American Express CEO Ken Chenault will retire at then end of the year after 16 years in the role.

Vice Chairman Stephen Squeri, who previously ran the company’s corporate card business, will succeed him. (American Express President Ed Gilligan had been expected to become CEO, but he died on a business trip two years ago.)

American Express was a strong performer for much of Chenault’s tenure but faced real challenges in recent years as it lost the Costco business and had to compete far more aggressively for premium cardholder business that was traditionally its exclusive domain.

Copyright jetcityimage / 123RF Stock Photo

The company’s shares are up 50% so far this year though, after being beaten down in the aftermath of the Costco loss and other setbacks. They did score exclusivity with Hilton taking that away from Citibank, though it’s small consolation for the significant market share they gave up with the Costco loss.

Gambits that looked incredibly promising — such as expanding into unbanked segments via plays with Walmart and Target, and building a coalition rewards program for retail (Plenti) — didn’t turn out as profitable as hoped. Increasingly they focus on lending (not merely charge cards) and the small business segment.

Going forward they face a Supreme Court case in the coming term. And they face significant competition with Chase as they fight to protect their Starwood co-brand deal (their second largest travel co-brand after Delta) now that Starwood has been acquired by Marriott — which has a longstanding relationship with Chase.

As CBS headlines on this note, worth mentioning that he’s also by far the most prominent African-American CEO, and is the only black Fortune 100 CEO to have served that span of time, ever.

How short is your memory?

AMEX was essentially bankrupt under his tenure. First the federal bank converted AMEX to a bank-holding company and then AMEX got access to TARP money. Great job Chenault’s for putting the company in that position and being bailed out by the taxpayers! He overleveraged the company and it should no longer exist.

The most recent problems amount to nothing compared to the existential threat in 2007.

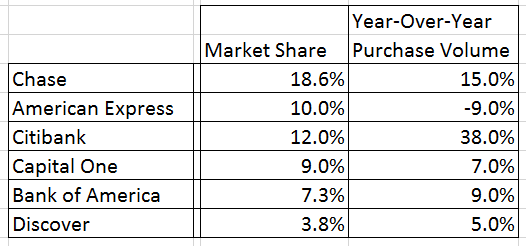

How did you calculate each companies market share? Thanks for the read!

@brian Why is his race relevant in this discussion? As a minority myself, I can’t understand why so many people are so quick to mention someone’s race or gender or sexual preference.

The assumption is that a lesbian, female,minority’s accomplishments are more significant than a straight, white, male’s accomplishments, even if both worked hard to get where they are and even if both had similar backgrounds growing up.

Plenti & bluebird did not work, but arguably they did not fail with costco. They stopped after Citi bid an insane amount

@Ben Thank you.

I didn’t even know he was African-American. Does it matter? Strange.

@ Ben, Geoff, Colleen: as a minority myself, I think it it worth mentioning his race as what he accomplished by rising through the ranks from the early 80’s – where Corporate America and society in general was not as open-minded/tolerant as now – is an achievement. There have only been a handful of minorities heading Blue Chip companies and so yes….I’m glad this was mentioned – as a positive model for others.

@ ABC: Goldman Sachs, AIG, Morgan Stanley, GM and all the others should then also be bankrupt. Heck…the US government should be bankrupt. Whether one agrees or disagrees with TARP, almost all companies that qualified, took advantage of it.

Remember that TARP came along because the Investment Banks (GS, etc…) are the ones that caused the financial mess that impacted other companies (like Amex and GM and others) to have to take TARP. [Ford is one of the few that didn’t take the handout].

GS and AIG should definitely have been left to fail. Crooks. Blankfein, Hank Paulson, Gary Cohn. All a bunch of crooks.