American Airlines shares extensive information about their frequent flyer program in their SEC filings. So their 10-K always makes for an interesting read — especially when comparing data that can be found in prior year filings.

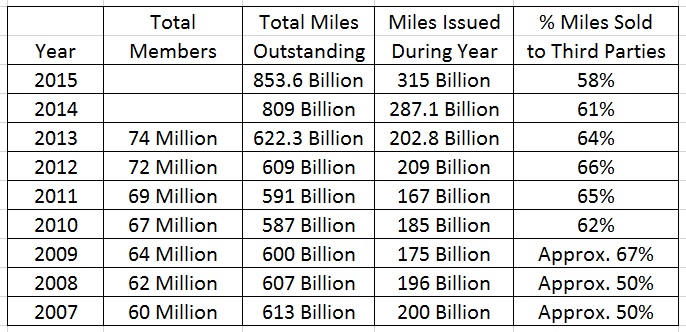

For instance, let’s take a look at the following chart that I’ve compiled.

American used to report the number of members in the program. They no longer do. Order of magnitude they have about 100 million members now that US Airways Dividend Miles has been folded into AAdvantage.

The big jump in miles issued between 2013 and 2014 is accounted for by reporting data for both programs in 2014.

2015 had another jump in miles issued, and at the same time a decrease in the percentage of miles sold to partners. Doing the math, the number of miles sold to partners stayed about the same (actually increased by about 1.6 billion or one-third of one percent).

The increase, then, came from miles printed by the program for travel on American. This gives us a window into the increased miles stemming from American’s premium cabin bonus.

American reports 8.3 million one-way awards redeemed, and that 6.5% of American’s seats were occupied by award passengers.

They also believe that there’s only minimal “displacement of revenue passengers” by award passengers because of their revenue management. Remember, up through the end of 2015 American was uniquely stingy releasing award seats on its own flights.

Partner redemptions, though, are expensive for the carrier. They report that “a one percentage point increase or decrease in the percentage of travel awards redeemed on partner airlines would have an approximate $35 million impact on the liability as of December 31, 2015.”

American has booked liability for outstanding mileage at $657 million as of December 31, 2015. There’s also $1.5 billion in deferred revenue from the sale of miles to third parties.

American Airlines Airbus A319

The 10-K spells out American’s accounting. They use ‘incremental cost’ to determine how much liability to book. American explains this is:

based on the estimated incremental cost of carrying one additional passenger. Incremental cost primarily includes unit costs incurred for fuel, food, and insurance as well as fees incurred when travel awards are redeemed on partner airlines. No profit or overhead margin is included in the accrual of incremental cost. These estimates are generally updated based upon our 12-month historical average of such costs.

Liability for outstanding US Airways Dividend Miles balances, though, were brought on using “the acquisition method of accounting…and therefore recorded the liability for outstanding US Airways’ mileage credits at fair value, an amount significantly in excess of incremental cost.”

That represents $296 million of the $657 million total liability, or 45%, even though it was less than a quarter of the total outstanding miles.

When the airline sells miles to partners they split up the revenue between future transportation (liability) and marketing (current revenue for service). They changed their accounting methodology for booking these transactions since the 2013 Citibank co-brand deal was a material modification to a major agreement subsequent to the 2011 adoption of new accounting standards for “Multiple-Deliverable Revenue Arrangements.” They US Airways acquisition, similarly, represented a material change to similar Dividend Miles agreements.

They now use a “relative selling price method” to determine the values of each component of the sale.

Revenue from their co-brand credit card agreement gets split up as:

- award travel

- licensing the American Airlines brand to the banks (including use of AAdvantage member lists)

- advertising

- lounge access for premium Citi cards

- free checked bags

The adoption of this new method reduced the award travel liability they booked for each mile sold.

American books very little cost per mile for miles sold. As a result they have huge incentives to keep redemption costs down.

I believe this ‘relative price selling method’ causes them to attribute too little of the revenue they’re gaining to future transportation which is the core of what customers are ultimately buying through their transactions. Brand licensing value only exists because customers believe they’re going to get future travel from American out of the deal. American is getting paid to advertise.. that there will be free flights for spending on their co-brand credit cards.

Instead they tell themselves they have very little money to spend on redemptions, since most of what they’re receiving from Citibank and Barclaycard is being given to them for things other than future award travel. That’s an analytic error that risks undermining the value proposition of the miles.

Am I mathing correctly – $657 million in liability for 853 billion outstanding miles is about 7 hundreths of a percent. That number seems insanely low no matter how little ‘revenue displacement’ there is, and I’m guessing it is why they (and other airlines) make non-air redemptions worth so little.

As an example, it assumes a 25,000 mile roundtrip in the US costs them about $8.75 each way. There’s no way it is that little when assuming even the basic fuel cost of carrying another 200 lbs., let alone any other marginal costs with carrying these travelers (6.5% increase means more staffing in hubs, phone call costs, etc.). This still excludes the other costs of elite travelers, such as free checked baggage.

Gah – first line should end in cent, not percent. I may be mathing correctly but apparently I’m not using my words properly.

@Benjamin not quite, there’s a bit of apples and oranges there, that liability refers to a subset of the miles not all the miles

“American books very little cost per mile for miles sold. As a result they have huge incentives to keep redemption costs down.”

Do we know the average cost per mile sold?

They expect a large portion of the miles will expire unredeemed.

There’s something off in the numbers.

You can impute miles redeemed in 2015 by doing:

Miles Outstanding 12/31/2014 (809 billion) + Miles issued in 2015 (315 billion) – Miles Outstanding 12/31/2015 (853.6 billion) which is 270.4 billion.

They say that a 100 bps change in partner redemptions would cost/save $35 MM per year. Let’s assume that 5% of all miles are redeemed on partners = 13.52 billion in 2015.

5% of that is 135.2 million.

100 bps of that is 1.352 million.

So partner redemptions cost them 25.88 cents/mile? No way. Let’s say for a moment that a partner award in 2015 (before costs went up) to Europe was 50,000 miles in J and 20,000 (off peak) in Y. My gut says they aren’t paying more than $200 for one way in Y and $500 for one way in J.

To get this to sync up, we’d have to then reduce that 25.88 cents/mile to 1.00 cents/mile. That would mean that partner awards only account for 1/25.88*0.05 = 0.19% of all miles redeemed.

If that’s true, good on AA. No need to devalue partner redemptions since it’s so tiny.

Seems like once AA goes revenue based, % of miles issued to third parties is going to skyrocket. Crazy.

@Benjamin – as Gary says, it’s “not quite”.

But your figures are not that far off. In fact figures published all the way back in 2006, and reported in HBR at the time showed that redemption of a 25,000 mile award on AA cost less than $15 on average to fulfill, after food, fuel, insurance and other expenses were factored in.

So yes – the true incremental costs are incredibly low.

How can they justify $25 INCREMENTAL cost to carry a checked bag when the incremental cost to carry a much heavier and needier person is $8.75?

@Terry,

Because they can!