Stifel’s Joseph DeNardi and Matthew Rachal think that American AAdvantage will drive the airline’s stock price growth.

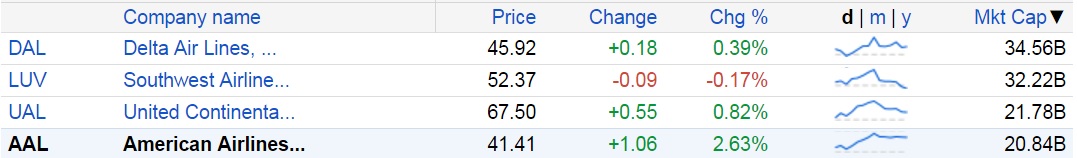

They report that analysts are pegging American’s stock at $54 while they expect $95 because of growth in AAdvantage revenue which is very high margin. Shares are worth $41 as I write this.

They argue that they’re the ones who see the value in the program today but soon everyone will because accounting changes going into effect next year will cause greater disclosure and greater awareness of the value of the program. What they are talking about here is new accounting standard 606 which United, Delta, and American are all adopting effective January 1, 2018.

- Roughly speaking it requires loyalty programs to defer more of their revenue and to recognize greater redemption costs — those frequent flyer tickets need to be estimated at fair value, not the incremental cost of carrying an additional passenger.

- Delta and United already show greater costs for their redemptions than American does, so American is likely to have a greater shift in its accounting.

DeNardi hinted at his emphasis on the loyalty program as a driver of growth during the last quarterly earnings call.

I think it remains to be seen how much useful information we’re really going to get, it’s notable that American’s most recent 10-K filing stopped providing most of the useful AAdvantage information that allowed a determination in past years such as in 2015:

- American issued 315 billion miles, 58% to third parties. (This dropped from 61% the year before, likely a result of premium cabin bonuses causing the airline to issue more miles to itself; the shift to revenue-based earning likely means an increase in the percentage sold to third parties.)

- Miles were sold to partners for on average just over 1.2 cents apiece (likely closer to 2 cents each for most partners, and slightly below a penny to banks).

- American believed it cost them just $34 to fulfill a 25,000 mile domestic roundtrip award. (This is a number that will change most under new accounting standards.)

We know that up until 2012 American believed it took an average of 28 months for earned miles to be redeemed. And that American is carrying $2.8 billion in liability on its balance sheet for AAdvantage redemptions. They’re going to have to calculate this upward, but they’re going to spread out the hit over past years rather than taking the hit all at once. Considering Delta carries about $4 billion and United $5 billion in deferred revenue, American’s reporting shift may be the largest.

Meanwhile there are real risks to frequent flyer programs. Each has one major customer — a bank — and if credit card interchange rates fall the largest stream of revenue may fall with it.

Is it possible that the market has undervalued frequent flyer programs for decades? No spin-off has raised as much or at as high a valuation as Aeroplan in 2005. Several recent spin-offs (airberlin, Jet Airways, Alitalia) were more about the tail wagging the airline dog of control (Etihad) rather than a fair valuation of the program itself.

That said, given current market caps it’s possible that the frequent flyer programs are worth 25% – 50% of each airline’s total market cap.

Of course it’s also possible that the market values the loyalty programs appropriately, and the rest of the business just isn’t that valuable as we might think… that all the profits airlines are throwing off don’t support a higher valuation because they aren’t expected to last, let alone grow.

Regardless if AAdvantage is undervalued likely so too is MileagePlus and SkyMiles. Maybe Warren Buffet’s bet on airlines is really his enchantment with miles and points.

(HT: Alan H.)

Gary, if miles are sold to credit card issuers for under a penny per mile (not doubting that), why aren’t there more cards with 1.5x or 2x mile earning on all spend? If 1.5% with no annual fee and a sign-up bonus is normal, why not 1.5 miles per dollar instead?

I’m it following the argument.

It currently cost AA 0.1-0.2c/mile to generate a redeemed mile. And they sell it for 1-2c/mile.a margin of 80-90%.

With the new accounting changes it will cost AA ~1c/mile to generate a redeemed mile. The margin is now less than 50%.

The accounting changes should result in reduced valuation of the AAdvantage program.

ABC – you’re pretty close.

The “appearance” is that the liability will balloon and it will look like redemptions cost more.

But in truth – the real incremental cost of redemption doesn’t change.

What changes is that more “revenue” gets deferred into the liability, and upon redemption flows back into Passenger Revenue.

So in practice – it’s really just a change in the timing of revenue recognition.

But it will give the appearance of both higher liabilities and also higher revenues from Points redemptions.

To some degree – there is pressure to segment that revenue on the Income Statement – which would then highlight just how profitable these programs are. That’s the argument being made by the analysts, which Gary mentioned.

If I’m buying airline stock, it is gonna be BALTIA 🙂

At least you don’t hold a gun to our head and force is to buy aadvantage miles like lucky does.

I think his and your readers will be a big reason of the stock price increase.

Gary, is this number correct: 854 billion miles? that alone is like 10 billion dollars?

Off topic to this thread, I note that for the example period AA earned about $5B selling FF miles to institutions. (854 billion miles, 58% sold, assume one cent per mile sold).

On the redemption side, 854 billion miles sold that year could be redeemed for about 71 million cheap domestic saver fares at 12,000 miles each. That’s about 200,000 award trips per day for a year. If everyone redeemed more expensive flights, say 60,000 mile awards, that’s still 40,000 award trips a day for a year.

If those numbers are right, AA must be counting on most of the miles never being used.

Forgot to check follow-up box

Aside from the fact that market caps seldom reflect the actually value of a company, particularly one with real hard assets like airplanes and property, the value of a FF program can be said to be just as speculative. At one time, Air Canada’s Aeroplan was thought to be worth more than the airline itself. Today, Aeroplan’s stock (as a separate spun-off company renamed AIMIA) is worth less than half what it was valued in its IPO…which was based on that specious pseudo-valuation. US airline FF programs have now become captives of their affiliated bank credit cards, significantly detached from their airline/flight miles origins.

The majority of program members are earning less from flying (RDMs) and more from credit card charges (of sign up bonuses). A small proportion are earning higher levels of RDMs because their companies purchase full fare tickets, but the question arises how will these increasingly million mile+ accounts will be redeemed. The old accounting held accumulated FF miles as a liability until they were cashed out. We are only just into the revenue-based accumulated RDMs to know what redemption patterns will end up being. So once more, such musings about the value of these divisions will remain speculative until concrete data becomes available. It’s a strong bet those high-mileage accounts will be redeemed for J and F seats, which have a greater impact on an airline’s bottom line than domestic or even international Y tickets, particularly if the redemption is on a partner airline which involves a real dollar cost vs an accounting entry.

I think the main thrust of the Stifel analyst’s $95 target is that AA’s earnings are more DURABLE from the cyclicality of the airline industry because those frequent flyer mileage-selling earnings will be pretty consistent (even in an economic downturn, according to the analyst), even if demand for air travel cyclically declines.

Frankly, the only way AAL stock will rise to $95 on this analysis is via investor SENTIMENT, not actual fundamentals. It’s always a bit of a mystery why investors value certain business sectors more than others, and it often involves irrational human emotions. Generally, new and exciting things are valued more than stable traditional businesses even if — objectively — the future earnings streams from new enterprises are inherently more risky and often more hope-based than reality-based (I’m looking at you, Tesla).

I do think that, overall, the airline industry deserves a higher price-to-earnings ratio that it currently has because: 1) Stifel is right that selling frequent flyer miles is a good not-very-cyclical business; and 2) earnings in the core USA airline business are far more durable than they used to be, now that the business is largely a well-managed oligopoly.

That said, I wouldn’t count on AAL seeing $95 anytime soon. 🙂