On Wednesday morning I debated Stifel Managing Director Joseph DeNardi on whether or not to spin off frequent flyer programs at the Airline Information MEGA event in Florida.

Joe is the best-known face of the argument that loyalty programs are the primary drivers of revenue and value for airlines, and he’s argued that the overall businesses are undervalued because investors don’t clearly see how much good, high margin revenue is coming in from credit card partnerships versus from the airline as old-line industrial. He was charged with defending the idea of spinning programs off into a separate business, and I was charged with arguing against this.

Hasn’t This Question Already Been Settled?

In some sense we’re having this debate 15 years too late. Journalists covering airlines used to think of frequent flyer programs as costs that didn’t give any airline a real advantage (since everyone offered a program). That changed, I think, with United’s bankruptcy which disclosed that the only profitable piece of United was Mileage Plus.

In 2005 Air Canada, desperate for cash, sold off its frequent flyer program. They’ve since purchased it back, getting better access to card revenue, to their customers (they lacked the rich data the frequent flyer program affords) and a better ability to provide tailored treatment to their best customers.

Virgin Australia is buying back its program. Aeromexico has said they plan to do the same thing (although their current agreement runs through 2029 so all bets are off what will really happen).

airberlin’s topbonus program is no longer in business. The airline stopped paying them for miles awarded from flights. Jet Airways JetPrivilege is a zombie, since its associated airline is out of business. That’s tremendous concentration of risk.

Alitalia Millemiglia continues on, owned in part by Etihad. Many of the spinoffs of the last decade where done to give Etihad added influence and a way to funnel cash to partner airlines despite strict foreign ownership restrictions. That made the programs look like they were valued more richly by the market than they actually were.

The market has seemed to move past the idea that frequent flyer programs are exceptionally valuable standalone businesses.

Frequent Flyer Programs are Good Businesses, But Not as Great as Claimed

Two and a half years ago DeNardi said American could double its stock price with a spinoff. He was arguing AAdvantage was worth over $30 billion, when the whole airline at the time had a market cap of $21 billion. That market cap has been driven down closer to $12 billion in recent months.

He’s told me that getting big multiples on frequent flyer earnings requires just a 4% – 6% annual rate of earnings growth. I’d suggest that we’re actually at the top for frequent flyer program earnings.

- Revenue is at risk because interchange is more likely to fall than to rise

- Expenses will need to rise to compete with bank issued proprietary cards

Banks buy miles to incentivize transactions through their network. If the margins banks were earning on card swipe fees were to fall, the amount they’ve be able and willing to pay to incentivize customers would fall too.

This could happen due to regulation of interchange (realistic in an Elizabeth Warren presidency), competition (Amex is already lowering the fees it charges to attract more small business acceptance), and new technology (competitors for processing payments that force Visa and Mastercard to drive down their prices).

There’s certainly more downside risk than upside potential in revenue. And with Chase, American Express, Citi, and Capital One all having built their own transferable points programs that in some ways are more attractive than airline co-brands, airlines will have to compete aggressively to maintain and grow spend.

Loyalty Programs Need to Be More Integrated Into Airlines, Not Less

My ultimate argument is that loyalty programs need to be more tightly integrated into airlines, not less so.

Air Canada for years was unable to get award change fees waived for Super Elite customers. Aeroplan said if Air Canada didn’t want these customers to pay, the airline could pay instead. After reacquiring the program one of the first changes Air Canada made was to waive these fees to better serve loyal customers.

Copyright: ronniechua / 123RF Stock Photo

When Scott Kirby joined United he had a growth plan. And he pointed out that not only did United’s domestic network need to grow back to where it had once been, but that doing so would make the airline’s credit card more attractive to consumers. Critical mass in a market would make the product more relevant to card customers, improving card acquisition and spend.

He also realized based on his experience at American that inflight credit card acquisition is the most effective marketing channel they had. United didn’t do this, because Chase had never agreed to pay extra for the privilege. To Kirby that was nuts – they were leaving card spend and mileage sales on the table, and they moved to solve this.

By better integrating card revenue into the equation United was able to think differently about its route planning and inflight service. That would be exceptionally difficult to do selling off the future credit card income stream in advance to a separate company.

I think that if loyalty revenue implications were better integrated into route planning at American, there’d be more of a question as to whether it’s made sense to draw down in the New York market (becoming less relevant to credit card customers in the all important New York financial center) and whether eliminating first the earn and then the burn relationship with Alaska Airlines – to reduce the program’s relevance and co-brand card attractiveness from Silicon Valley through the Pacific Northwest – made sense.

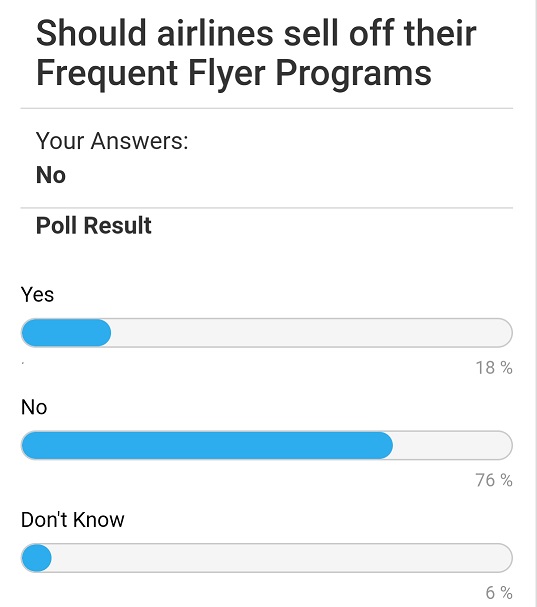

Industry Was Convinced

The audience was polled by conference app at the end of our session. Most agreed with me that they wouldn’t ‘push the button’ to sping off programs.

The Broader Spin-off Idea, Though, is 100% Right

There’s so much card revenue sloshing around the airline that it covers up for a lot of errors across the rest of the business. What Joe really wants, I think, is to account for loyalty program revenue separately from the rest of the business so that it’s clear how each is performing (as well as being easier for investors to value the revenue streams appropriately).

During Delta’s 3rd quarter earnings call he also asked CEO Ed Bastian whether Sandeep Dube, who runs SkyMiles, ought to have a C-level position. He’s right and this isn’t just a reward for swimming in American Express money.

Credit card ancillary revenue needs to be part of the equation as the airline thinks across its business. It needs to be a part of network planning. And the way to do that is to elevate it out of the back corners of the airline.

Too much card revenue also covers up mistakes inside of loyalty programs. It makes it look like whatever programs are doing is right because of the volume of profits, even when they leave money on the table or chase away revenue. A better, more detailed breakdown of information would force loyalty programs to be better too, not just force airlines to be better.

Back in the day, companies tried to unlock this sort of trapped value by issuing “tracking stock” in the crown jewel piece of their business. The idea never took hold mainly because investors were smart enough to recognize that unless it is a separate company, the crown jewel business shares the risk profile of the larger, less impressive entity. I.e. if the bad part of the business screwed up cash management and became insolvent, the crown jewel business would swirl the drain right along with it.

I believe it should be spun-off as an entirely separate company, but with more of a universal currency model that is transferable to many programs sort of like what Marriott/SPG has done with airline transfers. And similar to Marriott’s relationship with United, the spun off AA program could have sort of a preferred relationship with AA so the points are more valuable if used on AA.

With the sale of the crown jewel, the capital freed up could go a long way in debt service/capital investment and actually help shore up the risk profile of the airline part of the business. Otherwise that trapped value just stays trapped and can never be monetized to improve either business.

LATAM recently bought back its Brazilian loyalty program, Multiplus (now named LATAM Pass, in line with the program from Chile and the other countries).

@Gary: Based on your argument about the forward-looking risks of FF programs, airlines should take DiNardi’s offer (a doubling in equity value) and spin them off. There is no way they can make up that sort of value by tinkering with the programs in house.

The frictions at Air Canada that you describe were an artifact of that specific contract, not a criticism of spinoffs per se.

@L3 – I dealt with the argument of “just do better spinoffs” in previous discussions with Joe, the more you contract to ensure a frequent flyer program remains responsive to an airline’s needs the less valuable it becomes [the new loyalty program entity faces restrictions that prevent it from profit maximizing].

And to be clear Joe DeNardi isn’t making an offer, he’s making a predict of value, a prediction I suggest he’s wrong about. If airlines could sell off their programs for way more than they’re worth, sure, do it. My point is they cannot actually do this, Joe’s valuations are wrong, for reasons I lay out in this post (and others).