change the AAdvantage® program and its terms and conditions at

any time with or without notice, and to end the AAdvantage® program with six months’ notice. Any such

changes may affect your ability to use AAdvantage® Rewards and Benefits that you have already

accumulated. American Airlines is not responsible for products or services offered by other participating companies. All third-party provider terms and conditions apply. For more information on miles and Loyalty Points, visit www.aa.com/loyaltypoints. For complete details about the AAdvantage® program, visit aa.com/aadvantage. For the AAdvantage® terms and conditions, visit AAdvantage terms and conditions − AAdvantage program − American Airlines.

American Airlines, AAdvantage®, the Flight Symbol logo and the Tail Design are marks of American

Airlines, Inc.

This is a deal that is easily beaten by dozens of places that do not meddle with miles. See Google for savings accounts returning > 4.5% p.a.

To take the “signup/180 day prison” bonus, the rate of interest is less than 0.6%. On a 6 month deposit that is very poor.

I sure would like to know the dates and flights you see business class award seats to Japan for 50,000 miles?????

While I always appreciate these deals, I always wonder who happens to have $50k lying around to toss at banks like this.

@jdh

Top law firm equity partners and their dependents.

You really want to travel the world in style? Redeem all your miles for LSAT prep. Enroll in law school. Make partner at a law firm. Profits per equity partner at the top firms are in excess of $8MM. The top partner at Paul, Weiss last year made $40MM.

To become equity partner is to realize how dumb and trifling all the miles, points, and first class seats on commercial airliners really are. Oh, you ate lobster thermidor on a Singapore A380? I had 100% grass-fed and grass-finished filet mignon reverse-seared onboard my Global Express, paired with my thousand dollar Hennessy and the company of a woman you could never date because she doesn’t date men who don’t make equity partner.

2 AA miles p.a. is a paltry 2.8%. Way below market.. Per quick Google search the first article is Nerdwallet:

“BEST OF

Best High-Yield Savings Accounts of November 2024: Up to 5.25%”

Basking is unproductive. Wrong shark.

5.25% = $2,625. Enough for a lot more fares than AA mileage

Was looking in your excellent write up of any mention that it used to be 2.5 miles per dollar and that customers were notified that it would be dropping to 2 miles per dollar effective November 1 by email on October 31 at 5:00 pm. I’ve had a mileage account with them for a decade as well. Pretty healthy reduction in points accrual with no notice. Not a very Texas friendly move.

I have been looking for that AA Autralia space. Found J last yr but no luck so far booking for 2025 at lower levels or similar.

Just be aware that Bask will devalue their mileage rate without notice, like they did yesterday. Notified of a 20% devaluation in earnings rate from 2.5 to 2.0 miles. I received their email last night; change effective this morning.

@ SFO/EWR – LOL so you are instead taking time from billing gazillion $/hr to read a blog with tips you will never use…ok

@Gary Was looking for the same thing as DSK.

@ SFO/EWR — So, basically what you are saying is if you are a law firm equity partner you afford the best hookers.. Gross.

@SFO/EWR, or Paul Weiss, or any of the other names you post under. So where did you go to law school? Please enlighten us. You seem to love to post the same nonsense on multiple blogs about stuff you know nothing about.

If you were an equity partner at a major NYC firm, you wouldn’t have time to post on points-and-miles blogs, or even read them. If you were an associate, you definitely wouldn’t have time because it would cut into your precious billable hours that you absolutely need to make partner. If you were smart, you’d know that the real money is in banking, not law. So, my guess is that you are none of the above.

Also, your idea of money equals good looking women equals happiness–wow. Just wow.

@SFO/EWR All that the others have said and yet you post here. To be ignorant is forgivable, to be arrogant is not.

Gary how about taking them to task for the big devaluation down to 2 miles per dollar from 2.5.

I moved money out in response.

Not proportional to the rate changes elsewhere. Short term fed funds rate went down less than 10% (500 vs 550 bps).

This is a 20% reduction in earning. You should be pounding the table about his devaluation.

” They clearly want this to be a very attractive value proposition.”

They can make that clearer by offering Loyalty Points in additional to miles. Or at minimum, give people the choice between earning LPs and miles.

I agree with JoeSchmo….give me LP’s and I would put a deposit in.

I see this as a vert Shady thing that’s being offered

@Greg – interest rates are headed down, so I always expected this rate to fall. And they don’t change mileage-earning in as granular a fashion as they do interest rates. Increases seemed disproportional too, to be honest. When the program launched Nearly 5 years ago I didn’t necessarily expect them to increase from 1 mile per dollar at all. The old checking product never increased from 1 mile per dollar in the nearly two decades I earned with it!

They have every ability to change mileage earning in a granular fashion. Stand up for your readers who signed up for these accounts, we deserve value for our deposits and will let our money do the talking when we don’t get it.

This seems like a mediocre deal. I often see accounts offering 5% on a 1 yr CD and I personally have high yield insured accounts at Morgan Stanley and Goldman that earn 5%+ with no hold requirements. And who wants the hassle of dealing with a 2nd (3rd?) tier bank?

DOC has a lot of bank bonus signup deals if you want to park your $$$. Or just charge a lot of groceries on your MileUp card if you need AA miles.

FYI they will debank you if you send money to Coinbase or Gemini. I know from experience.

First all the comments are from 2024 so repeat post

Anyway I’ve got north of 400,000 AA miles good for two trips tops 😉

I had 50K in both Mileage and interest accounts So I could see just how much those AA miles cost I have switched most into the interest account with $10K left in miles just for fun

Also added another $100K from almost 0% BofAm MM to Bask and President Bank. Both wi/ 4+%

@Bill n DC — A ‘repeat’… no way! Gary *never* does that… Bah!

While it is most certainly a repost, I do appreciate that he included the ‘47%’ hypothetical state and federal combined income tax rate. Feels like that in NYC with the local tax rate included (easily 30% effective.) *sigh* At least it feels like it goes towards something here.

4.5% APY was not unreasonable in 2024, and CDs were higher, +5.25%; while rates have decreased in 2025, with the potential for stagflation (tariffs included), we could see higher rates soon; or, if #47 fires J. Powell, then 0% rates! Eep…

@ Gary- Is there any update on the Yieldstreet offer from last December. I have not had any miles post to my AA account. Have others received the miles? Just wondering other people’s experiences with this.