American Airlines released a shareholder presentation supporting its positions on votes at the carrier’s annual meeting.

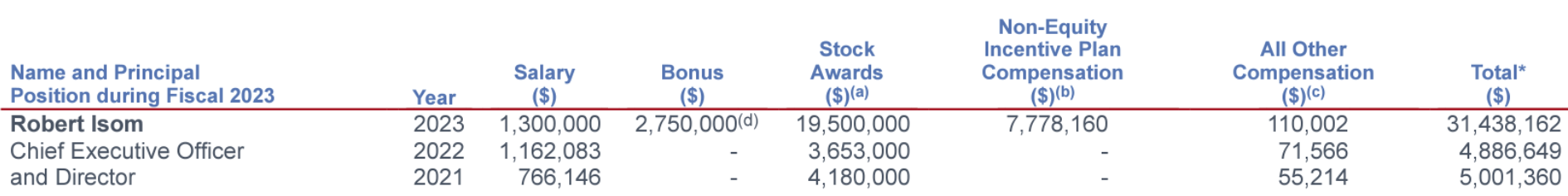

That means re-electing its slate to the Board, approving its auditor, and making corporate governance changes that allow amendments to certificate of incorporation and bylaws by simple majority vote. But the item that gets the most space is the non-binding advisory vote on CEO Robert Isom’s $31 million compensation package.

The board of directors, which approved the compensation, is very much related. The compensation is excessive not in the abstract (they point out that Delta CEO Ed Bastian has earned more) but because Isom’s performance hasn’t earned his.

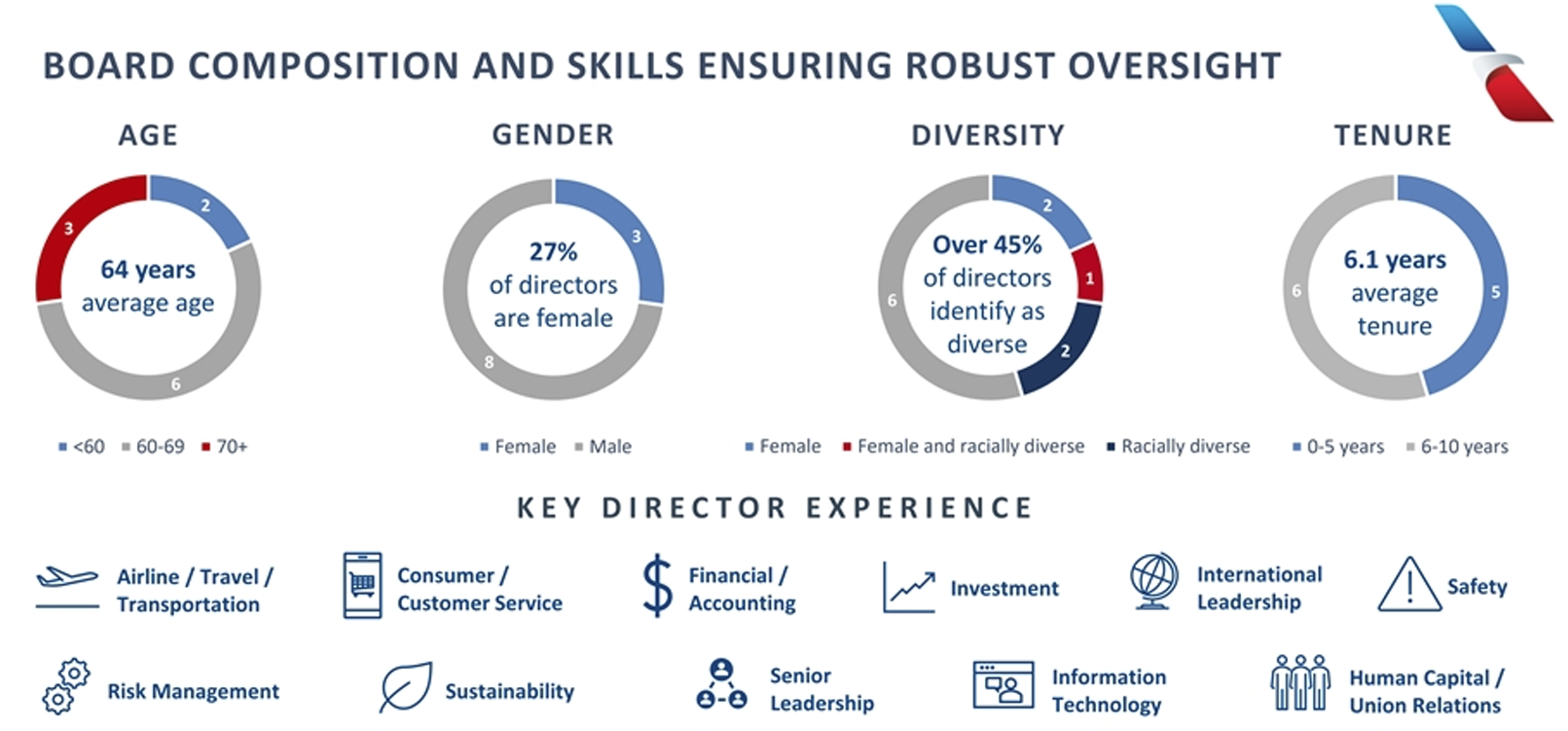

The hallmark of this board is:

- Lack of airline experience. Former CEO Doug Parker, who largely built the board, called this out. Before adding former Northwest Airlines CEO (and Robert Isom boss) Doug Steenland to the board during the pandemic, they did not have a single director that had ever worked for an airline. Parker said, ” That has an impact on their deliberations and their ability to understand.”

- Lack of accountability. This is a backslapping board that never held the previous CEO accounting for destroying the company’s share price, destroying its employee relations, and destroying customer loyalty by degrading the product and service offered. There was no accountability for losing its primary partner in South America, or for underperforming its primary rivals.

Interestingly, American seems to acknowledge the previous failings of the board though it’s unclear how they’ve actually improved upon in. They say that resignations and additions over the last four years “have strengthened the alignment of Board composition and skills with our long-term strategic priorities and bolstered the Board’s oversight capabilities.” While not obvious that they’re capable now, the company acknowledges their board was even less effective in the past according to American itself.

Former Northwest CEO Steenland is doing a lot of the lift here, and he beings union experience imposing wage cuts and layoffs while workers were told to consider dumpster diving to save money.

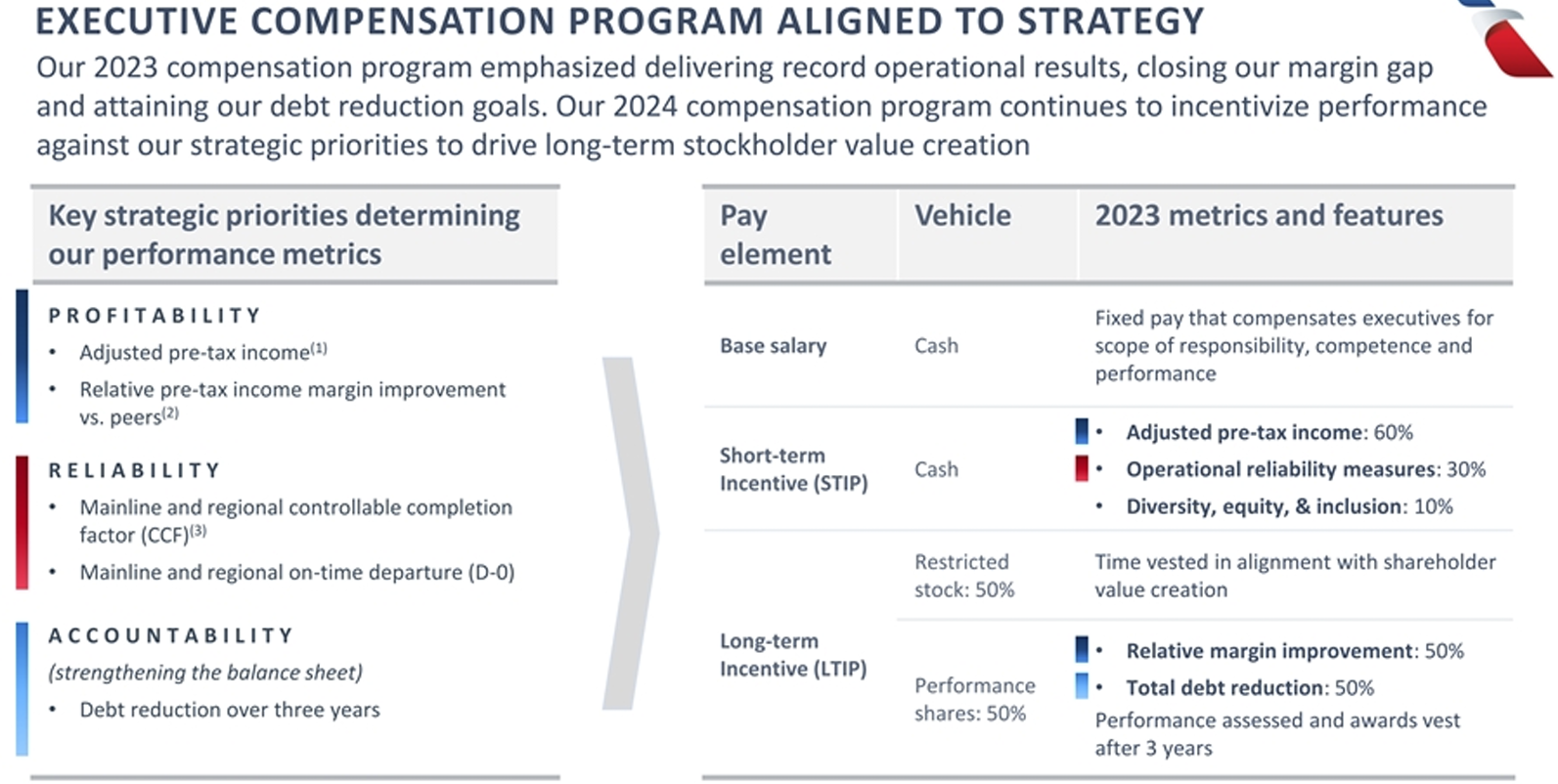

They also brag that they reversed their pandemic-era losses without noting that this is because people are traveling again when they weren’t then. American did not do this. In fact, according to filings regarding Isom’s compensation they have substantially reduced their financial goals so that a ‘home run’ is now $2.5 billion in profit when that had been below their projected average profit seven years ago, when inflation alone should mean 20% higher profit on a nominal basis.

Bizarrely, they justify the high bonuses paid out to Isom on the basis of the bonuses being outsized relative to his base compensation (the bullet points out that 91% of his total compensation was bonuses, to justify giving him large bonuses).

The fundamental problem though is that American Airlines is underperforming financially, and its shares have lost over half their value compared to prior to the pandemic. They have not gained anything over the past year. So what exactly are they paying for?

Moreover, Isom’s strategy isn’t generating profitability.

- He’s consistently pushed the line that they simply need operational reliability to perform financially. They’ve achieved huge gains in reliability but that hasn’t translated financially, because operational reliability is simply table stakes. They won’t make money without it, but customers won’t prefer them over other airlines that are also reliable.

- Instead of following a premium strategy that’s generated profits for Delta and United, his message to employees when becoming CEO was to cut costs. However American Airlines is and will remain a high cost carrier, which means they need to earn a revenue premium to be profitable.

- He’s allowed Vasu Raja to cut off managed corporate contracts and shed travel agents. The theory is they’ll fill planes either way, so why discount, and why incur higher distribution costs? But airlines like Delta and United are reporting big gains in high yield corporate business travel, while American is not. Raja explained that during the first quarter earnings call as the result of American’s weakness in coastal markets (Northeast, West Coast) but that too is a strategic failure.

There’s chart after chart to justify the pay – which underscores how much work the company needs to do to try to justify it. They cannot just say ‘American Airlines delivers outsized returns and creates greater shareholder value, so it makes sense to deliver strong compensation to the CEO.’ Isom himself stammered trying to justify it to employees even though he had prepared remarks.

The problem isn’t ‘paying a CEO too much’. The problem is pay for lack of performance. And they’re doing it in a completely self-destructive manner. They need to close a flight attendant contract. The National Mediation Board has said that if a deal isn’t reached at the end of next week, they could release flight attendants to strike.

One of the most contentious remaining issues is retro pay – whether flight attendants will get make goods for raises they would have received over the period since 2019 when their contract became amendable but no new deal was reached (as Southwest flight attendants are being paid). Inflation has eroded their pay so much in the interim that first and second year Boston-based cabin crew qualify for food stamps.

- The Board is justifying Isom’s pay as retro pay!

- The reason he wasn’t paid more earlier is because it was illegal to do so

- This was a condition of taxpayer bailouts, which were delivered largely with the support of labor – and in particular flight attendants (Sara Nelson, who appears to want to raid American and gain representation of its cabin crew).

That makes it harder to get a deal done without retro pay, when he’s giving it to himself. Not delaying a decision on his own back pay until a flight attendant contract is done may cost the airline $200 million in additional labor expense. The very fact that Isom is taking this pay now, rather than later, demonstrates he doesn’t deserve it.

And the Board could easily have paid him less (1) based on merit, (2) based on Isom’s next-best alternative [he’s not being hired as CEO of Delta, United or Southwest], and (3) because if he left over pay he’s hardly irreplaceable – not so much better than the median airline CEO that American couldn’t afford new leadership.

I just want to say that I’m a United employee and I really like working for Scott Kirby. It’s a great working environment.