A month after announcing a new rewards checking account American Express is surveying a new business checking account that’s potentially more lucrative.

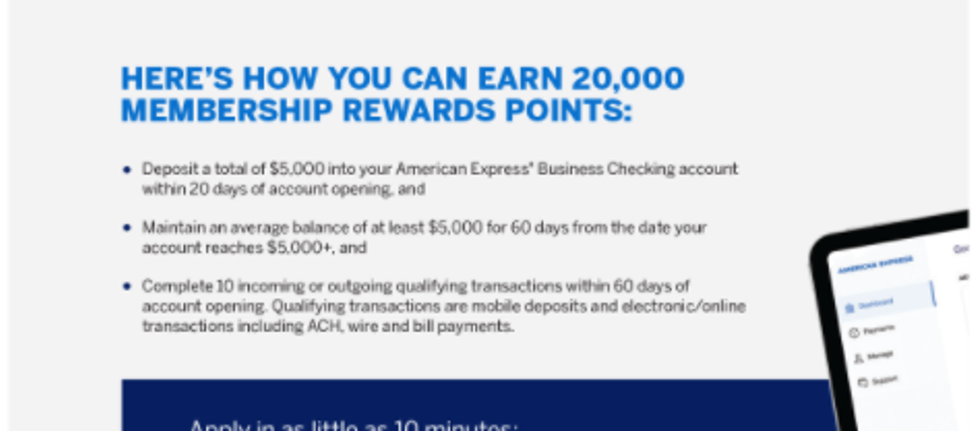

- Initial bonus: 20,000 points if you keep $5000 on deposit for 60 days and complete 10 transactions with the account within 60 days.

- Rewards for debit spend: 1 point per $2 spent. American Express managed to workaround the Durbin amendment which makes debit transactions possible with their Bluebird card, for instance. Generally rewards-earning debit went away because the federal government outlawed earning a return on debit, so it no longer made sense to pay to incentivize debit transactions.

- No monthly fees: this seems like an ante for a strong account.

- High interest: for a checking account of 1.1% APY on up to $500,000. That’s quite generous as something other than a teaser rate or with a low cap right now, though if they earn enough margin on debit that could help and of course we should be seeing interest rate hikes though I’ll leave it to others smarter than I am to be on whether those will be muted somewhat by the collapse of the world.

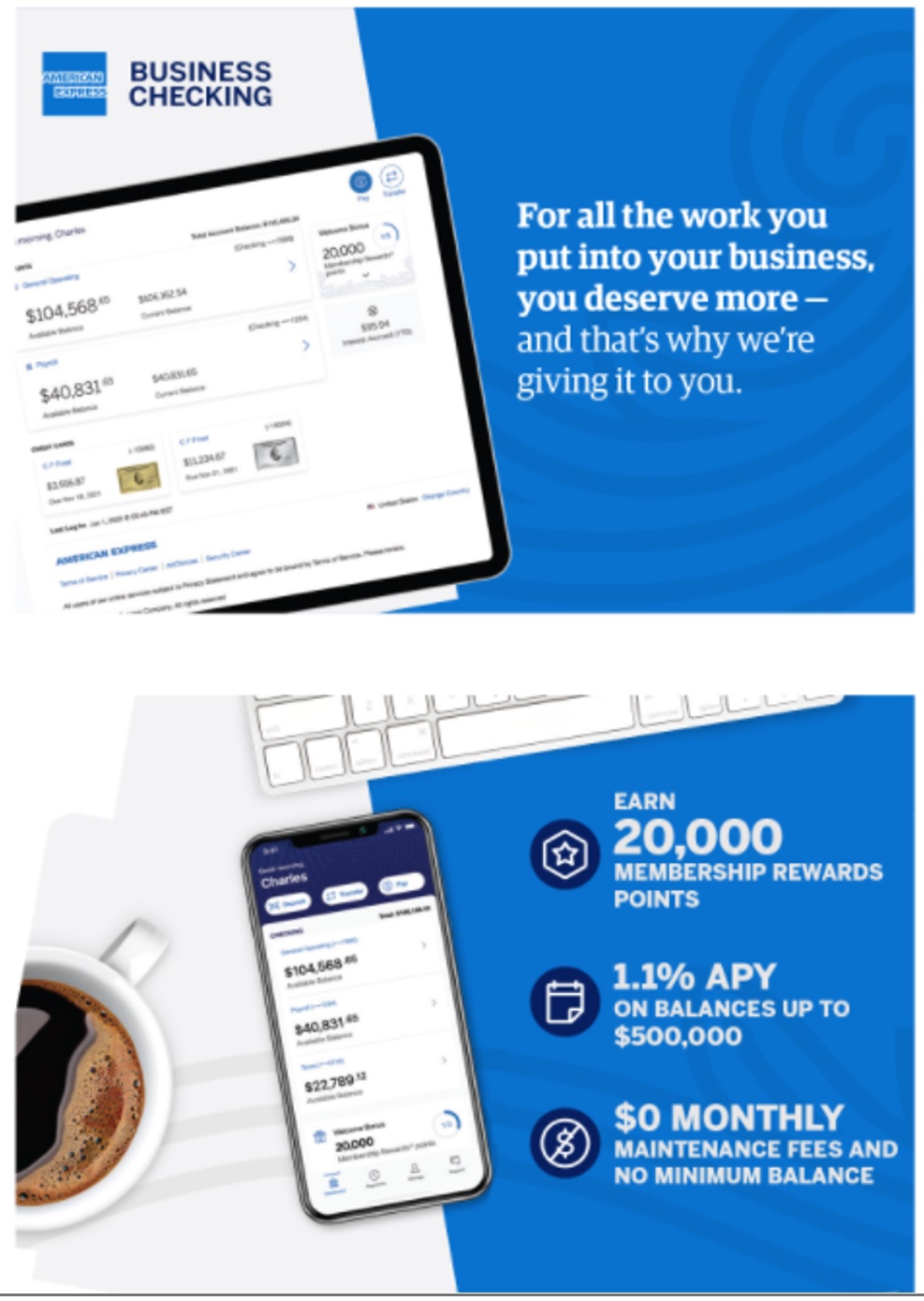

Here’s the promotional material being tested:

(HT: Tom)

Perhaps I’m missing something here but that really doesn’t sound very compelling, at least for my business.

The initial bonus is no great shakes. You can get the same for an AU on some cards.

The 1 MR point/$2 is half (or less) of what you can earn with other cards.

I already don’t pay a fee for my business checking.

The interest is nice for now but I try to avoid keeping enough money in my checking account to make that really worthwhile.

This isn’t necessarily bad, it’s just not that hot for me and I suspect many other people. You also lose a lot, like having a local branch to solve problems for you and issue new cards and cashiers checks on the spot, or just buy change for your business. You’re also using a debit card for many transactions, which loses some benefits and protections. IMO, hard pass but for people who do all banking remotely it may be worth it.

@ Gary — Is this based on the AMEX-owned Kabbage checking platform?

Amex has entered the world of personal and business checking like a kid who is learning how to use a clutch transmission. They are absolutely not ready for primetime.

@Gene – No. Kabbage is a different (but similar) Business Checking product from Amex. Kabbage issues a MasterCard debit card and is run by Green Dot Bank. Amex Biz Checking issues an Amex Debit card issued by American Express Bank. Both offer 1.1% APY.

Serious question for people: how do you keep track of so many travel credit cards? Some other sites occasionally mention the 20+ cards in their wallets. As a poor person I am fascinated (as I am with all the first world comments about travel).

Your world seems maddeningly complex and frustrating. Am I missing something? And yes, I am prepared for all the snarky comments about the poor. Even Jackson Waterston is welcome

(though I find his comments on personal revenge troubling-where does it end?).

I wonder if I liked smelling leaded gas exhaust as a child too much.

But I’ve always been curious about other worlds…..

Jorge, your world view is just fine and don’t let anyone tell you anything different. Regarding Jackson Waterson, keep in mind that he has expressly endorsed national socialism (which in Nazi-ism) in comments and his comments seem thinly veiled white supremacist.

On to credit cards . . .

There are individuals who can obtain sufficient points via ongoing spending to cover their travel. I’ve done a lot of number crunching and found that a person can typically achieve about 95 percent of total potential points (given one’s spending pattern) with only three credit cards. Once at that point, one must ask what their “cost of complexity” is. So, you are absolutely right.

There are other individuals who primarily collect points via welcome bonuses. For these persons, the proper strategy would be to maintain the three long-term keepers mentioned above and then hold all other cards for the obligatory one-year hold period to secure the welcome bonus and then cancel.

But, then, there’s a third type of person. There’s a psychology about tier status. FM’s Greg commented in a podcast — which I paraphrase — don’t let your personal identity be defined by your tier status. Some people are driven by non-practical reasons to obtain tier status — it’s something about the person’s self-image. The same applies to credit cards. Some people are driven by non-practical reasons to hold a fistful of credit cards — it’s something about the person’s self-image.

I’d say your position is healthy and grounded.

American Express always has great offers for AMEX cardholders.

Reno Joe, your reply to Jorge sounds like a fair assessment. Jorge, I have a lot of credit cards and they are all set for auto paid in full from my main checking account. Being able to check accounts online greatly simplifies keeping track. I also have auto deposit so I just need to be sure account balance will cover all debts.

After having been in this game for 20+ years and now having 20+ credit cards (most of which sit in a drawer) it used to take quite an effort to keep track of them with spreadsheets and Quicken but now between AwardWallet and TravelFreely apps it’s fairly easy to do.