I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

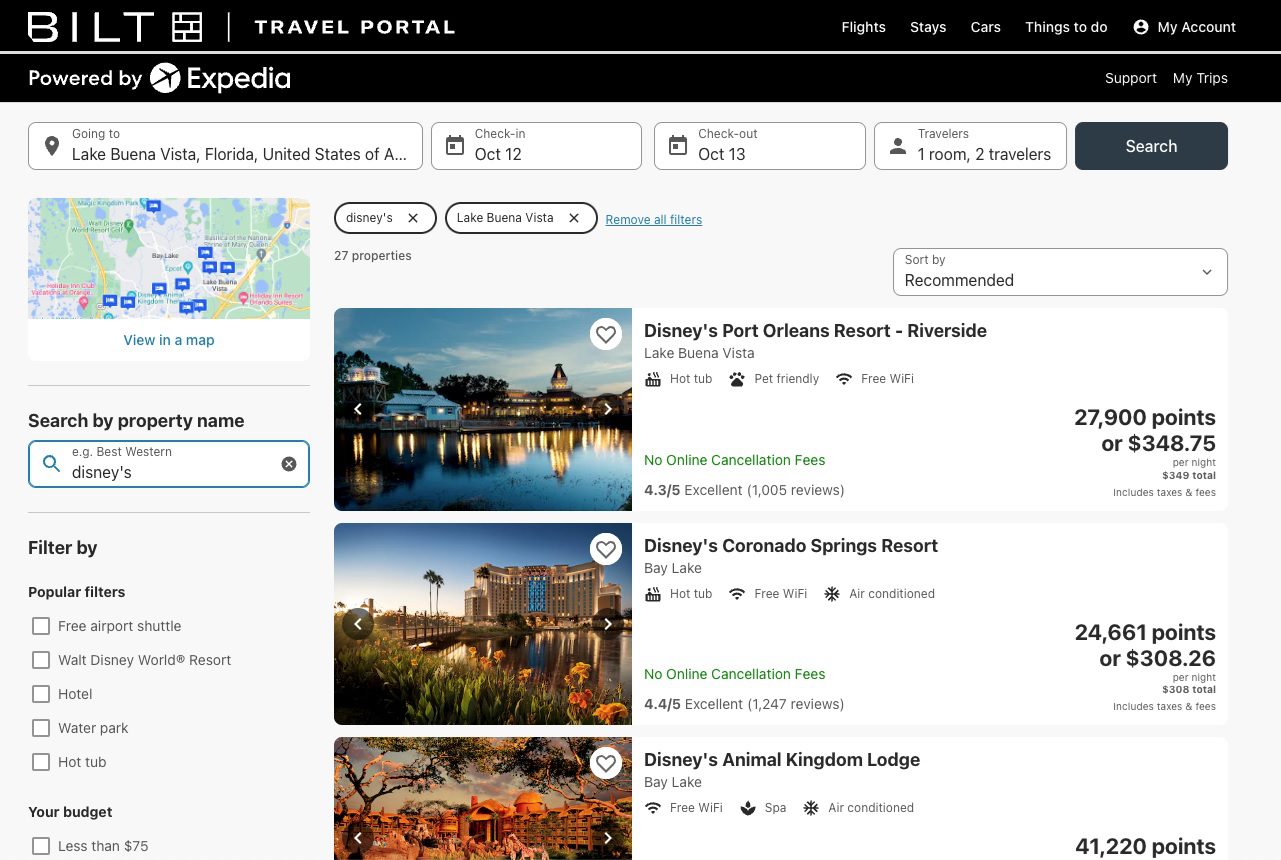

Bilt has launched a travel portal so that – in addition to transferring points to partners like American, United, and Hyatt – Bilt Rewards members can book their preferred trip (whatever it is) and pay with points instead of cash.

Each point is valued at 1.25 cents apiece when spent this way. That beats most credit card portal values, and matches Chase with its Sapphire Preferred Card.

- You can spend all points on an itinerary, or use points as partial payment on a booking, through either Bilt’s website or mobile app

- Both points and points+cash bookings trigger travel protections that come with the Bilt Rewards Mastercard

- Expedia is the portal provider

This is something members have been asking for. It’s something that other transferable points cards offer. So adding it eliminates an argument some consumers might have when comparing the Bilt Rewards Mastercard to other rewards cards like the Chase Sapphire Preferred Card.

Right now with award availability tight, since there are so few unsold seats out there, portal booking can be an efficient way to maximize the value of your points. But in general I’m not a fan of these sites since they put a booking agent between you and the travel provider. And since it’s not a concierge-level agent, that can be challenging when reservations go askew as they sometimes do in travel. So I still far prefer to transfer points to airlines or hotels.

Richer Points-Earning For Spend Through The Portal

Bilt Mastercard’s travel category for earning 2 points per dollar doesn’t include online travel agency websites, but has been extended to include the Bilt Rewards travel portal powered by Expedia.

Even without the card, Bilt Rewards members earn one point per dollar spent through the portal. This is a huge opportunity, for instance a Chase Sapphire Reserve® cardmember who earns 3 points per dollar on travel (including through Expedia) could also earn an additional 1 Bilt Rewards point per dollar by booking through the Bilt portal.

Assuming the Bilt travel portal codes similarly to Expedia and other online booking sites, it’s potentially worth booking through Bilt’s portal for air rather than on Expedia regardless of what credit card you use.

Put another way Expedia rebates are limited through shopping portals. You earn just $1.25 going through Rakuten and booking a flight with Expedia. Bilt Rewards trumps other cash back portals for any trip you might have booked with Expedia. And that’s true whether you’re a cardmember or not. Although Capital One does reward bookings through its own travel portal more than this.

Since they’re able to do one point per dollar for non-cardholders, I’d like to see cardmembers earn at least 3 points per dollar through the portal – the one point program members would get anyway plus bonus category spend (rather than effectively earning at the unbonused spend rate).

Unique: Spend Points For Disney Vacations

Bilt’s travel portal is unique in that it includes booking Disney hotel properties. Those are usually excluded from the online portal (though programs that let you spend points for statement credits against travel can use those credits on Disney hotels).

In fact, theme park tickets and on property hotels are included in this – not just for Disney. That’s going to benefit those of you visiting Universal as well.

Compare Points Versus Cash Bookings Instantly

Bilt has built in award search into their app with American, United and Aeroplan. They now let you flip between those options and spending points directly for paid travel, which for domestic travel may be cheaper (since airlines often – but not always – give you less than 1.25 cents apiece in value for your miles when no saver award space is available).

Use Points If You Can

You’d think I would say that paid bookings are better, because for air travel at least they earn miles and elite status credit.

Hotel stays will treat portal bookings as ‘third party’ and you may not be treated as well as on a direct-booked paid stay, or on a points stay. You aren’t generally supposed to earn points or status credit, and most chains won’t recognize elite status benefits on third party bookings like those made through Expedia.

More importantly if something goes wrong you’re dealing with Expedia customer service, which I’ve always found frustrating due to interminable holds, disempowered agents, and a general lack of understanding of how to address issues. If you’re booking airfare months in advance there’s a reasonable chance of a schedule change, and if you don’t like how rebooking occurs automatically you’re in for a treat.

To be clear I haven’t found any bank travel portal I’ve really been happy with, regardless of provider. Google was supposed to remake online travel an that never happened (intense lobbying by incumbent online agencies over anti-trust may have scared them off the mission). I’m not sure who they should have gone with instead of Expedia.

And furthermore, more options are better. Having the choice to make a travel portal booking at 1.25 cents apiece is a feature many members value. It fills a hole, and removes an argument that privileges other cards over this one that some readers of this site have made as well. I just wouldn’t be complete without noting the challenges of working with Expedia support.

Bilt’s points transfer partners are:

- Star Alliance: Air Canada Aeroplan, Turkish Miles & Smiles, United Airlines MileagePlus

- oneworld: American AAdvantage, Cathay Pacific Asia Miles

- SkyTeam: Air France KLM Flying Blue

- Non-alliance: Emirates Skywards, Virgin Atlantic Flying Club, Hawaiian Airlines HawaiianMiles

- Hotels: Hyatt, IHG Rewards

Matches Sapphire Preferred

One knock on the Bilt Rewards Mastercard has been that, while they have great transfer partners and offer points-earning and benefits similar to Chase Sapphire Preferred Card but without an annual fee plus the ability to earn points on your rent, you couldn’t book any itinerary you wanted to through a travel portal. That’s now changed. And they’ve matched the per-point value that Sapphire Preferred offers, beating what you get per-point for travel portal bookings from other card issuers as well.

Since both cards offer 2 points per dollar on travel and 3 points per dollar on dining, as well as robust insurance coverage, the key differentiators between the two I think are:

- Annual Fee: Bilt’s annual fee is $0, while Sapphire Preferred’s is $95

- Transfer partners: Bilt has American AAdvantage as a transfer partner; both have United, Aeroplan and Hyatt; Bilt doesn’t have Singapore, Marriott or British Airways/Iberia/Aer Lingus but does have Turkish, Cathay Pacific, and Hawaiian.

You must make at least 5 purchases each month to earn points with the Bilt Mastercard.

So for Citi Prestige holders, this is pretty cool if the flight prices out identical to the airline’s website or other OTAs: 6X on flights! 5X from the prestige on OTAs/airlines and an extra 1X from Bilt.

But of course, YMMV, Expedia is not the best choice in 100% of cases, especially for non-domestic flights.

Overall a good card and a potentially a great card for those paying rent.

Minor point, which should be addressed is that BILT is rounding down on spending.

If an amount charged is $2.99, it rounds down to $2.

If you are making a good number of transactions, 25+, it could easily cost you hundreds of points over a year.

Lol Cap One Portal lets you book Disney hotels