American Airlines stock went on a speculative tear as investors guessed that the Reddit ‘Wall Street Bets’ forum might turn their attention to the heavily-shorted airline stock after the GameStop play ends, or even sooner.

But the GameStop play is unique, a short squeeze like nothing we’ve seen since Volkswagen in 2008. It isn’t something that happens every day, at the drop of a hat, because a collective hedge fund on Reddit decides a stock is the next meme.

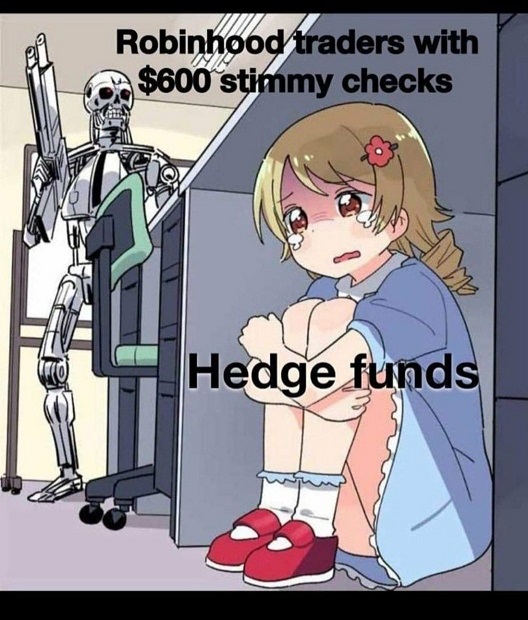

I don’t have a beef with hedge funds, until they start calling for government regulation to protect themselves from retail investors (usually claiming to be concerned that those retail investors might suffer losses, justifying stopping people from buying shares thereby limiting increases in share prices).

And I don’t have a beef with commentators, either, except handwringing over this by CNBC’s Andrew Ross Sorkin who is literally co-creator of Showtime’s Billions where people do this sort of thing every episode. Season 1, Episode 4 was even titled “Short Squeeze.”

Into the GameStop frenzy, comes an American Airlines plan to sell $1 billion in stock. During this week’s earnings call the airline wouldn’t speak to recent share price moves, or comment on GameStop, but mentioned only that they had an outstanding authorization from their board to sell additional shares.

American Airlines authorized the sale of another $1 billion in stock, the carrier said in a filing Friday, an effort to shore up cash as Covid-19 continues to depress travel demand.

American authorized a $1 billion stock sale in October and sold $882.4 million at $12.87 a share. Under the new agreement, it would sell up to $1.12 billion.

The problem for American Airlines, though, is in the time it takes to do the paperwork to pump a billion dollars worth of shares into the market, the Wall Street Bets rumors can shift.

To be sure, the authorization to sell shares isn’t new. But it’s timed coincidentally with the speculative runup in price. Of course investors may just think American Airlines has a good shot at another $3 billion stimmie from Treasury.

Fascinating. I think you would enjoy Matt Levine’s Money Stuff newsletter. You think very similarly and I’ll bet he covers AA in his Monday newsletter, though you beat him to the punch on this one.

A lot of hype on these other stocks are from FOMO and not getting into GME early. I bought GME back in November with all the other WSB regulars.

And luckily it being a bullish market right now, people can just throw money into anything and do fine.

Matt Levine’s free newsletter is the best. In the words of Levine, “Everything is securities fraud”.

The paradox of the redditt run ups is that they, in fact, may turn out to be self-fullfilling prophecies. Companies like American, whose debt might overwhelm them into bankruptcy, end up being able to sell shares into the frenzy and suddenly are no longer bankruptcy candidates. AMC Entertainment is an example of a company which has been able to raise significant equity capital off the strength of the short squeeze. If what we read is correct, many of the Robin Hood short squeeze players are intrigued with the idea of “sticking it to the man”. What they may find out is that, while they’ve hurt the hedge fund part of the establishment, they’ve helped other parts of the establishment like American.

The details are different, but in 1990, Citibank was in difficult straits with a very depressed stock price. Saudi investor, Al Waleed bin Tal Al Saud invested $590 million in a convertible preferred stock which instantly solved Citi’s capital problems and led to an increase in the price of its stock giving Al Saud an immediate return on his investment. He actually did it again in the depths of the financial crisis.

Jerry — excellent point.

When this financial bubble pops completely, and it will eventually, the outcome is going to be very ugly. Perhaps even uglier than the Great Depression.

What investments made some great returns during the Great Depression? Investments in entertainment, as ironic as it may seem given what’s going on with two of the above-mentioned entertainment companies’ stocks, two companies that seem extremely overvalued to me.

@Jerry — Irrational valuations — from small investors and large investors — OFTEN change the prospects of companies. I vividly remember Priceline’s absurd valuation for a business model (name your own price) which never worked well in the real world. But investors gave Priceline so much money they were able to buy “real businesses” that did work, like booking.com.

Bubbles burst. Period.

AAL’s valuation has been inflated for months because of the Robinhood crowd. Trying to live off of that excess valuation rather than correcting the fundamentals of the business never produces value for a business. The Great Recession proved that.

For the 4th quarter, AAL’s CASM ex (unit cost w/o fuel, special charges etc) was 40% higher than Delta’s while DAL’s CASM ex was within a few percent of Southwest’s and JetBlue’s. United’s CASM ex was 30% higher than DAL’s.

AAL hasn’t been able or willing to get costs out of its system, largely due to excess employee costs that go back to the American/USAirways merger in which Doug Parker used the support of labor to overthrow AMR’s standalone reorganization plan and set up the merger which put Parker at the top.

You can’t fake the fundamentals. When Delta is blocking about 1/3 of its seats from being sold and still ends up with an enormous cost advantage to American and United while the low cost carriers are targeting American and United (LUV starts O’Hare in a couple weeks, Miami expands, and Houston Bush starts in weeks, all flying top routes for AA and UA) and JetBlue continues to grow at Newark, it is clear where all of the industry see vulnerability and opportunity.

and short sellers will be a lot more nervous about dumping a bunch of money into companies that cannot produce financially after the GME fiasco – which was the only point of the WSB crowd. If hedge funds can make money on corporate poor performance and then be countered by a pool of retail investors, short selling is a whole lot risker.

and given that Janet Yellen has a history w/ hedge funds, the Biden administration is better off to let the markets sort this all out on their own that to try to regulate either side – other than to intervene when clear manipulation of the markets takes place which might have been the case by stopping or slowing hedge fund losses in GME and others.

Parker can issue all of the stock he can sell but ultimately demand will return to the airline industry and the trajectory or shrinking and sacrificing market share that AAL was on pre-covid will return.

“because a collective hedge fund on Reddit decides a stock is the next meme.” Looking at what happened with Reddit I don’t think the people behind it are doing it for a meme. The strategy was rather involved and showed a high degree of sophistication. While there are individuals who are jumping in and don’t know what they are doing I am willing to bet that behind the scenes of the reddit crowd there are some big money players who know exactly what they are doing and are manipulating these people to help drive up the price.

Next is silver.

If everyone bought a few hundred bucks in physical silver (or on the commodities exchange and demanded delivery) and just stuck it in the basement, short sellers (I am looking at you, JP Morgan) would be decapitated. There is not enough silver in the world for them to cover at any price. No such thing as silver mines any more pretty much, it is all a byproduct of gold/lead/etc. mining. And a lot goes into batteries, solar panels, etc. anyway.

From mid-day Thursday to Friday close, spot silver was up 10%. Those Reddit guys have tasted blood, and they like it.

How long until the holding of gold and silver by private citizens gets banned?