Air Canada Aeroplan was supposed to launch the new version of its frequent flyer program today. That’s actually delayed a day, changeovers are hard. A year ago Air Canada’s reservation system cutover was a huge challenge for award tickets. And Aeroplan leadership has experience working with one of the worst cutovers of all time (United Airlines in 2012).

Hopefully everything works smoothly once everything is set now to become live on Monday, November 9. In the meantime the program is down for the transition. In the meantime here’s 7 things that are great in the new program, and 4 that aren’t.

As part of the launch of the new program Air Canada has just announced a new suite of credit cards. The airline re-acquired its program, after spinning it off 15 years ago, funding the deal by extending its relationship with its co-brand card issuers. Today we’ve learned about its new co-brand credit cards in Canada. Details on a U.S. program are still forthcoming. We also learn about a new airline redemption partnership.

Holding the cards make award pricing less expensive, and spending on the cards can help earn Aeroplan elite status.

Earning Buddy Passes

One of the key features to understand before diving into Air Canada’s new lineup of credit cards is their ‘Buddy Passes’ which can be earned with some of their cards as a signup bonus. These are coach companion tickets (buy one get one) with no blackout or inventory restrictions, valid on any Air Canada flight in North America.

Companion tickets have become common features of co-brand credit cards. You can earn (a significantly restricted) one on the American AAdvantage cards from Barclays. You receive them with the premium Delta cards – coach for Platinum, first class for Reserve. And they’ve been the key feature of Alaska Airlines credit card for time immemorial, largely without restriction and valid on any Alaska Airlines itinerary albeit no longer good for first class.

Air Canada now offers something akin to Alaska’s, where the companion’s fare is just taxes and fees, though Alaska’s just comes with their base card annually versus as a signup bonus.

Reducing The Price Of Air Canada Award Travel

For travel on Air Canada itself pricing will be dynamic. There’s a saver price, take Toronto – Los Angeles in economy at 12,500 miles (per the award chart) but pricing might go up to 17,500 miles. And the 40% premium (an extra 5000 miles to get to 17,500 miles) makes most inventory available for redemption.

Elite members and co-brand credit card customers will get better pricing – not just more access to saver awards, but more inventory all along the way. So even if a saver award isn’t available, they’re more likely to get a lower price than other members. An elite member with the credit card gets access to even more inventory still.

If you’re booking a partner award that includes an Air Canada segment, and the Air Canada flight you want isn’t available as a saver award, that won’t require pricing the whole itinerary more expensively. Instead booking a more expensive Air Canada segment increases the price of the award proportional to distance of that segment. And that Air Canada segment may increase the award price less if you have status, a co-brand card, or both.

American Express Cards

The new American Express Aeroplan Reserve Card brings heavy (13 gram) credit cards to the Canadian co-brand market, equivalent to a Chase Sapphire Reserve, but nothing as heavy as Citi Prestige, Amex Platinum, Capital and Venture or even the Delta Platinum card which weighs in at 15 grams.

It comes with an initial bonus of up to 65,000 Aeroplan points: 35,000 points and a $100 statement credit after $3000 spend within 3 months then 5000 points each of the first six months where you spend $1000 or more.

Earning is 3x on Air Canada purchases, 2x on dining and food delivery in Canada, and 1x on everything else. At this point I view ‘3-2-1’ as a lazy value proposition.

Card benefits include access to Air Canada Maple Leaf Lounges, Maple Leaf Cafes, and Priority Pass – for the cardholder and 1 guest; priority airport services; rollover elite qualifying miles + eupgrades; 1000 elite status miles and 1 flight segment per $5,000 spend; $99 companion ticket at $25,000 spend (use worldwide for a higher co-pay); upgrade priority (the first tie-breaker after elite status, above branded fare and fare class); CAD$599 annual fee.

Existing cardmembers aren’t eligible for a new card bonus, but are being rewarded for continued use of their cards:

- 1000 bonus points for every $1000 in purchases (up to 10,000 points)

- 2x the points on eligible grocery purchases in Canada, up to $5,000

- $100 annual fee credit

The small business American Express Aeroplan Business Reserve Card is also 13 grams (Sapphire Reserve weight) and offers up to 65,000 Aeroplan points and a $100 statement credit:

- 35,000 points and a $100 statement credit after $5000 spend in the first three months

- 5,000 points each of the first six months you spend $2,000 a month on the card

Earning is 3x on Air Canada; 2x on hotel and car rentals. And the card earns 1000 elite status miles and 1 flight segment per $5,000 spend; first checked bag free; access to better redemption inventory; Air Canada lounge access.

The base level American Express Aeroplan Card offers:

- 9000 bonus points and a Buddy Pass after $1500 spend

- 1000 points each of the first six months that you spend at least $500 on the card

Earning is 2x on Air Canada and 1.5x on dining and food delivery in Canada. The card earns 1000 elite status miles and 1 flight segment per $10,000 spend; first checked bag free; access to better redemption inventory; CAD$139 annual fee.

Aeroplan members who RSVP’d for Amex cards in advance are eligible for an additional 10,000 miles as well.

TD Aeroplan Cards

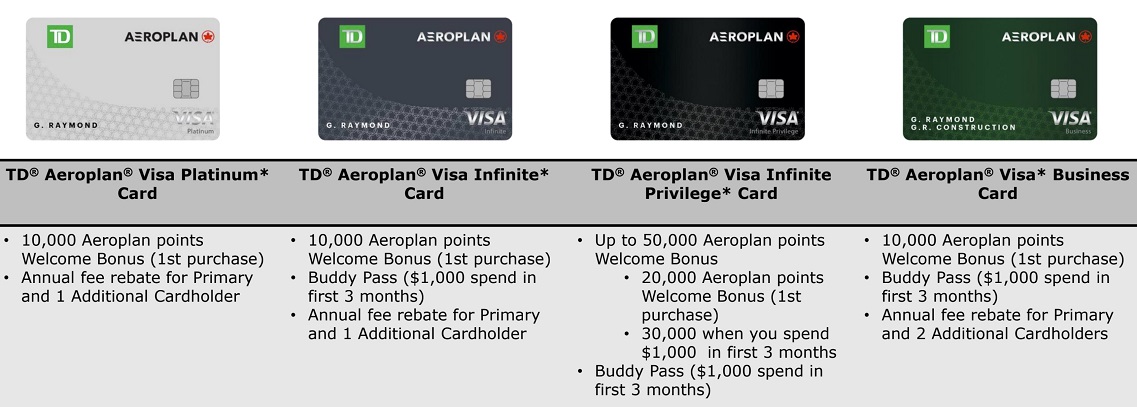

TD Bank has four Aeroplan cards on offer including their small business card. The ultra premium Visa Infinite has a nice 50,000 point offer. These are the TD-issued card offers through January 17, 2021:

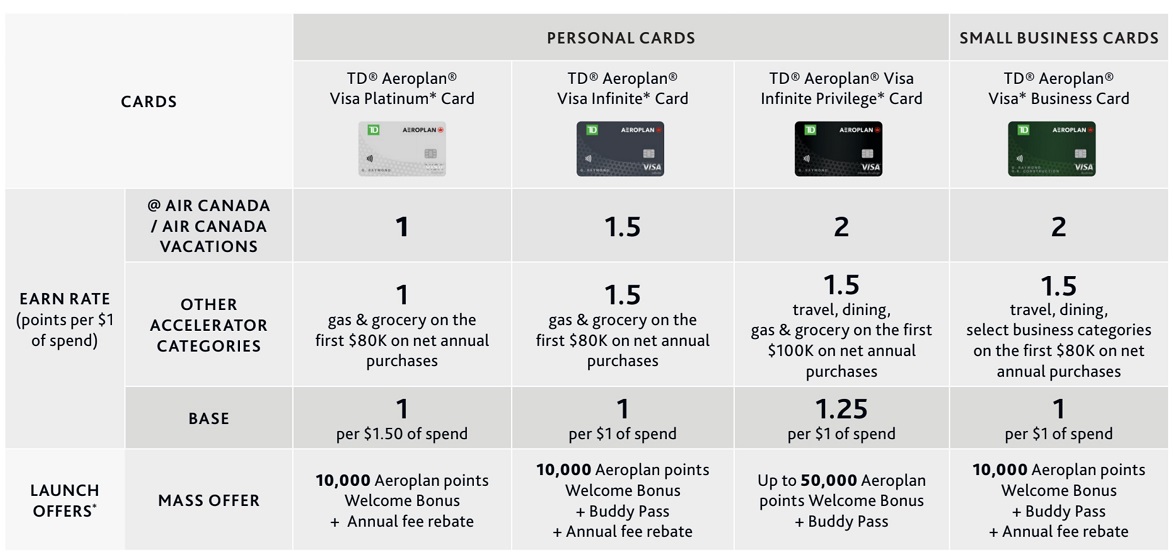

And here’s card earn:

Benefits though largely map with American Express and the other Visa issuer:

- Entry level card: isn’t focused on travel benefits

- Primary consumer card: comes with airport and baggage benefits and spend counting towards status.

- Premium card: offers lounge access and extra benefits for elites.

- Small business cards: travel benefits, spending towards status, and lounge passes

CIBC Aeroplan Cards

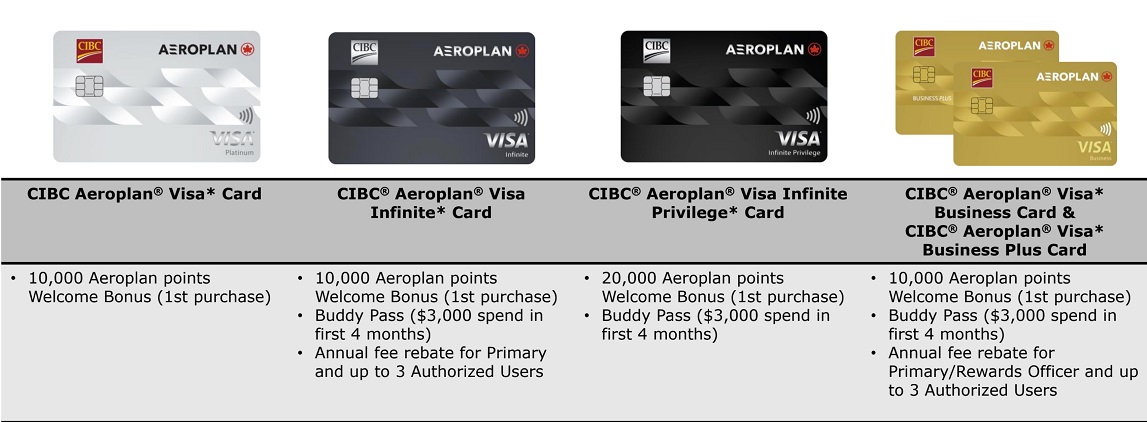

CIBC issued-Aeroplan cards add four to the dizzying array of Aeroplan co-brands. Here are the launch offers available through January 31, 2021.

Acquisition offers are going to be really important to capture consumer attention given the wide array of choices, and as a result I’m surprised to see them so modest here.

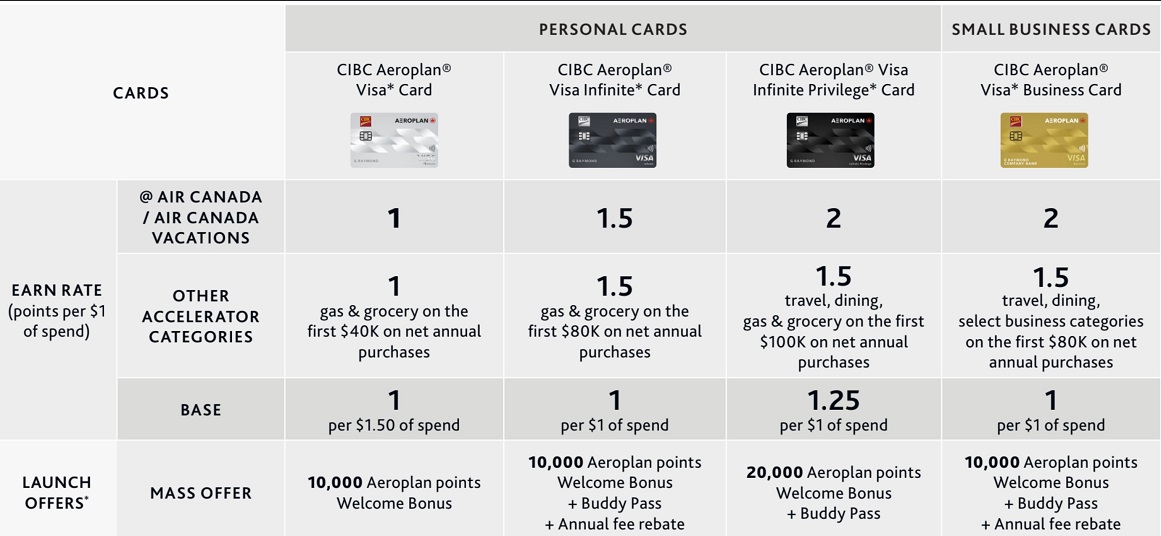

Here’s the earning structure, as with TD a little less generous than comparable Amex cards:

Benefits though largely map with American Express and TD bank:

- Entry level card: isn’t focused on travel benefits

- Primary consumer card: comes with airport and baggage benefits and spend counting towards status.

- Premium card: offers lounge access and extra benefits for elites.

- Small business cards: travel benefits, spending towards status, and lounge passes

New Air Serbia Partnership

Aeroplan recently added several partners, including Etihad, and Etihad-controlled Air Serbia becomes a partner on Monday as well. It’ll be a redemption partner only, not an earning partner, so you will be able to include Air Serbia flights in award tickets but not earn Aeroplan miles for paid travel on Air Serbia.

This new partner can be combined with other partners, including in Star Alliance, to create a single award and will be priced the same as other partners. As with other awards in the new Aeroplan there’s no fuel surcharges but you do pay a CAD$39 partner redemption fee when including partner(s) on an award ticket.

The partnership page will be here by Monday.

Air Serbia Airbus A330

Air Canada Credit Cards Overall

Air Canada and its co-brand card partners are offering good elite status earning and benefits for the airline’s frequent flyers. Overall the cards are improved.

They’ve come up with an interesting model for earning of initial bonuses – requiring not just a single spending target, but consistent spend over several months. It’ll be interesting to see if that causes consumer adoption of the cards on an ongoing basis the way minimum spend requirements were originally designed to.

Earning on the cards is generally weak by the best American standards with uninspiring 3-2-1 earn at best – although:

- It’s reasonable by U.S. airline standards, cards tend to offer less rich rewards when banks are paying the airline partner and not just rebating consumers.

- You’re earning miles based on Canadian dollar spend and as long as the Canadian dollar remains weak that will make up for it.

We don’t know what the U.S. card will look like, but I’m grateful to be able to earn 5x and 4x bonus categories regularly on much of my spend, and transfer from my American Express Membership Rewards account to Aeroplan as-needed.

The new program’s redemptions of course no longer incur fuel surcharges which is huge for bookings that would have required it (like Air Canada itself, and Lufthansa) but the offsetting increases in points prices makes redemptions on airlines that didn’t used to have fuel surcharges (like United, Turkish, and EVA Air) much more expensive.

Can you speak to how US citizens can get Canadian cards?

Who is their US bank partner?

Doesn’t Matter. They jacked up business class to europe from 55K to 70K. Aero-Plan and Air Canada are Dead as far as I’m concerned.

Garbage airline.

Will just steal your money.

On the last big journey of my lifetime, after a vaccine and pandemic calmdown, I hope to use my points on Swiss (and others) First Class. But I fear that reservations on short notice will be difficult and that availability will be months after the initial call and then, one will receive an itinerary full of useless and nerve-racking connections, which will highly increase the risk of loss, delay and damage to luggage. I am sixty and can no longer withstand that much stress!!!

Dizzying array of options, indeed. And at the same time, none of the products stand out in any way. But then again, such is the Canadian credit card market in general.

Thank you for the thorough review.

I think this is great, and I would love to get a TD card. I already have some flights picked out from the new chart. Now who is their American partner going to be, Chase or Citi?